Fond-ICO Global

-

DATABASE (210)

-

ARTICLES (377)

Creator of the integrated supply chain management model, YH Global’s participation in the One Belt One Road Initiative gives it enormous growth potential.

Creator of the integrated supply chain management model, YH Global’s participation in the One Belt One Road Initiative gives it enormous growth potential.

The late-stage venture capital and growth equity firm founded and led by Russian billionaire Yuri Milner manages about $10bn in assets. Among its well-known investments are Facebook, Twitter, Alibaba, Xiaomi, JD.com, Spotify, Flipkart and AirBnB.DST Global was founded in 2009 as a means for Milner’s Mail.ru to continue investing at scale, by separately managing investment activities from the Mail.ru primary business. In 2012, Milner stepped down from Mail.ru to focus on DST Global, and DST Global eventually became fully independent from Mail.ru.

The late-stage venture capital and growth equity firm founded and led by Russian billionaire Yuri Milner manages about $10bn in assets. Among its well-known investments are Facebook, Twitter, Alibaba, Xiaomi, JD.com, Spotify, Flipkart and AirBnB.DST Global was founded in 2009 as a means for Milner’s Mail.ru to continue investing at scale, by separately managing investment activities from the Mail.ru primary business. In 2012, Milner stepped down from Mail.ru to focus on DST Global, and DST Global eventually became fully independent from Mail.ru.

Founded by pioneering tech investor Ozi Amanat in 2015, K2 Global is a venture capital firm based in Silicon Valley and Singapore. Amanat, who moved to Singapore in 2012, is one of Twitter’s early backers, raising $25m to invest in the social media startup that later went public in 2013. The Harvard graduate in psychology and economics also invested in Uber, Spotify and Alibaba during his career as a venture capitalist. Amanat is the chief investment officer of K2 VC, K2 Global and Singapore-based Spice Global controlled by Indian billionaire B K Modi.In 2017, K2 also announced a $183m VC fund focusing on early-stage startups that aim to address global challenges. The majority of K2 limited partners are based outside the US in countries like Australia, Japan, Singapore, Hong Kong and Indonesia.

Founded by pioneering tech investor Ozi Amanat in 2015, K2 Global is a venture capital firm based in Silicon Valley and Singapore. Amanat, who moved to Singapore in 2012, is one of Twitter’s early backers, raising $25m to invest in the social media startup that later went public in 2013. The Harvard graduate in psychology and economics also invested in Uber, Spotify and Alibaba during his career as a venture capitalist. Amanat is the chief investment officer of K2 VC, K2 Global and Singapore-based Spice Global controlled by Indian billionaire B K Modi.In 2017, K2 also announced a $183m VC fund focusing on early-stage startups that aim to address global challenges. The majority of K2 limited partners are based outside the US in countries like Australia, Japan, Singapore, Hong Kong and Indonesia.

Established in 1995, Richmond Global Ventures is a global venture capital managed by Partners Peter Kellner and David Frazee.

Established in 1995, Richmond Global Ventures is a global venture capital managed by Partners Peter Kellner and David Frazee.

Global Founders Capital is a global venture fund that invests in seed and Series A, or participates in later rounds. It typically does not invest in pre-launch. The venture fund was set up in 2013 by Rocket Internet chief Oliver Samwer, his brother Marc, and former Delivery Hero co-CEO Fabian Siegel as a €150 million fund for high-potential internet businesses.

Global Founders Capital is a global venture fund that invests in seed and Series A, or participates in later rounds. It typically does not invest in pre-launch. The venture fund was set up in 2013 by Rocket Internet chief Oliver Samwer, his brother Marc, and former Delivery Hero co-CEO Fabian Siegel as a €150 million fund for high-potential internet businesses.

Target Global is an international venture capital firm based in Berlin with offices in London, Tel Aviv and Barcelona.The firm has a total of more than €800m in assets under management, investing mainly in fast-growing tech startups across multiple investment stages and focusing on trillion-euro markets.

Target Global is an international venture capital firm based in Berlin with offices in London, Tel Aviv and Barcelona.The firm has a total of more than €800m in assets under management, investing mainly in fast-growing tech startups across multiple investment stages and focusing on trillion-euro markets.

Global Brain Corporation is an early stage venture capital fund based in Tokyo, Japan. It was founded in 1998 and has expanded globally, with offices in South Korea’s Seoul, Southeast Asia and Silicon Valley, USA. Leveraging its global network, the company aims to nurture world-class venture companies through investments and hands-on support. It also offers corporate venture capital fund management services and currently manages three such funds.

