Fidelity International

-

DATABASE (262)

-

ARTICLES (257)

Fidelity China Special Situations PLC

Founded in 2010, Fidelity China Special Situations PLC (FCSS) is managed by Dale Nicholls who has worked at Fidelity International since 1996. Listed on the FTSE 250 Index, FCSS is said to be the UK’s largest China-focused investment trust with access to Fidelity's investment research resources and investment licenses in China.Focusing on companies that are most likely to benefit from China’s growth and changing economy, FCSS has invested in over 100 businesses in the country. Besides technology, it is also seeking opportunities in the consumer space and healthcare.

Founded in 2010, Fidelity China Special Situations PLC (FCSS) is managed by Dale Nicholls who has worked at Fidelity International since 1996. Listed on the FTSE 250 Index, FCSS is said to be the UK’s largest China-focused investment trust with access to Fidelity's investment research resources and investment licenses in China.Focusing on companies that are most likely to benefit from China’s growth and changing economy, FCSS has invested in over 100 businesses in the country. Besides technology, it is also seeking opportunities in the consumer space and healthcare.

Formerly Fidelity Growth Partners, the renamed Eight Roads Ventures is the investment arm of Fidelity International Limited. In China for over 20 years, it counts among its successful investments/exits Alibaba, WuXi PharmaTech, AsiaInfo and iSoftStone. It focuses on early- and growth-stage companies across eight broad sectors.

Formerly Fidelity Growth Partners, the renamed Eight Roads Ventures is the investment arm of Fidelity International Limited. In China for over 20 years, it counts among its successful investments/exits Alibaba, WuXi PharmaTech, AsiaInfo and iSoftStone. It focuses on early- and growth-stage companies across eight broad sectors.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Established in March 2015, SPDB International is an offshore investment bank wholly owned by Shanghai Pudong Development Bank (SPD Bank). It plays an important role in SPD Bank’s aspiration of becoming an international commercial bank with investment banking capabilities. SPDB International has three wholly-owned subsidiaries in Hong Kong as well as several offshore and onshore special purpose vehicles and subsidiaries to facilitate its management and investment operations.

Established in March 2015, SPDB International is an offshore investment bank wholly owned by Shanghai Pudong Development Bank (SPD Bank). It plays an important role in SPD Bank’s aspiration of becoming an international commercial bank with investment banking capabilities. SPDB International has three wholly-owned subsidiaries in Hong Kong as well as several offshore and onshore special purpose vehicles and subsidiaries to facilitate its management and investment operations.

Eight Roads Ventures is the investment arm of Bermuda-based investment management giant Fidelity International Limited, which was founded in 1969. (It was formerly called Fidelity Growth Partners.) Its investment focus includes emerging technology and healthcare companies in North America, Europe and China in their go-to-market stage and early customer traction. It has offices in the UK, China, India and Japan and has seen 42 exits and has invested in over 300 companies to date. It also participates in Series A to D funding rounds and is a major investor in real estate.

Eight Roads Ventures is the investment arm of Bermuda-based investment management giant Fidelity International Limited, which was founded in 1969. (It was formerly called Fidelity Growth Partners.) Its investment focus includes emerging technology and healthcare companies in North America, Europe and China in their go-to-market stage and early customer traction. It has offices in the UK, China, India and Japan and has seen 42 exits and has invested in over 300 companies to date. It also participates in Series A to D funding rounds and is a major investor in real estate.

Astra International is an Indonesian conglomerate most famous for its automotive importing and related businesses, although it has subsidiaries in finance, agri-business and property as well. The holding company, PT Astra International Tbk., is listed in the Indonesian stock exchange. Its investments so far have been focused in Indonesia. Companies like Gojek, Sayurbox, and Halodoc have become part of Astra’s portfolio.

Astra International is an Indonesian conglomerate most famous for its automotive importing and related businesses, although it has subsidiaries in finance, agri-business and property as well. The holding company, PT Astra International Tbk., is listed in the Indonesian stock exchange. Its investments so far have been focused in Indonesia. Companies like Gojek, Sayurbox, and Halodoc have become part of Astra’s portfolio.

Founded in 1973 in Hong Kong, CCB International is a financial and investment services company owned by China Construction Bank Corporation (CCB). Through its subsidiaries, the company provides customers worldwide with services including direct investment, underwriting, financial advisory, corporate mergers and acquisitions, asset management and securities brokerage. CCB International (Holdings) serves customers worldwide. Its core business is divided into three main areas: pre-IPO, IPO and post-IPO.

