Food safety

-

DATABASE (198)

-

ARTICLES (329)

Founded in 2010, Hosen Capital is a PE firm under the New Hope Group. With RMB 5 billion under management, Hosen Capital focuses on the consumption upgrading and industrial upgrading of the agricultural and food sectors. Its investors include New Hope Group, West Hope Group, Delong Steel, Temasek Holdings, ADM and Mitsui & Co.

Founded in 2010, Hosen Capital is a PE firm under the New Hope Group. With RMB 5 billion under management, Hosen Capital focuses on the consumption upgrading and industrial upgrading of the agricultural and food sectors. Its investors include New Hope Group, West Hope Group, Delong Steel, Temasek Holdings, ADM and Mitsui & Co.

Founded in 2009, Septwolves Venture Capital is a subsidiary of Septwolves Holding Group Co Ltd. The VC firm currently manages assets worth RMB 1bn.Focusing on investment opportunities in the communications and other traditional industries like logistics, Septwolves also invests in diverse sectors including mobile internet, energy, food, pharmaceutical, textile and software.

Founded in 2009, Septwolves Venture Capital is a subsidiary of Septwolves Holding Group Co Ltd. The VC firm currently manages assets worth RMB 1bn.Focusing on investment opportunities in the communications and other traditional industries like logistics, Septwolves also invests in diverse sectors including mobile internet, energy, food, pharmaceutical, textile and software.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

Co-Founder of Qraved

Cambridge and Stanford graduate Adrian Li was born in London to parents from Hong Kong and Malaysia. He holds a bachelor’s degree in Economics from Cambridge University and an MBA from Stanford University. He is currently a board member of dating startup Paktor, media company MBDC, female online community Female Daily Network, technology development company Imaginato and food social network startup Qraved. He is also the founding and managing partner of venture capital firm Convergence Ventures.

Cambridge and Stanford graduate Adrian Li was born in London to parents from Hong Kong and Malaysia. He holds a bachelor’s degree in Economics from Cambridge University and an MBA from Stanford University. He is currently a board member of dating startup Paktor, media company MBDC, female online community Female Daily Network, technology development company Imaginato and food social network startup Qraved. He is also the founding and managing partner of venture capital firm Convergence Ventures.

Co-founder and CEO of Magalarva

After graduating in Mechanical Engineering at Universitas Indonesia, Rendria Labde worked for oil and gas firm JGC Indonesia for two years. He left in 2015 to establish PT Magale Sayana Indonesia, a property development company with a unique focus on environmental sustainability. The company completed an eco-living residential complex Sandar Andara and started a new project Magalarva to use insect larvae to process food waste into agricultural products. Rendria became the CEO of Magalarva.

After graduating in Mechanical Engineering at Universitas Indonesia, Rendria Labde worked for oil and gas firm JGC Indonesia for two years. He left in 2015 to establish PT Magale Sayana Indonesia, a property development company with a unique focus on environmental sustainability. The company completed an eco-living residential complex Sandar Andara and started a new project Magalarva to use insect larvae to process food waste into agricultural products. Rendria became the CEO of Magalarva.

Kinara is a venture capital fund based in Indonesia. Established in 2011, it focuses on impact investments that include supporting inclusive economy initiatives and eco-friendly ventures such as Greeneration. Kinara has been managing Indonesia’s first business impact acceleration program that has produced 11 enterprises in the food security sector since 2016. Other priority sectors are microfinance, clean tech, agriculture and fisheries.

Kinara is a venture capital fund based in Indonesia. Established in 2011, it focuses on impact investments that include supporting inclusive economy initiatives and eco-friendly ventures such as Greeneration. Kinara has been managing Indonesia’s first business impact acceleration program that has produced 11 enterprises in the food security sector since 2016. Other priority sectors are microfinance, clean tech, agriculture and fisheries.

AddVenture is a Russian VC fund investing internationally. The firm has US$120m under management, participating in funding rounds with an investment range between US$1m and US$10m. The firm’s portfolio comprises 23 investments and five exits.AddVenture's investment criteria focus on local services, marketplaces, SaaS, food-tech and health-tech startups.

AddVenture is a Russian VC fund investing internationally. The firm has US$120m under management, participating in funding rounds with an investment range between US$1m and US$10m. The firm’s portfolio comprises 23 investments and five exits.AddVenture's investment criteria focus on local services, marketplaces, SaaS, food-tech and health-tech startups.

Co-founder and CTO of BlackGarlic

Willy Haryanto has a degree in Computer Science from Purdue University, USA and a master’s in Information Technology from the University of Melbourne, Australia. He acquired computer programming and software development skills as a manager for telecommunications company Indosmart between 2006 and 2009.After his master’s, he co-founded food delivery website Klik-Eat with fellow Purdue graduate Michael Saputra. They sold the company and went on to establish meal subscription startup BlackGarlic, where he serves as CTO.

