Eyes of Things

-

DATABASE (996)

-

ARTICLES (811)

Alberto Knapp Bjeren has more than 20 years of experience in the tech startup ecosystem in Spain and internationally. He is the CEO of London-based digital tech PR agency Wunderman Thompson. He also founded the agency’s Madrid-based digital consultancy The Cocktail that has offices in London, New York, Mexico City and Bogota.Knapp is also a partner and advisor at Seaya Ventures, a Spanish VC with investments in startups like Cabify and Glovo. As an angel investor, he has participated in the pre-seed and seed rounds of Spain’s femtech WOOM and other undisclosed startups.

Alberto Knapp Bjeren has more than 20 years of experience in the tech startup ecosystem in Spain and internationally. He is the CEO of London-based digital tech PR agency Wunderman Thompson. He also founded the agency’s Madrid-based digital consultancy The Cocktail that has offices in London, New York, Mexico City and Bogota.Knapp is also a partner and advisor at Seaya Ventures, a Spanish VC with investments in startups like Cabify and Glovo. As an angel investor, he has participated in the pre-seed and seed rounds of Spain’s femtech WOOM and other undisclosed startups.

Greater Bay Area Homeland Development Fund

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

Established in 2016, LEADx Capital Partners is a German-based VC and is the investment arm of major retailer METRO Group. Since its founding, the VC has invested in 36 different companies, with a special focus on European retail, the same sector as METRO Group. It has already had one successful exit, the M&A of GuestU, which provides free internet to tourists. LEADx was the lead investor in the €18m Series B round of online printing marketplace 360imprimir, known as 360 Onlineprint in markets outside Iberia and Latin America.

Established in 2016, LEADx Capital Partners is a German-based VC and is the investment arm of major retailer METRO Group. Since its founding, the VC has invested in 36 different companies, with a special focus on European retail, the same sector as METRO Group. It has already had one successful exit, the M&A of GuestU, which provides free internet to tourists. LEADx was the lead investor in the €18m Series B round of online printing marketplace 360imprimir, known as 360 Onlineprint in markets outside Iberia and Latin America.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

Based in London, CPT Capital is the venture arm of private equity pioneer Jeremy Coller's private family office. Coller is the founder of Europe’s first private equity for secondaries in 1990. The British philanthropist has also established several business schools and the Jeremy Coller Foundation that aims to eliminate factory farming. In 2017, CPT Capital was founded to disrupt the food industry with investments in the alt-protein sector to create the “future of food and materials” like plant-based, recombinant and cell-cultured proteins.

Based in London, CPT Capital is the venture arm of private equity pioneer Jeremy Coller's private family office. Coller is the founder of Europe’s first private equity for secondaries in 1990. The British philanthropist has also established several business schools and the Jeremy Coller Foundation that aims to eliminate factory farming. In 2017, CPT Capital was founded to disrupt the food industry with investments in the alt-protein sector to create the “future of food and materials” like plant-based, recombinant and cell-cultured proteins.

Founded in 2012 in Geneva, Seedstars is one of the world’s largest accelerators with programs operating globally including Seedstars Global Startup Competition for emerging economies and seed-stage investors. Seedstars is also an investor, focusing on supporting startups founded in emerging economies across market segments. Its portfolio of 60 companies includes startups from its accelerator programs and participation in the $30,000 pre-seed round for Mexican loan fintech DB Menos. It is also one of two impact investors backing the $530,000 seed funding round for Bangladeshi cloud-kitchen and delivery startup Kludio.

Founded in 2012 in Geneva, Seedstars is one of the world’s largest accelerators with programs operating globally including Seedstars Global Startup Competition for emerging economies and seed-stage investors. Seedstars is also an investor, focusing on supporting startups founded in emerging economies across market segments. Its portfolio of 60 companies includes startups from its accelerator programs and participation in the $30,000 pre-seed round for Mexican loan fintech DB Menos. It is also one of two impact investors backing the $530,000 seed funding round for Bangladeshi cloud-kitchen and delivery startup Kludio.

