European Investment Fund

-

DATABASE (980)

-

ARTICLES (511)

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

Co-founder and co-CEO of Indexa Capital

Since 2016, François Derbaix has become a co-founder and adviser to Indexa Lending, in addition to his role as co-CEO of Indexa Capital. Derbaix is a serial entrepreneur, with interests in the vacation rental and retail sectors like Rentalia and Soysuper. He was the CEO of Toprural from 2000 to 2012, when it was acquired by North American travel giant HomeAway.Derbaix has also invested in various Spanish and Belgian internet businesses like Percentil. The University of Leuven summa cum laude graduate was the first private investor to join a fund managed by the European Investment Fund in 2014.

Since 2016, François Derbaix has become a co-founder and adviser to Indexa Lending, in addition to his role as co-CEO of Indexa Capital. Derbaix is a serial entrepreneur, with interests in the vacation rental and retail sectors like Rentalia and Soysuper. He was the CEO of Toprural from 2000 to 2012, when it was acquired by North American travel giant HomeAway.Derbaix has also invested in various Spanish and Belgian internet businesses like Percentil. The University of Leuven summa cum laude graduate was the first private investor to join a fund managed by the European Investment Fund in 2014.

Co-founder of Tonic App

couldnt find a colour picDavid Bórsos is the Hungarian-born co-founder of Tonic App for medical doctors and currently works as an officer at the European Investment Fund in Luxembourg. He co-founded Tonic App after studying for his MBA at IE Business School in Madrid, where he met the rest of the co-founding team. Bórsos previously worked as Head of Business Intelligence at Job Today and as a Business Analyst at various levels at Goodyear, both in Luxembourg. He also holds a BSc from Deberceni Egyetem in Hungary and worked for Samsung Electronics and TVA in the same country.

couldnt find a colour picDavid Bórsos is the Hungarian-born co-founder of Tonic App for medical doctors and currently works as an officer at the European Investment Fund in Luxembourg. He co-founded Tonic App after studying for his MBA at IE Business School in Madrid, where he met the rest of the co-founding team. Bórsos previously worked as Head of Business Intelligence at Job Today and as a Business Analyst at various levels at Goodyear, both in Luxembourg. He also holds a BSc from Deberceni Egyetem in Hungary and worked for Samsung Electronics and TVA in the same country.

Co-founder of Duodianyun

Peng Yao has a master’s in Electronic and Information Engineering from Tsinghua University. He was an industry researcher at Taikang Asset, an investment manager at SDIC Fund Management and Vangoo Capital Partners. He has investment experience in diverse industry sectors like healthcare, TMT and advanced equipment manufacturing.

Peng Yao has a master’s in Electronic and Information Engineering from Tsinghua University. He was an industry researcher at Taikang Asset, an investment manager at SDIC Fund Management and Vangoo Capital Partners. He has investment experience in diverse industry sectors like healthcare, TMT and advanced equipment manufacturing.

Founded in October 2015, Pagoda Investment is a private equity firm focusing on TMT, consumer products, healthcare and education. Its key investors include Queensland Investment Corporation Limited, a Queensland-based Australian VC, and some European-based family funds as well as pension funds, with a total of RMB 5bn under management.

Founded in October 2015, Pagoda Investment is a private equity firm focusing on TMT, consumer products, healthcare and education. Its key investors include Queensland Investment Corporation Limited, a Queensland-based Australian VC, and some European-based family funds as well as pension funds, with a total of RMB 5bn under management.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Russia-China Investment Fund (RCIF) is a private equity fund that invests in projects created to advance economic cooperation between Russia and China. RCIF was founded in 2012 by two government-backed funds: Russian Direct Investment Fund (RDIF) and China Investment Corporation (CIC). RCIF has received US$1 billion commitments from both RDIF and CIC. International institutional investors are expected to commit an additional US$2 billion. RCIF will invest at least 70% of its capital in Russia and CIS countries and around 30% in China.

Co-founder and CEO of Indexa Capital

With over 15 years of experience in the financial services, CFA professional Unai Ansejo Barra is a fixed-income fund manager at a government employees’ pension fund Itzarri EPSV. He is also a lecturer in risk management at the University of Basque Country, with a PhD in Finance and a Physics degree from the same university.He entered the tech scene in 2014 as co-founder and CEO of Bewa7er, an online platform to promote the economic rights of startups. He also co-founded the automated investment manager platform Indexa Capital in 2015.

With over 15 years of experience in the financial services, CFA professional Unai Ansejo Barra is a fixed-income fund manager at a government employees’ pension fund Itzarri EPSV. He is also a lecturer in risk management at the University of Basque Country, with a PhD in Finance and a Physics degree from the same university.He entered the tech scene in 2014 as co-founder and CEO of Bewa7er, an online platform to promote the economic rights of startups. He also co-founded the automated investment manager platform Indexa Capital in 2015.

