Eyes of Things

-

DATABASE (996)

-

ARTICLES (811)

Founded in 1992, Danish state investor Vaekstfonden is a growth fund that has financed more than 9,200 Danish tech and non-tech startups with total funding of 33.8bn Danish krone ($1=6.35DKK, or about €5.8bn), mostly at pre-seed and seed levels. The investor also manages funds from the Danish Ministry of Business, state grants, ordinary loans and green investments. Startup investments are normally carried out in cooperation with other public bodies such as innovation incubators.

Founded in 1992, Danish state investor Vaekstfonden is a growth fund that has financed more than 9,200 Danish tech and non-tech startups with total funding of 33.8bn Danish krone ($1=6.35DKK, or about €5.8bn), mostly at pre-seed and seed levels. The investor also manages funds from the Danish Ministry of Business, state grants, ordinary loans and green investments. Startup investments are normally carried out in cooperation with other public bodies such as innovation incubators.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Based in Jakarta, Maloekoe Ventures is an Indonesian-focused venture capital firm headed by Adrien Gheur, a former MD of hedge fund APS Asset Management.

Based in Jakarta, Maloekoe Ventures is an Indonesian-focused venture capital firm headed by Adrien Gheur, a former MD of hedge fund APS Asset Management.

Founded in 2016, Certain Capital is a subsidiary company of Dangdai Group focusing on investment in healthcare, culture and consumer industries.

Founded in 2016, Certain Capital is a subsidiary company of Dangdai Group focusing on investment in healthcare, culture and consumer industries.

Founded in 2016, Seekdource invests in startups in the fields of artificial intelligence, intelligent robotics and big data that have the potential for sustainable growth.

Founded in 2016, Seekdource invests in startups in the fields of artificial intelligence, intelligent robotics and big data that have the potential for sustainable growth.

Yuan Tou VC was founded as a private equity firm with a registered capital of RMB 10m in Beijing in December 2015.

Yuan Tou VC was founded as a private equity firm with a registered capital of RMB 10m in Beijing in December 2015.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Macquarie Capital is part of the Macquarie Group, comprising its corporate advisory, equity, debt and private capital markets businesses, and undertakes principal investing.

Macquarie Capital is part of the Macquarie Group, comprising its corporate advisory, equity, debt and private capital markets businesses, and undertakes principal investing.

Founded in January 2016, One Capital focuses on early and middle stage investment of internet+ startups in TMT, consumer, retail and healthcare industries.

Founded in January 2016, One Capital focuses on early and middle stage investment of internet+ startups in TMT, consumer, retail and healthcare industries.

Founded in 2013, China Merchants Wealth is a wholly owned asset management unit of China Merchants Fund, with RMB 200 billion under management.

Founded in 2013, China Merchants Wealth is a wholly owned asset management unit of China Merchants Fund, with RMB 200 billion under management.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Mark Pincus is the US co-founder of online social game maker Zynga, known for the mobile app games Words With Friends, Mafia Wars and FarmVille. He is also the managing member and co-founder of VC firm Reinvent Capital and a prolific angel investor worth $1.6bn, with early investments in Facebook and Twitter. To date, Pincus has invested in more than 50 startups and managed numerous successful exits including the aforementioned social media giants. His most recent investments include participation in the April 2021 $10m Series A round of US gaming app Underdog Fantasy and in the April 2021 €23.1m Series B round of Finland’s Yousician, the world’s largest music edtech.

Mark Pincus is the US co-founder of online social game maker Zynga, known for the mobile app games Words With Friends, Mafia Wars and FarmVille. He is also the managing member and co-founder of VC firm Reinvent Capital and a prolific angel investor worth $1.6bn, with early investments in Facebook and Twitter. To date, Pincus has invested in more than 50 startups and managed numerous successful exits including the aforementioned social media giants. His most recent investments include participation in the April 2021 $10m Series A round of US gaming app Underdog Fantasy and in the April 2021 €23.1m Series B round of Finland’s Yousician, the world’s largest music edtech.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

Start with the little things: 5 Indonesian social impact startups

From providing student loans to empowering marginalized groups and farmers, these Indonesian startups are revitalizing local communities

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

NutraSign: Farm-to-fork traceability app for healthier lifestyles

NutraSign is an app that lets businesses and consumers identify and trace contaminated products within a food supply chain in seconds, using blockchain technology

