Eyes of Things

-

DATABASE (996)

-

ARTICLES (811)

JJ VC is a joint initiative by JJ.cn and a group of investors specialized in TMT investment. JJ.cn is a leading developer and operator in online board and card games.

JJ VC is a joint initiative by JJ.cn and a group of investors specialized in TMT investment. JJ.cn is a leading developer and operator in online board and card games.

Intudo Ventures is an Indonesia-focused venture capital firm. It invests in companies led by returning Southeast Asian entrepreneurs who had studied or worked outside the region for a significant amount of time.

Intudo Ventures is an Indonesia-focused venture capital firm. It invests in companies led by returning Southeast Asian entrepreneurs who had studied or worked outside the region for a significant amount of time.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

Founded in Shenzhen in 2013, HNF focuses on industries such as mobile internet, entertainment, healthcare and education. It was named one of China’s New Investment Organization’s Top 20 companies for 2017.

Founded in Shenzhen in 2013, HNF focuses on industries such as mobile internet, entertainment, healthcare and education. It was named one of China’s New Investment Organization’s Top 20 companies for 2017.

Founded in 1994, Fosun Pharma covers all key sectors of the pharmaceutical and healthcare industrial chain. It has been aggressively expanding globally, conducting investment and M&As in healthcare industries.

Founded in 1994, Fosun Pharma covers all key sectors of the pharmaceutical and healthcare industrial chain. It has been aggressively expanding globally, conducting investment and M&As in healthcare industries.

One of the earliest PE firms in China focusing on growth-stage investment in high-tech companies. With RMB 20 billion under management, Tsing-yuan Captial has invested in 170+ companies.

One of the earliest PE firms in China focusing on growth-stage investment in high-tech companies. With RMB 20 billion under management, Tsing-yuan Captial has invested in 170+ companies.

Founded in 1996, Index Ventures is a venture capital firm based in London, Jersey, Geneva and San Francisco. It has 35,000 employees worldwide working to manage a portfolio of 160 companies across 24 countries.

Founded in 1996, Index Ventures is a venture capital firm based in London, Jersey, Geneva and San Francisco. It has 35,000 employees worldwide working to manage a portfolio of 160 companies across 24 countries.

Founded in 2014, Prosperico Ventures targets the healthcare sector. The VC has invested in nearly 30 startups working on medical devices, pharmaceutical R&D, provision of medical services and precision medicine.

Founded in 2014, Prosperico Ventures targets the healthcare sector. The VC has invested in nearly 30 startups working on medical devices, pharmaceutical R&D, provision of medical services and precision medicine.

Khosla Ventures is a Silicon Valley-based VC, founded in 2004 by Indian-born founder of tech pioneer Sun Microsystems Vinod Khosla. The company has no specific interest in terms of sector but heavily favors “large problems that are amenable to technology solutions” and invests in so-called high potential 'black swans´. Healthcare is a strong focus and its most recent investments include in the Portuguese home physiotherapy tech solution SWORD Health's 2021 $85m Series C and $25m Series B rounds besides its 2020 $17m Series A round which it led. Khosla has over $5bn under management and more than 70 staff, with investments in more than 700 startups, leading more than one-third. Other recent investments include in the July 2021 $75m Series C round of Indian personal health and fitness app HealthifyMe and, the same month, in the $12.5m Series A round of US commercial real estate app for tenants and property managers Jones.

Khosla Ventures is a Silicon Valley-based VC, founded in 2004 by Indian-born founder of tech pioneer Sun Microsystems Vinod Khosla. The company has no specific interest in terms of sector but heavily favors “large problems that are amenable to technology solutions” and invests in so-called high potential 'black swans´. Healthcare is a strong focus and its most recent investments include in the Portuguese home physiotherapy tech solution SWORD Health's 2021 $85m Series C and $25m Series B rounds besides its 2020 $17m Series A round which it led. Khosla has over $5bn under management and more than 70 staff, with investments in more than 700 startups, leading more than one-third. Other recent investments include in the July 2021 $75m Series C round of Indian personal health and fitness app HealthifyMe and, the same month, in the $12.5m Series A round of US commercial real estate app for tenants and property managers Jones.

Tongfang Holch conducts direct investment, angel investment, PE investment and NEEQ investment with billions of RMB under management. It is one of the fastest-growing PE investment firms in China.

