Eyes of Things

-

DATABASE (996)

-

ARTICLES (811)

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Easo Ventures is a Spanish early-stage VC established in 2018 in the Basque city of San Sebastian, offering selected companies either €50,000 or €100,000 according to their development stage. It currently has 29 companies in its portfolio across verticals and technologies, but all must be based in Spain. Its most recent investments include the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and the €1.2m post-seed round of drone company Alerion.

Easo Ventures is a Spanish early-stage VC established in 2018 in the Basque city of San Sebastian, offering selected companies either €50,000 or €100,000 according to their development stage. It currently has 29 companies in its portfolio across verticals and technologies, but all must be based in Spain. Its most recent investments include the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and the €1.2m post-seed round of drone company Alerion.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Having backed some of the most successful US tech companies such as Facebook, PayPal and SpaceX, Oakhouse Partners is a micro-VC headquartered in San Francisco. Led by Jason Portnoy, Andrew Maguire and Stephanie Fernandez, the firm mainly backs companies based in the Bay Area and within the US. Currently focused on breakthrough technologies like blockchain, robotics, 3D printing and CRISPR, Oakhouse Partners typically participates in seed rounds with investments of $250,000–500,000 and in Series A rounds of $1m–1.5m.

Redview Capital was founded in 2016 by Yu Jianming, Managing Partner and co-founder of New Horizon Capital. It is a private equity fund focused on sectors of advanced manufacturing, clean energy, new materials, consumer products and retail. Redview Capital currently has $560m in assets under management.

Redview Capital was founded in 2016 by Yu Jianming, Managing Partner and co-founder of New Horizon Capital. It is a private equity fund focused on sectors of advanced manufacturing, clean energy, new materials, consumer products and retail. Redview Capital currently has $560m in assets under management.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

The Chinese affiliate of top Silicon Valley venture capital firm Sequoia Capital was founded in 2005 by Neil Shen (Shen Nanpeng), a co-founder of Ctrip, China's largest travel booking site. With more than US$6 billion under management in 2015, the firm has invested in more than 300 startups in China, including some of the country's biggest brands: Alibaba, JD.com, Didi, DJI, Sina and Qihoo 360. Sequoia, together with China Broadband Capital, also helped to bring to China LinkedIn and AirBnB, companies that both have invested in.

The Chinese affiliate of top Silicon Valley venture capital firm Sequoia Capital was founded in 2005 by Neil Shen (Shen Nanpeng), a co-founder of Ctrip, China's largest travel booking site. With more than US$6 billion under management in 2015, the firm has invested in more than 300 startups in China, including some of the country's biggest brands: Alibaba, JD.com, Didi, DJI, Sina and Qihoo 360. Sequoia, together with China Broadband Capital, also helped to bring to China LinkedIn and AirBnB, companies that both have invested in.

One of the earliest backers of Chinese internet firms, most famously Tencent and JD.com, Hillhouse Capital is a US$20 billion fund today. Founded in 2005 by Zhang Lei, a Yale School of Management graduate (the initial US$20 million used to start Hillhouse came from the Yale Endowment), the long-term fundamental equity investor is focused on China and Asia, particularly the consumer, TMT, industrials and healthcare sectors. It manages capital for institutional clients, e.g., university endowments, foundations, sovereign wealth funds and pension funds, and invests across all equity stages.

One of the earliest backers of Chinese internet firms, most famously Tencent and JD.com, Hillhouse Capital is a US$20 billion fund today. Founded in 2005 by Zhang Lei, a Yale School of Management graduate (the initial US$20 million used to start Hillhouse came from the Yale Endowment), the long-term fundamental equity investor is focused on China and Asia, particularly the consumer, TMT, industrials and healthcare sectors. It manages capital for institutional clients, e.g., university endowments, foundations, sovereign wealth funds and pension funds, and invests across all equity stages.

