Entrepreneurs Roundtable Accelerator

-

DATABASE (163)

-

ARTICLES (248)

CareCapital, with offices in Hong Kong and Shangai, is a leading investor in the global oral and dental industry. The firm’s operations span clinical and education, consumers product, orthodontics, digital equipment, SaaS, distribution, and industry-specific services. Its team comprises industry experts such as dental entrepreneurs, managers, and practitioners, healthcare investors; the company’s portfolio includes companies based in North America with revenues of RMB 5bn, Europe RMB 1.5bn, and Asia RMB 3.5bn. In June 2020, the company signed strategic partnerships with SINOCERA and Hillhouse Capital to work closely in the development and growth of dental restoration.

CareCapital, with offices in Hong Kong and Shangai, is a leading investor in the global oral and dental industry. The firm’s operations span clinical and education, consumers product, orthodontics, digital equipment, SaaS, distribution, and industry-specific services. Its team comprises industry experts such as dental entrepreneurs, managers, and practitioners, healthcare investors; the company’s portfolio includes companies based in North America with revenues of RMB 5bn, Europe RMB 1.5bn, and Asia RMB 3.5bn. In June 2020, the company signed strategic partnerships with SINOCERA and Hillhouse Capital to work closely in the development and growth of dental restoration.

Ideabox Ventures is a VC launched by Indonesian telecoms Indosat Ooredoo, Kejora Ventures and Mountain Partners SEA in November 2016. The VC was an addition to the existing annual accelerator Ideabox program that had nurtured startups like Dealoka, Pawoon and Wobe. More venture capital is expected to come from new partnerships with global institutions in Asia, Europe and North America. Early stage or pre-Series A funding of up to US$500,000 will be awarded to each startup, as well as strategic commercial consultancy and support services to boost the expansion of the VC’s portfolio firms.

Ideabox Ventures is a VC launched by Indonesian telecoms Indosat Ooredoo, Kejora Ventures and Mountain Partners SEA in November 2016. The VC was an addition to the existing annual accelerator Ideabox program that had nurtured startups like Dealoka, Pawoon and Wobe. More venture capital is expected to come from new partnerships with global institutions in Asia, Europe and North America. Early stage or pre-Series A funding of up to US$500,000 will be awarded to each startup, as well as strategic commercial consultancy and support services to boost the expansion of the VC’s portfolio firms.

Startupbootcamp Commerce Amsterdam

Startupbootcamp Commerce Amsterdam is part of the Startupbootcamp accelerator global group that was originally founded in Denmark in 2010. The Commerce Amsterdam programs are dedicated to early-stage startups in the e-commerce and retail verticals. They help founders during the MVP development phase and provide mentoring support across logistics solutions, fraud security, AI, big data, advertising, marketing and sales.The programs are based in a co-working space in Amsterdam and founders receive €15,000 to cover their living expenses in the city during the three-month period of intense mentorship, masterclasses and pitching opportunities.

Startupbootcamp Commerce Amsterdam is part of the Startupbootcamp accelerator global group that was originally founded in Denmark in 2010. The Commerce Amsterdam programs are dedicated to early-stage startups in the e-commerce and retail verticals. They help founders during the MVP development phase and provide mentoring support across logistics solutions, fraud security, AI, big data, advertising, marketing and sales.The programs are based in a co-working space in Amsterdam and founders receive €15,000 to cover their living expenses in the city during the three-month period of intense mentorship, masterclasses and pitching opportunities.

Founded in 2011, StartUp Health is a New-York based accelerator. Chaired by former Time Warner CEO Jerry Levin, the platform is reputed to have the world’s largest portfolio of digital health companies spanning 12 countries. StartUp Health also runs the StartUp Health Academy, StartUp Health Network, StartUp Health Ventures and StartUp Health Media. Investment partners include Novartis, Ping An Group, Otsuka, Chiesi Group, Masimo and GuideWell, all of whom contributed to the US$31-million StartUp Health Transformer Fund II in 2018. StartUp Health has managed 15 exits and invested in more than 250 companies.

