Fond-ICO Global

-

DATABASE (210)

-

ARTICLES (377)

Capital V is a French rural-based investor that only invests in solutions that facilitate sustained behavioral change and eliminate the consumption of animal products. Its investments range from €10,000 to €1m and currently has 20 startups in its portfolio, mainly plant-based meat makers.In 2020, it announced its participation in Pitch & Plant 2020, the global investment competition by Vevolution for plant-based and animal-free startups, offering £100,000 to finalists. Among its recent investments are participation in the extended 2020 seed round of THIS, a UK-based plant-based meat startup that has raised over £6m to date and, in August 2020, in vegan confectionary manufacturer, Livia’s that has raised over £1m so far.

Capital V is a French rural-based investor that only invests in solutions that facilitate sustained behavioral change and eliminate the consumption of animal products. Its investments range from €10,000 to €1m and currently has 20 startups in its portfolio, mainly plant-based meat makers.In 2020, it announced its participation in Pitch & Plant 2020, the global investment competition by Vevolution for plant-based and animal-free startups, offering £100,000 to finalists. Among its recent investments are participation in the extended 2020 seed round of THIS, a UK-based plant-based meat startup that has raised over £6m to date and, in August 2020, in vegan confectionary manufacturer, Livia’s that has raised over £1m so far.

Since 2005, Demeter Partners has been one of the major VC and private equity funds supporting technology companies in developing solutions for ecological and energy transitions. The firm typically invests €1m–€30m in early and growth stages of startups. With assets worth over €1bn under management, its portfolio in 2019 was estimated to have cut 4.3m tons of CO2 with 575 GWh of clean energy produced. In 2021, Demeter was named the “Best Sustainable Equity investor” by a panel of former Fortune 500 individuals, global experts and industry leaders to recognize Demeter’s commitment to the UN’s SDG and ESG strategy.

Since 2005, Demeter Partners has been one of the major VC and private equity funds supporting technology companies in developing solutions for ecological and energy transitions. The firm typically invests €1m–€30m in early and growth stages of startups. With assets worth over €1bn under management, its portfolio in 2019 was estimated to have cut 4.3m tons of CO2 with 575 GWh of clean energy produced. In 2021, Demeter was named the “Best Sustainable Equity investor” by a panel of former Fortune 500 individuals, global experts and industry leaders to recognize Demeter’s commitment to the UN’s SDG and ESG strategy.

CEO and founder of Petit Pli

Ryan Mario Yasin is an engineer, designer and sustainable fashion entrepreneur based in London. Originally from Reykjavik, Iceland, Yasin graduated in aeronautical engineering at Imperial College London and has a master’s in global innovation design from the Royal College of Art. As a 23-year-old design student, Yasin founded materials technology startup Petit Pli, and developed the design for the company’s first product, a pleated garment that could expand up to seven sizes to last children through their first few years of life. Petit Pli now makes expandable pleated clothes for children and adults, using a fabric derived from recycled plastic and a structure inspired by origami, architecture and space satellites. Petit Pli products have won a number of prestigious awards, such as the UK James Dyson Award, Time Magazine’s best invention of 2020 and the Red Dot Product Design Award.Yasin has a strong interest in photography and in the interplay between art and engineering. In 2020, Yasin was included by Forbes in its 30 Under 30 list for Europe.

Ryan Mario Yasin is an engineer, designer and sustainable fashion entrepreneur based in London. Originally from Reykjavik, Iceland, Yasin graduated in aeronautical engineering at Imperial College London and has a master’s in global innovation design from the Royal College of Art. As a 23-year-old design student, Yasin founded materials technology startup Petit Pli, and developed the design for the company’s first product, a pleated garment that could expand up to seven sizes to last children through their first few years of life. Petit Pli now makes expandable pleated clothes for children and adults, using a fabric derived from recycled plastic and a structure inspired by origami, architecture and space satellites. Petit Pli products have won a number of prestigious awards, such as the UK James Dyson Award, Time Magazine’s best invention of 2020 and the Red Dot Product Design Award.Yasin has a strong interest in photography and in the interplay between art and engineering. In 2020, Yasin was included by Forbes in its 30 Under 30 list for Europe.