Global Brain Corporation is an early stage venture capital fund based in Tokyo, Japan. It was founded in 1998 and has expanded globally, with offices in South Korea’s Seoul, Southeast Asia and Silicon Valley, USA. Leveraging its global network, the company aims to nurture world-class venture companies through investments and hands-on support. It also offers corporate venture capital fund management services and currently manages three such funds.

With about US$20 billion under management worldwide, New York-headquartered Tiger Global Management was founded in 2000 with US$25 million by billionaire Charles "Chase“ Coleman. Part private equity manager, part hedge fund manager, Tiger Global is known for its big bets on tech startups, including some of today's leading names Facebook, LinkedIn, Zynga and Uber.

With about US$20 billion under management worldwide, New York-headquartered Tiger Global Management was founded in 2000 with US$25 million by billionaire Charles "Chase“ Coleman. Part private equity manager, part hedge fund manager, Tiger Global is known for its big bets on tech startups, including some of today's leading names Facebook, LinkedIn, Zynga and Uber.

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

Founded in 2001, Mitsui Global Investment is a subsidiary of Mitsui & Co. The firm typically invests in the US, and has offices in Silicon Valley, New York, Shanghai, Beijing and Mumbai.

Founded in 2001, Mitsui Global Investment is a subsidiary of Mitsui & Co. The firm typically invests in the US, and has offices in Silicon Valley, New York, Shanghai, Beijing and Mumbai.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

Global Basket Mulia Investama (GBMI) was established in 2015 in Indonesia with a focus on young entrepreneurs. In 2018, they invested IDR10bn in crowdfunding website Kolase.

Global Basket Mulia Investama (GBMI) was established in 2015 in Indonesia with a focus on young entrepreneurs. In 2018, they invested IDR10bn in crowdfunding website Kolase.

PT Global Digital Niaga is the parent company of Blibli, one of Indonesia’s leading e-commerce websites. The company is a subsidiary of Djarum Group, an Indonesian conglomerate most famous for its tobacco business. In 2017, GDN acquired travel booking website Tiket.com and its sister website Indonesia Flight.

PT Global Digital Niaga is the parent company of Blibli, one of Indonesia’s leading e-commerce websites. The company is a subsidiary of Djarum Group, an Indonesian conglomerate most famous for its tobacco business. In 2017, GDN acquired travel booking website Tiket.com and its sister website Indonesia Flight.

Founded in September 2019 by Patrick Morris, Eat Beyond went public on the Canadian Securities Exchange in November 2020. The company’s shares are also traded on the Frankfurt Exchange in Germany and OTC Markets in the US. Morris had worked in capital markets for over 15 years and wanted to find a solution to help retail investors access the emerging markets of alt-proteins and other future food sectors.First of its kind in Canada, the Eat Beyond Global Investment Fund focuses on four key areas: meat, seafood, eggs, and dairy. It also participates in cell agriculture and other experimental projects. Current investments include foodtechs and alt-food source companies working on plant-based proteins, fermented proteins, cultured proteins, agriculture and consumer packaged goods.

Founded in September 2019 by Patrick Morris, Eat Beyond went public on the Canadian Securities Exchange in November 2020. The company’s shares are also traded on the Frankfurt Exchange in Germany and OTC Markets in the US. Morris had worked in capital markets for over 15 years and wanted to find a solution to help retail investors access the emerging markets of alt-proteins and other future food sectors.First of its kind in Canada, the Eat Beyond Global Investment Fund focuses on four key areas: meat, seafood, eggs, and dairy. It also participates in cell agriculture and other experimental projects. Current investments include foodtechs and alt-food source companies working on plant-based proteins, fermented proteins, cultured proteins, agriculture and consumer packaged goods.

Future Food Asia by ID Capital: Introducing Asia's agrifood startups to the world

More than a meeting of startups and investors, the conference showcases ID Capital’s investment thesis and Big Ag’s support for agrifood tech in the world’s most populous region

ID Capital CEO & founder Isabelle Decitre, an early mover investing in Asian agrifood startups

An early backer of Ynsect, one of the best-funded insect protein startups to date, Decitre sees growing interest in agrifood tech startups, but notes they still need to offer exit opportunities

Cubiq Foods: Bioreactor farms producing the food of tomorrow

Growing appetite for meat alternatives expected to fuel demand for Cubiq’s low calorie, Omega 3-enriched lab-grown fats

QOA: Gourmet guilt-free chocolate, without the cocoa

Munich-based QOA transforms industrial food waste into vegan chocolate, enabling consumers to avoid the sustainability and ethical issues of cocoa production

Indonesian online basic food startups like Sayurbox and Wahyoo have had as much as a fivefold jump in orders and are working to sustain strong sales post-social distancing

In depth: The business ecosystems China’s tech giants and unicorns build

Startups could accept to join Alibaba, Tencent or other tech giants in their ecosystems and scale quickly. Or they could say no and keep their independence. But do they really have a choice?