Willy Haryanto has a degree in Computer Science from Purdue University, USA and a master’s in Information Technology from the University of Melbourne, Australia. He acquired computer programming and software development skills as a manager for telecommunications company Indosmart between 2006 and 2009.After his master’s, he co-founded food delivery website Klik-Eat with fellow Purdue graduate Michael Saputra. They sold the company and went on to establish meal subscription startup BlackGarlic, where he serves as CTO.

Launched in 2014, Convergence Ventures (formerly Convergence Accel) is a venture fund focused on investing in Indonesia. The fund is led by Donald Wihardja and ex-Rocket Internet man Adrian Li. Li is also the co-founder of Qraved, one of Indonesia's leading food social networking startup.

Launched in 2014, Convergence Ventures (formerly Convergence Accel) is a venture fund focused on investing in Indonesia. The fund is led by Donald Wihardja and ex-Rocket Internet man Adrian Li. Li is also the co-founder of Qraved, one of Indonesia's leading food social networking startup.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

Jonathan Neman is a co-founder and co-CEO of USA healthy-eating restaurant franchise Sweetgreen. As co-CEO, he has managed the salad chain since opening its first outlet in 2007, raising more than $470m in VC funding in the process. Neman is also an investor in various F&B startups, such as frozen food maker EatPops and Indonesian coffee chain Kopi Kenangan.

Jonathan Neman is a co-founder and co-CEO of USA healthy-eating restaurant franchise Sweetgreen. As co-CEO, he has managed the salad chain since opening its first outlet in 2007, raising more than $470m in VC funding in the process. Neman is also an investor in various F&B startups, such as frozen food maker EatPops and Indonesian coffee chain Kopi Kenangan.

With New Hope Group, one of China’s biggest agriculture and food businesses, as its cornerstone investor, HosenCare Brothers had operated as a PE arm within the group for nearly a decade. In 2017, it began to operate under its current name. It currently manages assets worth more than RMB 3bn, and mainly invests in sectors of medtech, healthcare, biotechnology and smart manufacturing.

With New Hope Group, one of China’s biggest agriculture and food businesses, as its cornerstone investor, HosenCare Brothers had operated as a PE arm within the group for nearly a decade. In 2017, it began to operate under its current name. It currently manages assets worth more than RMB 3bn, and mainly invests in sectors of medtech, healthcare, biotechnology and smart manufacturing.

For rich Chinese wanting to acquire nice things and good taste, glamorous lifestyle editor Wendy can help with her online magazine, e-store and offline events.

For rich Chinese wanting to acquire nice things and good taste, glamorous lifestyle editor Wendy can help with her online magazine, e-store and offline events.

Samaipata Ventures is an early stage venture capital fund founded by Jose del Barrio, a Spanish entrepreneur who succeeded in the e-commerce food delivery business Nevera Roja. The VC invests in European companies involved in e-commerce and marketplaces, especially in Southern Europe. As entrepreneurs themselves, the partners aim to increase cooperation between SMEs and venture capitalists.

Samaipata Ventures is an early stage venture capital fund founded by Jose del Barrio, a Spanish entrepreneur who succeeded in the e-commerce food delivery business Nevera Roja. The VC invests in European companies involved in e-commerce and marketplaces, especially in Southern Europe. As entrepreneurs themselves, the partners aim to increase cooperation between SMEs and venture capitalists.

Gigacover: Providing a financial safety net for gig workers

Gigacover is eyeing multi-billion-dollar opportunities in income and healthcare protection and financial services for the 150m self-employed workers in Southeast Asia, about half of whom are underbanked

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Plant-based eggs: The next big thing in the alternative protein market

Plant-based eggs may be the fastest growing segment in plant-based foods, but hacking the formula for a perfect egg substitute is proving a hurdle. Are alt-protein startups up for the challenge?

Oscillum: The intelligent label to reduce food waste

The Spanish biotech startup has developed sensors embedded in biodegradable plastic labels to monitor “product freshness” beyond expiration dates, helping consumers to avoid food waste and save money

