Forum of Young Global Leaders

-

DATABASE (996)

-

ARTICLES (811)

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Maniv Mobility is an Israel-based venture capitalist firm, focused mainly on mobility, automotive, transportation and logistic solutions. The fund is backed by venture arms of BMW, Hyundai, LG Electronics, the Renault-Nissan-Mitsubishi Alliance, Shell and Valeo amongst others. Headquartered in Isreal, in Tel Aviv a city that is growing in the mobility space with an increasing number of automotive venture arms.Maniv Mobility operates since 2016 with an initial funding capital of $44mn and a further capital injection in 2019 of $100mn. With an international investment portfolio and global ambitions, the firm has built over the years strategic partners in Europe, North America, Israel looking for long term expansion in Asian markets.The company has been within the VCs that backed Drive.ai, the autonomous vehicle startup later acquired by Apple.

Maniv Mobility is an Israel-based venture capitalist firm, focused mainly on mobility, automotive, transportation and logistic solutions. The fund is backed by venture arms of BMW, Hyundai, LG Electronics, the Renault-Nissan-Mitsubishi Alliance, Shell and Valeo amongst others. Headquartered in Isreal, in Tel Aviv a city that is growing in the mobility space with an increasing number of automotive venture arms.Maniv Mobility operates since 2016 with an initial funding capital of $44mn and a further capital injection in 2019 of $100mn. With an international investment portfolio and global ambitions, the firm has built over the years strategic partners in Europe, North America, Israel looking for long term expansion in Asian markets.The company has been within the VCs that backed Drive.ai, the autonomous vehicle startup later acquired by Apple.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

CEO and founder of Petit Pli

Ryan Mario Yasin is an engineer, designer and sustainable fashion entrepreneur based in London. Originally from Reykjavik, Iceland, Yasin graduated in aeronautical engineering at Imperial College London and has a master’s in global innovation design from the Royal College of Art. As a 23-year-old design student, Yasin founded materials technology startup Petit Pli, and developed the design for the company’s first product, a pleated garment that could expand up to seven sizes to last children through their first few years of life. Petit Pli now makes expandable pleated clothes for children and adults, using a fabric derived from recycled plastic and a structure inspired by origami, architecture and space satellites. Petit Pli products have won a number of prestigious awards, such as the UK James Dyson Award, Time Magazine’s best invention of 2020 and the Red Dot Product Design Award.Yasin has a strong interest in photography and in the interplay between art and engineering. In 2020, Yasin was included by Forbes in its 30 Under 30 list for Europe.

Ryan Mario Yasin is an engineer, designer and sustainable fashion entrepreneur based in London. Originally from Reykjavik, Iceland, Yasin graduated in aeronautical engineering at Imperial College London and has a master’s in global innovation design from the Royal College of Art. As a 23-year-old design student, Yasin founded materials technology startup Petit Pli, and developed the design for the company’s first product, a pleated garment that could expand up to seven sizes to last children through their first few years of life. Petit Pli now makes expandable pleated clothes for children and adults, using a fabric derived from recycled plastic and a structure inspired by origami, architecture and space satellites. Petit Pli products have won a number of prestigious awards, such as the UK James Dyson Award, Time Magazine’s best invention of 2020 and the Red Dot Product Design Award.Yasin has a strong interest in photography and in the interplay between art and engineering. In 2020, Yasin was included by Forbes in its 30 Under 30 list for Europe.

Co-founder of Vence

Sky Kurtz graduated in finance at Arizona State University in 2004. He also completed a master’s in business administration from Stanford University Graduate School of Business in 2011.He started his corporate career in New York at Lehman Brothers where he worked as an analyst from 2004–2006. He went on to work at CCMP Capital as an associate for three years until 2009. After various board member roles in US, he became the VP of Francisco Partners in 2011, a global private equity firm based in San Francisco.In 2014, he became the CEO of Mateen Corporation that manufactures high-performance fiber-reinforced polymers in the UAE and New Zealand. In 2016, he co-founded Vence Corp, a virtual fencing device manufacturer for livestock management. Currently based in UAE, Kurtz also founded Pure Harvest Smart Farms in Abu Dhabi. He is the CEO of the Middle East’s first commercial-scale, semi-automated, hybrid greenhouse growing system. Kurtz is also an advisor at e-commerce beauty startup Powder.ae and an entrepreneur-in-residence at Shorooq Investments.

Sky Kurtz graduated in finance at Arizona State University in 2004. He also completed a master’s in business administration from Stanford University Graduate School of Business in 2011.He started his corporate career in New York at Lehman Brothers where he worked as an analyst from 2004–2006. He went on to work at CCMP Capital as an associate for three years until 2009. After various board member roles in US, he became the VP of Francisco Partners in 2011, a global private equity firm based in San Francisco.In 2014, he became the CEO of Mateen Corporation that manufactures high-performance fiber-reinforced polymers in the UAE and New Zealand. In 2016, he co-founded Vence Corp, a virtual fencing device manufacturer for livestock management. Currently based in UAE, Kurtz also founded Pure Harvest Smart Farms in Abu Dhabi. He is the CEO of the Middle East’s first commercial-scale, semi-automated, hybrid greenhouse growing system. Kurtz is also an advisor at e-commerce beauty startup Powder.ae and an entrepreneur-in-residence at Shorooq Investments.