Tongfang Holch conducts direct investment, angel investment, PE investment and NEEQ investment with billions of RMB under management. It is one of the fastest-growing PE investment firms in China.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

Founded in 2014, Stellar Kapital is a VC and investment firm that seeks to empower new entrepreneurs and launch new tech events including a cultural and music Stellar Fest in 2018. Its first fund of US$10 million was mainly invested in real-sector companies. Armed with a second investment fund of US$25 million, Stellar Kapital is looking to invest in startups with funding ranging from US$200,000 to US$1 million. The VC also invests directly in offline companies like co-working business Freeware Spaces, Stellar Parking and Divestekno, an oil and gas company.

Founded in 2014, Stellar Kapital is a VC and investment firm that seeks to empower new entrepreneurs and launch new tech events including a cultural and music Stellar Fest in 2018. Its first fund of US$10 million was mainly invested in real-sector companies. Armed with a second investment fund of US$25 million, Stellar Kapital is looking to invest in startups with funding ranging from US$200,000 to US$1 million. The VC also invests directly in offline companies like co-working business Freeware Spaces, Stellar Parking and Divestekno, an oil and gas company.

Vynn Capital LP was founded in early 2018 by former Gobi Partners vice president Victor Chua and Darren Chua from Singapore. Victor joined Gobi in 2015 and was on Forbes’ 30 under 30 Asia list 2017: Finance and Venture Capital.The Malaysian VC, with plans to raise a maiden fund of US$40 million, will focus on financing collaborations among large corporates, SMEs and innovative startups in the ASEAN region including Myanmar. It will invest in 15 to 30 companies. with seed funds ranging from US$300,000 to US$500,000 and Series A of US$1 million.

Vynn Capital LP was founded in early 2018 by former Gobi Partners vice president Victor Chua and Darren Chua from Singapore. Victor joined Gobi in 2015 and was on Forbes’ 30 under 30 Asia list 2017: Finance and Venture Capital.The Malaysian VC, with plans to raise a maiden fund of US$40 million, will focus on financing collaborations among large corporates, SMEs and innovative startups in the ASEAN region including Myanmar. It will invest in 15 to 30 companies. with seed funds ranging from US$300,000 to US$500,000 and Series A of US$1 million.

Ideabox Ventures is a VC launched by Indonesian telecoms Indosat Ooredoo, Kejora Ventures and Mountain Partners SEA in November 2016. The VC was an addition to the existing annual accelerator Ideabox program that had nurtured startups like Dealoka, Pawoon and Wobe. More venture capital is expected to come from new partnerships with global institutions in Asia, Europe and North America. Early stage or pre-Series A funding of up to US$500,000 will be awarded to each startup, as well as strategic commercial consultancy and support services to boost the expansion of the VC’s portfolio firms.

Ideabox Ventures is a VC launched by Indonesian telecoms Indosat Ooredoo, Kejora Ventures and Mountain Partners SEA in November 2016. The VC was an addition to the existing annual accelerator Ideabox program that had nurtured startups like Dealoka, Pawoon and Wobe. More venture capital is expected to come from new partnerships with global institutions in Asia, Europe and North America. Early stage or pre-Series A funding of up to US$500,000 will be awarded to each startup, as well as strategic commercial consultancy and support services to boost the expansion of the VC’s portfolio firms.

Wu received his bachelor's in Tourism Management from Nanjing University in 1995. His background is in e-commerce. Wu was one of the original founders of Luoji Siwei, but he left the company in 2013. His current business venture is Context Lab, a corporate services platform. Wu participated in Kuaipeilian's seed funding round.

Wu received his bachelor's in Tourism Management from Nanjing University in 1995. His background is in e-commerce. Wu was one of the original founders of Luoji Siwei, but he left the company in 2013. His current business venture is Context Lab, a corporate services platform. Wu participated in Kuaipeilian's seed funding round.