Co-founder of Vence

Sky Kurtz graduated in finance at Arizona State University in 2004. He also completed a master’s in business administration from Stanford University Graduate School of Business in 2011.He started his corporate career in New York at Lehman Brothers where he worked as an analyst from 2004–2006. He went on to work at CCMP Capital as an associate for three years until 2009. After various board member roles in US, he became the VP of Francisco Partners in 2011, a global private equity firm based in San Francisco.In 2014, he became the CEO of Mateen Corporation that manufactures high-performance fiber-reinforced polymers in the UAE and New Zealand. In 2016, he co-founded Vence Corp, a virtual fencing device manufacturer for livestock management. Currently based in UAE, Kurtz also founded Pure Harvest Smart Farms in Abu Dhabi. He is the CEO of the Middle East’s first commercial-scale, semi-automated, hybrid greenhouse growing system. Kurtz is also an advisor at e-commerce beauty startup Powder.ae and an entrepreneur-in-residence at Shorooq Investments.

Sky Kurtz graduated in finance at Arizona State University in 2004. He also completed a master’s in business administration from Stanford University Graduate School of Business in 2011.He started his corporate career in New York at Lehman Brothers where he worked as an analyst from 2004–2006. He went on to work at CCMP Capital as an associate for three years until 2009. After various board member roles in US, he became the VP of Francisco Partners in 2011, a global private equity firm based in San Francisco.In 2014, he became the CEO of Mateen Corporation that manufactures high-performance fiber-reinforced polymers in the UAE and New Zealand. In 2016, he co-founded Vence Corp, a virtual fencing device manufacturer for livestock management. Currently based in UAE, Kurtz also founded Pure Harvest Smart Farms in Abu Dhabi. He is the CEO of the Middle East’s first commercial-scale, semi-automated, hybrid greenhouse growing system. Kurtz is also an advisor at e-commerce beauty startup Powder.ae and an entrepreneur-in-residence at Shorooq Investments.

Established in 1958, VERSO Capital is a boutique merchant banking and financial services firm based in Luxembourg. It also has offices in Geneva, Fribourg, Vaduz, Dubai, Singapore and BVI. VERSO specializes in sectors like education, food and renewables. Since 2011, the firm has invested over $700bn in venture capital in the global startup ecosystem. Funds worth over $245m were pumped into climatech, foodtech and biotech sectors since 2017. In February 2021, it merged with Swiss alternative asset manager ALDINI Capital that was also founded in 1958 and based in Switzerland and Liechtenstein. VERSO will leverage the expertise of ALDINI in hedge funds, private equity and real estate.

Established in 1958, VERSO Capital is a boutique merchant banking and financial services firm based in Luxembourg. It also has offices in Geneva, Fribourg, Vaduz, Dubai, Singapore and BVI. VERSO specializes in sectors like education, food and renewables. Since 2011, the firm has invested over $700bn in venture capital in the global startup ecosystem. Funds worth over $245m were pumped into climatech, foodtech and biotech sectors since 2017. In February 2021, it merged with Swiss alternative asset manager ALDINI Capital that was also founded in 1958 and based in Switzerland and Liechtenstein. VERSO will leverage the expertise of ALDINI in hedge funds, private equity and real estate.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Maniv Mobility is an Israel-based venture capitalist firm, focused mainly on mobility, automotive, transportation and logistic solutions. The fund is backed by venture arms of BMW, Hyundai, LG Electronics, the Renault-Nissan-Mitsubishi Alliance, Shell and Valeo amongst others. Headquartered in Isreal, in Tel Aviv a city that is growing in the mobility space with an increasing number of automotive venture arms.Maniv Mobility operates since 2016 with an initial funding capital of $44mn and a further capital injection in 2019 of $100mn. With an international investment portfolio and global ambitions, the firm has built over the years strategic partners in Europe, North America, Israel looking for long term expansion in Asian markets.The company has been within the VCs that backed Drive.ai, the autonomous vehicle startup later acquired by Apple.

