European Investment Fund

-

DATABASE (980)

-

ARTICLES (511)

Co-founder and COO of Ebaoyang

Former vice-president of China Aerospace Capital, with over 12 years’ experience in finance, investment and operation management.

Former vice-president of China Aerospace Capital, with over 12 years’ experience in finance, investment and operation management.

A member of the family that founded the Zamora Company (which owns Spanish liquor brands Martin Miller, Ramón Bilbao and Licor 43), Ángel Zamora is currently an active entrepreneur, investor and strategy consultant for several European MNCs. He has explored investment opportunities within the Spanish technology ecosystem, backing startups with global ambitions and supporting them in their overseas expansion, especially to Latin American countries. Zamora is an MBA graduate from the Darden Business School in the US.

A member of the family that founded the Zamora Company (which owns Spanish liquor brands Martin Miller, Ramón Bilbao and Licor 43), Ángel Zamora is currently an active entrepreneur, investor and strategy consultant for several European MNCs. He has explored investment opportunities within the Spanish technology ecosystem, backing startups with global ambitions and supporting them in their overseas expansion, especially to Latin American countries. Zamora is an MBA graduate from the Darden Business School in the US.

ESADE Ban is a network of private investors, comprised of ex-alumnae of the Barcelona, Spain-based ESADE Business School. Founded in 2010, the organization consists of 260 business angels, venture capital companies, family firms and senior managers that have invested more than €27 million in 120 startups. The entity won the European Business Angel Network's 2016 award for best performing business angel and hold investment events throughout the year.

ESADE Ban is a network of private investors, comprised of ex-alumnae of the Barcelona, Spain-based ESADE Business School. Founded in 2010, the organization consists of 260 business angels, venture capital companies, family firms and senior managers that have invested more than €27 million in 120 startups. The entity won the European Business Angel Network's 2016 award for best performing business angel and hold investment events throughout the year.

Mercy Corps’ Social Venture Fund

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

MNC Media Investment started out as Linktone, a China-based media company that was acquired in 2008 by Indonesia’s MNC group that is owned by business tycoon and politician Hary Tanoesoedibjo. Linktone was rebranded as MNC Media Investment Ltd in 2014 to focus on various entertainment and marketing products, as well as other media services. Its shares are also listed on the Australian Stock Exchange and quoted on the OTC Markets Group’s OTC Pink.

MNC Media Investment started out as Linktone, a China-based media company that was acquired in 2008 by Indonesia’s MNC group that is owned by business tycoon and politician Hary Tanoesoedibjo. Linktone was rebranded as MNC Media Investment Ltd in 2014 to focus on various entertainment and marketing products, as well as other media services. Its shares are also listed on the Australian Stock Exchange and quoted on the OTC Markets Group’s OTC Pink.

Co-Founder and CEO of Ziztour

MBA of Ivey Business School at Western University. Formerly division manager at 3M. Two years of experience in investment.

MBA of Ivey Business School at Western University. Formerly division manager at 3M. Two years of experience in investment.

Abanlex is a Spanish law firm specialized in data protection and innovation technology. The firm has a team of cybersecurity consultants, technology lawyers, university professors and marketing specialists. Abanlex is well-known for its 2014 victory over Google in the 'Right to be forgotten' case, in which the European Court of Justice established the legal basis of responsibility of search engines concerning data and links appearing when searching for a specific name.Since 2011, Abanlex has been dedicated to defending blockchain project at national and European level, and has provided legal representation to companies in the legal-tech sector.

Abanlex is a Spanish law firm specialized in data protection and innovation technology. The firm has a team of cybersecurity consultants, technology lawyers, university professors and marketing specialists. Abanlex is well-known for its 2014 victory over Google in the 'Right to be forgotten' case, in which the European Court of Justice established the legal basis of responsibility of search engines concerning data and links appearing when searching for a specific name.Since 2011, Abanlex has been dedicated to defending blockchain project at national and European level, and has provided legal representation to companies in the legal-tech sector.

