EastWest Bank

-

DATABASE (142)

-

ARTICLES (141)

Brankas plugs small businesses into Indonesia’s growing e-commerce ecosystem with its centralized cash management, payments and transfers platform.

Brankas plugs small businesses into Indonesia’s growing e-commerce ecosystem with its centralized cash management, payments and transfers platform.

Sinolink Securities, one of China’s first securities exchanges, was founded in 1990. Since 2013, its securities have been graded AA by the China Securities Regulatory Commission. Sinolink Securities’ main focuses are securities, futures exchange and funds, but it also has an investment bank department.

Sinolink Securities, one of China’s first securities exchanges, was founded in 1990. Since 2013, its securities have been graded AA by the China Securities Regulatory Commission. Sinolink Securities’ main focuses are securities, futures exchange and funds, but it also has an investment bank department.

CEO and Co-founder of Plastic Bank

David Katz is the Canadian co-founder, president and CEO of Plastic Bank, a-first-of-a-kind social enterprise startup that monetizes plastic waste collection for some of the world’s poorest communities. Katz was inspired by a university seminar about recycling plastic waste in 2013 and founded Plastic Bank with CTO and brand strategist Shaun Frankson in Vancouver.In 2019, he became a fellow for the Unreasonable Group’s Impact Hub in Vancouver, an organization that supports social and environmental entrepreneurship. In 2011, he also founded Vancouver’s Core Values Institute, a consulting and global thought leadership platform for entrepreneurs.In 2014, he was also president of Vancouver’s chapter of the Entrepreneurs Organization for one year. He was named Global Citizen of the Year in 2014 by the international organization that has a network of over 10,000 business owners in 131 chapters across 40 countries. He also won the 2017 UN Lighthouse award for Planetary Health and Plastic Bank received the Paris COP21 Climate Conference Sustania Community Award in 2015.Katz completed a diploma in Hospitality Administration & Management at the British Columbia Institute of Technology in 1991 and started his own business in 1992 as founder and CEO of Nero Alarms. From 2005 to 2014, Katz worked full-time as the founder and president of Nero Global Tracking, a SaaS platform created to monitor the operations of mobile service vehicles. Nero SaaS is used in many Canadian cities and by the nation’s Defence Ministry. The company is now part of Vecima Networks Inc.

David Katz is the Canadian co-founder, president and CEO of Plastic Bank, a-first-of-a-kind social enterprise startup that monetizes plastic waste collection for some of the world’s poorest communities. Katz was inspired by a university seminar about recycling plastic waste in 2013 and founded Plastic Bank with CTO and brand strategist Shaun Frankson in Vancouver.In 2019, he became a fellow for the Unreasonable Group’s Impact Hub in Vancouver, an organization that supports social and environmental entrepreneurship. In 2011, he also founded Vancouver’s Core Values Institute, a consulting and global thought leadership platform for entrepreneurs.In 2014, he was also president of Vancouver’s chapter of the Entrepreneurs Organization for one year. He was named Global Citizen of the Year in 2014 by the international organization that has a network of over 10,000 business owners in 131 chapters across 40 countries. He also won the 2017 UN Lighthouse award for Planetary Health and Plastic Bank received the Paris COP21 Climate Conference Sustania Community Award in 2015.Katz completed a diploma in Hospitality Administration & Management at the British Columbia Institute of Technology in 1991 and started his own business in 1992 as founder and CEO of Nero Alarms. From 2005 to 2014, Katz worked full-time as the founder and president of Nero Global Tracking, a SaaS platform created to monitor the operations of mobile service vehicles. Nero SaaS is used in many Canadian cities and by the nation’s Defence Ministry. The company is now part of Vecima Networks Inc.

Co-founder, Director and COO of Travelio

Christie Amanda has Australian diplomas in hospitality and business from the Alexander Education Group and a bachelor’s in Management and Marketing from Curtin University. After graduating in 2007, she worked at Australian retailer Coles and at the Commonwealth Bank before returning to Indonesia. She worked at PT Indosurya Finance before becoming the COO of Code-O Solutions, a software development startup that she co-founded with Hendry Rusli in 2012.

Christie Amanda has Australian diplomas in hospitality and business from the Alexander Education Group and a bachelor’s in Management and Marketing from Curtin University. After graduating in 2007, she worked at Australian retailer Coles and at the Commonwealth Bank before returning to Indonesia. She worked at PT Indosurya Finance before becoming the COO of Code-O Solutions, a software development startup that she co-founded with Hendry Rusli in 2012.

