European Battery Alliance

DATABASE (122)

ARTICLES (228)

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

Shanghai Alliance Investment Ltd

Shanghai Alliance Investment Ltd is a state-owned company founded in September 1994 under the State-owned Assets Supervision and Administration Commission of Shanghai. It mainly engages in equity investment in hi-tech and modern services industry.It has invested over RMB 10bn in diverse sectors including information technology, biomedicine, new energy, environmental protection, new materials and financial services. In 2004, the company and Microsoft set up the joint venture Shanghai MSN Network Communications Technology Co Ltd that operates MSN China's website: msn.com.cn.

Shanghai Alliance Investment Ltd is a state-owned company founded in September 1994 under the State-owned Assets Supervision and Administration Commission of Shanghai. It mainly engages in equity investment in hi-tech and modern services industry.It has invested over RMB 10bn in diverse sectors including information technology, biomedicine, new energy, environmental protection, new materials and financial services. In 2004, the company and Microsoft set up the joint venture Shanghai MSN Network Communications Technology Co Ltd that operates MSN China's website: msn.com.cn.

Co-founder and Solutions Architect of Plant on Demand

Antonio Tripiana Caballero worked for almost two years as project engineer at the Signal Processing for Communications and Navigation (SPCOMNAV) research group at the Autonomous University of Barcelona (UAB).The Department of Telecommunications and Systems Engineering project was part of Tripiana’s master’s degree in Telecoms Systems Engineering during his university days from 2011 to 2016. He also completed a one-year exchange program at Finland’s Tampere University of Technology.Tripiana worked as a freelance full-stack developer in Barcelona during his studies. He worked for four months as a scientist at Barcelona’s Mobile World Capital to develop a cloud-based GNSS receiver for IoT devices with ultra-low battery consumption. He also spent five months testing receivers at the European Space Agency (ESA) in the Netherlands.In 2018, he co-founded Plant on Demand (POD) as the startup’s Solutions Architect. He took on the full-time role of CTO during 1Q2020.

Antonio Tripiana Caballero worked for almost two years as project engineer at the Signal Processing for Communications and Navigation (SPCOMNAV) research group at the Autonomous University of Barcelona (UAB).The Department of Telecommunications and Systems Engineering project was part of Tripiana’s master’s degree in Telecoms Systems Engineering during his university days from 2011 to 2016. He also completed a one-year exchange program at Finland’s Tampere University of Technology.Tripiana worked as a freelance full-stack developer in Barcelona during his studies. He worked for four months as a scientist at Barcelona’s Mobile World Capital to develop a cloud-based GNSS receiver for IoT devices with ultra-low battery consumption. He also spent five months testing receivers at the European Space Agency (ESA) in the Netherlands.In 2018, he co-founded Plant on Demand (POD) as the startup’s Solutions Architect. He took on the full-time role of CTO during 1Q2020.

ACA Investments is the Singapore-based affiliate of Asia Capital Alliance, a Japanese investment firm group. The group’s investment focus is on Japan and Southeast Asia, done by combining Japanese intellectual property and Southeast Asia’s growing markets and startup ecosystems. Its investments range from secondhand bookstore Book-Off, F&B brand owner HotLand Corporation (which operates Tsujiki Gindako), and Southeast Asian price comparison site iPrice.ACA Investments is also an affiliate of Japanese investment bank Daiwa Securities Group, which is Japan’s second-largest securities brokerage. In 2018, ACA Group announced that Daiwa Securities Group acquired a 34% stake in ACA Investments as part of a wider strategic alliance between ACA and Daiwa.

ACA Investments is the Singapore-based affiliate of Asia Capital Alliance, a Japanese investment firm group. The group’s investment focus is on Japan and Southeast Asia, done by combining Japanese intellectual property and Southeast Asia’s growing markets and startup ecosystems. Its investments range from secondhand bookstore Book-Off, F&B brand owner HotLand Corporation (which operates Tsujiki Gindako), and Southeast Asian price comparison site iPrice.ACA Investments is also an affiliate of Japanese investment bank Daiwa Securities Group, which is Japan’s second-largest securities brokerage. In 2018, ACA Group announced that Daiwa Securities Group acquired a 34% stake in ACA Investments as part of a wider strategic alliance between ACA and Daiwa.

