Food Industry Asia

-

DATABASE (520)

-

ARTICLES (584)

Mustard Seed MAZE is a Lisbon-based VC firm that invests in early-stage startups, primarily in social impact enterprises. Endowed with €40m, the VC has invested in projects dealing with food wastage, human trafficking, postnatal depression and general healthcare.So far, it has managed one exit, with the majority of its portfolio of 20 companies based in Europe. Recent investment rounds include $3m seed funding for Portuguese mesh network tech HypeLabs, €1.15m seed round for Spanish fintech StudentFinance and $12m Series B round for UK-based food waste app Winnow.

Mustard Seed MAZE is a Lisbon-based VC firm that invests in early-stage startups, primarily in social impact enterprises. Endowed with €40m, the VC has invested in projects dealing with food wastage, human trafficking, postnatal depression and general healthcare.So far, it has managed one exit, with the majority of its portfolio of 20 companies based in Europe. Recent investment rounds include $3m seed funding for Portuguese mesh network tech HypeLabs, €1.15m seed round for Spanish fintech StudentFinance and $12m Series B round for UK-based food waste app Winnow.

The first IOT device that cooks and automatically dispenses healthy pet food to a required quantity and schedule

The first IOT device that cooks and automatically dispenses healthy pet food to a required quantity and schedule

Co-founder and CMO of Trax Center

Before founding the smart vehicle tracking app Trax Center, Hendy Wijaya had worked in the automotive industry for five years, from distributing spare parts to managing repair shops and car rentals. Based on his work experience in the industry, Hendy felt that the vehicle tracking systems that were available in the Indonesian market were inferior. He saw an opportunity to develop a better vehicle tracking solution and created Trax Center. The smart vehicle tracking system was jointly developed with two friends, a software developer Hadi Darmanto and a consumer behavior analyst Ganjar Setyanegara.

Before founding the smart vehicle tracking app Trax Center, Hendy Wijaya had worked in the automotive industry for five years, from distributing spare parts to managing repair shops and car rentals. Based on his work experience in the industry, Hendy felt that the vehicle tracking systems that were available in the Indonesian market were inferior. He saw an opportunity to develop a better vehicle tracking solution and created Trax Center. The smart vehicle tracking system was jointly developed with two friends, a software developer Hadi Darmanto and a consumer behavior analyst Ganjar Setyanegara.

Co-founder of 4D ShoeTech

Feng Zifeng read Engineering at South China Agricultural University in 2014. In 2015, he incorporated the idea of emerging 3D printing technology into his college innovation project. He and a few friends created a 3-in-1 printer with 3D printing and scanning functions.In 2016, he led the team to conduct research to apply 3D printing technology in the footwear industry. He met Zhou Zhiheng, China’s general manager for footwear brand Michael Antonio. He decided to focus on using 3D printing technology in footwear industry and became a co-founder of 4D ShoeTech.

Feng Zifeng read Engineering at South China Agricultural University in 2014. In 2015, he incorporated the idea of emerging 3D printing technology into his college innovation project. He and a few friends created a 3-in-1 printer with 3D printing and scanning functions.In 2016, he led the team to conduct research to apply 3D printing technology in the footwear industry. He met Zhou Zhiheng, China’s general manager for footwear brand Michael Antonio. He decided to focus on using 3D printing technology in footwear industry and became a co-founder of 4D ShoeTech.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

Zaihui’s SaaS services help retailers boost customer loyalty and sales. It achieved the same growth in five months as US peer Fivestars in two years.

Zaihui’s SaaS services help retailers boost customer loyalty and sales. It achieved the same growth in five months as US peer Fivestars in two years.

The first China-based company to mass-produce 3D food printers, Shiyin Tech plans to deploy 100,000 self-service models in the next three years.

The first China-based company to mass-produce 3D food printers, Shiyin Tech plans to deploy 100,000 self-service models in the next three years.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

CTO and co-founder of The Not Company (NotCo)

Karim Pichara has a PhD in Computer Science from the Catholic University of Chile where he has been working for over 10 years since 2010. From 2011, Karim Pichara has also been working as a research associate at the Institute of Applied Computer Science, Harvard University, specializing in data mining and machine learning for astronomy. In November 2015, while at Harvard, Pichara and Matías Muchnick co-founded a plant-based foodtech, The Not Company (NotCo). Pichara became the CTO and headed the development of NotCo’s algorithm called “Giuseppe” that can analyze molecular structures of animal-based food to create similar plant-based food that cater to the human perception of taste and texture.

