European Battery Alliance

DATABASE (122)

ARTICLES (228)

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

Shanghai Alliance Investment Ltd

Shanghai Alliance Investment Ltd is a state-owned company founded in September 1994 under the State-owned Assets Supervision and Administration Commission of Shanghai. It mainly engages in equity investment in hi-tech and modern services industry.It has invested over RMB 10bn in diverse sectors including information technology, biomedicine, new energy, environmental protection, new materials and financial services. In 2004, the company and Microsoft set up the joint venture Shanghai MSN Network Communications Technology Co Ltd that operates MSN China's website: msn.com.cn.

Shanghai Alliance Investment Ltd is a state-owned company founded in September 1994 under the State-owned Assets Supervision and Administration Commission of Shanghai. It mainly engages in equity investment in hi-tech and modern services industry.It has invested over RMB 10bn in diverse sectors including information technology, biomedicine, new energy, environmental protection, new materials and financial services. In 2004, the company and Microsoft set up the joint venture Shanghai MSN Network Communications Technology Co Ltd that operates MSN China's website: msn.com.cn.

Co-founder and Solutions Architect of Plant on Demand

Antonio Tripiana Caballero worked for almost two years as project engineer at the Signal Processing for Communications and Navigation (SPCOMNAV) research group at the Autonomous University of Barcelona (UAB).The Department of Telecommunications and Systems Engineering project was part of Tripiana’s master’s degree in Telecoms Systems Engineering during his university days from 2011 to 2016. He also completed a one-year exchange program at Finland’s Tampere University of Technology.Tripiana worked as a freelance full-stack developer in Barcelona during his studies. He worked for four months as a scientist at Barcelona’s Mobile World Capital to develop a cloud-based GNSS receiver for IoT devices with ultra-low battery consumption. He also spent five months testing receivers at the European Space Agency (ESA) in the Netherlands.In 2018, he co-founded Plant on Demand (POD) as the startup’s Solutions Architect. He took on the full-time role of CTO during 1Q2020.

Antonio Tripiana Caballero worked for almost two years as project engineer at the Signal Processing for Communications and Navigation (SPCOMNAV) research group at the Autonomous University of Barcelona (UAB).The Department of Telecommunications and Systems Engineering project was part of Tripiana’s master’s degree in Telecoms Systems Engineering during his university days from 2011 to 2016. He also completed a one-year exchange program at Finland’s Tampere University of Technology.Tripiana worked as a freelance full-stack developer in Barcelona during his studies. He worked for four months as a scientist at Barcelona’s Mobile World Capital to develop a cloud-based GNSS receiver for IoT devices with ultra-low battery consumption. He also spent five months testing receivers at the European Space Agency (ESA) in the Netherlands.In 2018, he co-founded Plant on Demand (POD) as the startup’s Solutions Architect. He took on the full-time role of CTO during 1Q2020.

ACA Investments is the Singapore-based affiliate of Asia Capital Alliance, a Japanese investment firm group. The group’s investment focus is on Japan and Southeast Asia, done by combining Japanese intellectual property and Southeast Asia’s growing markets and startup ecosystems. Its investments range from secondhand bookstore Book-Off, F&B brand owner HotLand Corporation (which operates Tsujiki Gindako), and Southeast Asian price comparison site iPrice.ACA Investments is also an affiliate of Japanese investment bank Daiwa Securities Group, which is Japan’s second-largest securities brokerage. In 2018, ACA Group announced that Daiwa Securities Group acquired a 34% stake in ACA Investments as part of a wider strategic alliance between ACA and Daiwa.