Sky Ocean Ventures is a £25m impact investment fund and part of the Sky Media Group. It was launched in 2018 with the goal of accelerating businesses that can tackle global plastic pollution with innovative ideas and disruptive technologies. The firm has backed 20 startups that have developed solutions that help mitigate plastic disposals in the environment, such as disposable bottles made of paper, reusable delivery boxes, sachets made from seaweed and packaging made from wood chips. Sky Ocean Ventures also partners with, among others, The National Geographic and the Imperial College in London.

Sky Ocean Ventures is a £25m impact investment fund and part of the Sky Media Group. It was launched in 2018 with the goal of accelerating businesses that can tackle global plastic pollution with innovative ideas and disruptive technologies. The firm has backed 20 startups that have developed solutions that help mitigate plastic disposals in the environment, such as disposable bottles made of paper, reusable delivery boxes, sachets made from seaweed and packaging made from wood chips. Sky Ocean Ventures also partners with, among others, The National Geographic and the Imperial College in London.

Yingke PE was founded in 2010 and is headquartered in Shanghai. By the end of 2020, it had managed assets worth nearly RMB 50bn. In May 2021, it closed the RMB 10bn Yingke Science & Technology Innovation Industrial Fund. Over 90% of its funds come from financial institutions, state-owned enterprises and listed companies. Yingke PE has invested in more than 200 companies, focusing on biopharmaceuticals, core technology and upgraded consumption. Since its founding, the company has exited 53 projects, with an internal rate of return up to 54%.

Yingke PE was founded in 2010 and is headquartered in Shanghai. By the end of 2020, it had managed assets worth nearly RMB 50bn. In May 2021, it closed the RMB 10bn Yingke Science & Technology Innovation Industrial Fund. Over 90% of its funds come from financial institutions, state-owned enterprises and listed companies. Yingke PE has invested in more than 200 companies, focusing on biopharmaceuticals, core technology and upgraded consumption. Since its founding, the company has exited 53 projects, with an internal rate of return up to 54%.

Silicon Valley-based Tyche Partners was founded in 2015 to invest in hardtech sectors such as SpaceTech, IoT devices, cloud and enterprise infrastructure. Managing partner Weijie Yun is a computer science engineer and veteran entrepreneur as founder and CEO of Telegent Systems, AIP Networks and SiTek.The VC firm currently has 18 startups in its portfolio, including being lead investor for the $12m Series A round of Vence in May 2021. Vence is a California-based producer of virtual fencing wearables for livestock management.

Silicon Valley-based Tyche Partners was founded in 2015 to invest in hardtech sectors such as SpaceTech, IoT devices, cloud and enterprise infrastructure. Managing partner Weijie Yun is a computer science engineer and veteran entrepreneur as founder and CEO of Telegent Systems, AIP Networks and SiTek.The VC firm currently has 18 startups in its portfolio, including being lead investor for the $12m Series A round of Vence in May 2021. Vence is a California-based producer of virtual fencing wearables for livestock management.

Founded in London in 2009, Parkwalk is a specialist investor in deeptech spin-offs created at UK universities. Parkwalk currently has over £375m of assets under management and has invested in over 100 companies to date, emanating from the universities in Oxford, Cambridge, Imperial and Bristol, becoming the UK’s most active VC outside London. It currently has 143 portfolio companies, Its recent investments include the $17m May 2021 Series A round of cell therapy medtech Mogrify and in the April 2021 £1.9m seed round of HexagonFab, a medtech producing analytical lab instruments.

Founded in London in 2009, Parkwalk is a specialist investor in deeptech spin-offs created at UK universities. Parkwalk currently has over £375m of assets under management and has invested in over 100 companies to date, emanating from the universities in Oxford, Cambridge, Imperial and Bristol, becoming the UK’s most active VC outside London. It currently has 143 portfolio companies, Its recent investments include the $17m May 2021 Series A round of cell therapy medtech Mogrify and in the April 2021 £1.9m seed round of HexagonFab, a medtech producing analytical lab instruments.