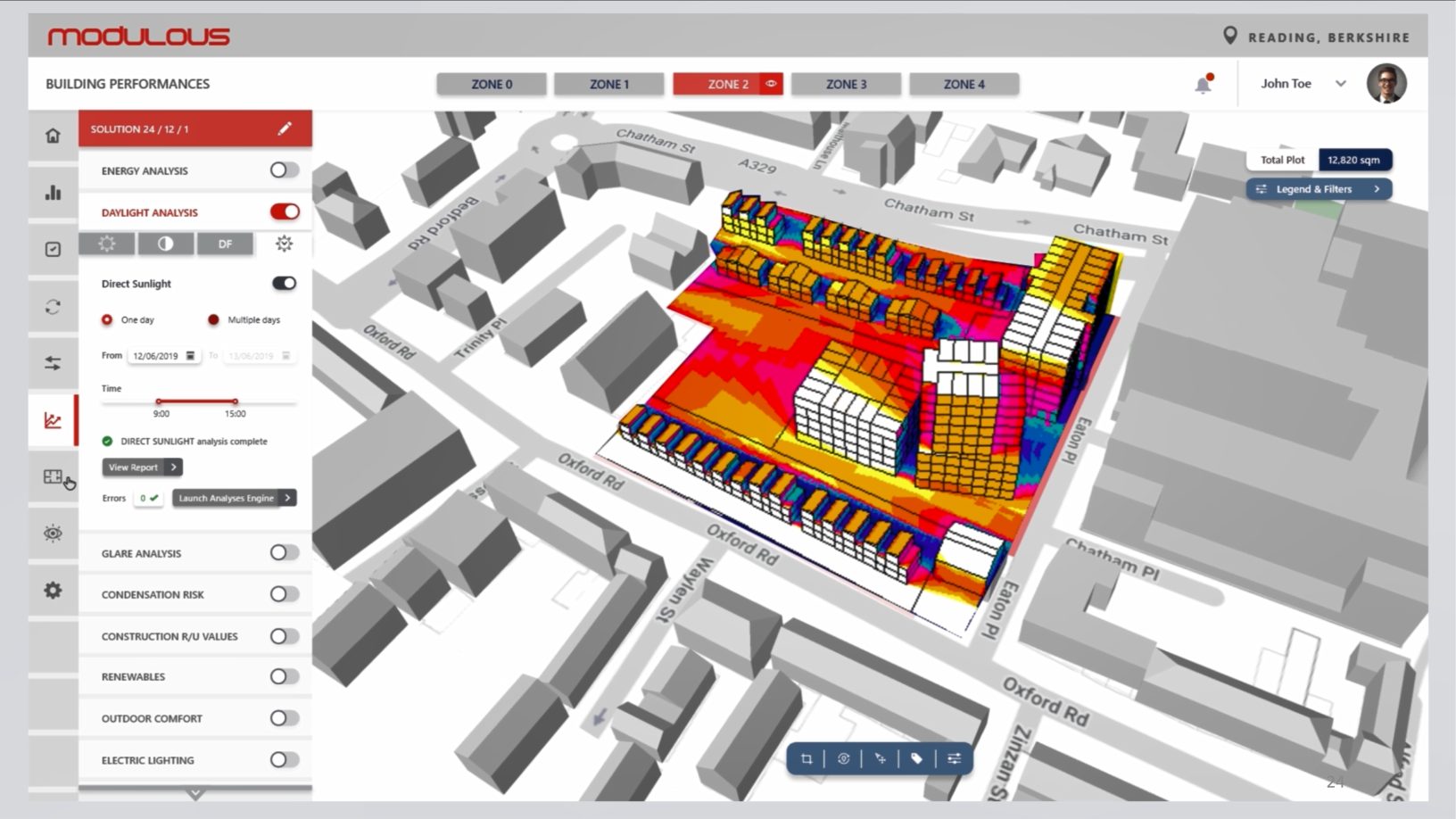

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

SigmaRail in funding talks, eyes 10-fold surge in revenue

The profitable Madrid-based startup is behind the “Google Maps” for railways to help make trains safer and provide better services

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

CarBlock eyes opportunities presented by the multi-billion car data market

This startup aims to transform the connected car and transportation industry by building a data circulation system based on blockchain

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

Sustainable last-mile grocery delivery startup Revoolt eyes French, LatAm expansion

Seeking up to €1m new funding for its growth, the Madrid-based startup with its EV fleet and turnkey IoT solutions has also broken even

Logisly challenges the Indonesian on-demand freight sector with managed marketplace

In less than a year of launching, Logisly has facilitated more than a thousand shipments and raised seed funding from three investors

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sorry, we couldn’t find any matches for“Eyes of Things”.