Maniv Mobility is an Israel-based venture capitalist firm, focused mainly on mobility, automotive, transportation and logistic solutions. The fund is backed by venture arms of BMW, Hyundai, LG Electronics, the Renault-Nissan-Mitsubishi Alliance, Shell and Valeo amongst others. Headquartered in Isreal, in Tel Aviv a city that is growing in the mobility space with an increasing number of automotive venture arms.Maniv Mobility operates since 2016 with an initial funding capital of $44mn and a further capital injection in 2019 of $100mn. With an international investment portfolio and global ambitions, the firm has built over the years strategic partners in Europe, North America, Israel looking for long term expansion in Asian markets.The company has been within the VCs that backed Drive.ai, the autonomous vehicle startup later acquired by Apple.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Founded in 2013 in Singapore, VVNP is a future-food solutions-orientated investor with a special interest in science-based companies that have the ability to scale global solutions, especially within Asia. It invests from seed stage to Series C level. Typical investments range from $300,000 to $3m and the investor has launched two funds to date. The first raised $40m and invested in seven companies globally, while the second was created in 2020, targeting $150m in total investment.The VC’s most recent investments include a €271,000 pre-seed investment round in Dutch poultry animal welfare biotech In Ovo in March 2021, and leading the as-yet-uncompleted 6m Swiss franc (approximately $6.56m) seed round in Swiss biotech SwissDeCode in January 2021 – a company that applies DNA testing to food traceability.

Founded in 2013 in Singapore, VVNP is a future-food solutions-orientated investor with a special interest in science-based companies that have the ability to scale global solutions, especially within Asia. It invests from seed stage to Series C level. Typical investments range from $300,000 to $3m and the investor has launched two funds to date. The first raised $40m and invested in seven companies globally, while the second was created in 2020, targeting $150m in total investment.The VC’s most recent investments include a €271,000 pre-seed investment round in Dutch poultry animal welfare biotech In Ovo in March 2021, and leading the as-yet-uncompleted 6m Swiss franc (approximately $6.56m) seed round in Swiss biotech SwissDeCode in January 2021 – a company that applies DNA testing to food traceability.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Founded in 2013, Visionnaire Ventures is based in San Francisco and invests globally in innovative technologies in diverse sectors like AI and ML, digital health, Big Data, IoT, mobile and agriculture. The firm is managed by a team of serial entrepreneurs and executives involved in global internet, game and online media companies.The VC is co-founded by managing partners Taizo Son, Keith Nilsson and Susan Choe who also founded Katalyst Ventures. Son is the brother of SoftBank’s Masayoshi Son based in Japan. Taizo founded Gungho Online in 2002, a major online gaming company that became public-listed in 2005. With a vision to create a Silicon Valley-like venture eco-system in East Asia, he also founded MOVIDA JAPAN in 2009. He also founded Mistletoe Inc as CEO in 2013 to support entrepreneurs and provide startup ecosystem development activities.

Founded in 2013, Visionnaire Ventures is based in San Francisco and invests globally in innovative technologies in diverse sectors like AI and ML, digital health, Big Data, IoT, mobile and agriculture. The firm is managed by a team of serial entrepreneurs and executives involved in global internet, game and online media companies.The VC is co-founded by managing partners Taizo Son, Keith Nilsson and Susan Choe who also founded Katalyst Ventures. Son is the brother of SoftBank’s Masayoshi Son based in Japan. Taizo founded Gungho Online in 2002, a major online gaming company that became public-listed in 2005. With a vision to create a Silicon Valley-like venture eco-system in East Asia, he also founded MOVIDA JAPAN in 2009. He also founded Mistletoe Inc as CEO in 2013 to support entrepreneurs and provide startup ecosystem development activities.