Founded in 2011, StartUp Health is a New-York based accelerator. Chaired by former Time Warner CEO Jerry Levin, the platform is reputed to have the world’s largest portfolio of digital health companies spanning 12 countries. StartUp Health also runs the StartUp Health Academy, StartUp Health Network, StartUp Health Ventures and StartUp Health Media. Investment partners include Novartis, Ping An Group, Otsuka, Chiesi Group, Masimo and GuideWell, all of whom contributed to the US$31-million StartUp Health Transformer Fund II in 2018. StartUp Health has managed 15 exits and invested in more than 250 companies.

Angels Capital is an investment vehicle created by Juan Roig as part of the Marina of Companies network in Valencia. Its mission is to grow startups within the Lanzadera accelerator, as well as external projects that facilitate the creation of a strong entrepreneurial ecosystem in Valencia. Angels Capital has 13 current investment projects, seven of which it is lead investor in and, since 2014, it has invested €15.5 million in capital. Recent investments include a €1 million venture round for cloud-based workflow platform SheetGo, and €360,000 in seed funding for bank aggregation system Afterbanks.

Angels Capital is an investment vehicle created by Juan Roig as part of the Marina of Companies network in Valencia. Its mission is to grow startups within the Lanzadera accelerator, as well as external projects that facilitate the creation of a strong entrepreneurial ecosystem in Valencia. Angels Capital has 13 current investment projects, seven of which it is lead investor in and, since 2014, it has invested €15.5 million in capital. Recent investments include a €1 million venture round for cloud-based workflow platform SheetGo, and €360,000 in seed funding for bank aggregation system Afterbanks.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

Founded in 2012 in Geneva, Seedstars is one of the world’s largest accelerators with programs operating globally including Seedstars Global Startup Competition for emerging economies and seed-stage investors. Seedstars is also an investor, focusing on supporting startups founded in emerging economies across market segments. Its portfolio of 60 companies includes startups from its accelerator programs and participation in the $30,000 pre-seed round for Mexican loan fintech DB Menos. It is also one of two impact investors backing the $530,000 seed funding round for Bangladeshi cloud-kitchen and delivery startup Kludio.

Founded in 2012 in Geneva, Seedstars is one of the world’s largest accelerators with programs operating globally including Seedstars Global Startup Competition for emerging economies and seed-stage investors. Seedstars is also an investor, focusing on supporting startups founded in emerging economies across market segments. Its portfolio of 60 companies includes startups from its accelerator programs and participation in the $30,000 pre-seed round for Mexican loan fintech DB Menos. It is also one of two impact investors backing the $530,000 seed funding round for Bangladeshi cloud-kitchen and delivery startup Kludio.

An experienced entrepreneur in internet business, Wen Chu founded the online community for media professionals No4media.com in 2001, the Guangzhou-based Click.com.cn in 2003, and the mobile entertainment website Moabc.com in 2005. Click.com.cn was acquired by the NASDAQ-listed company PACT in 2004. In March 2008, he founded the Great Wall Club (GWC), a communication platform for entrepreneurs and startups that has initiated and organized events such as the annual Global Mobile Internet Conference (GMIC) since 2008 and the startup competition G-Startup Worldwide. He currently is the president and CEO of GWC. He invested Xpeng Motors as an angel investor in 2014.

An experienced entrepreneur in internet business, Wen Chu founded the online community for media professionals No4media.com in 2001, the Guangzhou-based Click.com.cn in 2003, and the mobile entertainment website Moabc.com in 2005. Click.com.cn was acquired by the NASDAQ-listed company PACT in 2004. In March 2008, he founded the Great Wall Club (GWC), a communication platform for entrepreneurs and startups that has initiated and organized events such as the annual Global Mobile Internet Conference (GMIC) since 2008 and the startup competition G-Startup Worldwide. He currently is the president and CEO of GWC. He invested Xpeng Motors as an angel investor in 2014.

Toro Ventures is a VC fund based in Monterrey, Mexico, with offices in San Francisco. Led by entrepreneurs Elsa Treviño and Tuto Assad, the fund helps tech startups raise seed capital as well as build a network of family offices and business angels interested in investment opportunities in the Latin American tech ecosystem.Toro Ventures also supports big companies looking to innovate by connecting them with startups from relevant industry verticals. In December 2018, it made its biggest investment to date: €2 million in Spain's BEWE. Established in December 2016, the company has invested in nine startups, to date.