Daniel Romy is the CEO of Investments at Media Digital Ventures, the first media fund dedicated to Media for Equity in Spain. With assets valued at €35 million, MDV supports startups through powerful marketing campaigns in return for equity. Romy is experienced in venture capital and crowdfunding, having worked as COO for three years at The Crowd Angel, a leading equity crowdfunding platform. He is also a member of the investment committee of Inveready First II SCR that manages assets worth €20 million.

Daniel Romy is the CEO of Investments at Media Digital Ventures, the first media fund dedicated to Media for Equity in Spain. With assets valued at €35 million, MDV supports startups through powerful marketing campaigns in return for equity. Romy is experienced in venture capital and crowdfunding, having worked as COO for three years at The Crowd Angel, a leading equity crowdfunding platform. He is also a member of the investment committee of Inveready First II SCR that manages assets worth €20 million.

Lei is co-founder, chairman and CEO of Xiaomi, one of the world’s largest smartphone companies. Born in December 1969, he holds a degree in Engineering from Wuhan University. With a personal net worth of US$11.2 billion, Lei has invested in 33 companies as a business angel, including Vancl.com, UCWeb, and YY Inc., a live streaming social media platform in China. He has also invested in 270 companies through Shunwei Capital, where he is a founding partner. Lei's investment focuses are e-commerce, mobile internet and social networking.

Lei is co-founder, chairman and CEO of Xiaomi, one of the world’s largest smartphone companies. Born in December 1969, he holds a degree in Engineering from Wuhan University. With a personal net worth of US$11.2 billion, Lei has invested in 33 companies as a business angel, including Vancl.com, UCWeb, and YY Inc., a live streaming social media platform in China. He has also invested in 270 companies through Shunwei Capital, where he is a founding partner. Lei's investment focuses are e-commerce, mobile internet and social networking.

Founded in 1992 in Shanghai, Red Star Macalline is China's largest furniture retailer. By the end of 2017, it had built up a network of 256 shopping malls, offering home furnishings of about 20,000 brands across 177 cities in China. The company also engages in interior design and renovation. The company has been listed on the Hong Kong Stock Exchange in June 2015 and the Shanghai Stock Exchange in January 2018, making it the first Chinese home furnishing company listed on both exchanges.

Founded in 1992 in Shanghai, Red Star Macalline is China's largest furniture retailer. By the end of 2017, it had built up a network of 256 shopping malls, offering home furnishings of about 20,000 brands across 177 cities in China. The company also engages in interior design and renovation. The company has been listed on the Hong Kong Stock Exchange in June 2015 and the Shanghai Stock Exchange in January 2018, making it the first Chinese home furnishing company listed on both exchanges.

Established in 2017 in the UK, Firstminute Capital's investments are founders-driven, rather than by investment sectors. The early-stage venture capital firm has already invested in 32 companies in the US, UK, mainland Europe and Israel. In mid-2018, it raised its first fund of US$100m from 30 unicorns. Recent investments include in the Series A round of tax reclaim company Wevat, in peer-to-peer (P2P) fiat to crypto exchange platform Ramp's pre-seed round and in the seed round of cannabis e-commerce site Miss Grass.

Established in 2017 in the UK, Firstminute Capital's investments are founders-driven, rather than by investment sectors. The early-stage venture capital firm has already invested in 32 companies in the US, UK, mainland Europe and Israel. In mid-2018, it raised its first fund of US$100m from 30 unicorns. Recent investments include in the Series A round of tax reclaim company Wevat, in peer-to-peer (P2P) fiat to crypto exchange platform Ramp's pre-seed round and in the seed round of cannabis e-commerce site Miss Grass.

Salvador García Andrés received his MSc in Telecommunications Engineering from Alfonso X el Sabio University in 2000. He also studied Finance at the London School of Economics in 2002.He has held several senior positions in the FX and trading desks of ABN Amro, Rabobank and Vega Capital. In 2009, he co-founded Ebury, a fintech company that offers a range of financial products to help SMEs expand internationally.García Andrés is an active angel investor in European tech startups.

