Eyes of Things

-

DATABASE (996)

-

ARTICLES (811)

Established in 2003, JW Medical Systems (JWMS) is a wholly-owned subsidiary of high-end medical consumables manufacturer Bluesail. It’s an international company focusing on the R&D, manufacturing and marketing of high-tech interventional products. JWMS has offices in Beijing, Shanghai, Guangzhou, Shenyang and Xi'an.

Established in 2003, JW Medical Systems (JWMS) is a wholly-owned subsidiary of high-end medical consumables manufacturer Bluesail. It’s an international company focusing on the R&D, manufacturing and marketing of high-tech interventional products. JWMS has offices in Beijing, Shanghai, Guangzhou, Shenyang and Xi'an.

Founded in 2011, Kika Tech is an international mobile input software developer based in Beijing. Released in 2017 and powered by an AI engine, its core product Kika Keyboard supports more than 20 languages and helps users communicate authentically by predicting intent and context to enhance expressive communication. The company has 500m users worldwide and, as of the end of 2018, earned monthly revenue of RMB 20m. Kika CTO Yao Conglei is also co-founder and CTO of Bailian.ai.

Founded in 2011, Kika Tech is an international mobile input software developer based in Beijing. Released in 2017 and powered by an AI engine, its core product Kika Keyboard supports more than 20 languages and helps users communicate authentically by predicting intent and context to enhance expressive communication. The company has 500m users worldwide and, as of the end of 2018, earned monthly revenue of RMB 20m. Kika CTO Yao Conglei is also co-founder and CTO of Bailian.ai.

Founded in Silicon Valley by serial investor and founder of Google Ventures Bill Marris, Section 32 has multiple investment interests with medicine and biotech key amongst them. Marris himself has invested in over 500 companies, with over one-third resulting in IPO or M&A. Fifty of his portfolio companies have exceeded $1bn valuations, including Uber. Section 32 currently has 48 companies in its portfolio. Its most recent investments have included in Canadian remote medicine platform Cover Health’s $43m Series B round and in the $100m Series B round of US cancer detection software C2i Genomics, both in April 2021. In March 2021, it participated in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Founded in Silicon Valley by serial investor and founder of Google Ventures Bill Marris, Section 32 has multiple investment interests with medicine and biotech key amongst them. Marris himself has invested in over 500 companies, with over one-third resulting in IPO or M&A. Fifty of his portfolio companies have exceeded $1bn valuations, including Uber. Section 32 currently has 48 companies in its portfolio. Its most recent investments have included in Canadian remote medicine platform Cover Health’s $43m Series B round and in the $100m Series B round of US cancer detection software C2i Genomics, both in April 2021. In March 2021, it participated in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

SkyDeck Berkeley is the startup accelerator initiated by the University of California, Berkeley. It was established to commercialize the university’s research arm and startup ventures of its alumni. It provides non-equity funding assistance, mentorship and networking opportunities, as well as specialist resources for not-for-profit ventures.Since 2012, SkyDeck-backed startups have raised total funding of over $1.47bn, with 17 achieving exits through acquisitions. The accelerator’s investment-arm is Berkeley SkyDeck Fund also invests about $100,000 per startup during the program. Half of the SkyDeck fund’s profits goes to UC Berkeley to support public education projects. The fund is run by Chon Tang as managing partner and Brian Bordley as principal. Contributors to the fund include private individuals, corporations and VCs like Sequoia Capital, Sierra Ventures and Canvas Ventures.

SkyDeck Berkeley is the startup accelerator initiated by the University of California, Berkeley. It was established to commercialize the university’s research arm and startup ventures of its alumni. It provides non-equity funding assistance, mentorship and networking opportunities, as well as specialist resources for not-for-profit ventures.Since 2012, SkyDeck-backed startups have raised total funding of over $1.47bn, with 17 achieving exits through acquisitions. The accelerator’s investment-arm is Berkeley SkyDeck Fund also invests about $100,000 per startup during the program. Half of the SkyDeck fund’s profits goes to UC Berkeley to support public education projects. The fund is run by Chon Tang as managing partner and Brian Bordley as principal. Contributors to the fund include private individuals, corporations and VCs like Sequoia Capital, Sierra Ventures and Canvas Ventures.

Born in 1973, Li graduated from the School of Philosophy at Renmin University of China in 1997. After graduating, he worked as an IT journalist for China Youth Daily, where he interviewed tech giants such as Jack Ma. In early 2003, Li became chief editor of the IT section of web portal Sohu and then joined web portal NetEase as chief editor of its IT section later that year. In 2005, he resigned from NetEase and founded gaming portal Duowan. In 2008, Li founded YY Inc., a live streaming social media platform that went public on Nasdaq in 2012.

