European Social Innovation Competition

-

DATABASE (427)

-

ARTICLES (567)

Social Capital is a Palo Alto-based venture capital firm. Its stated mission is to "advance humanity by solving the world's hardest problems", with the firm investing in entrepreneurs who markedly improve their communities. Social Capital's diverse portfolio comprises healthcare companies, workplace productivity software Slack and SurveyMonkey and coworking space operator Rework (now GoWork).

Social Capital is a Palo Alto-based venture capital firm. Its stated mission is to "advance humanity by solving the world's hardest problems", with the firm investing in entrepreneurs who markedly improve their communities. Social Capital's diverse portfolio comprises healthcare companies, workplace productivity software Slack and SurveyMonkey and coworking space operator Rework (now GoWork).

Innovation Nest is an early-stage venture capitalist firm based in Krakow, Poland. Founded in 2010, the VC has invested in more than 50 startups, with a special focus on European B2B SaaS companies. The firm was the lead investor in eight of the startups' funding rounds.The VC usually participates in seed rounds, with the most recent being a US$1-million investment in Poland's fraud detection company Netone and another seed investment in Portuguese facility management platform Infraspeak. The VC has also joined a Series A round for ICT SaaS company CallPage and Series B funding in sensor company Estimote.

Innovation Nest is an early-stage venture capitalist firm based in Krakow, Poland. Founded in 2010, the VC has invested in more than 50 startups, with a special focus on European B2B SaaS companies. The firm was the lead investor in eight of the startups' funding rounds.The VC usually participates in seed rounds, with the most recent being a US$1-million investment in Poland's fraud detection company Netone and another seed investment in Portuguese facility management platform Infraspeak. The VC has also joined a Series A round for ICT SaaS company CallPage and Series B funding in sensor company Estimote.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

The European Investment Bank is a pan-European investor based in Luxembourg, and the only bank owned by European Union member states. Founded in 1958, the banks has invested in thousands of businesses and public and private infrastructure projects. It is the largest multilateral borrower and lender by volume and also now has an SME tech focus, with recipients needing to have sustainable business model and, usually, a European focus. In December 2020, the EIB launched a new €150m co-investment fund to support startups leveraging AI across Europe to address what it called “the multibillion-euro funding gap compared with the United States and China.” Its most recent investments include a €20m investment in the €32m Series C round of Portuguese international online print store 360imprimir (BIZAY) and its first spacetech investment, €20m in venture debt investment to Luxembourg-based Spire Global that is building a satellite constellation, both in December 2020.In 4Q 2020, it also invested €10m in Spanish industrial IoT startup Worldsensing, €15m in German identity verification platform IDnow and €15 in German sportstech platform KINEXON.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

Founded in 2018, Trinity Innovation Fund is a fund management firm that mainly invests in pharmaceutical innovations. TIF currently manages two PE funds and its limited partners include renowned pharmaceuticals and institutional investors. It also has offices managing funds overseas, for example, Trinity Innovation Bioventure Singapore Pte Ltd.

Founded in 2018, Trinity Innovation Fund is a fund management firm that mainly invests in pharmaceutical innovations. TIF currently manages two PE funds and its limited partners include renowned pharmaceuticals and institutional investors. It also has offices managing funds overseas, for example, Trinity Innovation Bioventure Singapore Pte Ltd.

Phitrust Partenaires is a France-based investment fund focused on social businesses in Europe and Asia.In Europe, the company acts as a VC firm dedicated to impact investing. Its investment vehicle contributes €150,000 to €800,000 to support projects that address social needs. Phitrust Partenaires also works in partnership with prominent European social funds.

Phitrust Partenaires is a France-based investment fund focused on social businesses in Europe and Asia.In Europe, the company acts as a VC firm dedicated to impact investing. Its investment vehicle contributes €150,000 to €800,000 to support projects that address social needs. Phitrust Partenaires also works in partnership with prominent European social funds.

Founded in 2014, Giant Innovation Capital is a venture capital fund by Giant Interactive Group, an online game developer and operator listed on the NYSE. It focuses on early stage investing in Internet startups.

Founded in 2014, Giant Innovation Capital is a venture capital fund by Giant Interactive Group, an online game developer and operator listed on the NYSE. It focuses on early stage investing in Internet startups.

Mercy Corps’ Social Venture Fund

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Xora Innovation is a subsidiary of the Singapore sovereign investment fund, Temasek. It was established as an early-stage deeptech investment platform that identifies startups connected with the Singapore science and technology ecosystem (although the startup can be based anywhere in the world). Xora plans to invest as a lead or co-lead in seed or Series A rounds, with later-stage investments being handled through Temasek. As of July 2021, Xora has invested in two companies based in Singapore: Allozymes, which provides enzyme engineering services, and Nuevocor, which is developing gene therapy for certain heart diseases.