Salvador García Andrés received his MSc in Telecommunications Engineering from Alfonso X el Sabio University in 2000. He also studied Finance at the London School of Economics in 2002.He has held several senior positions in the FX and trading desks of ABN Amro, Rabobank and Vega Capital. In 2009, he co-founded Ebury, a fintech company that offers a range of financial products to help SMEs expand internationally.García Andrés is an active angel investor in European tech startups.

Point72 Ventures is the investment arm of US financial group Point 72, established in 2016 in New York. Its principal interests are Fintech, Enterprise technology and A.I. It currently manages 39 companies in its portfolio and has managed the exit of another company, enterprise tech Apprente. Its recent investments include leading multilingual AI-driven translation platform Unbabel's US$60m Series C round, as well as leading the US$42m Series B investment round of Mexican fintech Creditjusto.

Point72 Ventures is the investment arm of US financial group Point 72, established in 2016 in New York. Its principal interests are Fintech, Enterprise technology and A.I. It currently manages 39 companies in its portfolio and has managed the exit of another company, enterprise tech Apprente. Its recent investments include leading multilingual AI-driven translation platform Unbabel's US$60m Series C round, as well as leading the US$42m Series B investment round of Mexican fintech Creditjusto.

Established in 2015, Olisipo Way is a Portuguese investor that funds early-stage investment in Portuguese tech and non-tech startups with a potential for international expansion acros all market verticals. It currently has 26 startups in its portfolio and recent investments include in the €125,000 pre-seed and €1.1m first phase seed round of healthy food service EatTasty. It has also invested in the €350,000 pre-seed round of revenue management for traveltech Climber and in the US$725,000 pre-seed round of adtech advertio.

Established in 2015, Olisipo Way is a Portuguese investor that funds early-stage investment in Portuguese tech and non-tech startups with a potential for international expansion acros all market verticals. It currently has 26 startups in its portfolio and recent investments include in the €125,000 pre-seed and €1.1m first phase seed round of healthy food service EatTasty. It has also invested in the €350,000 pre-seed round of revenue management for traveltech Climber and in the US$725,000 pre-seed round of adtech advertio.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

Oil and Gas Climate Initiative (OGCI) Climate Investments is a $1bn fund investing in innovative startups with solutions aimed at decarbonizing the oil and gas sectors and transportation, as well as those that recycle and store CO2 and reduce related emissions.Members of the organization are big players of the oil and gas industry representing more than 30% of global operated oil and gas production. These companies include Shell, Total, BP, Chevron, CNPC, Petrobras, Repsol, Eni, Equinor, ExxonMobil, Occidental and Saudi Aramco.

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

Start with the little things: 5 Indonesian social impact startups

From providing student loans to empowering marginalized groups and farmers, these Indonesian startups are revitalizing local communities

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

NutraSign: Farm-to-fork traceability app for healthier lifestyles

NutraSign is an app that lets businesses and consumers identify and trace contaminated products within a food supply chain in seconds, using blockchain technology