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

Start with the little things: 5 Indonesian social impact startups

From providing student loans to empowering marginalized groups and farmers, these Indonesian startups are revitalizing local communities

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

NutraSign: Farm-to-fork traceability app for healthier lifestyles

NutraSign is an app that lets businesses and consumers identify and trace contaminated products within a food supply chain in seconds, using blockchain technology

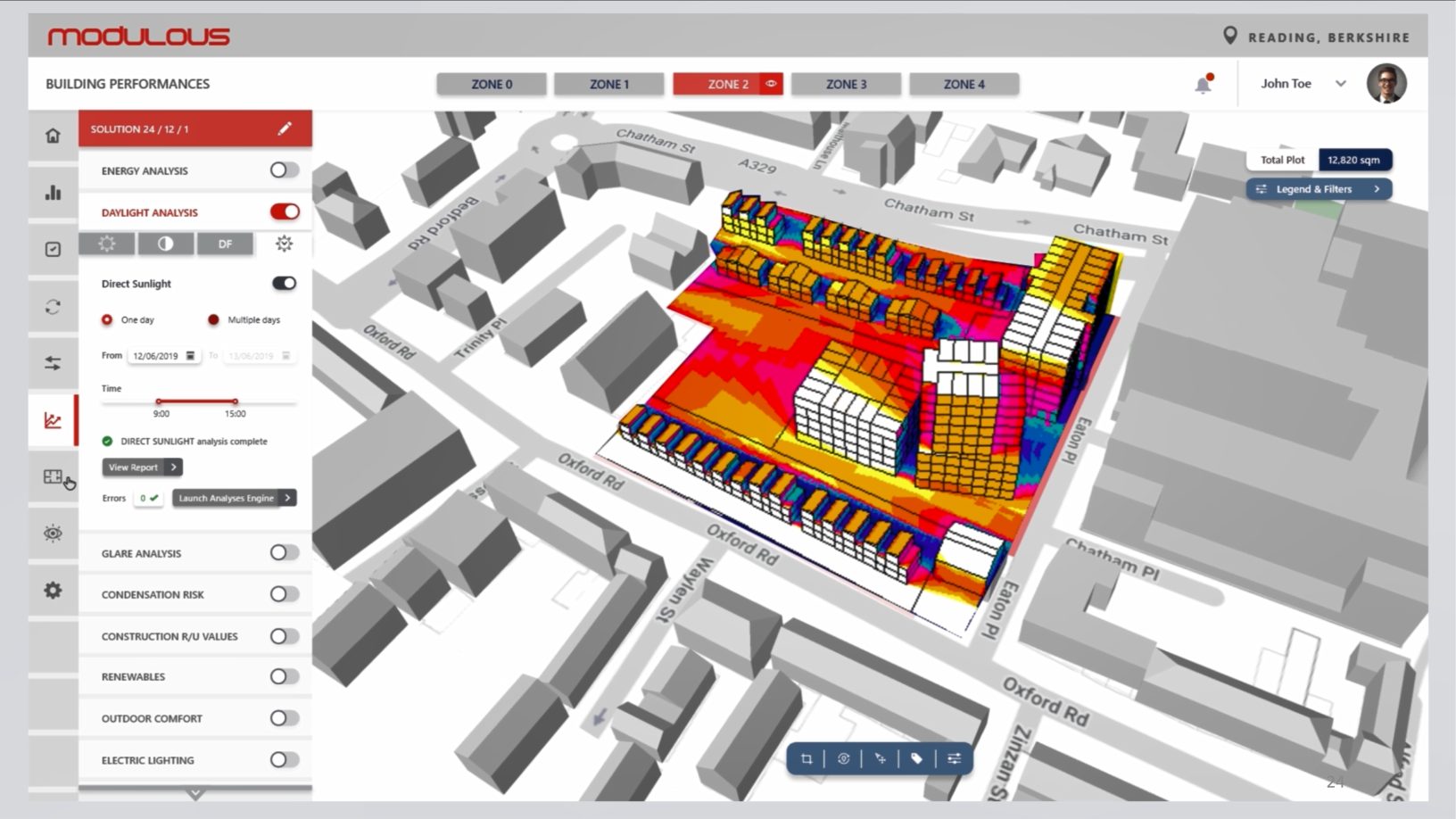

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

SigmaRail in funding talks, eyes 10-fold surge in revenue

The profitable Madrid-based startup is behind the “Google Maps” for railways to help make trains safer and provide better services

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

CarBlock eyes opportunities presented by the multi-billion car data market

This startup aims to transform the connected car and transportation industry by building a data circulation system based on blockchain

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

Sustainable last-mile grocery delivery startup Revoolt eyes French, LatAm expansion

Seeking up to €1m new funding for its growth, the Madrid-based startup with its EV fleet and turnkey IoT solutions has also broken even

Logisly challenges the Indonesian on-demand freight sector with managed marketplace

In less than a year of launching, Logisly has facilitated more than a thousand shipments and raised seed funding from three investors

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sorry, we couldn’t find any matches for“Eyes of Things”.