Fidelity International

-

DATABASE (262)

-

ARTICLES (257)

Kibo Ventures is a Madrid-based venture capital firm founded in 2011 by Alquilino Peña, Jose Maria Amusategui and Javier Torremocha with €114 million under management. The firm is supported by a network of 31 international co-investors who offer access to foreign markets, especially to the US and Latin America, as well as digital-savvy operating partners who provide guidance on technology matters. As of July 2018, Kibo had invested in 44 companies, five of which it has successfully exited, including Blink Booking (acquired by Groupon in 2013), Ducksboard (acquired by New Relic in 2014) and Trip4real (acquired by AirBnB in 2016).

Kibo Ventures is a Madrid-based venture capital firm founded in 2011 by Alquilino Peña, Jose Maria Amusategui and Javier Torremocha with €114 million under management. The firm is supported by a network of 31 international co-investors who offer access to foreign markets, especially to the US and Latin America, as well as digital-savvy operating partners who provide guidance on technology matters. As of July 2018, Kibo had invested in 44 companies, five of which it has successfully exited, including Blink Booking (acquired by Groupon in 2013), Ducksboard (acquired by New Relic in 2014) and Trip4real (acquired by AirBnB in 2016).

Brad Bao (Bao Zhoujia) graduated in International Marketing at Wuhan University in 1997 and obtained an MBA from UC Berkeley in 2005. He worked in marketing at FORMICA from January 1997 to March 1998 and went on to work at Kodak until April 2000. He was at IBM until April 2001 when he finally decided to become an entrepreneur and co-founded NORICT in Beijing.He was also the GM and VP of the US branch for Tencent from 2005–2012. He joined Kinzon Capital as managing partner in September 2013 and co-founded LimeBike in the US in November 2016.

Brad Bao (Bao Zhoujia) graduated in International Marketing at Wuhan University in 1997 and obtained an MBA from UC Berkeley in 2005. He worked in marketing at FORMICA from January 1997 to March 1998 and went on to work at Kodak until April 2000. He was at IBM until April 2001 when he finally decided to become an entrepreneur and co-founded NORICT in Beijing.He was also the GM and VP of the US branch for Tencent from 2005–2012. He joined Kinzon Capital as managing partner in September 2013 and co-founded LimeBike in the US in November 2016.

Making Ideas Business was founded in 2012 by a group of 51 students and professors after the end of the 2011-2012 Master in Internet Business at ISDI, an international institution that offers training and degree programs in digital business management.Along with mentoring and industry expertise, the fund provides tech startups in the Spanish ecosystem with seed investments. It has invested €260,000 in five companies to date.The group today includes more than 78 partners and angel investors that, in total, have more than 1,000 years of professional experience and 50,000 hours of training in the internet sector.

Making Ideas Business was founded in 2012 by a group of 51 students and professors after the end of the 2011-2012 Master in Internet Business at ISDI, an international institution that offers training and degree programs in digital business management.Along with mentoring and industry expertise, the fund provides tech startups in the Spanish ecosystem with seed investments. It has invested €260,000 in five companies to date.The group today includes more than 78 partners and angel investors that, in total, have more than 1,000 years of professional experience and 50,000 hours of training in the internet sector.

Salut Monràs is Wealth Manager and CEO of Valra Finances, S.L., a family holding company with financial assets and investments in Biotech, AI, Fintech and real estate. She has broad experience in communication, production and design and is passionate about aesthetics and creativity. She is a mother of three and a former international model, professor and entrepreneur. She is general manager of Lorda, S.L., model agent and booker for Francina Modelling Agency and is also founder of Mother Studio and co-founder and commercial director of HELMUTANDCO. She has a degree in Graphic Design from the Ramon Llull University.

Salut Monràs is Wealth Manager and CEO of Valra Finances, S.L., a family holding company with financial assets and investments in Biotech, AI, Fintech and real estate. She has broad experience in communication, production and design and is passionate about aesthetics and creativity. She is a mother of three and a former international model, professor and entrepreneur. She is general manager of Lorda, S.L., model agent and booker for Francina Modelling Agency and is also founder of Mother Studio and co-founder and commercial director of HELMUTANDCO. She has a degree in Graphic Design from the Ramon Llull University.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

AIA Group is the largest independent publicly listed pan-Asian life insurance group. Headquartered in Hong Kong, the group operates in 18 markets across Asia-Pacific. In 2014, AIA began to partner with venture capital firms to launch AIA Accelerator to support innovative and disruptive startups.AIA Group was originally founded in Shanghai, under the name of American Asiatic Underwriters. In 1939, the founder Cornelius Vander Starr relocated the head office to New York. AIA became a subsidiary of American International Group (AIG). AIA was listed in Hong Kong in 2010 and AIG sold all its shares of AIA Group in 2012.