Karim Pichara has a PhD in Computer Science from the Catholic University of Chile where he has been working for over 10 years since 2010. From 2011, Karim Pichara has also been working as a research associate at the Institute of Applied Computer Science, Harvard University, specializing in data mining and machine learning for astronomy. In November 2015, while at Harvard, Pichara and Matías Muchnick co-founded a plant-based foodtech, The Not Company (NotCo). Pichara became the CTO and headed the development of NotCo’s algorithm called “Giuseppe” that can analyze molecular structures of animal-based food to create similar plant-based food that cater to the human perception of taste and texture.

Shaanxi Culture Industry Investment Group

With RMB 2.2 billion registered capital, this state-owned cultural enterprise was established by Shaanxi province. It receives subsidies from the regional government each year and currently holds total assets of more than RMB 16 billion. The group has 24 subsidiaries, which invest in a range of cultural industries: film and TV, cultural tourism, art, media, etc.

With RMB 2.2 billion registered capital, this state-owned cultural enterprise was established by Shaanxi province. It receives subsidies from the regional government each year and currently holds total assets of more than RMB 16 billion. The group has 24 subsidiaries, which invest in a range of cultural industries: film and TV, cultural tourism, art, media, etc.

CEO and co-founder of TurtleTree Labs

Cheese connoisseur, Lin Fengru, was unable to find milk that allowed her to make high-quality cheese. During her search around dairy farms in Asia, she realized that the poor quality of the milk was due to animal hygiene issues and the use of antibiotics and hormones on cows. The lack of quality dairy milk options inspired her to co-found TurtleTree Labs in January 2019 to create milk using stem cells.Lin graduated in information systems management and marketing in 2011 at Singapore Management University (SMU). In 2011, she joined Collis Asia as an account manager and left in 2014 to work at Salesforce in sales and business development. She joined Google Singapore in 2018 and worked as a territory account manager for Google Cloud Platform until June 2019. In 2020, she completed an MIT course in the science and business of biotechnology.

Cheese connoisseur, Lin Fengru, was unable to find milk that allowed her to make high-quality cheese. During her search around dairy farms in Asia, she realized that the poor quality of the milk was due to animal hygiene issues and the use of antibiotics and hormones on cows. The lack of quality dairy milk options inspired her to co-found TurtleTree Labs in January 2019 to create milk using stem cells.Lin graduated in information systems management and marketing in 2011 at Singapore Management University (SMU). In 2011, she joined Collis Asia as an account manager and left in 2014 to work at Salesforce in sales and business development. She joined Google Singapore in 2018 and worked as a territory account manager for Google Cloud Platform until June 2019. In 2020, she completed an MIT course in the science and business of biotechnology.

Founded in 2011, Unitus Impact is a venture capital firm focusing on impact investments in Southeast Asia and India. With offices in Bangalore, Ho Chi Minh city and San Francisco, the VC will soon be renamed as Patamar Capital. It currently invests in scalable businesses that aim to improve the livelihoods of the poor in Asia.

Founded in 2011, Unitus Impact is a venture capital firm focusing on impact investments in Southeast Asia and India. With offices in Bangalore, Ho Chi Minh city and San Francisco, the VC will soon be renamed as Patamar Capital. It currently invests in scalable businesses that aim to improve the livelihoods of the poor in Asia.

Ventek Ventures is a venture capital firm based in Los Angeles, USA. It focuses on tech investments, particularly in USA, China and Southeast Asia. Seekmi, its first foray in Southeast Asia, joins Ventek’s existing stable of East Asian investments including coding for kids codeSpark, crowdfunding academy ganfund, restaurant cloud services provider Foodomo and mobile creative suite Kdan.

Ventek Ventures is a venture capital firm based in Los Angeles, USA. It focuses on tech investments, particularly in USA, China and Southeast Asia. Seekmi, its first foray in Southeast Asia, joins Ventek’s existing stable of East Asian investments including coding for kids codeSpark, crowdfunding academy ganfund, restaurant cloud services provider Foodomo and mobile creative suite Kdan.

Headquartered in Shenzhen, Gemboom.com was founded in 2016. It invests mainly in early-stage startups in the high tech, industry upgrade and consumption upgrade sectors.

Headquartered in Shenzhen, Gemboom.com was founded in 2016. It invests mainly in early-stage startups in the high tech, industry upgrade and consumption upgrade sectors.

