European Space Agency

DATABASE (279)

ARTICLES (375)

Investisseurs & Partenaires (I&P)

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Founded in London in 1998, Kreos Capital is a pioneer growth debt provider. Kreos has completed over 630 deals worth over €3bn in pan-European countries and Israel. The Kreos Capital Group of companies and various funds are regulated by the Jersey Financial Services Commission.Kreos currently has 102 companies in its portfolio and has managed over 200 exits. Investee Riskified, an Israeli e-commerce fraud protection company, was listed on the NYSE at a $3.3bn valuation in August 2021. Kreos also joined recent investments in 2021 including the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed and the €9.5m round of Berlin-based HRtech expertlead.

Founded in London in 1998, Kreos Capital is a pioneer growth debt provider. Kreos has completed over 630 deals worth over €3bn in pan-European countries and Israel. The Kreos Capital Group of companies and various funds are regulated by the Jersey Financial Services Commission.Kreos currently has 102 companies in its portfolio and has managed over 200 exits. Investee Riskified, an Israeli e-commerce fraud protection company, was listed on the NYSE at a $3.3bn valuation in August 2021. Kreos also joined recent investments in 2021 including the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed and the €9.5m round of Berlin-based HRtech expertlead.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

CEO and co-founder of Refurbed

Kilian Kaminski graduated in communication and media studies in 2013 at Fresenius University in Cologne, Germany. Kaminski and Peter Windischhofer met during a master’s program at Hult International Business School. The two post-grads also worked in Shanghai in 2014.Kaminski held various business and marketing internship roles at Fiege Far East Holding and pottery-maker ProGreen in Shanghai, Hansa shipping GmbH and Hamburg Sparkasse bank in Germany and also at a music agency in Australia.In December 2014, he joined Amazon Services as an accounts manager in Munich. He also worked as Amazon’s program lead for certified refurbished DE marketplace for over two years.He left in 2017 and co-founded Refurbed with Windischhofer in Austria. In 2019, the CEO of Vienna-based refurbished electronics marketplace became an expert member of the Consumer Insight Action Panel, an EU initiative designed to support the transition to the circular economy.

Kilian Kaminski graduated in communication and media studies in 2013 at Fresenius University in Cologne, Germany. Kaminski and Peter Windischhofer met during a master’s program at Hult International Business School. The two post-grads also worked in Shanghai in 2014.Kaminski held various business and marketing internship roles at Fiege Far East Holding and pottery-maker ProGreen in Shanghai, Hansa shipping GmbH and Hamburg Sparkasse bank in Germany and also at a music agency in Australia.In December 2014, he joined Amazon Services as an accounts manager in Munich. He also worked as Amazon’s program lead for certified refurbished DE marketplace for over two years.He left in 2017 and co-founded Refurbed with Windischhofer in Austria. In 2019, the CEO of Vienna-based refurbished electronics marketplace became an expert member of the Consumer Insight Action Panel, an EU initiative designed to support the transition to the circular economy.

InnovationRCA is the Royal College of Art’s center for entrepreneurship and commercialization. It supports RCA students, alumni and employees looking to turn their ideas into new businesses. The center was established in 2004 and is based in London.The centre’s activities include providing startup incubation and acceleration services to potential RCA spin-offs. This includes coaching and business mentoring based on RCA’s design-led, user-centric approach, as well as intellectual property advice and support. In addition, the center offers access to office and workshop space, as well as funding. InnovationRCA runs its own angel investor network, AngelClubRCA. It has also partnered with a UK-based VC, Venrex Investment Management, to improve RCA startups’ access to private funding. In addition, the centre conducts programmes for external entrepreneurs and organisations looking to promote innovation and entrepreneurship worldwide.McKinsey has called InnovationRCA a “world-class spinout incubator", praising its work as a "significant driver of entrepreneurial growth” along with its ”impressive results". In July 2019, the UK Business Angels Association also named InnovationRCA its Accelerator of the Year.

InnovationRCA is the Royal College of Art’s center for entrepreneurship and commercialization. It supports RCA students, alumni and employees looking to turn their ideas into new businesses. The center was established in 2004 and is based in London.The centre’s activities include providing startup incubation and acceleration services to potential RCA spin-offs. This includes coaching and business mentoring based on RCA’s design-led, user-centric approach, as well as intellectual property advice and support. In addition, the center offers access to office and workshop space, as well as funding. InnovationRCA runs its own angel investor network, AngelClubRCA. It has also partnered with a UK-based VC, Venrex Investment Management, to improve RCA startups’ access to private funding. In addition, the centre conducts programmes for external entrepreneurs and organisations looking to promote innovation and entrepreneurship worldwide.McKinsey has called InnovationRCA a “world-class spinout incubator", praising its work as a "significant driver of entrepreneurial growth” along with its ”impressive results". In July 2019, the UK Business Angels Association also named InnovationRCA its Accelerator of the Year.