CEO and co-founder of Kobo360

In 2011, young Obi Ozor used his savings and loans from his family and friends to set up Bezmo Global to import second-hand trucks from the US and sell them in Nigeria. Despite suffering from kidney failure issues, he managed to run the business for four years to earn money to pay for his medical treatments. He fully recovered and moved to Michigan to continue his education.At the University of Michigan, Ozor met Ife Oyedele II and the two friends started an e-commerce venture to sell diapers and baby soap from the US to customers in Nigeria. Ozor moved to the University of Pennsylvania and graduated with a BA International Relations and Finance at Wharton School of Business. In 2014, he gained some work experience in investment banking at JP Morgan in New York.In 2015, Ozor returned to Nigeria and joined Uber as operations coordinator. In 2016, the serial entrepreneur and his friend Oyedele co-founded Uber-style logistics platform Kobo360 in Lagos.

In 2011, young Obi Ozor used his savings and loans from his family and friends to set up Bezmo Global to import second-hand trucks from the US and sell them in Nigeria. Despite suffering from kidney failure issues, he managed to run the business for four years to earn money to pay for his medical treatments. He fully recovered and moved to Michigan to continue his education.At the University of Michigan, Ozor met Ife Oyedele II and the two friends started an e-commerce venture to sell diapers and baby soap from the US to customers in Nigeria. Ozor moved to the University of Pennsylvania and graduated with a BA International Relations and Finance at Wharton School of Business. In 2014, he gained some work experience in investment banking at JP Morgan in New York.In 2015, Ozor returned to Nigeria and joined Uber as operations coordinator. In 2016, the serial entrepreneur and his friend Oyedele co-founded Uber-style logistics platform Kobo360 in Lagos.

Goldman Sachs is one of the biggest investment banking and financial services group in the world. The firm went public in 1999 under the ticker NYSE:GS. To date, Goldman Sachs has raised seven funds, their latest in May 2019 for a total of $4.4bn. Based in New York, the private banking group has made 788 investments with 256 exits. Investments include tech unicorns such as Spotify, Square, Zipline, Xiaomi and the Alibaba Group.Its 2019 annual report showed that Goldman Sachs generated over $36.55 bn in net revenues, with 10% ROE and 10.6% ROTE. As of mid-July 2020, the firm has a market capitalization of $74.33 bn. Goldman Sachs has offices in over 30 countries with major operations in four sectors: investment banking, global markets, asset management and consumer & wealth management.

Goldman Sachs is one of the biggest investment banking and financial services group in the world. The firm went public in 1999 under the ticker NYSE:GS. To date, Goldman Sachs has raised seven funds, their latest in May 2019 for a total of $4.4bn. Based in New York, the private banking group has made 788 investments with 256 exits. Investments include tech unicorns such as Spotify, Square, Zipline, Xiaomi and the Alibaba Group.Its 2019 annual report showed that Goldman Sachs generated over $36.55 bn in net revenues, with 10% ROE and 10.6% ROTE. As of mid-July 2020, the firm has a market capitalization of $74.33 bn. Goldman Sachs has offices in over 30 countries with major operations in four sectors: investment banking, global markets, asset management and consumer & wealth management.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