NYSE-listed Cheetah Mobile is a Beijing-based mobile internet company behind the popular utility applications Clean Master, Security Master and Battery Doctor. It also provides computer security software Duba Anti-virus and other platform products. Cheetah Mobile was formed from the merger of Kingsoft Security and Conew Image in 2010; it went public in 2014.

NYSE-listed Cheetah Mobile is a Beijing-based mobile internet company behind the popular utility applications Clean Master, Security Master and Battery Doctor. It also provides computer security software Duba Anti-virus and other platform products. Cheetah Mobile was formed from the merger of Kingsoft Security and Conew Image in 2010; it went public in 2014.

Shenzhen Sunrise New Energy Co. Ltd.

Founded in 1995, Shenzhen Sunrise New Energy Co. Ltd., formerly known as Shenzhen Rainbow Fine Chemical Industry Co. Ltd., was listed on the Shenzhen Stock Exchange in 2008. Its main lines of business include Lithium-ion battery, photovoltaic power generation and New Energy bus operation. In 2016, it set up a fund to invest in autonomous driving, wireless charging, advanced parking management, artificial intelligence and robotics sectors.

Founded in 1995, Shenzhen Sunrise New Energy Co. Ltd., formerly known as Shenzhen Rainbow Fine Chemical Industry Co. Ltd., was listed on the Shenzhen Stock Exchange in 2008. Its main lines of business include Lithium-ion battery, photovoltaic power generation and New Energy bus operation. In 2016, it set up a fund to invest in autonomous driving, wireless charging, advanced parking management, artificial intelligence and robotics sectors.

Founded in 2012, BAIC Capital is the investment arm of China's state-owned carmaker, BAIC Group. Headquartered in Beijing, it has branches in six cities across China and has two subsidiaries in Frankfurt and Silicon Valley. It currently manages over 40 funds, worth RMB 30bn. With a focus on connected cars and mobility services, it has invested in more than 100 companies including EV manufacturer BAIC BJEV, battery manufacturer and technology company CATL and ride-hailing giant Didi Chuxing.

Founded in 2012, BAIC Capital is the investment arm of China's state-owned carmaker, BAIC Group. Headquartered in Beijing, it has branches in six cities across China and has two subsidiaries in Frankfurt and Silicon Valley. It currently manages over 40 funds, worth RMB 30bn. With a focus on connected cars and mobility services, it has invested in more than 100 companies including EV manufacturer BAIC BJEV, battery manufacturer and technology company CATL and ride-hailing giant Didi Chuxing.

Co-founder and Chief Product Officer of Advotics

Thanks to the Singapore-MIT Alliance Fellowship Program, Jeffry William Tani was able to join a four-year postgrad PhD in Manufacturing System and Technology after graduating in 2009 with a Mechanical Engineering degree at Nanyang Technological University (NTU) in Singapore.In 2013, he joined Schlumberger as a new product development engineer. He left the Singapore-based oilfield mining services company in 2017 and returned to Indonesia to become the CPO of PT Advotics Teknologi Global.

Thanks to the Singapore-MIT Alliance Fellowship Program, Jeffry William Tani was able to join a four-year postgrad PhD in Manufacturing System and Technology after graduating in 2009 with a Mechanical Engineering degree at Nanyang Technological University (NTU) in Singapore.In 2013, he joined Schlumberger as a new product development engineer. He left the Singapore-based oilfield mining services company in 2017 and returned to Indonesia to become the CPO of PT Advotics Teknologi Global.

Co-founder and CEO of Kerjabilitas

After graduating in 2004 from the Universitas Negeri Surabaya in Indonesia, Rubby Emir worked at various NGOs and social enterprises, including the Red Cross and Rainforest Alliance.In 2014, he co-founded a nonprofit enterprise Saujana, working on environmental conservation and social issues. In 2015, the Saujana team launched Kerjabilitas, a job search platform for disabled people in Indonesia. Rubby is also a senior project manager at the Humanitarian Benchmark Consulting that provides consulting and support services for humanitarian activities.

After graduating in 2004 from the Universitas Negeri Surabaya in Indonesia, Rubby Emir worked at various NGOs and social enterprises, including the Red Cross and Rainforest Alliance.In 2014, he co-founded a nonprofit enterprise Saujana, working on environmental conservation and social issues. In 2015, the Saujana team launched Kerjabilitas, a job search platform for disabled people in Indonesia. Rubby is also a senior project manager at the Humanitarian Benchmark Consulting that provides consulting and support services for humanitarian activities.