Xora Innovation is a subsidiary of the Singapore sovereign investment fund, Temasek. It was established as an early-stage deeptech investment platform that identifies startups connected with the Singapore science and technology ecosystem (although the startup can be based anywhere in the world). Xora plans to invest as a lead or co-lead in seed or Series A rounds, with later-stage investments being handled through Temasek. As of July 2021, Xora has invested in two companies based in Singapore: Allozymes, which provides enzyme engineering services, and Nuevocor, which is developing gene therapy for certain heart diseases.

With a specific focus on clean energy, Innogy Innovation Hub was established in 2014 and currently has 53 startups in its portfolio spanning from Austria to Bangladesh. Recent investments include HypeLabs' US$3m seed round and the €4m Series A round of augmented and mixed reality solutions provider Holo-Light.

With a specific focus on clean energy, Innogy Innovation Hub was established in 2014 and currently has 53 startups in its portfolio spanning from Austria to Bangladesh. Recent investments include HypeLabs' US$3m seed round and the €4m Series A round of augmented and mixed reality solutions provider Holo-Light.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

Portuguese serial entrepreneur and angel investor, Carlos Oliveira is formerly the Secretary of State for Entrepreneurship, Competitiveness and Innovation in Portugal. He is also one of the 15 members of the European Commission's high-level group of innovators tasked with the creation of the European Innovation Council.In 2000, Oliveira founded a mobile services startup MobiComp and worked as its CEO until 2008 when he sold the company to Microsoft. He has also founded and invested in several startups, including StudentFinance fintech's €1.15m seed round. He is currently the executive president of the José Neves Foundation, set up by Farfetch founder José Neves to invest and transform Portugal into a knowledge economy.

Portuguese serial entrepreneur and angel investor, Carlos Oliveira is formerly the Secretary of State for Entrepreneurship, Competitiveness and Innovation in Portugal. He is also one of the 15 members of the European Commission's high-level group of innovators tasked with the creation of the European Innovation Council.In 2000, Oliveira founded a mobile services startup MobiComp and worked as its CEO until 2008 when he sold the company to Microsoft. He has also founded and invested in several startups, including StudentFinance fintech's €1.15m seed round. He is currently the executive president of the José Neves Foundation, set up by Farfetch founder José Neves to invest and transform Portugal into a knowledge economy.

RWA Invest GmbH is the wholesale company and service provider of the Raiffeisen Lagerhaus cooperatives, with over 1,000 distribution points and more than 120,000 cooperative members.The company also launched the Agro Innovation Lab (AIL) acceleration program focused on taking a leading role in cutting-edge technologies and innovation for agritech companies in the European region. The second cohort will involve activities in Austria and Germany.

RWA Invest GmbH is the wholesale company and service provider of the Raiffeisen Lagerhaus cooperatives, with over 1,000 distribution points and more than 120,000 cooperative members.The company also launched the Agro Innovation Lab (AIL) acceleration program focused on taking a leading role in cutting-edge technologies and innovation for agritech companies in the European region. The second cohort will involve activities in Austria and Germany.

Co-founder, CEO of Consumers Trust

Pedro Lourenço is the Portuguese co-founder and CEO of Consumers Trust, the company behind consumer complaints platform Portal da Queixa, founded in 2009. Since 2019, he has also been European Consumer Rights Ambassador at the European Commission, a position he was selected for thanks to his work at Consumers Trust. He is also co-founder and CEO at digital agency Megaklique Multimedia, and until 2015 was a co-founder of creative and innovation association Mexe-te. He holds a degree in Graphic Design, lives in Porto and is married to Consumers Trust co-founder Sónia Lage Lourenço.

Pedro Lourenço is the Portuguese co-founder and CEO of Consumers Trust, the company behind consumer complaints platform Portal da Queixa, founded in 2009. Since 2019, he has also been European Consumer Rights Ambassador at the European Commission, a position he was selected for thanks to his work at Consumers Trust. He is also co-founder and CEO at digital agency Megaklique Multimedia, and until 2015 was a co-founder of creative and innovation association Mexe-te. He holds a degree in Graphic Design, lives in Porto and is married to Consumers Trust co-founder Sónia Lage Lourenço.