Toro Ventures is a VC fund based in Monterrey, Mexico, with offices in San Francisco. Led by entrepreneurs Elsa Treviño and Tuto Assad, the fund helps tech startups raise seed capital as well as build a network of family offices and business angels interested in investment opportunities in the Latin American tech ecosystem.Toro Ventures also supports big companies looking to innovate by connecting them with startups from relevant industry verticals. In December 2018, it made its biggest investment to date: €2 million in Spain's BEWE. Established in December 2016, the company has invested in nine startups, to date.

Itnig was formed in Barcelona in 2011 as an independent and private initiative of a serial-entrepreneurs and tech-enthusiast group.Headquartered in 22@, the tech district of Barcelona, the company offers startup mentoring and services including accounting, business and software development, legal and human resources. Itnig acts as a startup builder, counting on a network of more than 160 people and over 70 investors. The company has also created its own fund to invest a maximum of €100,000 per company without following up on the investment.To date, Itnig has contributed to forming six startups.

Itnig was formed in Barcelona in 2011 as an independent and private initiative of a serial-entrepreneurs and tech-enthusiast group.Headquartered in 22@, the tech district of Barcelona, the company offers startup mentoring and services including accounting, business and software development, legal and human resources. Itnig acts as a startup builder, counting on a network of more than 160 people and over 70 investors. The company has also created its own fund to invest a maximum of €100,000 per company without following up on the investment.To date, Itnig has contributed to forming six startups.

Miguel Arias received an MSc in Civil Engineering from Universidad Politécnica de Madrid in 2002 and an MBA from IE Business School in 2005. He has served as global entrepreneurship director at Telefónica since 2018.Arias began his career as an engineer. In 2003, he founded IMASTE (since acquired by US communications firm ON24), a virtual events startup, where he served as CTO for nine years.Arias is an active angel investor in the Spanish tech ecosystem. He co-founded Chamberí Valley, which promotes networking initiatives among tech entrepreneurs, and mentors at programs such as the IE Venture Lab and Wayra Academy.

Miguel Arias received an MSc in Civil Engineering from Universidad Politécnica de Madrid in 2002 and an MBA from IE Business School in 2005. He has served as global entrepreneurship director at Telefónica since 2018.Arias began his career as an engineer. In 2003, he founded IMASTE (since acquired by US communications firm ON24), a virtual events startup, where he served as CTO for nine years.Arias is an active angel investor in the Spanish tech ecosystem. He co-founded Chamberí Valley, which promotes networking initiatives among tech entrepreneurs, and mentors at programs such as the IE Venture Lab and Wayra Academy.

Nickleby Capital is a London-based VC firm that focuses on three main areas: (1) investment capital for companies in the scale-up phase, Series A, Series B, and buyouts, (2) advisory services leveraging proprietary tech, researches and industry network, to accelerate PLCs and private companies' growth, and (3) real estate, advising on commercial and residential properties globally. The firm’s investors are mostly family offices and serial entrepreneurs that have built market-leading companies. The Nickleby Capital’s team is founded by a team of alumni from Goldman Sachs, Rothschild, BDO and Korn Ferry.

Nickleby Capital is a London-based VC firm that focuses on three main areas: (1) investment capital for companies in the scale-up phase, Series A, Series B, and buyouts, (2) advisory services leveraging proprietary tech, researches and industry network, to accelerate PLCs and private companies' growth, and (3) real estate, advising on commercial and residential properties globally. The firm’s investors are mostly family offices and serial entrepreneurs that have built market-leading companies. The Nickleby Capital’s team is founded by a team of alumni from Goldman Sachs, Rothschild, BDO and Korn Ferry.

DG Incubation was founded in 2009 as the investment arm of Japanese internet company Digital Garage Group. The firm invests through its Open Network Lab Seed Accelerator Program for its seed-stage portfolio, and through DG Incubation for its early-to-late stage portfolio. DG Incubation gives foundation support to early-stage startups, such as problem identification. For later-stage startups, the firm gives data and analysis and supports the recruitment process, among others. It has offices in Tokyo, Kamakura (Japan) and San Francisco. It has invested in 98 companies to date and has seen 23 exits including companies like Facebook, Twitter and LinkedIn.