As one of the original enterprises of the Japanese Mitsubishi Group, Mitsubishi Motors started its automotive business in the pre-World War era. Mitsubishi Heavy Industries produced and imported cars for local use. The automotive company became part of the Renault-Nissan-Mitsubishi alliance in 2016 after Nissan acquired a controlling stake in Mitsubishi Motors. Indonesia's Gojek is its latest investment to expand into the ride-hailing tech sector in Southeast-Asia.

As one of the original enterprises of the Japanese Mitsubishi Group, Mitsubishi Motors started its automotive business in the pre-World War era. Mitsubishi Heavy Industries produced and imported cars for local use. The automotive company became part of the Renault-Nissan-Mitsubishi alliance in 2016 after Nissan acquired a controlling stake in Mitsubishi Motors. Indonesia's Gojek is its latest investment to expand into the ride-hailing tech sector in Southeast-Asia.

Co-founder and CEO of Loket

Calling himself a serial entrepreneur, Edy Sulistyo has created and sold three tech startups. Founded in 2009, the event management platform eEvent was sold to US-based EnvisionPoint in 2013. Revenues were mainly earned from events held in USA. He also sold OW.com to Telepathy Inc and Kamus.net to Stand4 LLC. Other internet companies he built included FilesUpload, guestHub, Parking-Hub and CircleMail.Edy graduated in 2006 with a bachelor’s in Computer Science Engineering at the Ohio State University. He is also the managing director of S3 Tech Alliance, a startup incubator in Ohio, USA.

Calling himself a serial entrepreneur, Edy Sulistyo has created and sold three tech startups. Founded in 2009, the event management platform eEvent was sold to US-based EnvisionPoint in 2013. Revenues were mainly earned from events held in USA. He also sold OW.com to Telepathy Inc and Kamus.net to Stand4 LLC. Other internet companies he built included FilesUpload, guestHub, Parking-Hub and CircleMail.Edy graduated in 2006 with a bachelor’s in Computer Science Engineering at the Ohio State University. He is also the managing director of S3 Tech Alliance, a startup incubator in Ohio, USA.

Schneider Electric is a Europe-based company primarily providing energy management and automation solutions for homes, commercial and industrial-scale properties. The company was originally named Schneider & Cie, founded in 1836 as a metal and weaponry, but between 1975 and 1999 began to refocus towards the electrical industry. The company was renamed Schneider Electric in 1999.Schneider’s technologies focus on managing energy use and conserving energy through a combination of hardware and software. Consequently, Schneider’s investments into startups revolve around the energy sector, with companies like solar power management service Xurya, battery manufacturer Verkor, and building management SaaS Clockworks Analytics as part of their portfolio.

Schneider Electric is a Europe-based company primarily providing energy management and automation solutions for homes, commercial and industrial-scale properties. The company was originally named Schneider & Cie, founded in 1836 as a metal and weaponry, but between 1975 and 1999 began to refocus towards the electrical industry. The company was renamed Schneider Electric in 1999.Schneider’s technologies focus on managing energy use and conserving energy through a combination of hardware and software. Consequently, Schneider’s investments into startups revolve around the energy sector, with companies like solar power management service Xurya, battery manufacturer Verkor, and building management SaaS Clockworks Analytics as part of their portfolio.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

European venture capital firm Advent Venture Partners was established in 1981.

European venture capital firm Advent Venture Partners was established in 1981.

Iomob: Universal mobility app to help people find best route from A to B

Rapid growth in MaaS will boost revenue to over €1m by 2020 for Spanish transport app Iomob

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

Automated marketing platform Frizbit reaches over 1bn end-users; seeks European, LatAm expansion

Using AI and proprietary technology, Frizbit aims to help clients retain customers with personalized and automated push notification campaigns

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Infraspeak to raise up to €12m in Series A funding to accelerate European expansion

CEO Felipe Ávila da Costa discusses his rapidly growing facilities management platform that's helping airports, malls and hospitals run smoothly from Brazil to Mozambique

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

In-store robots and online doctors serve customers 24/7 at Dingdang Medicine Express

Dingdang also offers cheaper medicines and 28-minute home delivery, thanks to its innovative logistics and partnership models

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Subsidy cut has dented sales, but China's EV manufacturers need better products to win over buyers