Country Garden Venture Capital

Founded in 2019, Country Garden Venture Capital is the corporate venturing arm of Chinese real estate developer Country Garden. With its parent company as the cornerstone investor, it is focused on certain sectors of the supply chain, namely, technology, healthcare and consumption. As of March 2021, Country Garden Venture Capital has invested around RMB 10bn in over 50 companies with an average return above 80%. Among them, 15 have achieved unicorn status ($1bn in valuation), while four have successfully gone public.

Founded in 2019, Country Garden Venture Capital is the corporate venturing arm of Chinese real estate developer Country Garden. With its parent company as the cornerstone investor, it is focused on certain sectors of the supply chain, namely, technology, healthcare and consumption. As of March 2021, Country Garden Venture Capital has invested around RMB 10bn in over 50 companies with an average return above 80%. Among them, 15 have achieved unicorn status ($1bn in valuation), while four have successfully gone public.

Founded in 1993 by former journalist Hugo Shong (Xiong Xiaoge), a godfather figure in China's VC community, IDG is one of the leading VC firms in China, having invested in some 450 companies (as of end-2015) with over 100 successful exits. Among the biggest names are Tencent, Baidu, Xiaomi, Vancl, Sohu, Ctrip and Qihoo 360.

Founded in 1993 by former journalist Hugo Shong (Xiong Xiaoge), a godfather figure in China's VC community, IDG is one of the leading VC firms in China, having invested in some 450 companies (as of end-2015) with over 100 successful exits. Among the biggest names are Tencent, Baidu, Xiaomi, Vancl, Sohu, Ctrip and Qihoo 360.

Prime Mont V.C is a private equity manager focused on investing in businesses with public listing potential and and in the integration, merger and reorganization of businesses in the Greater China capital markets. The team includes Institute of Economics (CASS) Deputy Director and Peking University HSBC Business School Professor Zhang Ping as its chief strategy officer.

Prime Mont V.C is a private equity manager focused on investing in businesses with public listing potential and and in the integration, merger and reorganization of businesses in the Greater China capital markets. The team includes Institute of Economics (CASS) Deputy Director and Peking University HSBC Business School Professor Zhang Ping as its chief strategy officer.

Mass media empire Condé Nast was established in 1909 by Condé Montrose Nast. The company’s portfolio includes some of the most well-known titles in media: Vogue, GQ, The New Yorker and Vanity Fair. Initially print-focused, the company ventured into film, television and digital video programming with the launch of Condé Nast Entertainment in 2011.

Mass media empire Condé Nast was established in 1909 by Condé Montrose Nast. The company’s portfolio includes some of the most well-known titles in media: Vogue, GQ, The New Yorker and Vanity Fair. Initially print-focused, the company ventured into film, television and digital video programming with the launch of Condé Nast Entertainment in 2011.

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

Start with the little things: 5 Indonesian social impact startups

From providing student loans to empowering marginalized groups and farmers, these Indonesian startups are revitalizing local communities

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

NutraSign: Farm-to-fork traceability app for healthier lifestyles

NutraSign is an app that lets businesses and consumers identify and trace contaminated products within a food supply chain in seconds, using blockchain technology