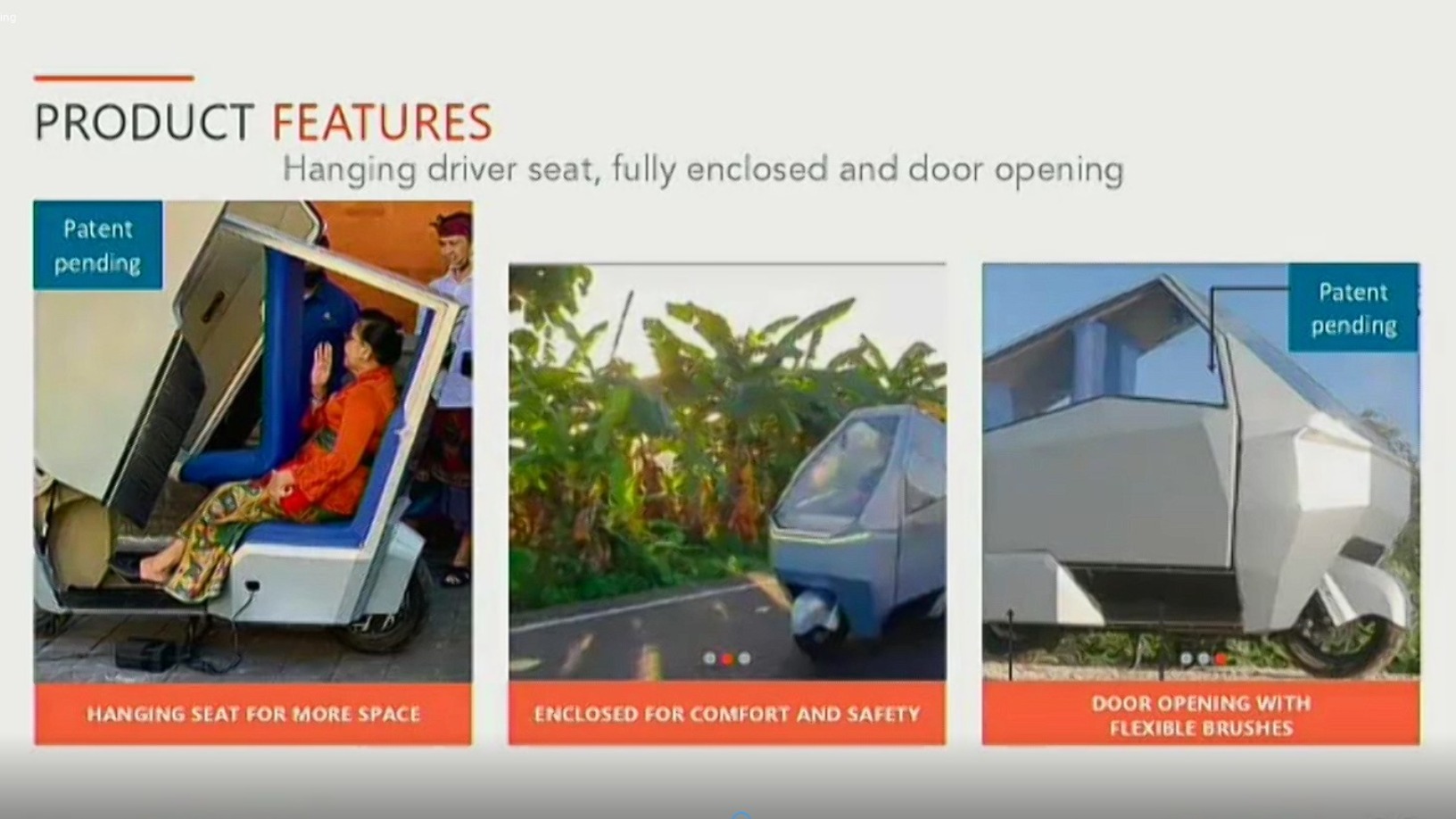

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

IXON: Preserving food without canning or freezing

Chinese foodtech IXON aims to disrupt global cold chain logistics with its novel food preparation and packaging solution that keeps food fresh at room temperature for years

SWITCH Singapore: Sustainability startups see growing demand from corporates

Sophie’s BioNutrients, Ubiik and Intello Labs also note new trends in technology and supply chain arising from the Covid-19 pandemic, across the food, manufacturing and e-commerce sectors

Nongguanjia: Housekeeper of Chinese farmers' fortunes

Combining fintech and e-commerce, Nongguanjia started by monetizing land circulation, to help hundreds of millions of Chinese farmers get financing and thrive

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

New Food Invest: Challenges of growing an alt-protein startup

Founders of three alt-protein startups in the US share what motivated them to start, their personal experiences growing the businesses, getting funding and finding strategic partners

agroSingularity: Turning discarded fruits and vegetables into usable powder to fix food waste

Closing €1.2m new funding will help the Murcia-based foodtech to build its own technology and facilities, expand into new markets

3D printing foodtech Natural Machines joins Euronext's pre-IPO training program

With its 3D printed vegan candies and snowflake pizzas, Natural Machines already has more than 300 companies using its Foodini food printer, which it’s upgrading with laser tech for simultaneous cooking too

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

NutraSign: Farm-to-fork traceability app for healthier lifestyles

NutraSign is an app that lets businesses and consumers identify and trace contaminated products within a food supply chain in seconds, using blockchain technology

Sorry, we couldn’t find any matches for“Food safety”.