Entrepreneurs Roundtable Accelerator

-

DATABASE (163)

-

ARTICLES (248)

InnoSpace is a startup service platform focusing on the early stage incubation of internet/mobile internet companies, with RMB angel funds and two 3-month startup accelerator programs each year. InnoSpace has helped its projects raise about RMB 600 million in total and is one of the four incubator partners of Intel in China.

InnoSpace is a startup service platform focusing on the early stage incubation of internet/mobile internet companies, with RMB angel funds and two 3-month startup accelerator programs each year. InnoSpace has helped its projects raise about RMB 600 million in total and is one of the four incubator partners of Intel in China.

Start-Up Chile is a public accelerator program set up by the Chilean government and looks to invest in startups across the world with Chile as their foundation. It has a diverse portfolio, having invested in startups from Europe, North America and Asia. Start-Up Chile primarily gives seed and grant funding, typically investing between $15,000 and $90,000.

Start-Up Chile is a public accelerator program set up by the Chilean government and looks to invest in startups across the world with Chile as their foundation. It has a diverse portfolio, having invested in startups from Europe, North America and Asia. Start-Up Chile primarily gives seed and grant funding, typically investing between $15,000 and $90,000.

Healthbox is a Chicago-based medtech accelerator that was established in 2010 with a global focus. To date, it has invested in more than 90 startups, mostly in seed rounds of up to $100,000 per startup. The firm has seen three exits so far. Since 2014, Healthbox has also been offering consultancy services.

Healthbox is a Chicago-based medtech accelerator that was established in 2010 with a global focus. To date, it has invested in more than 90 startups, mostly in seed rounds of up to $100,000 per startup. The firm has seen three exits so far. Since 2014, Healthbox has also been offering consultancy services.

Founded in 2013, Visionnaire Ventures is based in San Francisco and invests globally in innovative technologies in diverse sectors like AI and ML, digital health, Big Data, IoT, mobile and agriculture. The firm is managed by a team of serial entrepreneurs and executives involved in global internet, game and online media companies.The VC is co-founded by managing partners Taizo Son, Keith Nilsson and Susan Choe who also founded Katalyst Ventures. Son is the brother of SoftBank’s Masayoshi Son based in Japan. Taizo founded Gungho Online in 2002, a major online gaming company that became public-listed in 2005. With a vision to create a Silicon Valley-like venture eco-system in East Asia, he also founded MOVIDA JAPAN in 2009. He also founded Mistletoe Inc as CEO in 2013 to support entrepreneurs and provide startup ecosystem development activities.

Founded in 2013, Visionnaire Ventures is based in San Francisco and invests globally in innovative technologies in diverse sectors like AI and ML, digital health, Big Data, IoT, mobile and agriculture. The firm is managed by a team of serial entrepreneurs and executives involved in global internet, game and online media companies.The VC is co-founded by managing partners Taizo Son, Keith Nilsson and Susan Choe who also founded Katalyst Ventures. Son is the brother of SoftBank’s Masayoshi Son based in Japan. Taizo founded Gungho Online in 2002, a major online gaming company that became public-listed in 2005. With a vision to create a Silicon Valley-like venture eco-system in East Asia, he also founded MOVIDA JAPAN in 2009. He also founded Mistletoe Inc as CEO in 2013 to support entrepreneurs and provide startup ecosystem development activities.