Yuantai Investment Partners Fund

Yuantai Investment Partners Fund is co-founded by You Qingyi, the partner of China Soft Investment Corporation, and Shao Yangdong, the former financial analyst in investment banking department of Salomon Brothers Inc. with more than 20 years experience in investment.

Yuantai Investment Partners Fund is co-founded by You Qingyi, the partner of China Soft Investment Corporation, and Shao Yangdong, the former financial analyst in investment banking department of Salomon Brothers Inc. with more than 20 years experience in investment.

Shansheng Equity Investment Fund

Shansheng Equity Investment Fund was launched in September 2020 with Beijing Huayao Zhongwei Investment Management as its manager.

Shansheng Equity Investment Fund was launched in September 2020 with Beijing Huayao Zhongwei Investment Management as its manager.

Established in 2018, Jensen Group Investment Fund is the generalist investment fund of Danish entrepreneur Steen Ulf Jensen, founder of the Jensen Group, a global manufacturer of machines for the heavy-duty laundry industry based in Belgium. Jensen was also the CEO of Box TV and Digicel Cabel. The fund has so far invested in four startups with Jensen becoming board chairman at the investee companies. In 2020, the fund acquired stakes in the July €1.1m seed round of Danish alt-leather biotech Beyond Leather Materials and in the funding of Danish bike lock startup PentaLock earlier in March.

Established in 2018, Jensen Group Investment Fund is the generalist investment fund of Danish entrepreneur Steen Ulf Jensen, founder of the Jensen Group, a global manufacturer of machines for the heavy-duty laundry industry based in Belgium. Jensen was also the CEO of Box TV and Digicel Cabel. The fund has so far invested in four startups with Jensen becoming board chairman at the investee companies. In 2020, the fund acquired stakes in the July €1.1m seed round of Danish alt-leather biotech Beyond Leather Materials and in the funding of Danish bike lock startup PentaLock earlier in March.

CGN Industrial Investment Fund

CGN Industrial Investment Fund Co., Ltd. was co-founded by China General Nuclear Power Group (CGN), China Cinda Asset Management Co., Ltd. and China Three Gorges Corporation in Shenzhen in 2008. With over RMB 15 billion assets under management, the fund invests mainly in the sectors of nuclear power, solar power, forestry and mining.

CGN Industrial Investment Fund Co., Ltd. was co-founded by China General Nuclear Power Group (CGN), China Cinda Asset Management Co., Ltd. and China Three Gorges Corporation in Shenzhen in 2008. With over RMB 15 billion assets under management, the fund invests mainly in the sectors of nuclear power, solar power, forestry and mining.

Co-founder, CEO and CFO of Growpal

Ahmad Rizqy Akbar is the CEO and CFO of Growpal, an investment crowdfunding platform for aquaculture and fishery projects. A graduate of Aquaculture studies from Indonesia’s Universitas Brawijaya, he has run his own fish and shrimp farm and had worked at Pertamina Dana Ventura, a venture capital fund owned by national oil and gas firm Pertamina. In 2017, he joined fellow Brawijaya graduate Paundra Noorbaskoro to establish Growpal.

Ahmad Rizqy Akbar is the CEO and CFO of Growpal, an investment crowdfunding platform for aquaculture and fishery projects. A graduate of Aquaculture studies from Indonesia’s Universitas Brawijaya, he has run his own fish and shrimp farm and had worked at Pertamina Dana Ventura, a venture capital fund owned by national oil and gas firm Pertamina. In 2017, he joined fellow Brawijaya graduate Paundra Noorbaskoro to establish Growpal.

China Culture Industrial Investment Fund

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

Guangzhou Yuexiu Industrial Investment Fund Management

Founded by the conglomerate Yuexiu Enterprises (Holdings) Limited in 2011, Guangzhou Yuexiu Industrial Investment Fund Management is mainly engaged in equity investment, mezzanine investment and FOF investment. The firm managed total of assets worth over RMB 60bn by the end of 2018.

Founded by the conglomerate Yuexiu Enterprises (Holdings) Limited in 2011, Guangzhou Yuexiu Industrial Investment Fund Management is mainly engaged in equity investment, mezzanine investment and FOF investment. The firm managed total of assets worth over RMB 60bn by the end of 2018.