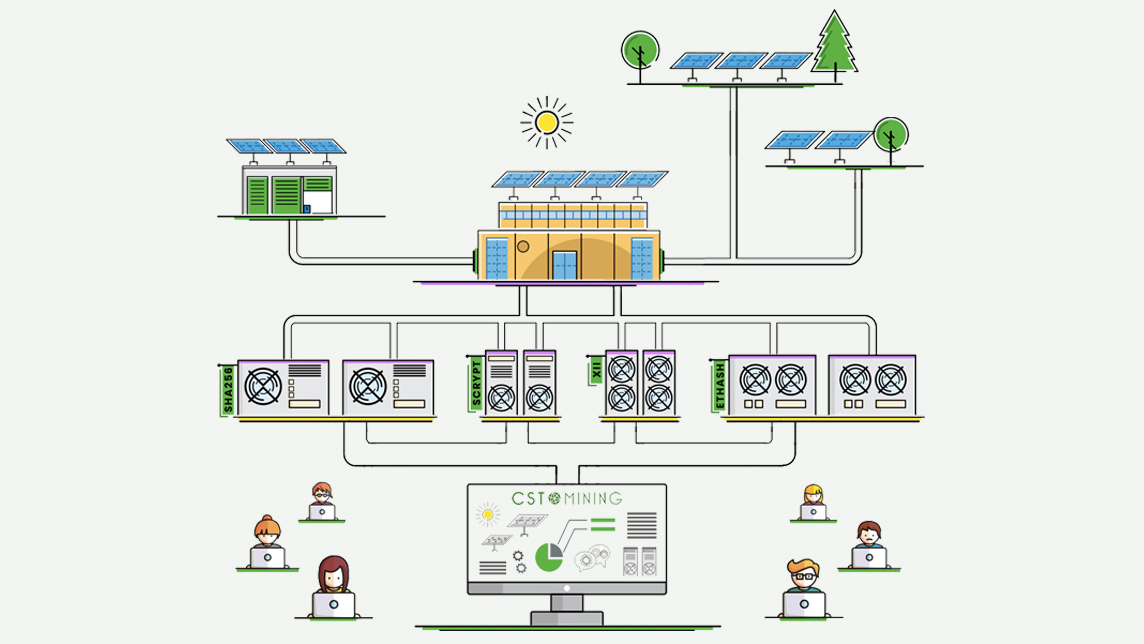

Cryptosolartech: Harnessing solar power to make cryptomining less environmentally harmful

The Spanish startup also sources cheaper electricity for cryptomining. It recently raised €8.85m in a pre-ICO, enabling it to build the world's first solar-powered cryptomining farm

Tutellus.io: Creating social change by tokenizing education

Tutellus.io has built an incentive-based tokenized education system to boost students’ motivation and teachers’ commitment while facilitating global access to education

Iomob: Universal mobility app to help people find best route from A to B

Rapid growth in MaaS will boost revenue to over €1m by 2020 for Spanish transport app Iomob

CarBlock eyes opportunities presented by the multi-billion car data market

This startup aims to transform the connected car and transportation industry by building a data circulation system based on blockchain

Event ticketing veterans create Tracer to fight touts, improve market transparency and fairness

Tracer is the first to combine dynamic QR codes and blockchain to challenge ticketing's $12bn secondary sales market