DG Incubation was founded in 2009 as the investment arm of Japanese internet company Digital Garage Group. The firm invests through its Open Network Lab Seed Accelerator Program for its seed-stage portfolio, and through DG Incubation for its early-to-late stage portfolio. DG Incubation gives foundation support to early-stage startups, such as problem identification. For later-stage startups, the firm gives data and analysis and supports the recruitment process, among others. It has offices in Tokyo, Kamakura (Japan) and San Francisco. It has invested in 98 companies to date and has seen 23 exits including companies like Facebook, Twitter and LinkedIn.

Labeled "world’s most powerful startup incubator" by Fast Company, Y Combinator was established in 2005 as a seed accelerator. Since then, Y Combinator has funded over 1,850 startups with a combined valuation of over US$100 billion. Twice a year, Y Combinator invests US$150,000 per company across a large number of startups in exchange for a 7% stake. The startups then move to Silicon Valley for three months. Each cycle ends with a Demo Day, where the startups pitch to an invite-only audience of high-profile investors. Its most valuable startups to date are Airbnb, Stripe, Cruise, Dropbox and Coinbase.

Labeled "world’s most powerful startup incubator" by Fast Company, Y Combinator was established in 2005 as a seed accelerator. Since then, Y Combinator has funded over 1,850 startups with a combined valuation of over US$100 billion. Twice a year, Y Combinator invests US$150,000 per company across a large number of startups in exchange for a 7% stake. The startups then move to Silicon Valley for three months. Each cycle ends with a Demo Day, where the startups pitch to an invite-only audience of high-profile investors. Its most valuable startups to date are Airbnb, Stripe, Cruise, Dropbox and Coinbase.

Jesus Monleon started his professional career in the financial sector, but left soon after to become an entrepreneur. He founded eMagister.com, a consulting firm dedicated to the IT management market. He also established Offerum that is now part of Groupalia. Another venture Glamourum was acquired by JolieBox in 2012. He is currently a leading advisor and business angel within the Spanish startup ecosystem. In 2008, he co-founded the famous Spanish accelerator SeedRocket. Together with several other investors, he also set up a €12-million fund to establish SeedRocket 4Founders Capital in 2017.

Jesus Monleon started his professional career in the financial sector, but left soon after to become an entrepreneur. He founded eMagister.com, a consulting firm dedicated to the IT management market. He also established Offerum that is now part of Groupalia. Another venture Glamourum was acquired by JolieBox in 2012. He is currently a leading advisor and business angel within the Spanish startup ecosystem. In 2008, he co-founded the famous Spanish accelerator SeedRocket. Together with several other investors, he also set up a €12-million fund to establish SeedRocket 4Founders Capital in 2017.

