Fidelity International

-

DATABASE (262)

-

ARTICLES (257)

Fidelity China Special Situations PLC

Founded in 2010, Fidelity China Special Situations PLC (FCSS) is managed by Dale Nicholls who has worked at Fidelity International since 1996. Listed on the FTSE 250 Index, FCSS is said to be the UK’s largest China-focused investment trust with access to Fidelity's investment research resources and investment licenses in China.Focusing on companies that are most likely to benefit from China’s growth and changing economy, FCSS has invested in over 100 businesses in the country. Besides technology, it is also seeking opportunities in the consumer space and healthcare.

Founded in 2010, Fidelity China Special Situations PLC (FCSS) is managed by Dale Nicholls who has worked at Fidelity International since 1996. Listed on the FTSE 250 Index, FCSS is said to be the UK’s largest China-focused investment trust with access to Fidelity's investment research resources and investment licenses in China.Focusing on companies that are most likely to benefit from China’s growth and changing economy, FCSS has invested in over 100 businesses in the country. Besides technology, it is also seeking opportunities in the consumer space and healthcare.

Formerly Fidelity Growth Partners, the renamed Eight Roads Ventures is the investment arm of Fidelity International Limited. In China for over 20 years, it counts among its successful investments/exits Alibaba, WuXi PharmaTech, AsiaInfo and iSoftStone. It focuses on early- and growth-stage companies across eight broad sectors.

Formerly Fidelity Growth Partners, the renamed Eight Roads Ventures is the investment arm of Fidelity International Limited. In China for over 20 years, it counts among its successful investments/exits Alibaba, WuXi PharmaTech, AsiaInfo and iSoftStone. It focuses on early- and growth-stage companies across eight broad sectors.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Established in March 2015, SPDB International is an offshore investment bank wholly owned by Shanghai Pudong Development Bank (SPD Bank). It plays an important role in SPD Bank’s aspiration of becoming an international commercial bank with investment banking capabilities. SPDB International has three wholly-owned subsidiaries in Hong Kong as well as several offshore and onshore special purpose vehicles and subsidiaries to facilitate its management and investment operations.

Established in March 2015, SPDB International is an offshore investment bank wholly owned by Shanghai Pudong Development Bank (SPD Bank). It plays an important role in SPD Bank’s aspiration of becoming an international commercial bank with investment banking capabilities. SPDB International has three wholly-owned subsidiaries in Hong Kong as well as several offshore and onshore special purpose vehicles and subsidiaries to facilitate its management and investment operations.

Eight Roads Ventures is the investment arm of Bermuda-based investment management giant Fidelity International Limited, which was founded in 1969. (It was formerly called Fidelity Growth Partners.) Its investment focus includes emerging technology and healthcare companies in North America, Europe and China in their go-to-market stage and early customer traction. It has offices in the UK, China, India and Japan and has seen 42 exits and has invested in over 300 companies to date. It also participates in Series A to D funding rounds and is a major investor in real estate.

Eight Roads Ventures is the investment arm of Bermuda-based investment management giant Fidelity International Limited, which was founded in 1969. (It was formerly called Fidelity Growth Partners.) Its investment focus includes emerging technology and healthcare companies in North America, Europe and China in their go-to-market stage and early customer traction. It has offices in the UK, China, India and Japan and has seen 42 exits and has invested in over 300 companies to date. It also participates in Series A to D funding rounds and is a major investor in real estate.

Astra International is an Indonesian conglomerate most famous for its automotive importing and related businesses, although it has subsidiaries in finance, agri-business and property as well. The holding company, PT Astra International Tbk., is listed in the Indonesian stock exchange. Its investments so far have been focused in Indonesia. Companies like Gojek, Sayurbox, and Halodoc have become part of Astra’s portfolio.

Astra International is an Indonesian conglomerate most famous for its automotive importing and related businesses, although it has subsidiaries in finance, agri-business and property as well. The holding company, PT Astra International Tbk., is listed in the Indonesian stock exchange. Its investments so far have been focused in Indonesia. Companies like Gojek, Sayurbox, and Halodoc have become part of Astra’s portfolio.

Founded in 1973 in Hong Kong, CCB International is a financial and investment services company owned by China Construction Bank Corporation (CCB). Through its subsidiaries, the company provides customers worldwide with services including direct investment, underwriting, financial advisory, corporate mergers and acquisitions, asset management and securities brokerage. CCB International (Holdings) serves customers worldwide. Its core business is divided into three main areas: pre-IPO, IPO and post-IPO.

Founded in 1973 in Hong Kong, CCB International is a financial and investment services company owned by China Construction Bank Corporation (CCB). Through its subsidiaries, the company provides customers worldwide with services including direct investment, underwriting, financial advisory, corporate mergers and acquisitions, asset management and securities brokerage. CCB International (Holdings) serves customers worldwide. Its core business is divided into three main areas: pre-IPO, IPO and post-IPO.