Eliminating subsidies is a painful must for the sustainability of China’s electric vehicle industry

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

GoWithFlow: Scaling ERP platform for sustainable mobility in global transportation markets

Portugal’s CEiiA spin-off leads the way to manage smart transportation systems of cities and corporations to boost fleet performance by reducing CO2 emissions and maintenance costs

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

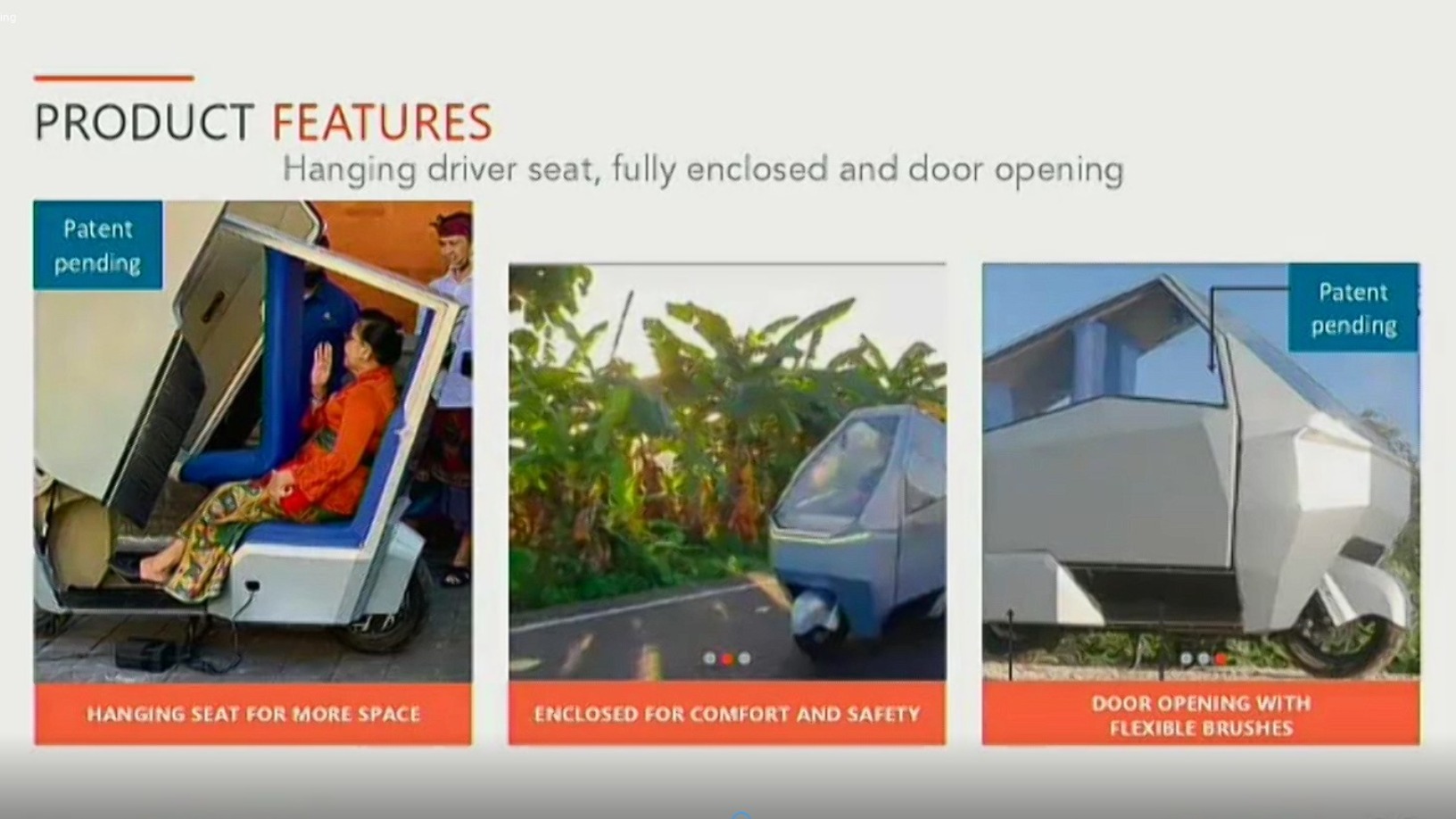

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Sorry, we couldn’t find any matches for“European Battery Alliance”.