ACA Investments is the Singapore-based affiliate of Asia Capital Alliance, a Japanese investment firm group. The group’s investment focus is on Japan and Southeast Asia, done by combining Japanese intellectual property and Southeast Asia’s growing markets and startup ecosystems. Its investments range from secondhand bookstore Book-Off, F&B brand owner HotLand Corporation (which operates Tsujiki Gindako), and Southeast Asian price comparison site iPrice.ACA Investments is also an affiliate of Japanese investment bank Daiwa Securities Group, which is Japan’s second-largest securities brokerage. In 2018, ACA Group announced that Daiwa Securities Group acquired a 34% stake in ACA Investments as part of a wider strategic alliance between ACA and Daiwa.

NYSE-listed Cheetah Mobile is a Beijing-based mobile internet company behind the popular utility applications Clean Master, Security Master and Battery Doctor. It also provides computer security software Duba Anti-virus and other platform products. Cheetah Mobile was formed from the merger of Kingsoft Security and Conew Image in 2010; it went public in 2014.

NYSE-listed Cheetah Mobile is a Beijing-based mobile internet company behind the popular utility applications Clean Master, Security Master and Battery Doctor. It also provides computer security software Duba Anti-virus and other platform products. Cheetah Mobile was formed from the merger of Kingsoft Security and Conew Image in 2010; it went public in 2014.

Shenzhen Sunrise New Energy Co. Ltd.

Founded in 1995, Shenzhen Sunrise New Energy Co. Ltd., formerly known as Shenzhen Rainbow Fine Chemical Industry Co. Ltd., was listed on the Shenzhen Stock Exchange in 2008. Its main lines of business include Lithium-ion battery, photovoltaic power generation and New Energy bus operation. In 2016, it set up a fund to invest in autonomous driving, wireless charging, advanced parking management, artificial intelligence and robotics sectors.

Founded in 1995, Shenzhen Sunrise New Energy Co. Ltd., formerly known as Shenzhen Rainbow Fine Chemical Industry Co. Ltd., was listed on the Shenzhen Stock Exchange in 2008. Its main lines of business include Lithium-ion battery, photovoltaic power generation and New Energy bus operation. In 2016, it set up a fund to invest in autonomous driving, wireless charging, advanced parking management, artificial intelligence and robotics sectors.

Founded in 2012, BAIC Capital is the investment arm of China's state-owned carmaker, BAIC Group. Headquartered in Beijing, it has branches in six cities across China and has two subsidiaries in Frankfurt and Silicon Valley. It currently manages over 40 funds, worth RMB 30bn. With a focus on connected cars and mobility services, it has invested in more than 100 companies including EV manufacturer BAIC BJEV, battery manufacturer and technology company CATL and ride-hailing giant Didi Chuxing.

Founded in 2012, BAIC Capital is the investment arm of China's state-owned carmaker, BAIC Group. Headquartered in Beijing, it has branches in six cities across China and has two subsidiaries in Frankfurt and Silicon Valley. It currently manages over 40 funds, worth RMB 30bn. With a focus on connected cars and mobility services, it has invested in more than 100 companies including EV manufacturer BAIC BJEV, battery manufacturer and technology company CATL and ride-hailing giant Didi Chuxing.

Co-founder and Chief Product Officer of Advotics

Thanks to the Singapore-MIT Alliance Fellowship Program, Jeffry William Tani was able to join a four-year postgrad PhD in Manufacturing System and Technology after graduating in 2009 with a Mechanical Engineering degree at Nanyang Technological University (NTU) in Singapore.In 2013, he joined Schlumberger as a new product development engineer. He left the Singapore-based oilfield mining services company in 2017 and returned to Indonesia to become the CPO of PT Advotics Teknologi Global.

Thanks to the Singapore-MIT Alliance Fellowship Program, Jeffry William Tani was able to join a four-year postgrad PhD in Manufacturing System and Technology after graduating in 2009 with a Mechanical Engineering degree at Nanyang Technological University (NTU) in Singapore.In 2013, he joined Schlumberger as a new product development engineer. He left the Singapore-based oilfield mining services company in 2017 and returned to Indonesia to become the CPO of PT Advotics Teknologi Global.