BOC International (China) Limited

With the approval of the China Securities Regulatory Commission, BOC International (China) Limited was established in February 2002. It is jointly controlled by BOC International Holdings Limited, China National Petroleum Corporation, State Development & Investment Corporation, Hongta Tobacco Group Corporation, China General Technology (Group) Holding Limited, and Shanghai State-owned Assets Operation Corporation. Headquartered in Shanghai, BOC International (China) Limited has 115 branches in over 80 Chinese cities including Beijing and Shenzhen. BOC International (China) Limited engages in PE investment, alternative investment and futures business through its wholly-owned subsidiaries including BOC International Investment Co., Ltd. It also collaborates with BOC International Holdings Limited, which was established by Bank of China in Hong Kong in 1998, for marketing, risk management, and other business. BOC International (China) Limited went public on Shanghai Stock Exchange in 2020.

With the approval of the China Securities Regulatory Commission, BOC International (China) Limited was established in February 2002. It is jointly controlled by BOC International Holdings Limited, China National Petroleum Corporation, State Development & Investment Corporation, Hongta Tobacco Group Corporation, China General Technology (Group) Holding Limited, and Shanghai State-owned Assets Operation Corporation. Headquartered in Shanghai, BOC International (China) Limited has 115 branches in over 80 Chinese cities including Beijing and Shenzhen. BOC International (China) Limited engages in PE investment, alternative investment and futures business through its wholly-owned subsidiaries including BOC International Investment Co., Ltd. It also collaborates with BOC International Holdings Limited, which was established by Bank of China in Hong Kong in 1998, for marketing, risk management, and other business. BOC International (China) Limited went public on Shanghai Stock Exchange in 2020.

Susquehanna International Group

Susquehanna International Group is a privately held global investment, trading and technology firm servicing securities markets worldwide.

Susquehanna International Group is a privately held global investment, trading and technology firm servicing securities markets worldwide.

CMB International is a wholly-owned subsidiary of China Merchants Bank. It has two private equity funds. The first, based in Shenzhen, was founded in 2017, and the second, based in Hong Kong, was founded in 2010. CMB International's Shenzhen division invests in the internet, healthcare, automobile, new energy and consumption sectors.

CMB International is a wholly-owned subsidiary of China Merchants Bank. It has two private equity funds. The first, based in Shenzhen, was founded in 2017, and the second, based in Hong Kong, was founded in 2010. CMB International's Shenzhen division invests in the internet, healthcare, automobile, new energy and consumption sectors.

BOCOM International Global Investment

BOCOM International is a wholly owned unit of Bank of Communications Co., Ltd..

BOCOM International is a wholly owned unit of Bank of Communications Co., Ltd..

Guotai Junan International is China’s first securities company with IPO-listing on the Hong Kong Stock Exchange. Based in Hong Kong, it provides wealth management, brokerage, corporate finance, loans and financing, asset management and financial products. Its parent company Guotai Junan Securities Company Limited is its controlling shareholder.

Guotai Junan International is China’s first securities company with IPO-listing on the Hong Kong Stock Exchange. Based in Hong Kong, it provides wealth management, brokerage, corporate finance, loans and financing, asset management and financial products. Its parent company Guotai Junan Securities Company Limited is its controlling shareholder.

CM International Financial Leasing Co. Ltd.

Founded in 2015, CM International Financial Leasing is a subsidiary of CMIG Leasing, with RMB 40 billion in assets.

Founded in 2015, CM International Financial Leasing is a subsidiary of CMIG Leasing, with RMB 40 billion in assets.

Backed by top Silicon Valley investors, Zipline builds drones that leapfrog inefficient infrastructures delivering lifesaving medical supplies to remote locations worldwide within 30mins.

Backed by top Silicon Valley investors, Zipline builds drones that leapfrog inefficient infrastructures delivering lifesaving medical supplies to remote locations worldwide within 30mins.

China Culture Industrial Investment Fund

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

In 2011, the China Culture Industrial Investment Fund was founded by the Ministry of Finance, BOC International Holdings Limited, China International Television Corporation and Shenzhen International Cultural Industry Fair Co., Ltd. It has RMB 20 billion in assets under management. The fund has invested more than RMB 3.5 billion in 40 startups and projects.

New Food Invest: Opportunities in the European alt-protein space

With a record €2.4bn investment in 2019, Europe’s foodtech sector appears poised for continued growth, but startups, corporations, governments and even universities can do more, experts say