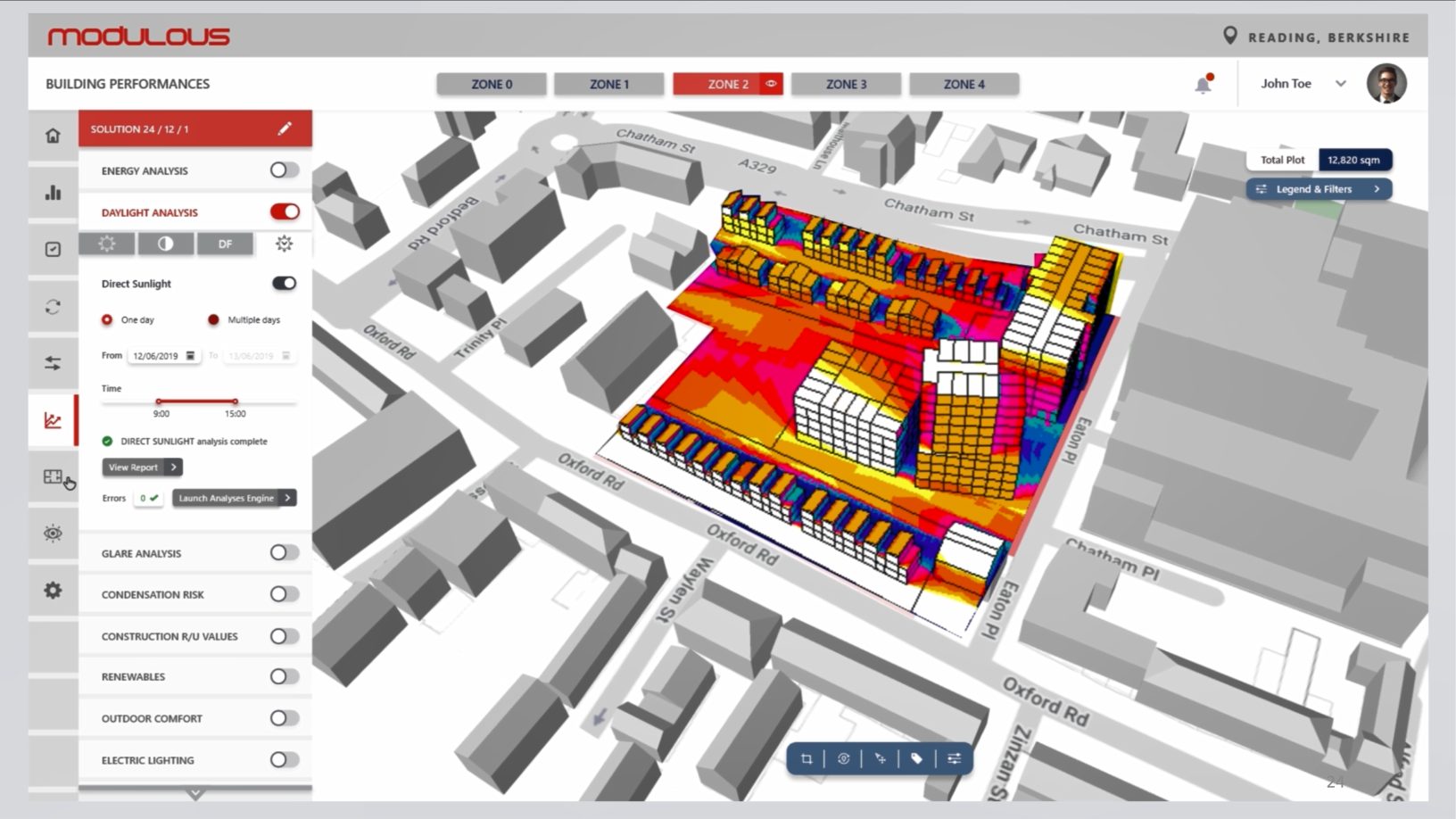

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

SigmaRail in funding talks, eyes 10-fold surge in revenue

The profitable Madrid-based startup is behind the “Google Maps” for railways to help make trains safer and provide better services

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

CarBlock eyes opportunities presented by the multi-billion car data market

This startup aims to transform the connected car and transportation industry by building a data circulation system based on blockchain

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

Sustainable last-mile grocery delivery startup Revoolt eyes French, LatAm expansion

Seeking up to €1m new funding for its growth, the Madrid-based startup with its EV fleet and turnkey IoT solutions has also broken even

Logisly challenges the Indonesian on-demand freight sector with managed marketplace

In less than a year of launching, Logisly has facilitated more than a thousand shipments and raised seed funding from three investors

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sorry, we couldn’t find any matches for“Eyes of Things”.