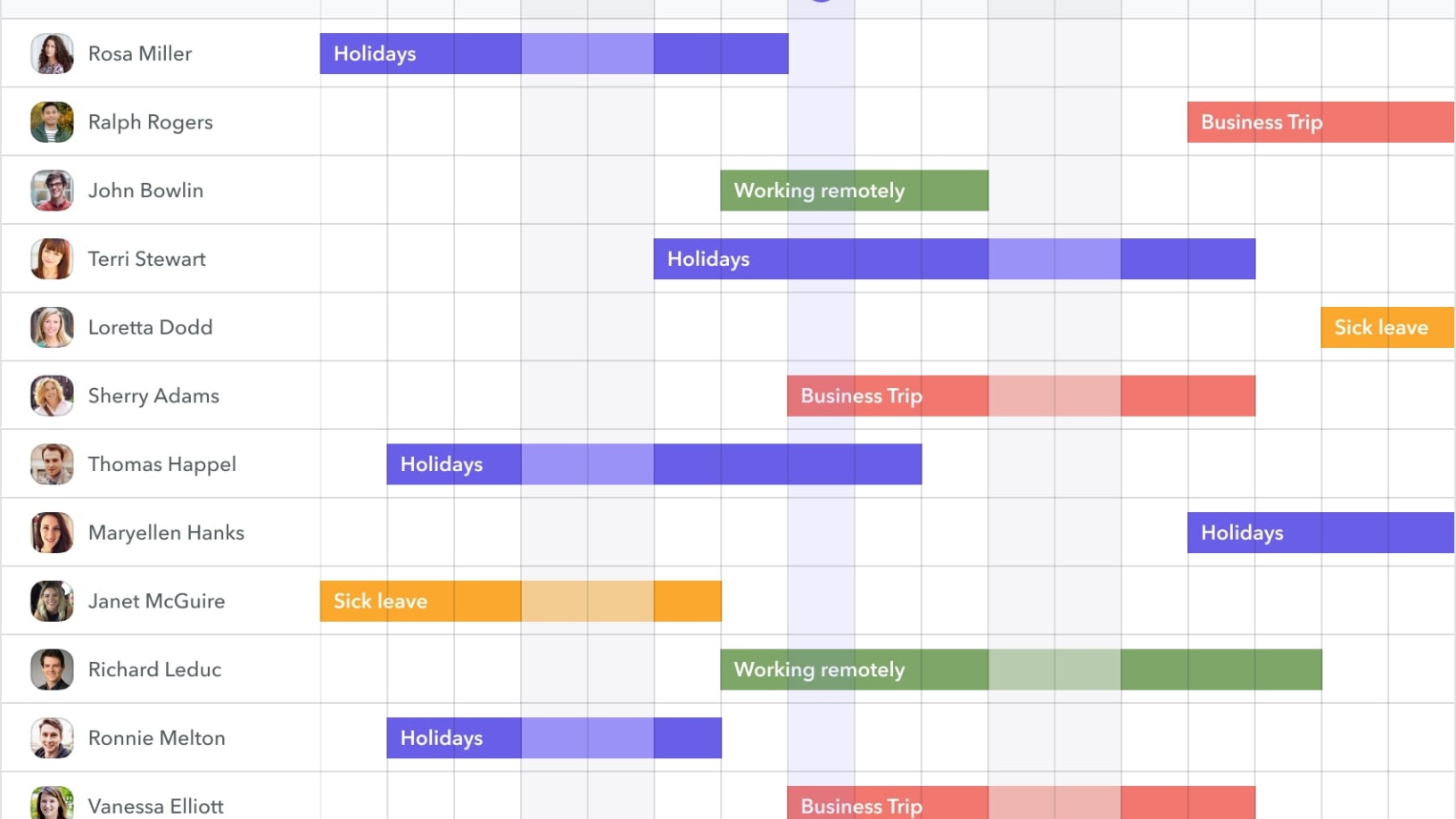

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

Calling Factorial “the Zendesk of HR," Silicon Valley heavyweight CRV led the round, in its first-ever investment in Spain

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Gestoos: The future is in the present with gesture recognition tech for consumers

From spotting and alerting sleepy drivers in their cars to switching on a washing machine with the wave of a hand, Gestoos's gesture and behavior recognition tech has wide application across devices and industries

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

VEnvirotech: Organic waste converted at source into biodegradable raw bioplastic

The Spanish startup presents an innovative circular business model to stand out in the ever-growing bioplastics sector with its on-site smart-waste container and garbage-consuming bacteria

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

Beonprice’s RMS sets the right price for every single hotel room 24/7

Ranked as 5th best RMS platform globally, Beonprice uses AI to stay ahead of competitors

SWORD Health: Reinventing the wheel for physiotherapy

AI-powered healthcare tech brings relief to overworked and understaffed physiotherapy providers

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Portofolio: Showing rookie investors the ropes without the rip-offs

Through investment education and the guidance of master traders, Portofolio aims to show aspiring forex and derivatives traders and investors how to avoid scams and stabilize their returns

QOA: Gourmet guilt-free chocolate, without the cocoa

Munich-based QOA transforms industrial food waste into vegan chocolate, enabling consumers to avoid the sustainability and ethical issues of cocoa production

Agritech from Myanmar to Indonesia and beyond: Interview with Jefry Pratama, UMG Idealab

UMG, the Myanmar-based conglomerate, looks to Indonesia for investment and inspiration, with agritech and drones among its focuses

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

Sorry, we couldn’t find any matches for“European Investment Fund”.