P101, which stands for Programma 101, the first PC ever made in history, is an Italian VC focused on early-stage investments founded and headed by Managing Partner Andrea Di Camillo. As of January 2021, the firm has between €70m and €100m available for investments. The fund is backed by The European Investment Fund, the Italian Investment Fund SGR, and Azimut, an Italian asset manager operating since 1989 and parent company of Azimut Holding, listed on the Milan Stock Exchange (AZM.IM).Headquartered in Milan, P101 has invested in international startups through its two funds, P101 and P102. It usually co-invests maintaining a lead investor role. According to Di Camillo, the P102 fund has a higher investment ticket, ranging between €2m–5m, with the possibility of increasing to up to €10m in a single company. The firm also manages Ita500, a €40m fund established in partnership with Azimut in January 2020. With a 10-year term, Ita500 will co-invest with P101’s first and second funds in startups with revenues of up to €5m and SMEs with a turnover range of €5m–50m.

P101, which stands for Programma 101, the first PC ever made in history, is an Italian VC focused on early-stage investments founded and headed by Managing Partner Andrea Di Camillo. As of January 2021, the firm has between €70m and €100m available for investments. The fund is backed by The European Investment Fund, the Italian Investment Fund SGR, and Azimut, an Italian asset manager operating since 1989 and parent company of Azimut Holding, listed on the Milan Stock Exchange (AZM.IM).Headquartered in Milan, P101 has invested in international startups through its two funds, P101 and P102. It usually co-invests maintaining a lead investor role. According to Di Camillo, the P102 fund has a higher investment ticket, ranging between €2m–5m, with the possibility of increasing to up to €10m in a single company. The firm also manages Ita500, a €40m fund established in partnership with Azimut in January 2020. With a 10-year term, Ita500 will co-invest with P101’s first and second funds in startups with revenues of up to €5m and SMEs with a turnover range of €5m–50m.

CEO and co-founder of Capaball

Sixto Arias is a veteran entrepreneur based in Madrid. He graduated with a BA Communications degree from Complutense University in 1992.In 2001, he started his first venture as co-founder of Movilisto that was sold to London-based mobile value-added services group Itouch Plc in 2004. In 2007, he founded media planner Mobext that was sold to Havas Media six years later.He is an angel investor focusing on projects relating to AI, education, IoT and mobile. He was the managing partner of Conector Startup Accelerator in Madrid for over two years. He is also the founder of the Mobile Marketing Association in Spain.Arias currently runs two startups: digital innovation agency Made in Mobile that he founded in 2014 and edtech Capaball co-founded in 2018. As a digital marketing specialist and experienced lecturer, he also works as a professor at ESCP Europe in Madrid and University of Sergio Arboleda in Colombia.

Sixto Arias is a veteran entrepreneur based in Madrid. He graduated with a BA Communications degree from Complutense University in 1992.In 2001, he started his first venture as co-founder of Movilisto that was sold to London-based mobile value-added services group Itouch Plc in 2004. In 2007, he founded media planner Mobext that was sold to Havas Media six years later.He is an angel investor focusing on projects relating to AI, education, IoT and mobile. He was the managing partner of Conector Startup Accelerator in Madrid for over two years. He is also the founder of the Mobile Marketing Association in Spain.Arias currently runs two startups: digital innovation agency Made in Mobile that he founded in 2014 and edtech Capaball co-founded in 2018. As a digital marketing specialist and experienced lecturer, he also works as a professor at ESCP Europe in Madrid and University of Sergio Arboleda in Colombia.

CEO and co-founder of Everimpact

Mathieu Carlier is CEO and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more accurate and immediate carbon emissions data to public bodies, municipalities, and businesses. He has over 20 years of experience as an advisor to governments, public institutions at the likes of the UN, the European Commission and EU Agencies, the Bill & Melinda Gates Foundation and large corporations in international development. Prior to Everimpact, much of Carlier’s career was spent in complex data systems projects for government elections or for health ministries in war-torn or post-conflict developing countries. This included delivering multimillion-dollar biometric and big data projects in the run-up to 50 presidential elections in countries like Afghanistan, Iraq, Pakistan, Libya, the Congo and Benin. Carlier is based in Copenhagen, Denmark and holds an MSc in Business Administration from the Burgundy School of Business.