CEO and founder of Diamond Foundry

Martin Roscheisen is an American-Austrian tech entrepreneur. He is CEO and co-founder of US-based unicorn Diamond Foundry, the first certified carbon-neutral producer of lab-grown diamonds. He has worked there since 2012, prior to the company’s official establishment in 2013.Roscheisen holds a PhD in computer science from Stanford University, where his classmates included Google founders Larry Page and Sergey Brin. He is one of the first generation of internet entrepreneurs, and has been involved in starting a number of companies. Before starting Diamond Foundry, Roscheisen headed the $640m solar startup Nanosolar from 2002–2010 as its CEO and founder. This was Silicon Valley's first solar power tech startup financed by American venture capital and, at the time, the highest-valued solar startup.When Nanosolar closed due to cheaper competition from China, much of its remaining technical expertise and resources went to setting up Diamond Foundry.In addition, Roscheisen was also formerlyCEO and the founder of eGroups. One of the first social media platforms to reach 50m users, the firm was acquired by Yahoo!.CTO and co-founder of enterprise software firm TradingDynamics, which sold to Ariba for $1.2bn.CTO and co-founder of FindLaw, a leading Internet legal site eventually sold to Thomson Reuters.In 2003, Fortune Magazine named Roscheisen one of America’s 40 Under 40, and one of the top 10 entrepreneurs in the country.

Martin Roscheisen is an American-Austrian tech entrepreneur. He is CEO and co-founder of US-based unicorn Diamond Foundry, the first certified carbon-neutral producer of lab-grown diamonds. He has worked there since 2012, prior to the company’s official establishment in 2013.Roscheisen holds a PhD in computer science from Stanford University, where his classmates included Google founders Larry Page and Sergey Brin. He is one of the first generation of internet entrepreneurs, and has been involved in starting a number of companies. Before starting Diamond Foundry, Roscheisen headed the $640m solar startup Nanosolar from 2002–2010 as its CEO and founder. This was Silicon Valley's first solar power tech startup financed by American venture capital and, at the time, the highest-valued solar startup.When Nanosolar closed due to cheaper competition from China, much of its remaining technical expertise and resources went to setting up Diamond Foundry.In addition, Roscheisen was also formerlyCEO and the founder of eGroups. One of the first social media platforms to reach 50m users, the firm was acquired by Yahoo!.CTO and co-founder of enterprise software firm TradingDynamics, which sold to Ariba for $1.2bn.CTO and co-founder of FindLaw, a leading Internet legal site eventually sold to Thomson Reuters.In 2003, Fortune Magazine named Roscheisen one of America’s 40 Under 40, and one of the top 10 entrepreneurs in the country.

InnovationRCA is the Royal College of Art’s center for entrepreneurship and commercialization. It supports RCA students, alumni and employees looking to turn their ideas into new businesses. The center was established in 2004 and is based in London.The centre’s activities include providing startup incubation and acceleration services to potential RCA spin-offs. This includes coaching and business mentoring based on RCA’s design-led, user-centric approach, as well as intellectual property advice and support. In addition, the center offers access to office and workshop space, as well as funding. InnovationRCA runs its own angel investor network, AngelClubRCA. It has also partnered with a UK-based VC, Venrex Investment Management, to improve RCA startups’ access to private funding. In addition, the centre conducts programmes for external entrepreneurs and organisations looking to promote innovation and entrepreneurship worldwide.McKinsey has called InnovationRCA a “world-class spinout incubator", praising its work as a "significant driver of entrepreneurial growth” along with its ”impressive results". In July 2019, the UK Business Angels Association also named InnovationRCA its Accelerator of the Year.

InnovationRCA is the Royal College of Art’s center for entrepreneurship and commercialization. It supports RCA students, alumni and employees looking to turn their ideas into new businesses. The center was established in 2004 and is based in London.The centre’s activities include providing startup incubation and acceleration services to potential RCA spin-offs. This includes coaching and business mentoring based on RCA’s design-led, user-centric approach, as well as intellectual property advice and support. In addition, the center offers access to office and workshop space, as well as funding. InnovationRCA runs its own angel investor network, AngelClubRCA. It has also partnered with a UK-based VC, Venrex Investment Management, to improve RCA startups’ access to private funding. In addition, the centre conducts programmes for external entrepreneurs and organisations looking to promote innovation and entrepreneurship worldwide.McKinsey has called InnovationRCA a “world-class spinout incubator", praising its work as a "significant driver of entrepreneurial growth” along with its ”impressive results". In July 2019, the UK Business Angels Association also named InnovationRCA its Accelerator of the Year.