Ocean Link is a private equity firm that mainly invests in consumer goods, tourism and TMT sectors in China. It currently manages two USD funds and one RMB fund. It has offices in Shanghai, Beijing and Hong Kong. The limited partners include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices. China’s largest online travel agency Trip.com and international private equity firm General Atlantic are strategic partners.In April 2020, Ocean Link proposed to acquire all of the outstanding ordinary shares of the Chinese online classifieds marketplace 58.com. The NYSE-listed company is in the process of evaluating the proposal.

Ocean Link is a private equity firm that mainly invests in consumer goods, tourism and TMT sectors in China. It currently manages two USD funds and one RMB fund. It has offices in Shanghai, Beijing and Hong Kong. The limited partners include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices. China’s largest online travel agency Trip.com and international private equity firm General Atlantic are strategic partners.In April 2020, Ocean Link proposed to acquire all of the outstanding ordinary shares of the Chinese online classifieds marketplace 58.com. The NYSE-listed company is in the process of evaluating the proposal.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Part of the Finnish Virala Group, Nidoco AB was established in Stockholm in 1965. The Swedish investment company is run by well-known Nordic family investors Alexander and Albert Ehrnrooth. The former is the CEO of Virala Oy AB. The latter was appointed as chairman of the Virala board in 2015. Nidoco and its four subsidiaries have stakes in more than 300 companies worldwide, including major shareholdings in three listed companies like Enersense International in Finland. Nidoco’s equity portfolio was worth nearly €360m in 2020.

Part of the Finnish Virala Group, Nidoco AB was established in Stockholm in 1965. The Swedish investment company is run by well-known Nordic family investors Alexander and Albert Ehrnrooth. The former is the CEO of Virala Oy AB. The latter was appointed as chairman of the Virala board in 2015. Nidoco and its four subsidiaries have stakes in more than 300 companies worldwide, including major shareholdings in three listed companies like Enersense International in Finland. Nidoco’s equity portfolio was worth nearly €360m in 2020.

Founder of Alkemis Games

A master’s degree holder in Entertainment Technology from Carnegie Mellon University, Pennsylvania, USA, Tedo Salim also graduated with a diploma of the same major from Nanyang Polytechnic, Singapore in 2007.Prior to running Alkemis Games, Tedo had worked as a Senior Software Engineer at GREE International Inc in San Francisco, from March 2012 to August 2014. He was with Schell Games in Pittsburgh as a Game Engineer for over three years, working mainly on iOS and Android mobile games such as War of Nations.

A master’s degree holder in Entertainment Technology from Carnegie Mellon University, Pennsylvania, USA, Tedo Salim also graduated with a diploma of the same major from Nanyang Polytechnic, Singapore in 2007.Prior to running Alkemis Games, Tedo had worked as a Senior Software Engineer at GREE International Inc in San Francisco, from March 2012 to August 2014. He was with Schell Games in Pittsburgh as a Game Engineer for over three years, working mainly on iOS and Android mobile games such as War of Nations.

Co-founder, Director, and Chief Strategy Officer of Travelio

After gaining work experience at the InterContinental Hotels Group in Singapore, Christina Suriadjaja decided to become a tech entrepreneur by co-founding Travelio, a spin-off from her father’s public-listed SSIA property conglomerate PT Surya Semesta Internusa Tbk.Christina attended the Singapore Sports School and was a member of the national netball team, before returning to Indonesia to study at the Jakarta International School. She worked as an intern at Ernst & Young and AXA, while reading a degree in Business Administration at the University of Southern California, USA.

After gaining work experience at the InterContinental Hotels Group in Singapore, Christina Suriadjaja decided to become a tech entrepreneur by co-founding Travelio, a spin-off from her father’s public-listed SSIA property conglomerate PT Surya Semesta Internusa Tbk.Christina attended the Singapore Sports School and was a member of the national netball team, before returning to Indonesia to study at the Jakarta International School. She worked as an intern at Ernst & Young and AXA, while reading a degree in Business Administration at the University of Southern California, USA.

Co-founder of Infra Digital Nusantara

A veteran in mobile communications and payments, Indah Maryani started her career at Indonesian telco giant Indosat in 2003. She worked there for over four years while reading a degree in Industrial Engineering at Universitas Persada Indonesia. Indah joined mobile company Utiba in 2007 and moved on to work at Fusion Payments in June 2011, climbing up the ranks to become VP of Services in 2015. Indah obtained an MBA from IPMI International Business School in 2017 and eventually left Fusion Payments to establish PT Infra Digital Indonesia.