Born in 1973, Li graduated from the School of Philosophy at Renmin University of China in 1997. After graduating, he worked as an IT journalist for China Youth Daily, where he interviewed tech giants such as Jack Ma. In early 2003, Li became chief editor of the IT section of web portal Sohu and then joined web portal NetEase as chief editor of its IT section later that year. In 2005, he resigned from NetEase and founded gaming portal Duowan. In 2008, Li founded YY Inc., a live streaming social media platform that went public on Nasdaq in 2012.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Bamboo Capital Partners is an impact investment company that focuses on supporting energy access, finance and healthcare-related ventures in developing countries. The company manages 10 investment funds across Asia, Africa, and Latin America, with companies in Indonesia, India, Kyrgyz Republic, and Brazil having received investments from this company. Bamboo Capital Partners states that their portfolio healthcare companies have served 3.4m patients, and 9.68m metric tons of CO2 emissions have been avoided through the use of solar panels and green energy championed by their startups.Bamboo Capital Partners have worked with governments and major investment groups to support the fulfillment of SDG goals through startup investing. In 2020, Bamboo Capital Partners was appointed by the government of Madagascar and the World Bank as the fund manager for the $40m Off-Grid Market Development Fund. Bamboo is also a partner of the Palladium Group, which owns a minority stake in the VC.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

Part of the larger Sonae Group of companies, Sonae IM was launched in 2015 and is the corporate venture arm for tech-based investments. Since their launch, they have backed various companies particularly in the retail technology sector. These include StyleSage (fashion tech in predictive analytics) and InovRetail (demand forecasting for retailers).

Part of the larger Sonae Group of companies, Sonae IM was launched in 2015 and is the corporate venture arm for tech-based investments. Since their launch, they have backed various companies particularly in the retail technology sector. These include StyleSage (fashion tech in predictive analytics) and InovRetail (demand forecasting for retailers).

Frontline Ventures is a London-based VC firm that typically invests in early-stage B2B companies with the bulk of funding going toward European companies seeking a U.S. expansion. The current Fund II, worth €60 million, closed in 2016 and they are looking to make investments of between €200,000 and €3 million each.

Frontline Ventures is a London-based VC firm that typically invests in early-stage B2B companies with the bulk of funding going toward European companies seeking a U.S. expansion. The current Fund II, worth €60 million, closed in 2016 and they are looking to make investments of between €200,000 and €3 million each.

CMS Zhiyuan Capital Co Ltd was founded in August 2009. It is a wholly-owned subsidiary of China Merchants Securities, with a registered capital of RMB 2.1 billion. Operating as a private equity firm, it is ranked amongst the top private funds in China with assets under management exceeding RMB 20 billion.

CMS Zhiyuan Capital Co Ltd was founded in August 2009. It is a wholly-owned subsidiary of China Merchants Securities, with a registered capital of RMB 2.1 billion. Operating as a private equity firm, it is ranked amongst the top private funds in China with assets under management exceeding RMB 20 billion.

The investment fund was established in 1998 by Luis Martín Cabiedes, one of the most prominent business angels in Spain. The VC provides funds for early-stage growth of internet and technology ventures in Spain, acting initially as a business angel and then becoming a venture capitalist for future funding rounds.

The investment fund was established in 1998 by Luis Martín Cabiedes, one of the most prominent business angels in Spain. The VC provides funds for early-stage growth of internet and technology ventures in Spain, acting initially as a business angel and then becoming a venture capitalist for future funding rounds.

With almost 20 years’ experience, ChinaEquity Group is one of the first Chinese investment firms. It was founded by Wang Chaoyong, a former child prodigy and one of the first Chinese people to study abroad and work on Wall Street as a banker. ChinaEquity Group invests in TMT, high-end consumption, internet, etc.

With almost 20 years’ experience, ChinaEquity Group is one of the first Chinese investment firms. It was founded by Wang Chaoyong, a former child prodigy and one of the first Chinese people to study abroad and work on Wall Street as a banker. ChinaEquity Group invests in TMT, high-end consumption, internet, etc.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

A private equity fund targeting fintech firms at the growth expansion and mature stage mainly in China, Europe, and the US. Its founding members include China Minsheng International Capital Limited (CMIC), a subsidiary of China Minsheng Investment Corporation Limited (CMI); and GF Investments (Cayman) Company Limited (GF Investments), a subsidiary of GF Securities.