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

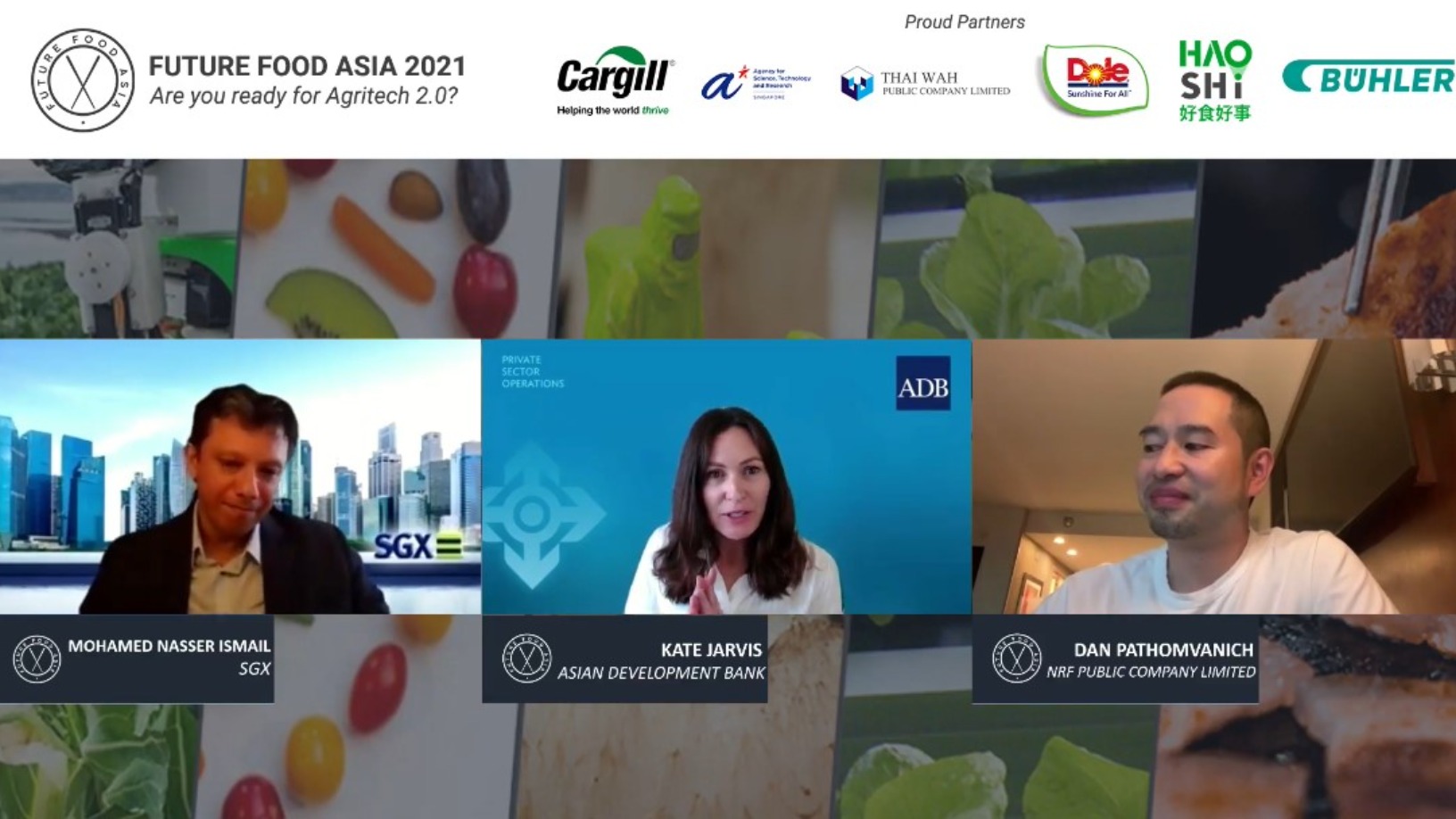

Future Food Asia 2021: Agrifood tech at an inflection point

Agrifood tech startups urged to harness consumer, investor and government feedback to create plentiful, nutritious food through sustainable means, but exercise caution when considering IPOs

Future Food Asia 2021: Impact assessments – getting the metrics right

Common impact measures are useful but each situation requires specific, sometimes subjective considerations. The priority is to gauge if the impact has led to positive changes

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

Future Food Asia 2021: Fireside chat with Green Monday's David Yeung

For Chinese startup Green Monday, it’s important to resonate with different local audiences by adapting to local culture and dietary habits and continuously fine-tuning existing products

