Evli Growth Partners

-

DATABASE (365)

-

ARTICLES (542)

Co-founder of Refurbed

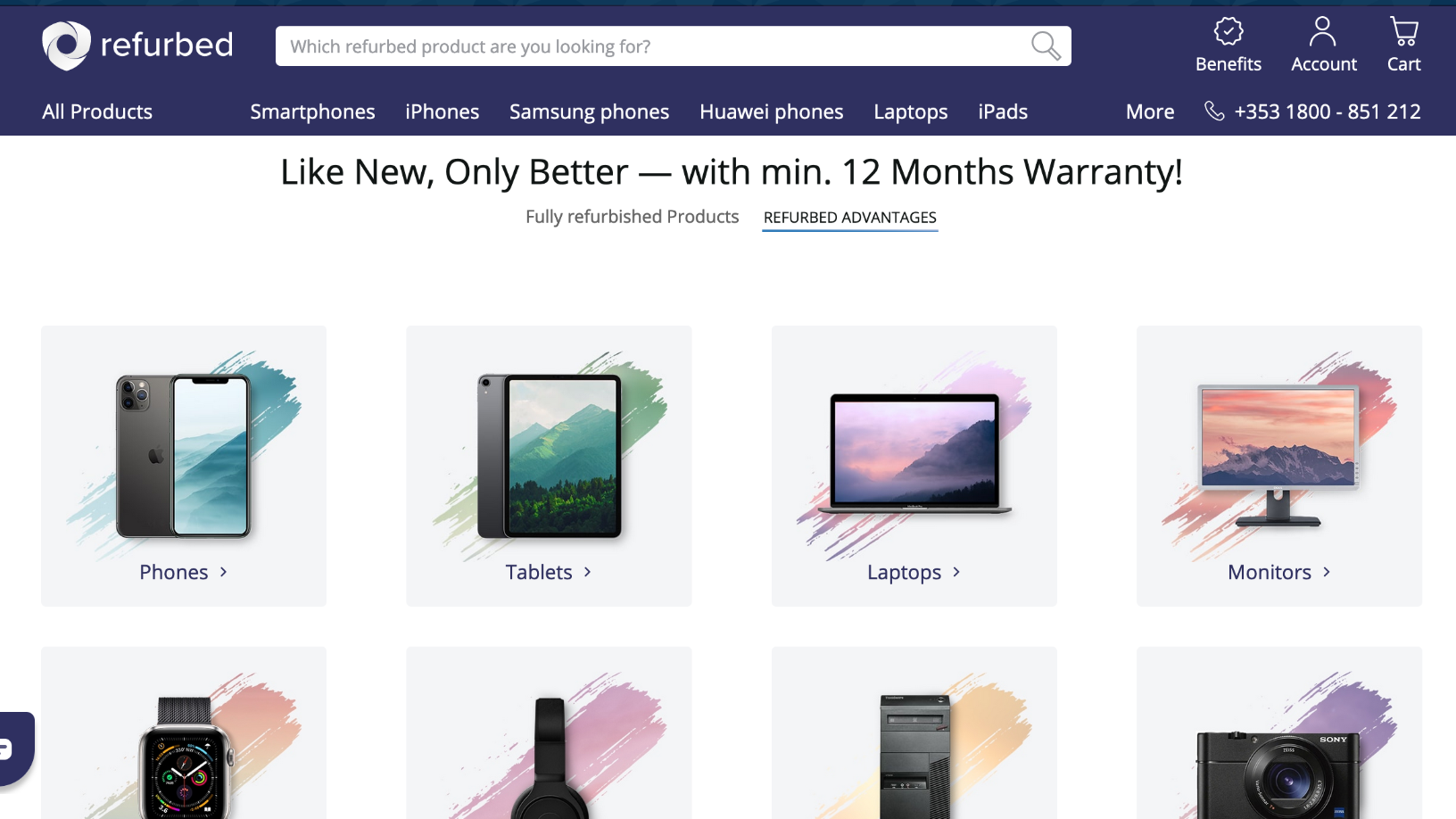

Peter Windischhofer graduated with a management degree in 2012 at Vienna University of Economics and Business, including a stint at the University of Hong Kong. Student internships included various roles at McKinsey & Company, Perella Weinberg Partners, Realtreuhand and Raiffeisen Bank.In 2012, he joined CUDOS Group and worked for over a year as a business analyst in Vienna. In 2013, he met Refurbed co-founder Kilian Kaminski during a master’s program run by Hult International Business School. Both men worked in China while studying international business. Windischhofer spent six months running an online “TripAdvisor” review platform for Chinese language schools in Shanghai.In October 2014, Windischhofer joined McKinsey & Company as a management consultant working on digital marketing and product development projects for marketplaces and e-commerce companies in Europe.In 2017, he left McKinsey to co-found Refurbed with Kaminski to build an Amazon-style marketplace for refurbished electronic goods. The idea was inspired by a personal experience when Windischhofer bought a used smartphone after seeing a classified ad. The phone stopped working after two weeks. The incident prompted him to create an e-commerce platform specializing in selling quality refurbished e-products with carbon-neutral credentials like planting a tree for every sales transaction.

Peter Windischhofer graduated with a management degree in 2012 at Vienna University of Economics and Business, including a stint at the University of Hong Kong. Student internships included various roles at McKinsey & Company, Perella Weinberg Partners, Realtreuhand and Raiffeisen Bank.In 2012, he joined CUDOS Group and worked for over a year as a business analyst in Vienna. In 2013, he met Refurbed co-founder Kilian Kaminski during a master’s program run by Hult International Business School. Both men worked in China while studying international business. Windischhofer spent six months running an online “TripAdvisor” review platform for Chinese language schools in Shanghai.In October 2014, Windischhofer joined McKinsey & Company as a management consultant working on digital marketing and product development projects for marketplaces and e-commerce companies in Europe.In 2017, he left McKinsey to co-found Refurbed with Kaminski to build an Amazon-style marketplace for refurbished electronic goods. The idea was inspired by a personal experience when Windischhofer bought a used smartphone after seeing a classified ad. The phone stopped working after two weeks. The incident prompted him to create an e-commerce platform specializing in selling quality refurbished e-products with carbon-neutral credentials like planting a tree for every sales transaction.