Led by China's largest software developer platform CSDN founder Jiang Tao and mobile games maker Linekong founder Wang Feng, GeekFounders was founded by a group of entrepreneurs in 2011. It focuses on early-stage investments in mobile gaming and entertainment, mobile vertical community, mobile SaaS, cloud technology and smart hardware. It has invested in more than 80 mobile internet startups.

Led by China's largest software developer platform CSDN founder Jiang Tao and mobile games maker Linekong founder Wang Feng, GeekFounders was founded by a group of entrepreneurs in 2011. It focuses on early-stage investments in mobile gaming and entertainment, mobile vertical community, mobile SaaS, cloud technology and smart hardware. It has invested in more than 80 mobile internet startups.

Co-founder of Uniplaces

University of Nottingham graduate Ben Grech holds a bachelor’s degree in Finance. Prior to co-founding Uniplaces in 2011, he was a biotech analyst at KBC Peel Hunt and a business analyst at SRC Oxford. He was also an associate at private equity firm HIG Capital for a year and founded NACUE, the UK’s leading membership organization for engaging students in enterprise. Grech is British and is also the founder of Nottingham Entrepreneurs in 2007 which he also presided over until 2009. He was CEO at Uniplaces until 2018 when he left the post and became Non-Executive Chairman.

University of Nottingham graduate Ben Grech holds a bachelor’s degree in Finance. Prior to co-founding Uniplaces in 2011, he was a biotech analyst at KBC Peel Hunt and a business analyst at SRC Oxford. He was also an associate at private equity firm HIG Capital for a year and founded NACUE, the UK’s leading membership organization for engaging students in enterprise. Grech is British and is also the founder of Nottingham Entrepreneurs in 2007 which he also presided over until 2009. He was CEO at Uniplaces until 2018 when he left the post and became Non-Executive Chairman.

Tetuan Valley has built a network of over 500 entrepreneurs through its six-week Madrid-based Startup School program, which was started in 2009 and is in its 25th edition. Partnering with Google, the European Commission, MIT and universities in Spain, Tetuan offers early stage startups guidance on financial and commercial strategy, while providing technology mentors to support them on product development.

Tetuan Valley has built a network of over 500 entrepreneurs through its six-week Madrid-based Startup School program, which was started in 2009 and is in its 25th edition. Partnering with Google, the European Commission, MIT and universities in Spain, Tetuan offers early stage startups guidance on financial and commercial strategy, while providing technology mentors to support them on product development.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

Founded by tech entrepreneur and investor Teruhide ("Teru") Sato, Tokyo-headquartered Beenos is a seed accelerator and investor in startups from fast-growing countries such as India, Indonesia and Turkey, as well as Japan and the United States. Beenos typically invests between US$100,000 and US$3 million.

Founded by tech entrepreneur and investor Teruhide ("Teru") Sato, Tokyo-headquartered Beenos is a seed accelerator and investor in startups from fast-growing countries such as India, Indonesia and Turkey, as well as Japan and the United States. Beenos typically invests between US$100,000 and US$3 million.

AngelPad is a New York and San Francisco-based accelerator program for seed-stage companies. Established in 2010, AngelPad has been ranked by MIT and others as the number one acceleration program in the US. It has invested in more than 150 companies, with recent investments in HypeLabs from Portugal and the US$4.5m seed round of local autonomous logistics vehicle maker Gatik.

AngelPad is a New York and San Francisco-based accelerator program for seed-stage companies. Established in 2010, AngelPad has been ranked by MIT and others as the number one acceleration program in the US. It has invested in more than 150 companies, with recent investments in HypeLabs from Portugal and the US$4.5m seed round of local autonomous logistics vehicle maker Gatik.