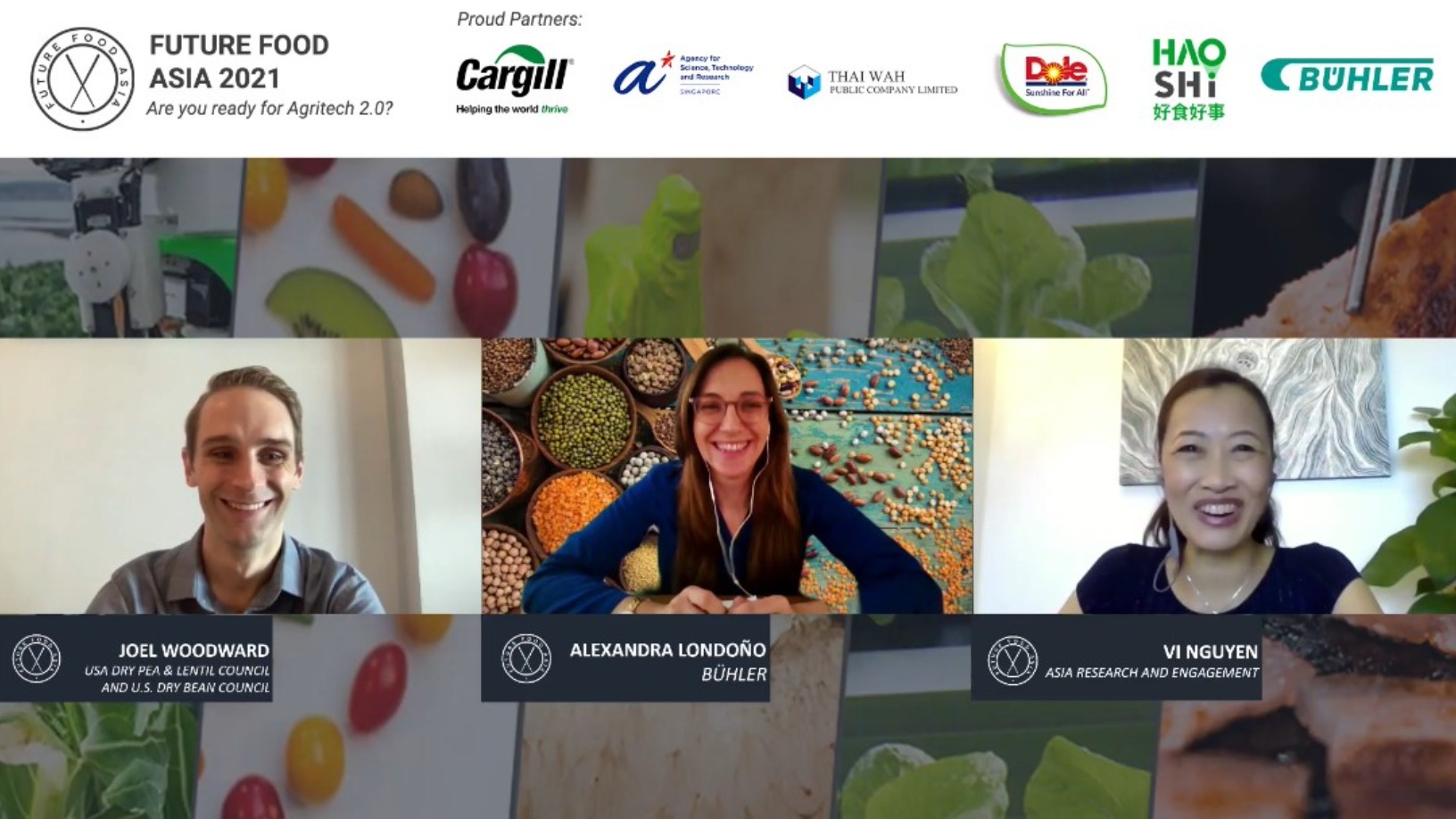

Future Food Asia 2021: Potential of pulses in the alt-protein space

Asia presents a unique opportunity for pulses as people in the region, who traditionally fractionated pulses for starch, now see protein as a useful byproduct

Future Food Asia by ID Capital: Introducing Asia's agrifood startups to the world

More than a meeting of startups and investors, the conference showcases ID Capital’s investment thesis and Big Ag’s support for agrifood tech in the world’s most populous region

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

Future Food Asia: Covid-19 sparked dramatic shifts in agriculture in China and India

Key Chinese players from e-commerce giant Pinduoduo and and agritech VC Omnivore share their insights at last week’s agrifood conference by ID Capital

Sorry, we couldn’t find any matches for“Food Industry Asia”.