Co-founder and CEO of Kerjabilitas

After graduating in 2004 from the Universitas Negeri Surabaya in Indonesia, Rubby Emir worked at various NGOs and social enterprises, including the Red Cross and Rainforest Alliance.In 2014, he co-founded a nonprofit enterprise Saujana, working on environmental conservation and social issues. In 2015, the Saujana team launched Kerjabilitas, a job search platform for disabled people in Indonesia. Rubby is also a senior project manager at the Humanitarian Benchmark Consulting that provides consulting and support services for humanitarian activities.

After graduating in 2004 from the Universitas Negeri Surabaya in Indonesia, Rubby Emir worked at various NGOs and social enterprises, including the Red Cross and Rainforest Alliance.In 2014, he co-founded a nonprofit enterprise Saujana, working on environmental conservation and social issues. In 2015, the Saujana team launched Kerjabilitas, a job search platform for disabled people in Indonesia. Rubby is also a senior project manager at the Humanitarian Benchmark Consulting that provides consulting and support services for humanitarian activities.

As one of the original enterprises of the Japanese Mitsubishi Group, Mitsubishi Motors started its automotive business in the pre-World War era. Mitsubishi Heavy Industries produced and imported cars for local use. The automotive company became part of the Renault-Nissan-Mitsubishi alliance in 2016 after Nissan acquired a controlling stake in Mitsubishi Motors. Indonesia's Gojek is its latest investment to expand into the ride-hailing tech sector in Southeast-Asia.

As one of the original enterprises of the Japanese Mitsubishi Group, Mitsubishi Motors started its automotive business in the pre-World War era. Mitsubishi Heavy Industries produced and imported cars for local use. The automotive company became part of the Renault-Nissan-Mitsubishi alliance in 2016 after Nissan acquired a controlling stake in Mitsubishi Motors. Indonesia's Gojek is its latest investment to expand into the ride-hailing tech sector in Southeast-Asia.

Co-founder and CEO of Loket

Calling himself a serial entrepreneur, Edy Sulistyo has created and sold three tech startups. Founded in 2009, the event management platform eEvent was sold to US-based EnvisionPoint in 2013. Revenues were mainly earned from events held in USA. He also sold OW.com to Telepathy Inc and Kamus.net to Stand4 LLC. Other internet companies he built included FilesUpload, guestHub, Parking-Hub and CircleMail.Edy graduated in 2006 with a bachelor’s in Computer Science Engineering at the Ohio State University. He is also the managing director of S3 Tech Alliance, a startup incubator in Ohio, USA.

Calling himself a serial entrepreneur, Edy Sulistyo has created and sold three tech startups. Founded in 2009, the event management platform eEvent was sold to US-based EnvisionPoint in 2013. Revenues were mainly earned from events held in USA. He also sold OW.com to Telepathy Inc and Kamus.net to Stand4 LLC. Other internet companies he built included FilesUpload, guestHub, Parking-Hub and CircleMail.Edy graduated in 2006 with a bachelor’s in Computer Science Engineering at the Ohio State University. He is also the managing director of S3 Tech Alliance, a startup incubator in Ohio, USA.

Schneider Electric is a Europe-based company primarily providing energy management and automation solutions for homes, commercial and industrial-scale properties. The company was originally named Schneider & Cie, founded in 1836 as a metal and weaponry, but between 1975 and 1999 began to refocus towards the electrical industry. The company was renamed Schneider Electric in 1999.Schneider’s technologies focus on managing energy use and conserving energy through a combination of hardware and software. Consequently, Schneider’s investments into startups revolve around the energy sector, with companies like solar power management service Xurya, battery manufacturer Verkor, and building management SaaS Clockworks Analytics as part of their portfolio.