The Alexa Fund provides up to $200 million in venture capital funding to fuel voice technology innovation. It is focused on how voice technology can improve customers’ lives, from early-stage pre-revenue companies to established brands. Areas of particular interest include: hardware products that would benefit from the Alexa Voice Service; skills that deliver new abilities to Alexa-enabled devices through the Alexa Skills Kit; and new contributions to the science behind voice technology, including text to speech, natural language understanding, automatic speech recognition, artificial intelligence and hardware component design.

The Alexa Fund provides up to $200 million in venture capital funding to fuel voice technology innovation. It is focused on how voice technology can improve customers’ lives, from early-stage pre-revenue companies to established brands. Areas of particular interest include: hardware products that would benefit from the Alexa Voice Service; skills that deliver new abilities to Alexa-enabled devices through the Alexa Skills Kit; and new contributions to the science behind voice technology, including text to speech, natural language understanding, automatic speech recognition, artificial intelligence and hardware component design.

Simone Investment Managers specializes in real estate and alternative assets management. It has property investments in South Korea and abroad in USA and Europe.

Simone Investment Managers specializes in real estate and alternative assets management. It has property investments in South Korea and abroad in USA and Europe.

Picart Petcare is the family business of Albert Icart Martori, co-founder of Kibus Petcare. It has been in operation since 1953 and is based in Barcelona. Not usually an investor in tech or startups, it has invested solely in healthy pet food preparation hardware startup Kibus with a pre-seed investment of €120,000 in 1Q 2019. Picart distributes pet food and animal feed in more than 25 European and Middle Eastern markets and is set to be a key distributor of Kibus' hardware.

Picart Petcare is the family business of Albert Icart Martori, co-founder of Kibus Petcare. It has been in operation since 1953 and is based in Barcelona. Not usually an investor in tech or startups, it has invested solely in healthy pet food preparation hardware startup Kibus with a pre-seed investment of €120,000 in 1Q 2019. Picart distributes pet food and animal feed in more than 25 European and Middle Eastern markets and is set to be a key distributor of Kibus' hardware.

Co-founder and CEO of Lubna.io

Kevin Cahya co-founded crypto robo-trading and investment platform Lubna.io in 2018. He started crypto trading as a hobby in 2015 while working as an investment associate at East Ventures. He also had a brief stint as operations project manager at Zalora Indonesia.Educated in the US, Kevin graduated from Shoreline Community College with an associate degree in International Business. He also has a bachelor's in Business Administration from the University of Southern California.

Kevin Cahya co-founded crypto robo-trading and investment platform Lubna.io in 2018. He started crypto trading as a hobby in 2015 while working as an investment associate at East Ventures. He also had a brief stint as operations project manager at Zalora Indonesia.Educated in the US, Kevin graduated from Shoreline Community College with an associate degree in International Business. He also has a bachelor's in Business Administration from the University of Southern California.

Co-founder of Mapan by Ruma

After graduating with an Industrial Engineering degree from Purdue University in the US, Sean DeWitt became a management consultant at PricewaterhouseCoopers. He later worked at the US Department of State and the Fund for New York City.In 2007, he joined the nonprofit Grameen Foundation that was established by Grameen Bank founder Muhammad Yunus. As part of the nonprofit, he helped Aldi Haryopratomo establish the social enterprise Ruma. DeWitt currently works for the World Resource Institute. He also holds master’s degrees in Development Finance and Environmental Economics from the University of London.

After graduating with an Industrial Engineering degree from Purdue University in the US, Sean DeWitt became a management consultant at PricewaterhouseCoopers. He later worked at the US Department of State and the Fund for New York City.In 2007, he joined the nonprofit Grameen Foundation that was established by Grameen Bank founder Muhammad Yunus. As part of the nonprofit, he helped Aldi Haryopratomo establish the social enterprise Ruma. DeWitt currently works for the World Resource Institute. He also holds master’s degrees in Development Finance and Environmental Economics from the University of London.

CEO and founder of ATRenew (formerly Aihuishou)

Chen graduated from Tongji University in 2002 with a bachelor’s degree in Computer Science, and from Fudan University in 2005 with a master’s degree in the same field. Upon graduation, he worked for Fortune 500 company Sykes Enterprises as a software engineer. In 2009, he received a RMB100,000 seed fund from Fudan University to start Leyi, a customer-to-customer (C2C) platform for trading second-hand goods, with Sun Wenjun, a friend he met through his master’s degree. Although the business failed after two and a half years, the two young entrepreneurs led their core team to form Aihuishou.