Mathieu Carlier is CEO and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more accurate and immediate carbon emissions data to public bodies, municipalities, and businesses. He has over 20 years of experience as an advisor to governments, public institutions at the likes of the UN, the European Commission and EU Agencies, the Bill & Melinda Gates Foundation and large corporations in international development. Prior to Everimpact, much of Carlier’s career was spent in complex data systems projects for government elections or for health ministries in war-torn or post-conflict developing countries. This included delivering multimillion-dollar biometric and big data projects in the run-up to 50 presidential elections in countries like Afghanistan, Iraq, Pakistan, Libya, the Congo and Benin. Carlier is based in Copenhagen, Denmark and holds an MSc in Business Administration from the Burgundy School of Business.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

New Food Invest: Opportunities in the European alt-protein space

With a record €2.4bn investment in 2019, Europe’s foodtech sector appears poised for continued growth, but startups, corporations, governments and even universities can do more, experts say

Alén Space: Nanosatellite company targets contracts of over €2 million by 2020

Alén Space seeks funding of €1.5 million to accelerate plans to win a share of the global market of 2,600 small satellites to be launched by 2023

Amid Covid-19 gloom, some bright spots in Portugal's tech startup scene

Despite a recession and doubling of the unemployment rate forecast this year, it's not all bad news for the Portuguese tech ecosystem

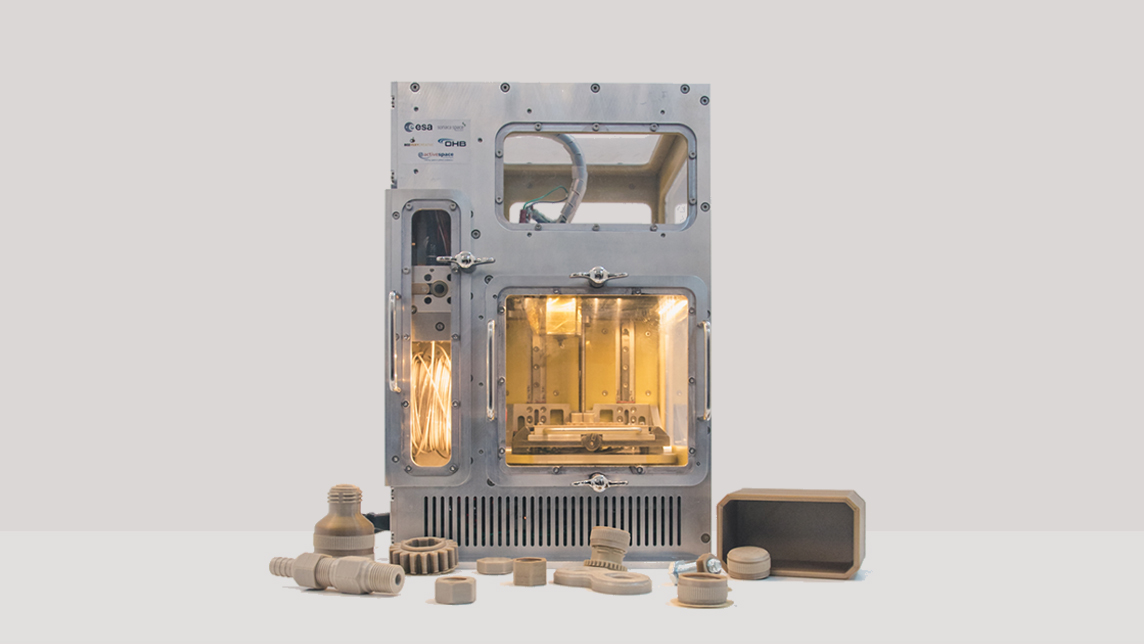

BEEVERYCREATIVE: Taking 3D printing from classrooms into Outer Space

Innovative 3D printing for daily use from a picturesque fishing village in Portugal.

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

Zero 2 Infinity: Multibillion-euro business line launches into near space

Europe's only near space player using balloon technology targets high demand in a lucrative market, including space tourism

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

Circular economy: Discarded goods get a new lease of life in Spain

From e-chargers inside phone booths, recycling chatbots to refurbished stadium seats from Atlético Madrid, the offbeat magic of the circular economy is fast becoming a lucrative business in Spain

Psquared: Providing flexible workplaces to help early-stage startups

The Barcelona-based startup converts a variety of buildings to hybrid office spaces for flexible work brought about by Covid-19, includes a reservations system to manage desk and meeting spaces

East Ventures raises funds, teams up with state agency to produce Covid-19 tests for Indonesia

East Ventures investee Nusantics has been working with state researchers to produce the prototype; expects mass production of the test kits soon

Sorry, we couldn’t find any matches for“European Space Agency”.