Co-founder of Investree

Amir Amiruddin graduated from Erasmus University in the Netherlands in 1994 and the University of Western Australia in 2011. Amir was formerly the managing director of AAA Securities, a director at Deutsche Bank Singapore and the managing director of Nomura Singapore. He is currently a partner at business and management consultancy Pascal Capital Asia in Singapore. Amir became a co-founder of Investree in October 2015.

Amir Amiruddin graduated from Erasmus University in the Netherlands in 1994 and the University of Western Australia in 2011. Amir was formerly the managing director of AAA Securities, a director at Deutsche Bank Singapore and the managing director of Nomura Singapore. He is currently a partner at business and management consultancy Pascal Capital Asia in Singapore. Amir became a co-founder of Investree in October 2015.

A Shanghai and Hong Kong-listed brokerage and investment bank, China Merchants Securities is one of China’s largest players, and part of the state-owned conglomerate, China Merchants Group.

A Shanghai and Hong Kong-listed brokerage and investment bank, China Merchants Securities is one of China’s largest players, and part of the state-owned conglomerate, China Merchants Group.

Headed by the influential Beatriz González, the only woman to helm a VC firm in Spain, Seaya Ventures invests in early-stage startups looking toward international growth, especially in Latin America. Beatriz González is also the daughter of Francisco González Rodríguez, the chairman of Spain’s second largest bank BBVA.

Headed by the influential Beatriz González, the only woman to helm a VC firm in Spain, Seaya Ventures invests in early-stage startups looking toward international growth, especially in Latin America. Beatriz González is also the daughter of Francisco González Rodríguez, the chairman of Spain’s second largest bank BBVA.

Co-Founder and CEO of Cicil

Former banker Leslie Lim is Singaporean and holds a bachelor’s degree in Engineering with Business Finance from University College London. As an undergraduate, Leslie was on the Dean’s List and graduated with first class honors, and received the Goldsmid Sessional Prize for Mechanical Engineering. He met Cicil co-founder while pursuing an MBA at INSEAD. Prior to co-founding Cicil, Leslie had worked at Barclays, HSBC, BNP Paribas Securities and Duxton Asset Management (Deutsche Bank Group).

Former banker Leslie Lim is Singaporean and holds a bachelor’s degree in Engineering with Business Finance from University College London. As an undergraduate, Leslie was on the Dean’s List and graduated with first class honors, and received the Goldsmid Sessional Prize for Mechanical Engineering. He met Cicil co-founder while pursuing an MBA at INSEAD. Prior to co-founding Cicil, Leslie had worked at Barclays, HSBC, BNP Paribas Securities and Duxton Asset Management (Deutsche Bank Group).

Co-founder and former CTO of Movvo

Roberto Ugo has had a business-driven mindset since he was young, having opened his first “bank”, albeit a simple family one, at aged five. Ugo majored in Data Telecommunications and Networks and E-Business at Boston University and the University of the West of Scotland, respectively. He also specialized in Computer Science at the University of Porto. Ugo went on to co-found Movvo, where he was CTO. He left the position in January 2017.

Roberto Ugo has had a business-driven mindset since he was young, having opened his first “bank”, albeit a simple family one, at aged five. Ugo majored in Data Telecommunications and Networks and E-Business at Boston University and the University of the West of Scotland, respectively. He also specialized in Computer Science at the University of Porto. Ugo went on to co-found Movvo, where he was CTO. He left the position in January 2017.

Co-founder and CTO of Karta

Jeff Hendrata co-founded motorcycle-mounted billboard firm Karta in 2016. He started his first company, digital media agency Brit-e2, in 2012 after graduating from Universitas Bina Nusantara with a bachelor's degree in Computer Science. Between 2012 and 2015, Jeff acted as Brit-e's CEO, overseeing projects with major clients, including Indonesia's fourth largest bank, CIMB Niaga and consumer products group Orang Tua. He remains an advisor to Brit-e after Karta was established.

Jeff Hendrata co-founded motorcycle-mounted billboard firm Karta in 2016. He started his first company, digital media agency Brit-e2, in 2012 after graduating from Universitas Bina Nusantara with a bachelor's degree in Computer Science. Between 2012 and 2015, Jeff acted as Brit-e's CEO, overseeing projects with major clients, including Indonesia's fourth largest bank, CIMB Niaga and consumer products group Orang Tua. He remains an advisor to Brit-e after Karta was established.