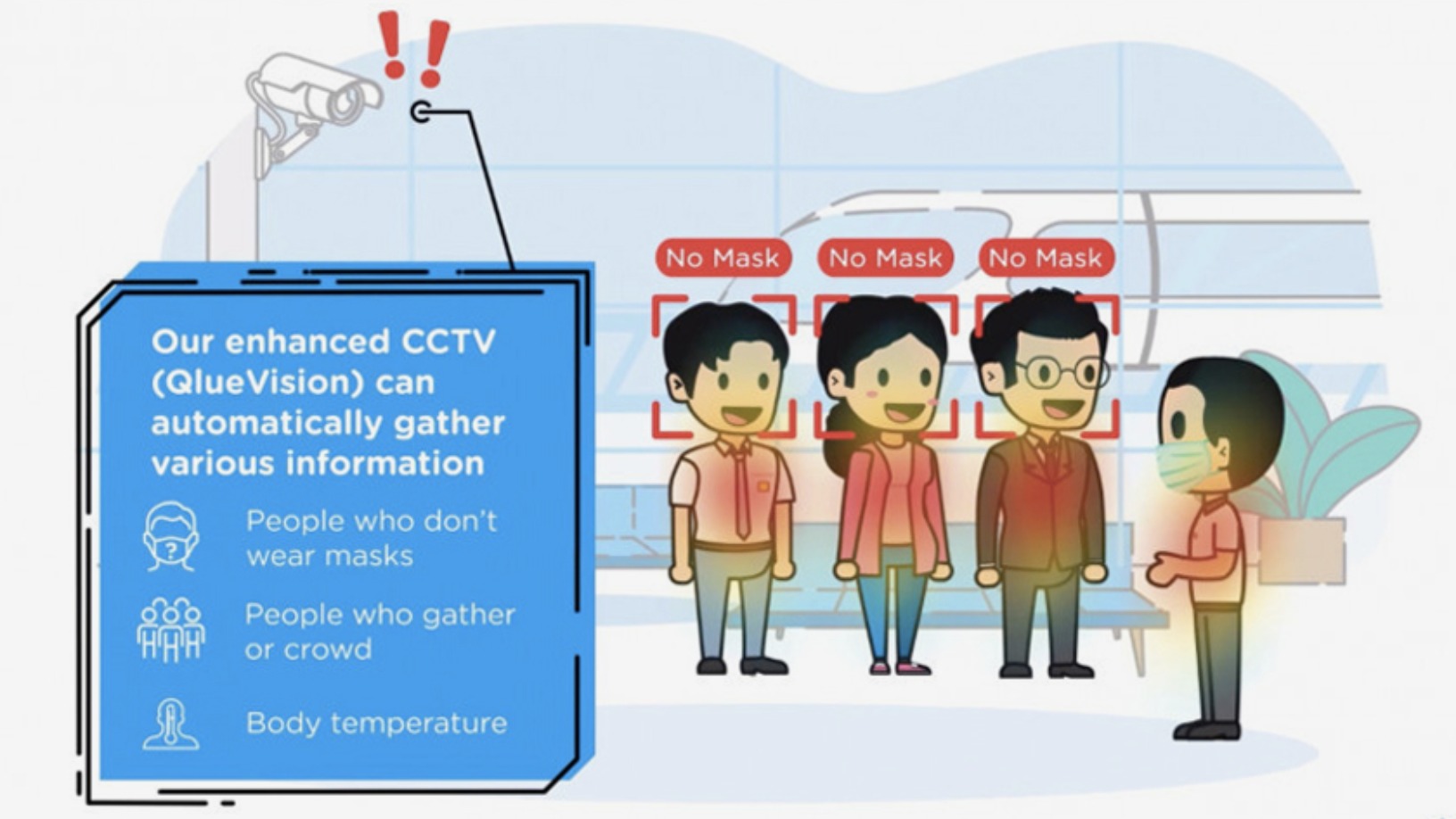

Indonesian smart city tech leader Qlue thrives amid Covid-19 with thermal scanner and B2G refocus

Plans to tilt its client portfolio toward B2B work are delayed as Qlue returns to its B2G roots

Plant on Demand: Helping small-scale organic farmers to thrive, sustainably

Plant on Demand will soon deploy product PODX’s “prescriptive” analytics to boost organic farmers’ productivity and prices, by optimizing future crop yields to match seasonal sales trends

Zoundream: Deciphering and mining the data in baby cries

The world’s first algorithm to translate baby cries into actionable insights for parents and hospitals seeks to boost early detection of pathologies and developmental disorders