A veteran in mobile communications and payments, Indah Maryani started her career at Indonesian telco giant Indosat in 2003. She worked there for over four years while reading a degree in Industrial Engineering at Universitas Persada Indonesia. Indah joined mobile company Utiba in 2007 and moved on to work at Fusion Payments in June 2011, climbing up the ranks to become VP of Services in 2015. Indah obtained an MBA from IPMI International Business School in 2017 and eventually left Fusion Payments to establish PT Infra Digital Indonesia.

Co-founder and Advisor of ChainGo

Pilar Troncoso is an entrepreneur with 12 years of experience in business, mergers and acquisitions at international accounting firm PwC. She also specializes in marketing, promotions, design and development of new ventures. She is passionate about digital innovations, such as the use of blockchain in consumer-oriented businesses and other industries. In 2016, she became the Senior VP of multi-device blockchain platform Nodalblock and also joined ChainGo as co-founder and advisor.

Pilar Troncoso is an entrepreneur with 12 years of experience in business, mergers and acquisitions at international accounting firm PwC. She also specializes in marketing, promotions, design and development of new ventures. She is passionate about digital innovations, such as the use of blockchain in consumer-oriented businesses and other industries. In 2016, she became the Senior VP of multi-device blockchain platform Nodalblock and also joined ChainGo as co-founder and advisor.

Co-founder and CEO of Marfeel

Xavi Beumala is a telecommunication engineer with a track record of extensive international and editorial positions in tech-related media. He was Technical Architect in Adobe Systems when he left in 2011 with a vision to create a company that could innovate the online media industry and its consumption across new and emerging devices. He invested his savings to bootstrap and start up Marfeel, a mobile ad-tech company with offices in Barcelona and New York, where he is currently co-founder and CEO.

Xavi Beumala is a telecommunication engineer with a track record of extensive international and editorial positions in tech-related media. He was Technical Architect in Adobe Systems when he left in 2011 with a vision to create a company that could innovate the online media industry and its consumption across new and emerging devices. He invested his savings to bootstrap and start up Marfeel, a mobile ad-tech company with offices in Barcelona and New York, where he is currently co-founder and CEO.

CTO and Co-founder of Solatom

Juan Martinez studied Industrial Engineering at the Polytechnic University of Valencia, Spain and holds a master's specializing in rotary machine design. He has spent over four years as a design and stress engineer at various Spanish engineering companies, including rail infrastructure firm Vossloh, Altran, an engineering R&D services company and ISATI (International Solutions for the Aeronautical and Telecommunications Industries). Since 2016, Martinez has been co-founder and CTO at Solatom, a startup that develops solar concentrators for industrial applications.

Juan Martinez studied Industrial Engineering at the Polytechnic University of Valencia, Spain and holds a master's specializing in rotary machine design. He has spent over four years as a design and stress engineer at various Spanish engineering companies, including rail infrastructure firm Vossloh, Altran, an engineering R&D services company and ISATI (International Solutions for the Aeronautical and Telecommunications Industries). Since 2016, Martinez has been co-founder and CTO at Solatom, a startup that develops solar concentrators for industrial applications.

DGene : Star Wars-inspired 3D holograms made affordable for businesses

DGene's mobile-based VR/AR solution using integrated light field cuts the need for 3D modeling, useful for many sectors from retail marketing to conference calls