Founded in 2013, Gaorong Capital is based in Beijing, with an additional office in Hong Kong. It invests primarily in early-stage and growth-stage startups in the TMT sector. Gaorong Capital’s backers include successful entrepreneurs and former investors in other world-class funds. It runs four US$ investment funds, three RMB investment funds and manages around RMB 11 billion.

Founded in 2013, Gaorong Capital is based in Beijing, with an additional office in Hong Kong. It invests primarily in early-stage and growth-stage startups in the TMT sector. Gaorong Capital’s backers include successful entrepreneurs and former investors in other world-class funds. It runs four US$ investment funds, three RMB investment funds and manages around RMB 11 billion.

Athos Capital is a venture capital firm established in 2017 with offices in Barcelona and Madrid. It currently operates a €1 million fund and has a portfolio of 10 Spain-based startups across the digital technology ecosystem (excluding real estate, biotech and healthcare). The team comprises Fernando Castiñeras, Robert Tomas, Giovanni Bologna and Elisabet Garriga, who have prior experience as venture capitalists, business consultants and entrepreneurs.

Athos Capital is a venture capital firm established in 2017 with offices in Barcelona and Madrid. It currently operates a €1 million fund and has a portfolio of 10 Spain-based startups across the digital technology ecosystem (excluding real estate, biotech and healthcare). The team comprises Fernando Castiñeras, Robert Tomas, Giovanni Bologna and Elisabet Garriga, who have prior experience as venture capitalists, business consultants and entrepreneurs.

Samaipata Ventures is an early stage venture capital fund founded by Jose del Barrio, a Spanish entrepreneur who succeeded in the e-commerce food delivery business Nevera Roja. The VC invests in European companies involved in e-commerce and marketplaces, especially in Southern Europe. As entrepreneurs themselves, the partners aim to increase cooperation between SMEs and venture capitalists.

Samaipata Ventures is an early stage venture capital fund founded by Jose del Barrio, a Spanish entrepreneur who succeeded in the e-commerce food delivery business Nevera Roja. The VC invests in European companies involved in e-commerce and marketplaces, especially in Southern Europe. As entrepreneurs themselves, the partners aim to increase cooperation between SMEs and venture capitalists.