Psquared: Providing flexible workplaces to help early-stage startups

The Barcelona-based startup converts a variety of buildings to hybrid office spaces for flexible work brought about by Covid-19, includes a reservations system to manage desk and meeting spaces

Koiki: Delivering social advancement, one parcel at a time

Social enterprise startup Koiki seeks to reduce the carbon footprint of e-commerce deliveries and provide jobs for Spain's most vulnerable people

Auara: Social enterprise and environmental sustainability in a bottle

Auara, with its 100% recycled-plastic mineral water bottles, aims to reduce its manufacturing carbon footprint while helping the most water-stressed citizens

Jakarta Aman uses social networking to improve neighborhood security

Backed by Jakarta's provincial government and MDI Ventures, neighborhood security app Jakarta Aman seeks to reignite the “gotong royong” spirit to keep communities safe

Consumers Trust: The company that gives consumers a voice

Consumers Trust has become Portugal's go-to company for customer complaint resolution; it is seeking funding to enable it to replicate its success in new markets

eFishery poised to benefit from Indonesia's growing aquaculture sector

eFishery's IoT automatic feeding system is delivering efficiencies and boosting output for small fish farmers, driving strong growth for the aquaculture startup.

MatMap: Making the construction sector more sustainable

Alicante-based startup MatMap gives a second lease of life to used construction materials that account for almost a third of EU waste

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

CloudGuide: Bringing museum tourism into the 21st century

CloudGuide, an app hosting official multimedia content from museums and tourist attractions, seeks post-seed funding to scale in Europe

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

Indonesia transport ministry to regulate ride-hailing app discounts

Despite criticism from riders and drivers, the ministry will cooperate with business competition supervisor to curb excessive discounts and prevent price wars

Next-generation social media app YouClap targets engagement over reach

Already valued at €5m one year after launching, the YouClap platform for online challenges will seek Series A investment before the end of 2019

Waterdrop: Using crowdfunding and social media to disrupt health insurance

Insurtech startup Waterdrop helps families in China who cannot afford medical treatment to raise money via online mutual aid and crowdfunding, while selling insurance plans too

Start with the little things: 5 Indonesian social impact startups

From providing student loans to empowering marginalized groups and farmers, these Indonesian startups are revitalizing local communities

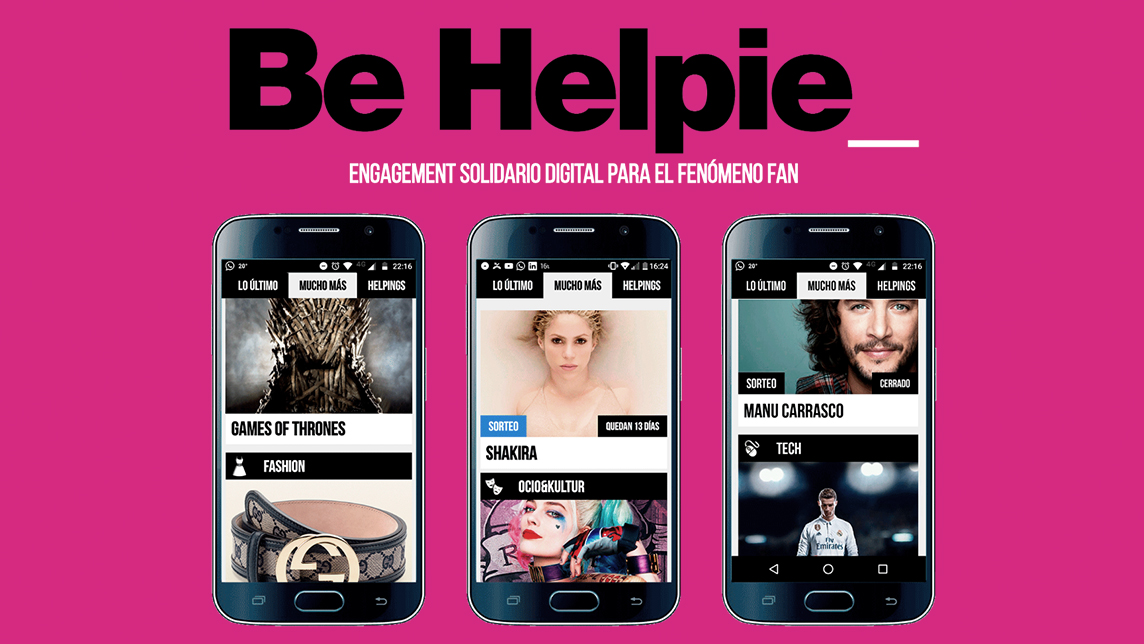

Be Helpie: Fundraising designed for Gen Z

CEO of Pamplona-based startup Be Helpie, Miguel Pueyo, tells CompassList at the Madrid South Summit about revolutionizing fundraising by engaging teens and young adults

Sorry, we couldn’t find any matches for“European Social Innovation Competition”.