Founder and CEO of MSParis of MSParis

With an educational background in finance and business, Xu spent seven years working in investment banking upon graduating from Columbia University in 2005. She worked at Deutsche Bank and Macquarie Capital in Hong Kong, where she helped major Chinese e-commerce companies such as Vipshop, Moonbasa and Alibaba with their overseas IPOs, among other financial needs. She is a CFA Charterholder. Xu founded Shanghai Qiansong Internet Technology Co., Ltd., the parent company of MSParis, in 2014.

With an educational background in finance and business, Xu spent seven years working in investment banking upon graduating from Columbia University in 2005. She worked at Deutsche Bank and Macquarie Capital in Hong Kong, where she helped major Chinese e-commerce companies such as Vipshop, Moonbasa and Alibaba with their overseas IPOs, among other financial needs. She is a CFA Charterholder. Xu founded Shanghai Qiansong Internet Technology Co., Ltd., the parent company of MSParis, in 2014.

Pioneering AI SaaS combining virtual clinic and database for mental health professionals enables quicker diagnoses, with up to 90% accuracy.

Pioneering AI SaaS combining virtual clinic and database for mental health professionals enables quicker diagnoses, with up to 90% accuracy.

Co-founder and CEO of Eragano

Stephanie Jesselyn is a former Business Intelligence Specialist at Zalora Indonesia, part of the German company Rocket Internet Gmbh. She had also worked as a management associate at DBS Bank in Jakarta for over a year, in addition to her earlier role as an investment analyst at Satuan Kekayaan Dana ITB in Bandung.Stephanie co-founded Eragano and became the CEO in July 2016.She has a bachelor’s in Industrial Engineering from the Institut Teknologi Bandung, Indonesia.

Stephanie Jesselyn is a former Business Intelligence Specialist at Zalora Indonesia, part of the German company Rocket Internet Gmbh. She had also worked as a management associate at DBS Bank in Jakarta for over a year, in addition to her earlier role as an investment analyst at Satuan Kekayaan Dana ITB in Bandung.Stephanie co-founded Eragano and became the CEO in July 2016.She has a bachelor’s in Industrial Engineering from the Institut Teknologi Bandung, Indonesia.

Co-founder and CEO of Qlue

Rama Raditya graduated with a master’s in Management Information Systems in 2005 from Strayer University, USA. He returned to Indonesia and joined PwC as an IT auditor for a year. He then worked at Bank Danamon as an IT auditor and advisor before moving on to Ernst & Young. In 2013, he founded TerralogiQ, which later launched Qlue as part of Jakarta’s Smart City initiative. Rama became the CEO of PT Qlue Performa Indonesia when Qlue was incorporated as a standalone company.

Rama Raditya graduated with a master’s in Management Information Systems in 2005 from Strayer University, USA. He returned to Indonesia and joined PwC as an IT auditor for a year. He then worked at Bank Danamon as an IT auditor and advisor before moving on to Ernst & Young. In 2013, he founded TerralogiQ, which later launched Qlue as part of Jakarta’s Smart City initiative. Rama became the CEO of PT Qlue Performa Indonesia when Qlue was incorporated as a standalone company.

Head of Customer Success and co-founder of Blox

Carlos Ricci Ricci has an MBA in marketing from Minas Gerais Catholic Pontifical University and an MBA in business finance from the Getulio Vargas Foundation.He has worked in banking for over 30 years, including more than 14 years in sales and risk management at Banco Fidis. He also worked as an account manager at ABN AMRO bank for over 16 years. He is now the co-founder and Head of Customer Success of edtech startup Blox.

Carlos Ricci Ricci has an MBA in marketing from Minas Gerais Catholic Pontifical University and an MBA in business finance from the Getulio Vargas Foundation.He has worked in banking for over 30 years, including more than 14 years in sales and risk management at Banco Fidis. He also worked as an account manager at ABN AMRO bank for over 16 years. He is now the co-founder and Head of Customer Success of edtech startup Blox.

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

With universal QR code, Indonesia achieves e-payment harmony

The move to standardize Indonesia's QR code is expected to unify the country's cashless payments system and lift tens of thousands of small merchants into the payments mainstream

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

QRIS: Will the new QR code standard rewrite Indonesia’s e-payments scene?