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

IONIC AI: Human-centric technology that enhances mobile phone performance

Giving new life to old mobile phones and upgrading cheaper ones, IONIC AI's tech also keeps gamers' phones cool for longer usage

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

SWITCH Singapore 2021: Tapping the $1tn sustainability market in Southeast Asia

Falling costs and simplified deployment of sustainability solutions will help boost adoption, especially in underprivileged communities

NutraSign: Farm-to-fork traceability app for healthier lifestyles

NutraSign is an app that lets businesses and consumers identify and trace contaminated products within a food supply chain in seconds, using blockchain technology

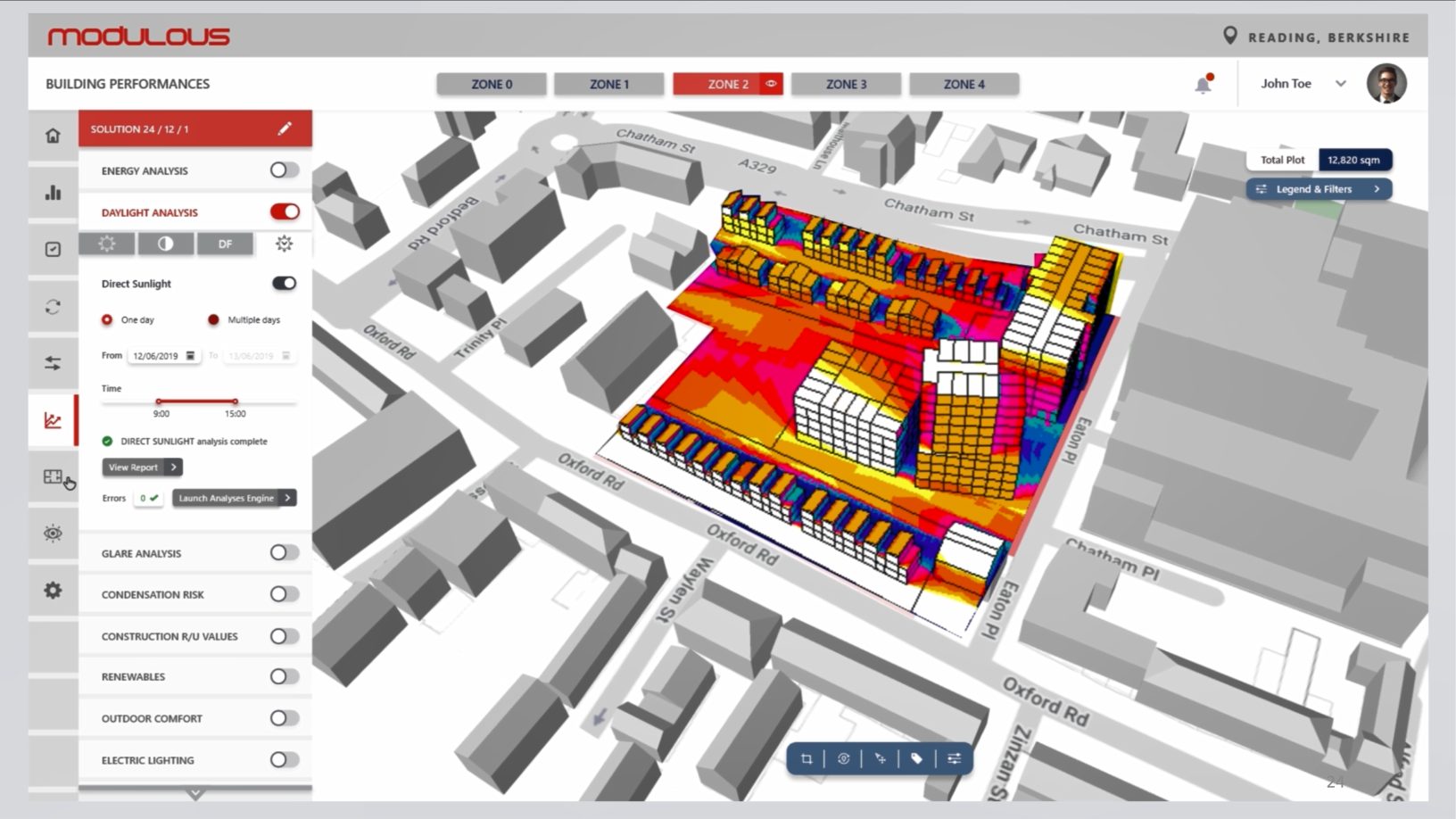

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

Sorry, we couldn’t find any matches for“Fond-ICO Global”.