Founded in 1973 in Hong Kong, CCB International is a financial and investment services company owned by China Construction Bank Corporation (CCB). Through its subsidiaries, the company provides customers worldwide with services including direct investment, underwriting, financial advisory, corporate mergers and acquisitions, asset management and securities brokerage. CCB International (Holdings) serves customers worldwide. Its core business is divided into three main areas: pre-IPO, IPO and post-IPO.

BOC International (China) Limited

With the approval of the China Securities Regulatory Commission, BOC International (China) Limited was established in February 2002. It is jointly controlled by BOC International Holdings Limited, China National Petroleum Corporation, State Development & Investment Corporation, Hongta Tobacco Group Corporation, China General Technology (Group) Holding Limited, and Shanghai State-owned Assets Operation Corporation. Headquartered in Shanghai, BOC International (China) Limited has 115 branches in over 80 Chinese cities including Beijing and Shenzhen. BOC International (China) Limited engages in PE investment, alternative investment and futures business through its wholly-owned subsidiaries including BOC International Investment Co., Ltd. It also collaborates with BOC International Holdings Limited, which was established by Bank of China in Hong Kong in 1998, for marketing, risk management, and other business. BOC International (China) Limited went public on Shanghai Stock Exchange in 2020.

With the approval of the China Securities Regulatory Commission, BOC International (China) Limited was established in February 2002. It is jointly controlled by BOC International Holdings Limited, China National Petroleum Corporation, State Development & Investment Corporation, Hongta Tobacco Group Corporation, China General Technology (Group) Holding Limited, and Shanghai State-owned Assets Operation Corporation. Headquartered in Shanghai, BOC International (China) Limited has 115 branches in over 80 Chinese cities including Beijing and Shenzhen. BOC International (China) Limited engages in PE investment, alternative investment and futures business through its wholly-owned subsidiaries including BOC International Investment Co., Ltd. It also collaborates with BOC International Holdings Limited, which was established by Bank of China in Hong Kong in 1998, for marketing, risk management, and other business. BOC International (China) Limited went public on Shanghai Stock Exchange in 2020.

Susquehanna International Group

Susquehanna International Group is a privately held global investment, trading and technology firm servicing securities markets worldwide.

Susquehanna International Group is a privately held global investment, trading and technology firm servicing securities markets worldwide.

CMB International is a wholly-owned subsidiary of China Merchants Bank. It has two private equity funds. The first, based in Shenzhen, was founded in 2017, and the second, based in Hong Kong, was founded in 2010. CMB International's Shenzhen division invests in the internet, healthcare, automobile, new energy and consumption sectors.

CMB International is a wholly-owned subsidiary of China Merchants Bank. It has two private equity funds. The first, based in Shenzhen, was founded in 2017, and the second, based in Hong Kong, was founded in 2010. CMB International's Shenzhen division invests in the internet, healthcare, automobile, new energy and consumption sectors.

BOCOM International Global Investment

BOCOM International is a wholly owned unit of Bank of Communications Co., Ltd..

BOCOM International is a wholly owned unit of Bank of Communications Co., Ltd..

Guotai Junan International is China’s first securities company with IPO-listing on the Hong Kong Stock Exchange. Based in Hong Kong, it provides wealth management, brokerage, corporate finance, loans and financing, asset management and financial products. Its parent company Guotai Junan Securities Company Limited is its controlling shareholder.

Guotai Junan International is China’s first securities company with IPO-listing on the Hong Kong Stock Exchange. Based in Hong Kong, it provides wealth management, brokerage, corporate finance, loans and financing, asset management and financial products. Its parent company Guotai Junan Securities Company Limited is its controlling shareholder.

CM International Financial Leasing Co. Ltd.

Founded in 2015, CM International Financial Leasing is a subsidiary of CMIG Leasing, with RMB 40 billion in assets.

Founded in 2015, CM International Financial Leasing is a subsidiary of CMIG Leasing, with RMB 40 billion in assets.

Backed by top Silicon Valley investors, Zipline builds drones that leapfrog inefficient infrastructures delivering lifesaving medical supplies to remote locations worldwide within 30mins.

Backed by top Silicon Valley investors, Zipline builds drones that leapfrog inefficient infrastructures delivering lifesaving medical supplies to remote locations worldwide within 30mins.