Part of the Thai-headquartered venture capitalist firm Ardent Capital, Ardent Ventures invests in early-stage technology startups across Southeast Asia. In 2016, Ardent Capital announced its merger with US-based Wavemaker Partners.

Part of the Thai-headquartered venture capitalist firm Ardent Capital, Ardent Ventures invests in early-stage technology startups across Southeast Asia. In 2016, Ardent Capital announced its merger with US-based Wavemaker Partners.

Ardent Capital is a Thai venture capital fund focusing on e-commerce and fulfilment services. It ran a subsidiary company named Ardent Ventures. In 2016, Ardent Capital merged with Wavemaker Partners. Ardent Capital maintains its portfolio, including Moxy (now Orami) and Snapcart. Ardent Ventures companies include SaleStock that is now managed by Wavemaker.

Ardent Capital is a Thai venture capital fund focusing on e-commerce and fulfilment services. It ran a subsidiary company named Ardent Ventures. In 2016, Ardent Capital merged with Wavemaker Partners. Ardent Capital maintains its portfolio, including Moxy (now Orami) and Snapcart. Ardent Ventures companies include SaleStock that is now managed by Wavemaker.

Skyview Fund is a venture capital firm that focuses on early-stage investments in TMT industries. Founded by Andrew Ren, Skyview raised over RMB 300 million for its first venture capital fund. On March 1, 2017, Alex Cong, a former partner at Matrix Partners, joined Skyview Fund as its second managing partner.

Skyview Fund is a venture capital firm that focuses on early-stage investments in TMT industries. Founded by Andrew Ren, Skyview raised over RMB 300 million for its first venture capital fund. On March 1, 2017, Alex Cong, a former partner at Matrix Partners, joined Skyview Fund as its second managing partner.

Huihe Capital was initiated by JD Logistics, the logistics arm of China’s e-retailer JD.com in 2019. The VC limited partners include JD Logistics, JD.com, listed companies and government-led funds. JD Logistics has already raised RMB 1.5bn for the VC fund to invest in logistics-related startups and technologies.