Chen graduated from Tongji University in 2002 with a bachelor’s degree in Computer Science, and from Fudan University in 2005 with a master’s degree in the same field. Upon graduation, he worked for Fortune 500 company Sykes Enterprises as a software engineer. In 2009, he received a RMB100,000 seed fund from Fudan University to start Leyi, a customer-to-customer (C2C) platform for trading second-hand goods, with Sun Wenjun, a friend he met through his master’s degree. Although the business failed after two and a half years, the two young entrepreneurs led their core team to form Aihuishou.

Co-founder and CTO of McFly

Liu Long graduated from Northwestern Polytechnic University based in Xi'an in 2010. The Information and Computing Science graduate went on to the Institute of Remote Sensing Applications (IRSA) at the Chinese Academy of Sciences to pursue a PhD in Microwave Remote Sensing in 2015. He stayed on at the IRSA as a research fellow with funding support from the Youth Science Fund program under the National Natural Science Foundation of China. In 2016, he co-founded agtech startup McFly with two Wuhan University alumni who are also experts in remote sensing technology.

Liu Long graduated from Northwestern Polytechnic University based in Xi'an in 2010. The Information and Computing Science graduate went on to the Institute of Remote Sensing Applications (IRSA) at the Chinese Academy of Sciences to pursue a PhD in Microwave Remote Sensing in 2015. He stayed on at the IRSA as a research fellow with funding support from the Youth Science Fund program under the National Natural Science Foundation of China. In 2016, he co-founded agtech startup McFly with two Wuhan University alumni who are also experts in remote sensing technology.

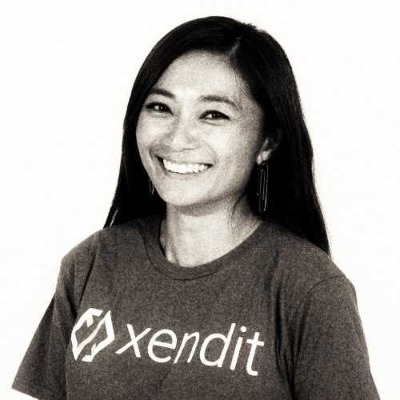

COO and co-founder of Xendit

Tessa Wijaya joined Indonesian fintech Xendit as co-founder and COO in 2016, a year after the payment gateway startup graduated from the Y Combinator program and launched its platform in Indonesia.Wijaya obtained a master’s in philosophy from the University of Sydney in 2006 after graduating from Syracuse University’s Maxwell School of Citizenship and Public Affairs in 2003. She returned to Indonesia and worked as a corporate development officer for over three years. In 2010, she became an analyst at Principia Management Group and Fairways Investment Group, both being Southeast Asia-focused investment firms. In 2013, Wijaya went on to work as an associate at Singapore-based investment firm Mizuho Asia Partners for over three years before joining Xendit back in Jakarta.

Tessa Wijaya joined Indonesian fintech Xendit as co-founder and COO in 2016, a year after the payment gateway startup graduated from the Y Combinator program and launched its platform in Indonesia.Wijaya obtained a master’s in philosophy from the University of Sydney in 2006 after graduating from Syracuse University’s Maxwell School of Citizenship and Public Affairs in 2003. She returned to Indonesia and worked as a corporate development officer for over three years. In 2010, she became an analyst at Principia Management Group and Fairways Investment Group, both being Southeast Asia-focused investment firms. In 2013, Wijaya went on to work as an associate at Singapore-based investment firm Mizuho Asia Partners for over three years before joining Xendit back in Jakarta.

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Triporate: Producing business travel itineraries and bookings 10x faster than human agents

Triporate helps corporates save time and money with its automated travel bookings from analyzing staff emails; it raised €1.3m recently

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

New Food Invest: Opportunities in the European alt-protein space

With a record €2.4bn investment in 2019, Europe’s foodtech sector appears poised for continued growth, but startups, corporations, governments and even universities can do more, experts say

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

Sorry, we couldn’t find any matches for“European Investment Fund”.