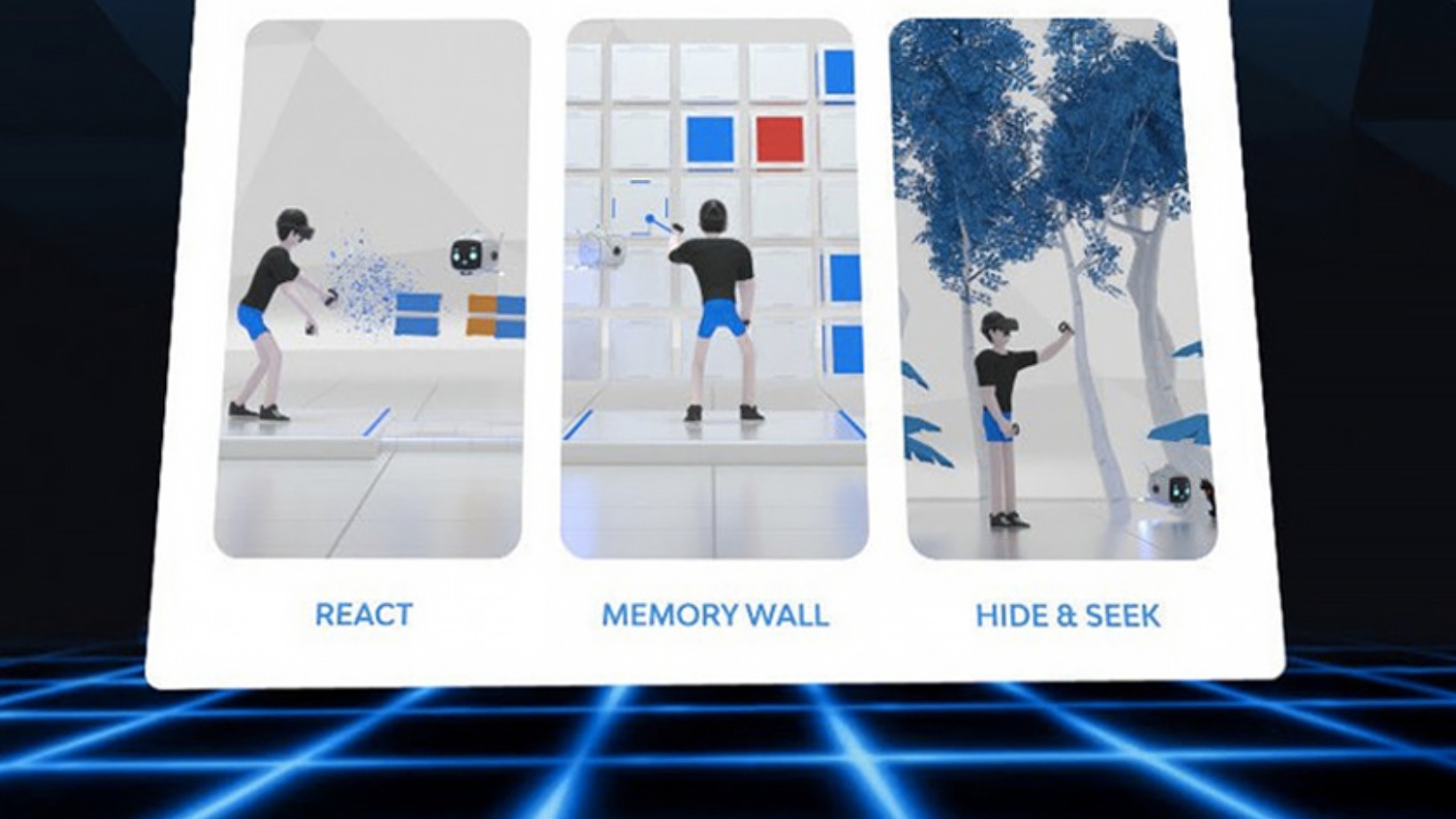

Virtuleap's VR games provide a mental workout, boosting brain health

Used by the AARP and Veteran's Health Administration in the US, Virtuleap’s games with AI-enabled assessment work to improve cognition and to counter degenerative diseases such as Alzheimer's

“Good thing about my style. Some like it, some hate it but everybody recognizes it.” @sofíabenjumea

Outspoken with a hands-on management style, Sofía Benjumea is a force to reckon with at Google’s Campus Madrid

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

Women entrepreneurs get ahead faster in Portugal

Still a long way to go for equality, but female founders in Portugal have made significant headstarts as tech innovators

Future Food Asia: Covid-19 sparked dramatic shifts in agriculture in China and India

Key Chinese players from e-commerce giant Pinduoduo and and agritech VC Omnivore share their insights at last week’s agrifood conference by ID Capital

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Xu Jinghong: Champion of young entrepreneurs and high-tech startups

Under Xu Jinghong’s leadership, Tsinghua Holdings grew its assets sevenfold and incubated over 10,000 businesses. In his new role as VC investor, Xu wants to nurture startups into future global leaders

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

BJTech: Chatbots to help young entrepreneurs and SMEs run businesses online

As more businesses go online during Covid-19, BJTech is using chatbots to help them manage customer service, inventory tracking and more

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

New Food Invest: Opportunities in the European alt-protein space

With a record €2.4bn investment in 2019, Europe’s foodtech sector appears poised for continued growth, but startups, corporations, governments and even universities can do more, experts say

Jesús Encinar: The Man Behind Idealista and 11870.com

Entrepreneur, angel investor and down-to-earth idealist

Sorry, we couldn’t find any matches for“Entrepreneurs Roundtable Accelerator”.