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

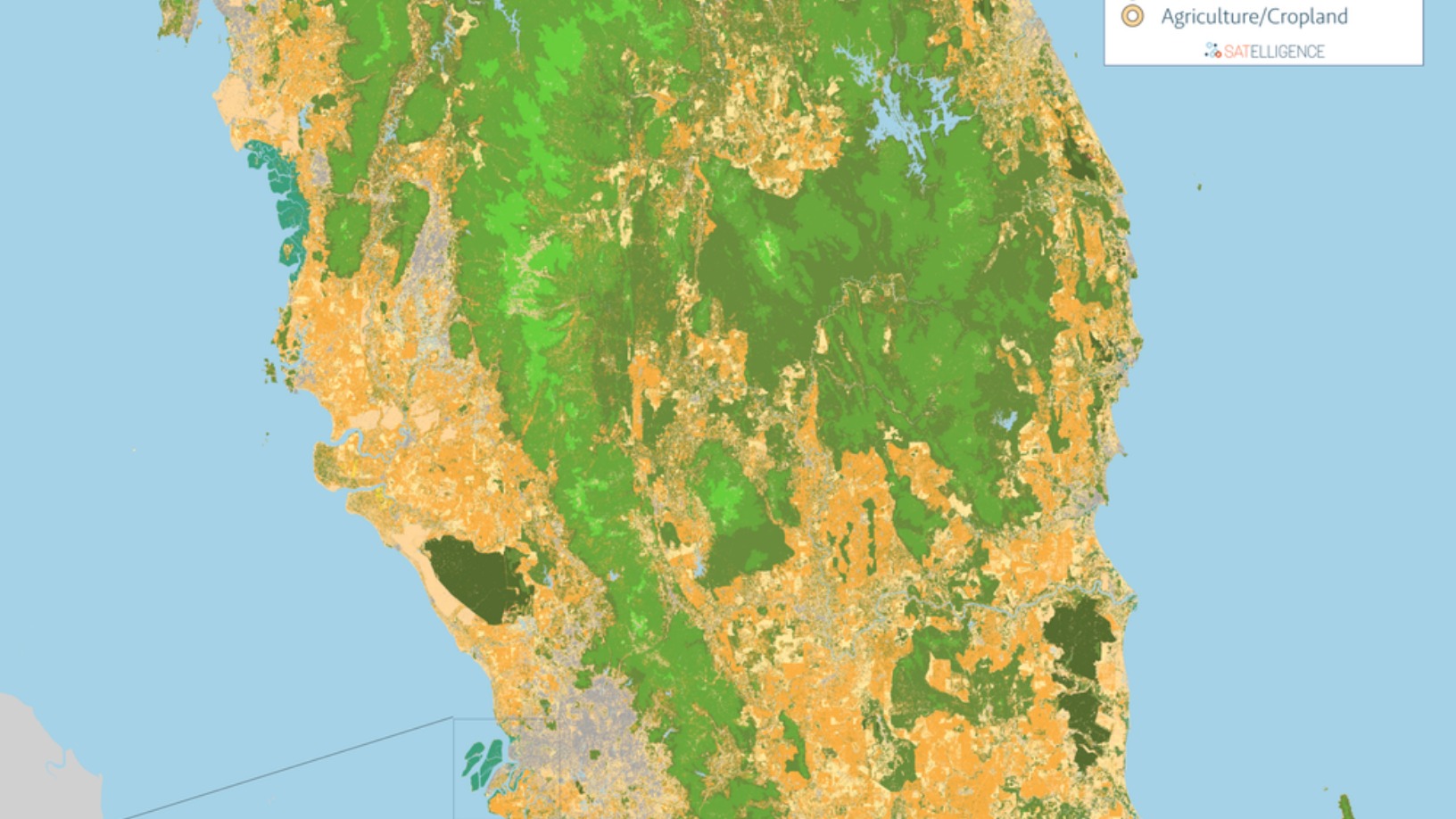

Satelligence: Satellite data and AI helping corporate giants source commodities more sustainably

Satelligence monitors environmental risks across 6bn hectares of mostly tropical forest for high-profile clients such as Pepsico, Nestlé and Unilever

Qlue on international expansion, privacy concerns in smart cities

Qlue's CEO Rama Raditya and CCO Maya Arvini on protecting individual privacy when handling citizens' data in smart cities, the lack of clarity in regulation of use of facial recognition technology in Indonesia

Bernardo Hernández: Celebrity investor and Google's former marketing whiz

The angel investor behind some of the most successful Spanish internet startups also has an unusual honor for techies – GQ’s Man of the Year

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

This EV maker caters to young consumers by making driving easier and more fun

Amongst all the players in China’s EV market, Xpeng Motors still stands out

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

Diamond Foundry: Growing conflict-free, eco-friendly diamonds in a lab

The world’s first lab-grown diamond producer certified carbon-neutral, Diamond Foundry became a unicorn recently with a $200m investment from Fidelity, adding to earlier funding from tech billionaires

CloudGuide: Bringing museum tourism into the 21st century

CloudGuide, an app hosting official multimedia content from museums and tourist attractions, seeks post-seed funding to scale in Europe

Solatom plans overseas expansion with backing from energy giants, impact investor

With a US patent in hand, the Valencian startup is banking on international sales of its concentrated solar power modules, targeting €1m in revenue by end-2021

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

“Good thing about my style. Some like it, some hate it but everybody recognizes it.” @sofíabenjumea

Outspoken with a hands-on management style, Sofía Benjumea is a force to reckon with at Google’s Campus Madrid

Sorry, we couldn’t find any matches for“Fidelity International”.