Enabling interoperability, the QRIS seeks to level the playing field until now dominated by GoPay and OVO – disruption that could go beyond the e-wallets scene

CraiditX gives banks and insurers AI tools for assessing consumer credit risk

Used by big lenders like Bank of China and Minsheng Bank, CraiditX's solutions can gauge consumer default risk even if a user has no credit history

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

This startup aims to be the DocuSign of China

Having captured a third of a largely untapped domestic e-contracting market, Shangshangqian looks to gain a greater foothold at home and abroad

Coinscrap: Digital piggy banks for millennials

Smart savings app helps young consumers save and invest every cent of spare change by rounding up payments for purchases

Alberto Gómez, Spain's blockchain evangelist

Alberto Gómez Toribio has been pioneering blockchain technology in Spain since 2013. He convinced the Bank of Spain to authorize capital raising with cryptocurrency and built the world's first decentralized Bitcoin exchange

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

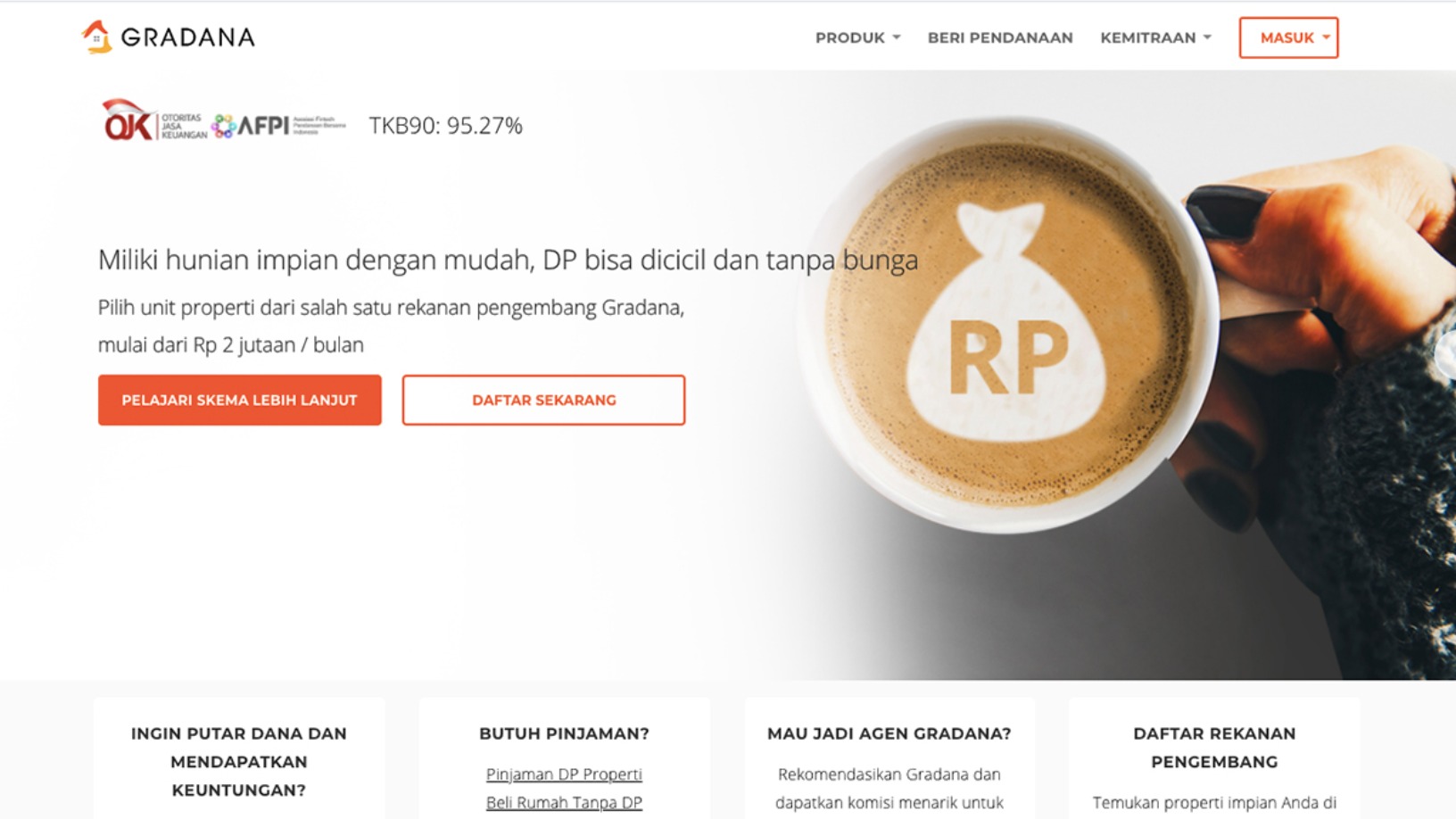

Gradana: P2P lending for more accessible home ownership in Indonesia

Gradana wants to create an ecosystem where developers, agents, landlords, buyers and lenders benefit one another through interconnected financing

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Sorry, we couldn’t find any matches for“EastWest Bank”.