China Culture Industrial Investment Fund

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

Kantox: Value for corporates, headache for banks

Moving beyond its initial remit of currency exchange, Europe's fourth-fastest growing fintech Kantox has garnered awards and financial sector hostility as it differentiates itself in a crowded marketplace

Clicars: Bringing certainty to buying a used car

Spanish online used car dealer aims to sell 10,000 vehicles by 2021 via its unique sales offer that has booked it €50 million in sales since 2016

Portugal's health & medtech startups: Taking innovation and disruption to heart

Backed by local and foreign money, Portugal’s healthcare and medical technology startups are hungry to go global

Atomian: The powerful cognitive software that thinks, works like the human brain

Combining natural language processing with big data, Atomian enables easy, quick and real-time access to information in databases and documents

Situm Technologies: The Google Maps for indoors, where GPS fails

It uses AI and mobile robotics to create high-precision, low-cost indoor location tech that integrates data processed from multiple radio and inertial sensors

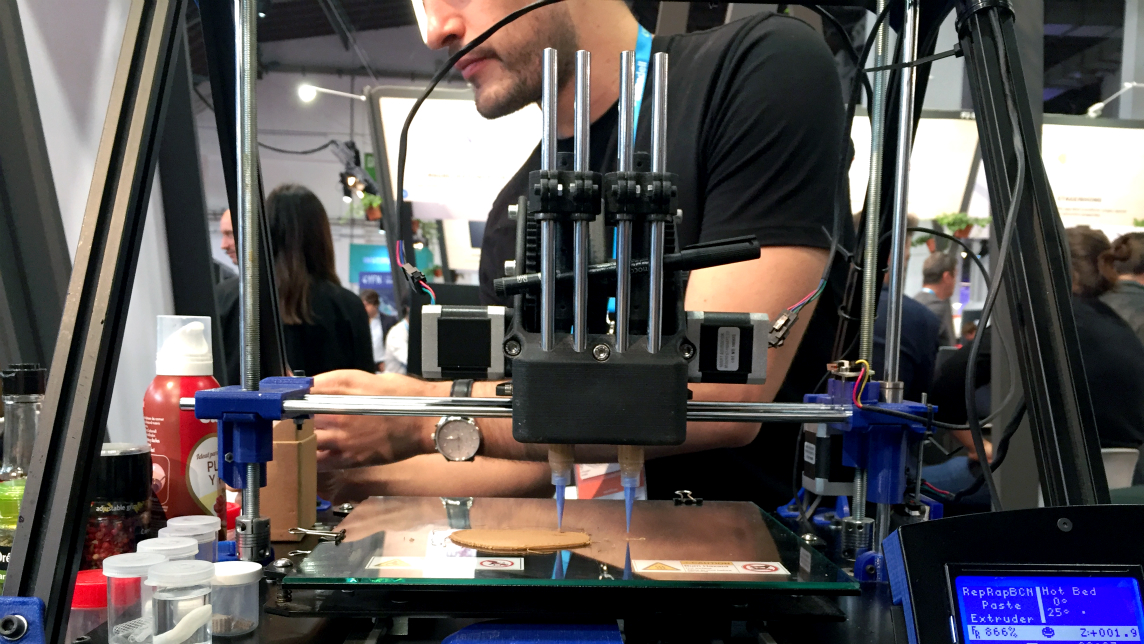

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

HOOP Carpool: Graduates bootstrap ride-sharing app to facilitate sustainable commuting

South Summit Malaga (Smart Mobility Encounters) winners Nathan Lehoucq and Andrea García Torrijos discuss their ride-sharing app for consumers and corporates

Belva Devara: The whiz kid transforming Indonesia’s education sector

Recently made advisor to the Indonesian president, edtech Ruangguru founder and CEO Belva Devara has also begun mentoring and promoting new startups in Indonesia

How Sea Water Analytics is using IoT to help keep beaches safe in Covid-19 era

Sea Water Analytics checks water quality, overcrowding, even jelly fish threats in Spanish beaches

More Asian men are into skincare and health products, and Elio is here to help (discreetly)

Elio believes offering privacy, free online consultations and discreet product packaging will encourage more men to take better care of their health

HigoSense launching advanced mobile device for self-triage and diagnosis, boosting telemedicine

The Polish medtech has developed a five-in-one diagnostic device for throat, ear, heart checks and more, with diagnosis in four minutes and compatible with diagnostic equipment

Clear Plate: Anti-food waste AI that rewards the diners who finish their food

Taking little steps to make a big difference in fighting food waste, Clear Plate engages with digital natives to spread the message

Sweden's imogo pioneers eco-friendly dye spraying system

The startup’s dyeing and finishing solutions convert the most resource-consuming parts of textile value chains into sustainable processes, with virtually no wastewater and using less energy and chemicals

Scoobic: Nifty electric three-wheelers for last-mile deliveries

Traveling up to 100 km on a single battery charge, Scoobic’s EVs, with delivery capacities of vans, is a sustainable solution to traffic jams and parking restrictions

Sorry, we couldn’t find any matches for“Fidelity International”.