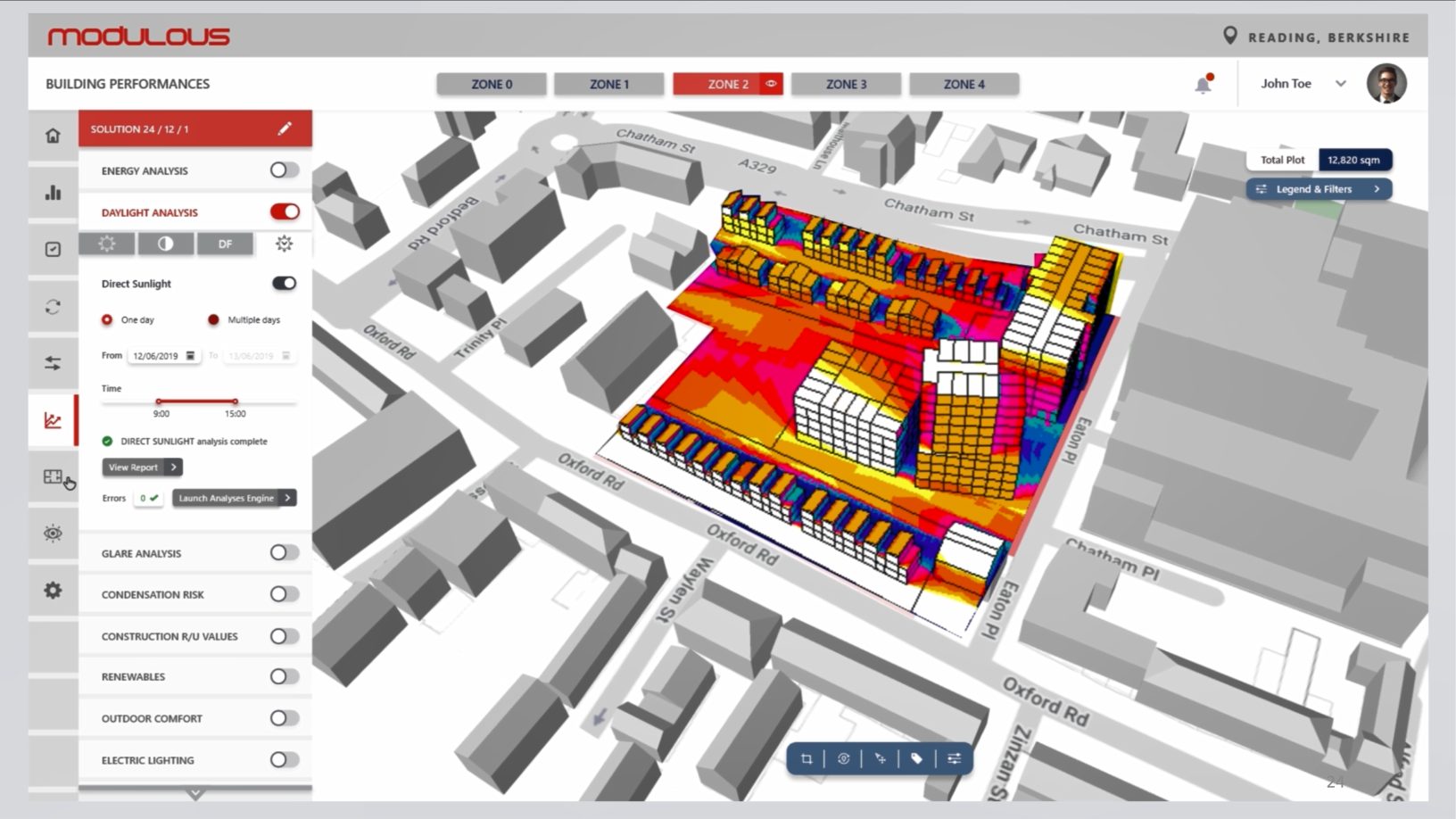

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

SigmaRail in funding talks, eyes 10-fold surge in revenue

The profitable Madrid-based startup is behind the “Google Maps” for railways to help make trains safer and provide better services

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

CarBlock eyes opportunities presented by the multi-billion car data market

This startup aims to transform the connected car and transportation industry by building a data circulation system based on blockchain

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

Sustainable last-mile grocery delivery startup Revoolt eyes French, LatAm expansion

Seeking up to €1m new funding for its growth, the Madrid-based startup with its EV fleet and turnkey IoT solutions has also broken even

Logisly challenges the Indonesian on-demand freight sector with managed marketplace

In less than a year of launching, Logisly has facilitated more than a thousand shipments and raised seed funding from three investors

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sorry, we couldn’t find any matches for“Eyes of Things”.