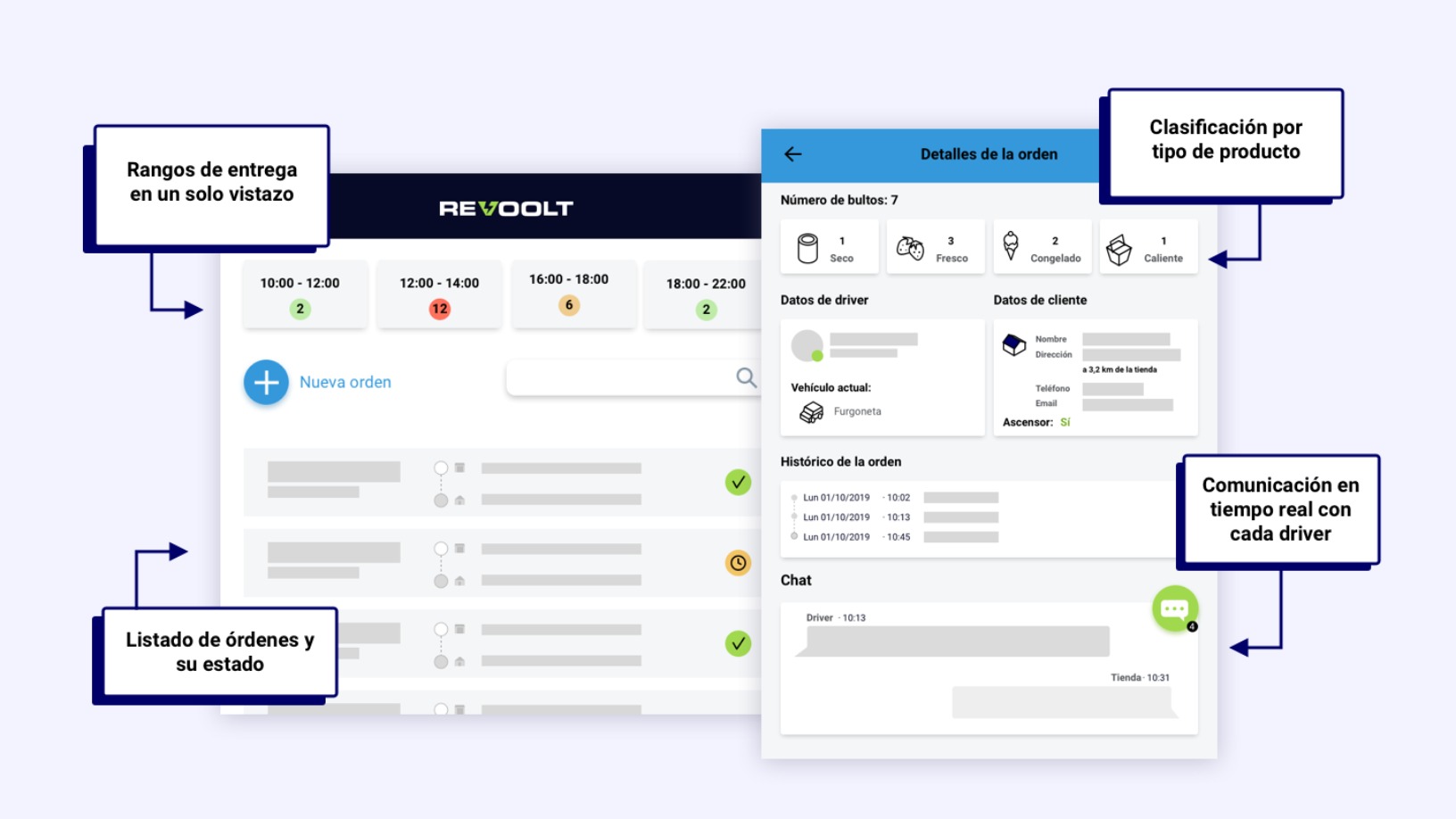

Revoolt: “Covid-19 accelerated our expansion plans and made us more ambitious”

Revoolt’s emission-free last-mile delivery model proved viable during the lockdown in Spain – growth that’s now its launchpad for international expansion and new funding

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

2gether: The world's first crypto-collaborative financial platform

Banking on the opportunities afforded by blockchain, 2gether is owned by its customers who get commission-free financial services in euros and cryptocurrency

Mediktor: AI medical diagnosis app wants to improve global health outcomes

NLP-based triage and diagnosis tool has achieved a 91% accuracy rate in clinical trials and raised €3 million funding

GoWithFlow: Scaling ERP platform for sustainable mobility in global transportation markets

Portugal’s CEiiA spin-off leads the way to manage smart transportation systems of cities and corporations to boost fleet performance by reducing CO2 emissions and maintenance costs

From state to BAT, China backs startups for global AI dominance

Finance, automobile, retail and healthcare seen to lead China’s advances and gains in AI, as part of a RMB 10 trillion economy by 2030

China's WeDoctor offers free coronavirus consultations globally in English and Chinese

WeDoctor lets anyone in the world send queries to doctors who fought to save lives in China's most affected Covid-19 districts, and now helping people overseas to stay safe during the pandemic

South Summit wants to go global, as it launches Brazilian chapter

CEO Marta del Castillo on South Summit’s LatAm, Asia expansion plans; its net-zero pledge; her new role as co-head to further drive growth and more

Sorry, we couldn’t find any matches for“Fond-ICO Global”.