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

Start with the little things: 5 Indonesian social impact startups

From providing student loans to empowering marginalized groups and farmers, these Indonesian startups are revitalizing local communities

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

NutraSign: Farm-to-fork traceability app for healthier lifestyles

NutraSign is an app that lets businesses and consumers identify and trace contaminated products within a food supply chain in seconds, using blockchain technology

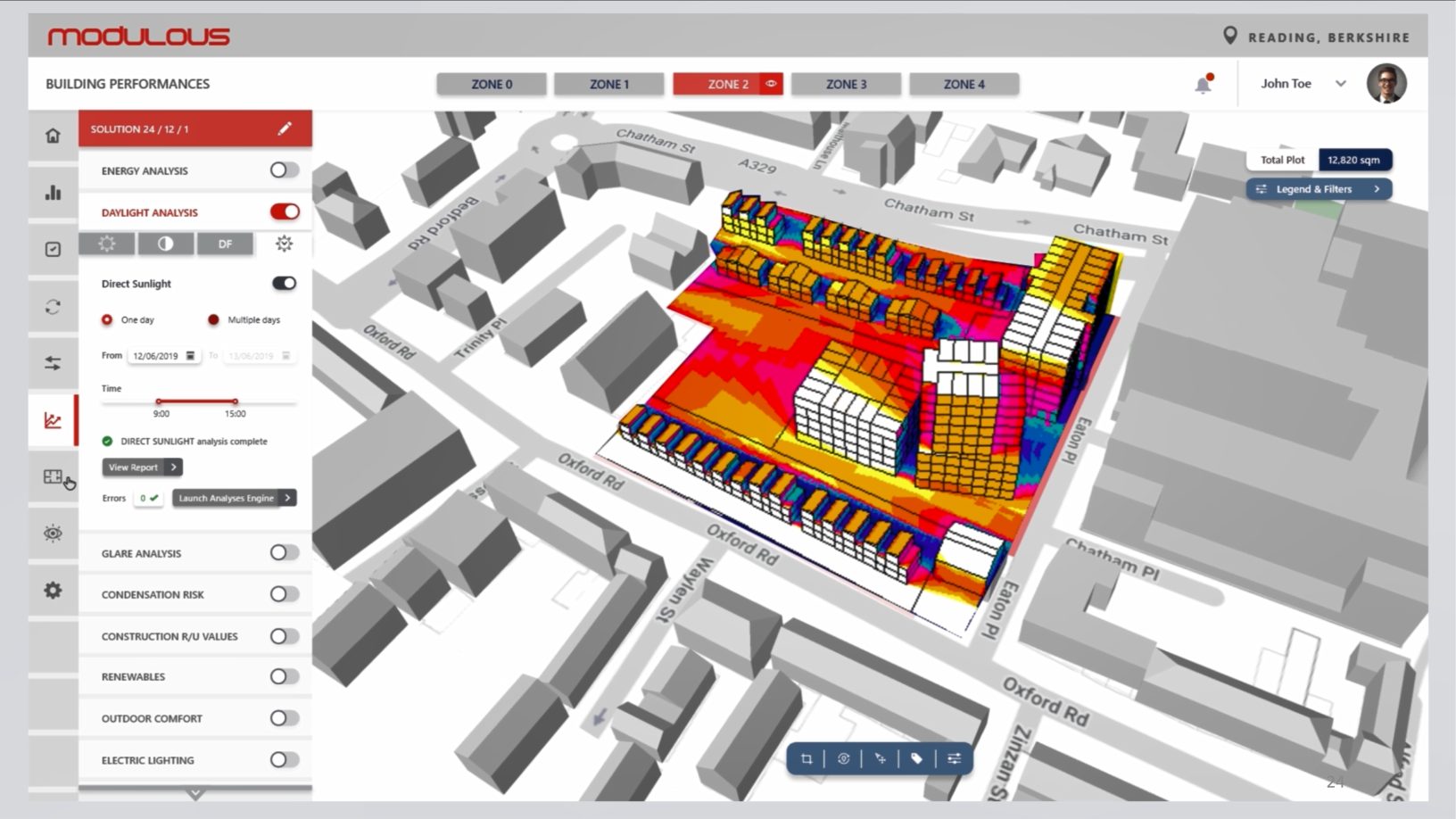

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

SigmaRail in funding talks, eyes 10-fold surge in revenue

The profitable Madrid-based startup is behind the “Google Maps” for railways to help make trains safer and provide better services

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

CarBlock eyes opportunities presented by the multi-billion car data market

This startup aims to transform the connected car and transportation industry by building a data circulation system based on blockchain

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

Sustainable last-mile grocery delivery startup Revoolt eyes French, LatAm expansion

Seeking up to €1m new funding for its growth, the Madrid-based startup with its EV fleet and turnkey IoT solutions has also broken even

Logisly challenges the Indonesian on-demand freight sector with managed marketplace

In less than a year of launching, Logisly has facilitated more than a thousand shipments and raised seed funding from three investors

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sorry, we couldn’t find any matches for“Eyes of Things”.