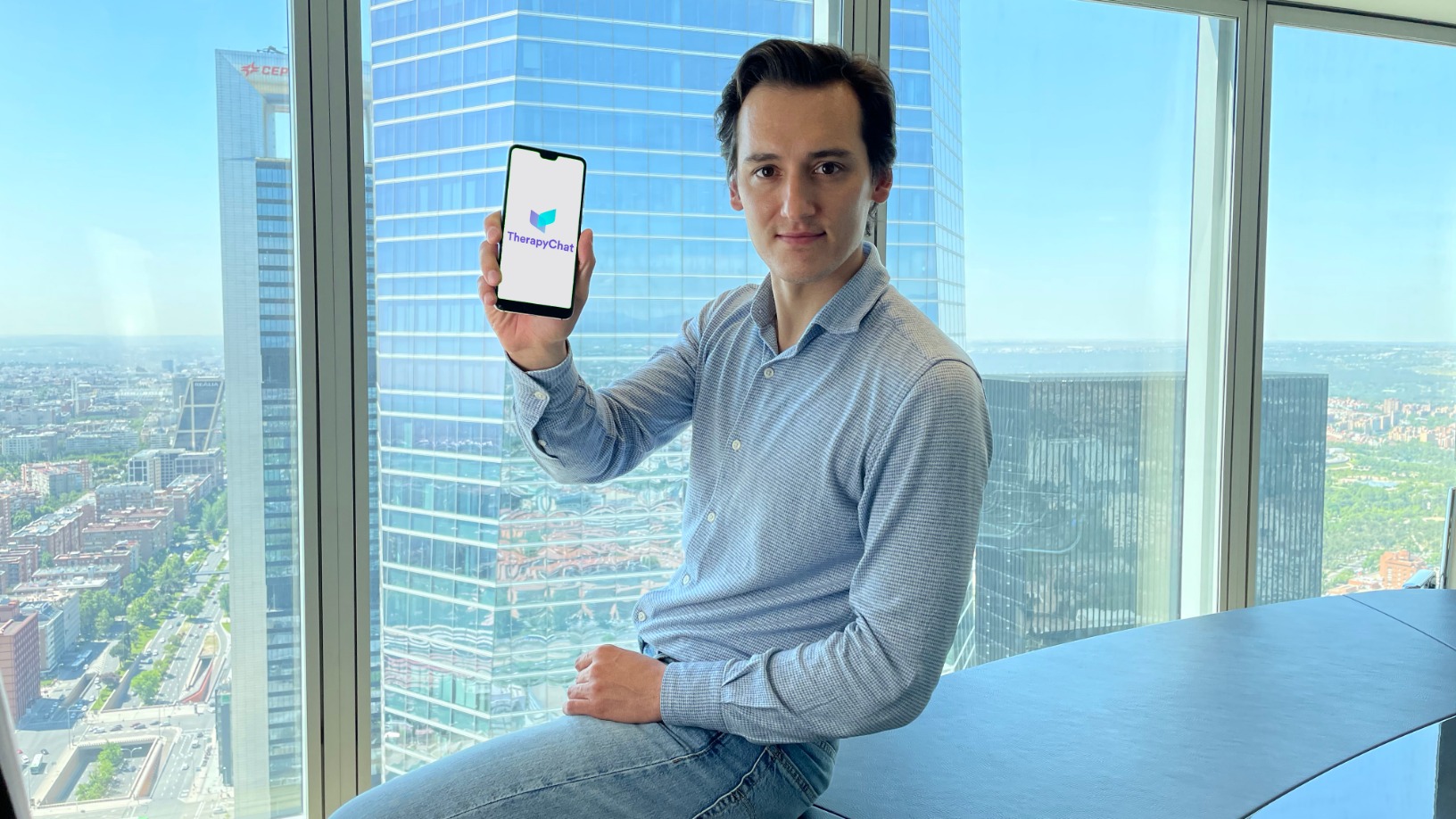

TherapyChat: Using AI to scale and improve accuracy in mental health treatment

Business for the Spanish startup has surged ninefold since Covid-19, with the company expanding to the UK and Italy

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

SigmaRail in funding talks, eyes 10-fold surge in revenue

The profitable Madrid-based startup is behind the “Google Maps” for railways to help make trains safer and provide better services

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

SoccerDream: World's first VR soccer training platform to launch in China, US

SoccerDream uses virtual reality to boost trainee players' performance on the field by 36% compared to their peers

Covid-19 symptoms checker and contact-tracing apps, virtual classrooms and 3D video-conferencing platforms are among the array of solutions for homebound adults and kids

Spain's gig and sharing economy startups flourish, despite barrage of restrictions

Startups like Glovo and Spotahome topped fundings raised in 2018 despite local regulatory risks, as Spanish tech firms conquer overseas markets

MBiz: Working toward the "tipping point" of e-procurement mainstreaming

Trusted by multinationals and conglomerates, Mbiz wants to take e-procurement mainstream by also working with municipal governments

Kobo360: Nigeria's Uber-style logistics startup turns pan-African dream into reality

Riding on Africa’s new free trade deal, Kobo360 aims to be the continent’s next unicorn by digitalizing logistics ops to transport goods quickly, reliably and more cheaply

Chinese startups join the race to address chip shortage amid funding boom

Would an overheated semiconductor startup scene and the ability to design cutting-edge chips be enough to help China achieve chip self-sufficiency?

SwissDeCode: Portable DNA test kits detect food contamination within minutes

DNAFoil, the startup’s rapid and accurate on-site food safety testing kit, can be deployed by non-expert staff after a few hours of training, with no need for lab equipment

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

OLIO: Zero food waste app expands with new product categories, going global

Recent $43m Series B funding will let sustainability app more than triple hiring, add homemade products and household goods to product listings

Sorry, we couldn’t find any matches for“Fidelity International”.