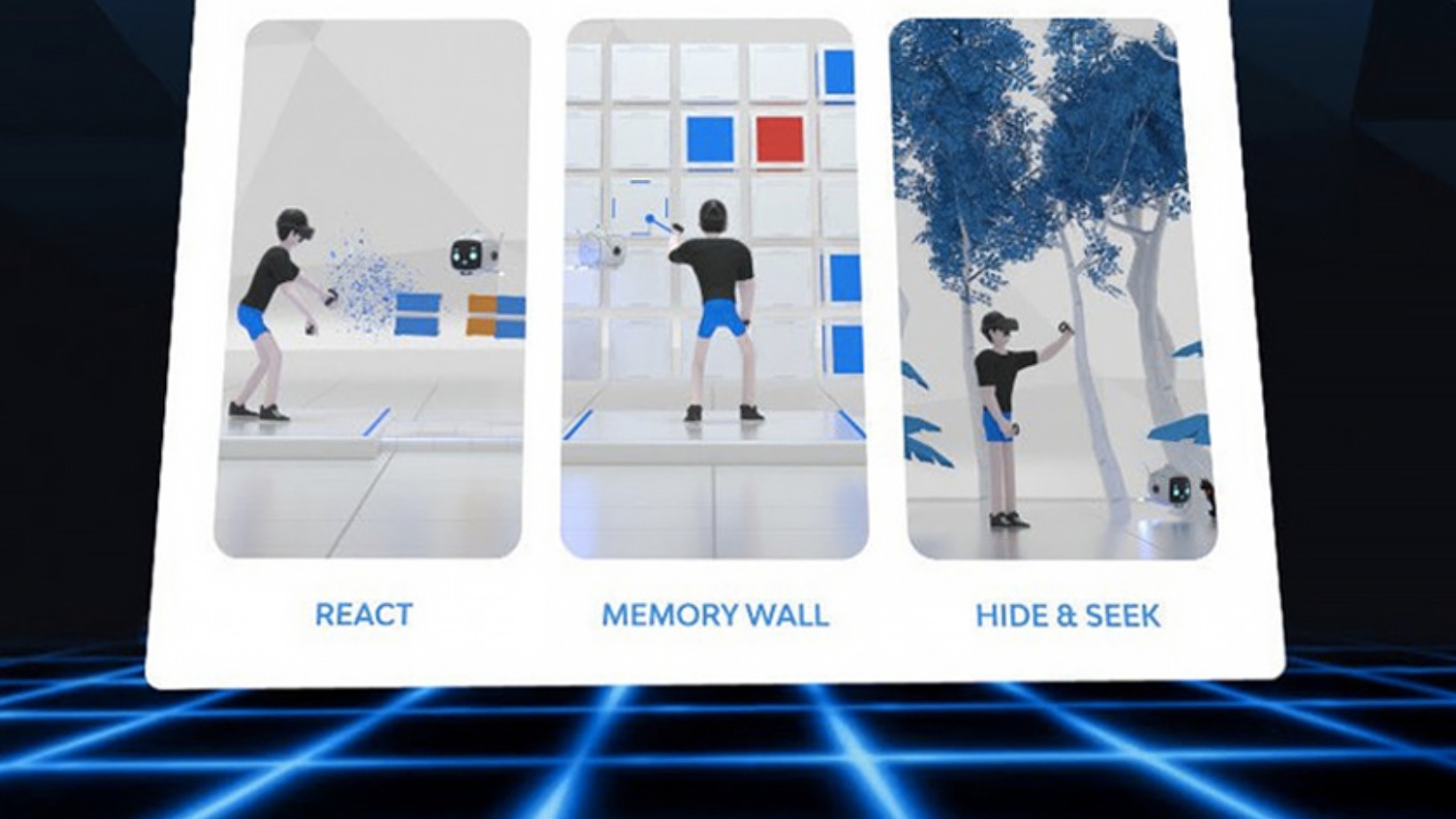

Virtuleap's VR games provide a mental workout, boosting brain health

Used by the AARP and Veteran's Health Administration in the US, Virtuleap’s games with AI-enabled assessment work to improve cognition and to counter degenerative diseases such as Alzheimer's

“Good thing about my style. Some like it, some hate it but everybody recognizes it.” @sofíabenjumea

Outspoken with a hands-on management style, Sofía Benjumea is a force to reckon with at Google’s Campus Madrid

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

Women entrepreneurs get ahead faster in Portugal

Still a long way to go for equality, but female founders in Portugal have made significant headstarts as tech innovators

Future Food Asia: Covid-19 sparked dramatic shifts in agriculture in China and India

Key Chinese players from e-commerce giant Pinduoduo and and agritech VC Omnivore share their insights at last week’s agrifood conference by ID Capital

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Xu Jinghong: Champion of young entrepreneurs and high-tech startups

Under Xu Jinghong’s leadership, Tsinghua Holdings grew its assets sevenfold and incubated over 10,000 businesses. In his new role as VC investor, Xu wants to nurture startups into future global leaders

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

BJTech: Chatbots to help young entrepreneurs and SMEs run businesses online

As more businesses go online during Covid-19, BJTech is using chatbots to help them manage customer service, inventory tracking and more

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

New Food Invest: Opportunities in the European alt-protein space

With a record €2.4bn investment in 2019, Europe’s foodtech sector appears poised for continued growth, but startups, corporations, governments and even universities can do more, experts say

Jesús Encinar: The Man Behind Idealista and 11870.com

Entrepreneur, angel investor and down-to-earth idealist

Sorry, we couldn’t find any matches for“Entrepreneurs Roundtable Accelerator”.