Huihe Capital was initiated by JD Logistics, the logistics arm of China’s e-retailer JD.com in 2019. The VC limited partners include JD Logistics, JD.com, listed companies and government-led funds. JD Logistics has already raised RMB 1.5bn for the VC fund to invest in logistics-related startups and technologies.

Captii Ventures focuses on building Southeast Asian based startups by providing access to entrepreneurial expertise and experience to support business growth and development. It is a multi stage investor, with a special interest in mobile tech startups, marketplace platforms that facilitate better matching of supply and demand and in new media that disrupts traditional communication channels. It likes startups that use technology to solve age old problems.

Captii Ventures focuses on building Southeast Asian based startups by providing access to entrepreneurial expertise and experience to support business growth and development. It is a multi stage investor, with a special interest in mobile tech startups, marketplace platforms that facilitate better matching of supply and demand and in new media that disrupts traditional communication channels. It likes startups that use technology to solve age old problems.

PadeInvest is involved in early-stage investments to accelerate the growth of Spanish startups. The angel investor consortium was named the Best Business Angels Network of 2013 by the Spanish Association of Business Angels (AEBAN).Based in Madrid, PadeInvest was established in 2010 by 35 IESE Business School students from the PADE’10 program for investment activities of tech startups. Its network comprises professionals in business management across multiple industry sectors.

PadeInvest is involved in early-stage investments to accelerate the growth of Spanish startups. The angel investor consortium was named the Best Business Angels Network of 2013 by the Spanish Association of Business Angels (AEBAN).Based in Madrid, PadeInvest was established in 2010 by 35 IESE Business School students from the PADE’10 program for investment activities of tech startups. Its network comprises professionals in business management across multiple industry sectors.

Subtraction Capital is a VC founded by managing partner Jason Portnoy who was previously VP of Financial Planning and Analysis at PayPal Inc.Portnoy supports portfolio companies in their scale-up and hyper-growth stage, working with their CEOs to raise capital, navigate complex negotiations, build and manage teams. The firm typically invests in SaaS startups in the San Francisco Bay Area and Salt Lake City.

Subtraction Capital is a VC founded by managing partner Jason Portnoy who was previously VP of Financial Planning and Analysis at PayPal Inc.Portnoy supports portfolio companies in their scale-up and hyper-growth stage, working with their CEOs to raise capital, navigate complex negotiations, build and manage teams. The firm typically invests in SaaS startups in the San Francisco Bay Area and Salt Lake City.

Evonik Venture Capital is the investment arm of Evonik Industries AG, a chemicals specialty provider in Germany. The firm also has offices in the US and China.With a fund size of €250m, Evonik has made more than 30 investments since 2012. The VC mainly invests in sectors such as nutrition & care, specialty additives and smart materials. Its portfolio includes early to growth stage startups, with investments of €15m per portfolio company.

Evonik Venture Capital is the investment arm of Evonik Industries AG, a chemicals specialty provider in Germany. The firm also has offices in the US and China.With a fund size of €250m, Evonik has made more than 30 investments since 2012. The VC mainly invests in sectors such as nutrition & care, specialty additives and smart materials. Its portfolio includes early to growth stage startups, with investments of €15m per portfolio company.

Founded in 1972, Kleiner Perkins, formerly Kleiner Perkins Caufield & Byers (KPCB) is one of the world’s largest venture capital firms.The firm has raised $10bn through 20 venture funds and four growth funds and has invested in over 850 companies worldwide. Its China advisory team was founded in 2007 with a fund of $360m. It has invested in many of China’s star enterprises, including one of the country’s largest e-commerce platform JD.com.

Founded in 1972, Kleiner Perkins, formerly Kleiner Perkins Caufield & Byers (KPCB) is one of the world’s largest venture capital firms.The firm has raised $10bn through 20 venture funds and four growth funds and has invested in over 850 companies worldwide. Its China advisory team was founded in 2007 with a fund of $360m. It has invested in many of China’s star enterprises, including one of the country’s largest e-commerce platform JD.com.