Schneider Electric is a Europe-based company primarily providing energy management and automation solutions for homes, commercial and industrial-scale properties. The company was originally named Schneider & Cie, founded in 1836 as a metal and weaponry, but between 1975 and 1999 began to refocus towards the electrical industry. The company was renamed Schneider Electric in 1999.Schneider’s technologies focus on managing energy use and conserving energy through a combination of hardware and software. Consequently, Schneider’s investments into startups revolve around the energy sector, with companies like solar power management service Xurya, battery manufacturer Verkor, and building management SaaS Clockworks Analytics as part of their portfolio.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

European venture capital firm Advent Venture Partners was established in 1981.

European venture capital firm Advent Venture Partners was established in 1981.

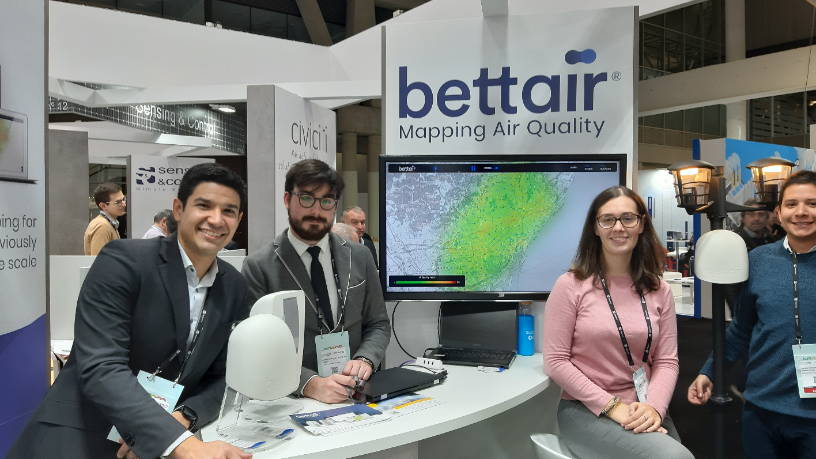

Bettair's air pollution monitoring system for cities promises over 90% accuracy

Combining smart sensors, AI and machine learning, Barcelona-based Bettair has developed a unique, affordable PaaS to accurately measure pollution levels in urban areas

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

IP Buoys: Mooring 4.0 smart buoys to protect marine ecosystems

Save the Posidonia! That’s the call from enterprising sailors who, with their startup IP Buoys, have found a way to protect the seagrass and marine life from the damaging impact of nautical tourism

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

Nutrinsect: Aiming at insects for human consumption for the planet's sake

Nutrinsect expects insect-based foodstuffs to supplement meat to satisfy the ever-growing hunger for protein

Bound4Blue’s aeronautical tech propels first sustainable shipping vessel in the Pacific

Winning €5m fresh funding, Bound4Blue also scores with its EC-backed pilot, the first of its kind, offering new possibilities to cargo vessels seeking sustainable transportation

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

SOURCE Global's solar-run panels turn air into drinking water

The US startup’s adapted solar panels extract water vapor from the air to produce potable water, a vital resource for distressed communities in disaster zones and remote areas

Diamond Foundry: Growing conflict-free, eco-friendly diamonds in a lab

The world’s first lab-grown diamond producer certified carbon-neutral, Diamond Foundry became a unicorn recently with a $200m investment from Fidelity, adding to earlier funding from tech billionaires

How millennials travel: Waynabox for low-cost, X-factor surprise getaways

Play online vacation games and let computers plan your holidays from just €150

For equality in education, Odilo brings books in the cloud free to millions worldwide

The "Amazon for digital content" Spanish edtech startup delivers virtual libraries and classrooms to kids and adults worldwide

StudentFinance: AI screening software matches students to IT courses and jobs

StudentFinance also offers "Study now, pay later" model, making IT courses financially accessible while helping companies overcome skilled tech talent shortage

Spain's 3D printing revolution to drive various sectors' growth

From medical splints to meat-free burgers, multimillion-dollar 3D tech hubs are spawning new verticals across Spain

Sorry, we couldn’t find any matches for“European Battery Alliance”.