Founded in 1992, Danish state investor Vaekstfonden is a growth fund that has financed more than 9,200 Danish tech and non-tech startups with total funding of 33.8bn Danish krone ($1=6.35DKK, or about €5.8bn), mostly at pre-seed and seed levels. The investor also manages funds from the Danish Ministry of Business, state grants, ordinary loans and green investments. Startup investments are normally carried out in cooperation with other public bodies such as innovation incubators.

Founded in 1992, Danish state investor Vaekstfonden is a growth fund that has financed more than 9,200 Danish tech and non-tech startups with total funding of 33.8bn Danish krone ($1=6.35DKK, or about €5.8bn), mostly at pre-seed and seed levels. The investor also manages funds from the Danish Ministry of Business, state grants, ordinary loans and green investments. Startup investments are normally carried out in cooperation with other public bodies such as innovation incubators.

Co-founded by renowned angel investors, Beijing Software and Information Services Exchange, leading IT listed companies and the Administrative Committee of Zhongguancun Haidian Science Park, Beiruan Angel focuses on mobile internet, cloud computing, modern services, cultural innovation and IC. One of its partners, Li Zhu, is also a founding partner of Innoangel Fund.

Co-founded by renowned angel investors, Beijing Software and Information Services Exchange, leading IT listed companies and the Administrative Committee of Zhongguancun Haidian Science Park, Beiruan Angel focuses on mobile internet, cloud computing, modern services, cultural innovation and IC. One of its partners, Li Zhu, is also a founding partner of Innoangel Fund.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

InnoSpace is a startup service platform focusing on the early stage incubation of internet/mobile internet companies, with RMB angel funds and two 3-month startup accelerator programs each year. InnoSpace has helped its projects raise about RMB 600 million in total and is one of the four incubator partners of Intel in China.

InnoSpace is a startup service platform focusing on the early stage incubation of internet/mobile internet companies, with RMB angel funds and two 3-month startup accelerator programs each year. InnoSpace has helped its projects raise about RMB 600 million in total and is one of the four incubator partners of Intel in China.

Zhenzhen Sun is a veteran investor who has worked in prestigious firms like Morgan Stanley and JP Morgan. After leaving JP Morgan in 2009, she worked for Chinese real estate developer LL Land. She left in 2013 to join PreAngel Partners, an angel investment fund. She recently joined Proxima Ventures, a China-based VC that invests in healthcare technology.

Zhenzhen Sun is a veteran investor who has worked in prestigious firms like Morgan Stanley and JP Morgan. After leaving JP Morgan in 2009, she worked for Chinese real estate developer LL Land. She left in 2013 to join PreAngel Partners, an angel investment fund. She recently joined Proxima Ventures, a China-based VC that invests in healthcare technology.

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

EV maker Xpeng Motors partners Didi to offer car rentals and better charging services

Besides working with China's largest ride-hailing platform, Xpeng Motors has also connected to the charging networks of EV maker NIO and TELD, China's biggest EV charging network

TroopTravel: Growth opportunities in Big Data corporate travel analytics

International award-winner TroopTravel wants to be the ultimate choice for global travellers.

Science4you cancels IPO amid market jitters, foresees slower growth

Portugal's largest toymaker will continue to focus on international markets, digital boost

Spain's 3D printing revolution to drive various sectors' growth

From medical splints to meat-free burgers, multimillion-dollar 3D tech hubs are spawning new verticals across Spain

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

From laundry to beauty salons: Mr Jeff’s exponential franchising growth

Mr Jeff, the startup opening 100 new laundries a month, has entered the beauty market with price-competitive on-demand services

Data integration platform Onna accelerates growth with Covid-19 boost

Corporates use up to 80 different apps in their workflows. Slack- and Dropbox-backed Onna is a central platform integrating all that fragmented data, giving companies greater control

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

RecyGlo, Myanmar's first circular economy waste management system, targets regional growth

Turning trash into cash, Yangon-based recycling pioneer RecyGlo wants to extend its zero-waste circular economy model to the rest of Southeast Asia

Sorry, we couldn’t find any matches for“Evli Growth Partners”.