Goldman Sachs is one of the biggest investment banking and financial services group in the world. The firm went public in 1999 under the ticker NYSE:GS. To date, Goldman Sachs has raised seven funds, their latest in May 2019 for a total of $4.4bn. Based in New York, the private banking group has made 788 investments with 256 exits. Investments include tech unicorns such as Spotify, Square, Zipline, Xiaomi and the Alibaba Group.Its 2019 annual report showed that Goldman Sachs generated over $36.55 bn in net revenues, with 10% ROE and 10.6% ROTE. As of mid-July 2020, the firm has a market capitalization of $74.33 bn. Goldman Sachs has offices in over 30 countries with major operations in four sectors: investment banking, global markets, asset management and consumer & wealth management.

Goldman Sachs is one of the biggest investment banking and financial services group in the world. The firm went public in 1999 under the ticker NYSE:GS. To date, Goldman Sachs has raised seven funds, their latest in May 2019 for a total of $4.4bn. Based in New York, the private banking group has made 788 investments with 256 exits. Investments include tech unicorns such as Spotify, Square, Zipline, Xiaomi and the Alibaba Group.Its 2019 annual report showed that Goldman Sachs generated over $36.55 bn in net revenues, with 10% ROE and 10.6% ROTE. As of mid-July 2020, the firm has a market capitalization of $74.33 bn. Goldman Sachs has offices in over 30 countries with major operations in four sectors: investment banking, global markets, asset management and consumer & wealth management.

Based in the Netherlands, Prosus is a global investor in consumer tech and Internet companies. It is a subsidiary of South African tech investment company Naspers. In August 2021 the two companies completed a cross-holding agreement in which Naspers owns 57% of Prosus while Prosus owns 49% of Naspers. The two companies share a single board.Prosus is the largest shareholder in Chinese tech giant Tencent and Russian tech platform Mail.ru. Meanwhile, its venture division invests in a variety of fintech, food delivery, and other consumer tech companies. In Indonesia, it has invested in Bibit, a stock and mutual funds investment platform, as well as fishery trading and community development startup Aruna. It has also invested in edtech platforms like Indian executive learning platform Eruditus, and US-based coding education company SoloLearn.

Based in the Netherlands, Prosus is a global investor in consumer tech and Internet companies. It is a subsidiary of South African tech investment company Naspers. In August 2021 the two companies completed a cross-holding agreement in which Naspers owns 57% of Prosus while Prosus owns 49% of Naspers. The two companies share a single board.Prosus is the largest shareholder in Chinese tech giant Tencent and Russian tech platform Mail.ru. Meanwhile, its venture division invests in a variety of fintech, food delivery, and other consumer tech companies. In Indonesia, it has invested in Bibit, a stock and mutual funds investment platform, as well as fishery trading and community development startup Aruna. It has also invested in edtech platforms like Indian executive learning platform Eruditus, and US-based coding education company SoloLearn.

Established in 1958, VERSO Capital is a boutique merchant banking and financial services firm based in Luxembourg. It also has offices in Geneva, Fribourg, Vaduz, Dubai, Singapore and BVI. VERSO specializes in sectors like education, food and renewables. Since 2011, the firm has invested over $700bn in venture capital in the global startup ecosystem. Funds worth over $245m were pumped into climatech, foodtech and biotech sectors since 2017. In February 2021, it merged with Swiss alternative asset manager ALDINI Capital that was also founded in 1958 and based in Switzerland and Liechtenstein. VERSO will leverage the expertise of ALDINI in hedge funds, private equity and real estate.

Established in 1958, VERSO Capital is a boutique merchant banking and financial services firm based in Luxembourg. It also has offices in Geneva, Fribourg, Vaduz, Dubai, Singapore and BVI. VERSO specializes in sectors like education, food and renewables. Since 2011, the firm has invested over $700bn in venture capital in the global startup ecosystem. Funds worth over $245m were pumped into climatech, foodtech and biotech sectors since 2017. In February 2021, it merged with Swiss alternative asset manager ALDINI Capital that was also founded in 1958 and based in Switzerland and Liechtenstein. VERSO will leverage the expertise of ALDINI in hedge funds, private equity and real estate.

Established in San Francisco in 1998, global VC firm e.ventures now has offices and teams in the US, Brazil, Germany, China and Japan. The company invests from seed stage to later stages in sums ranging from US$500,000 to US$30m. It has invested in over 275 companies to date, as lead investor in 70, and has managed 42 exits, including Groupon and Farfetch. Recent investments include cloud-based contract management company Icertis's US$115m Series E round and workforce app Staffbase's Series C round. The VC has six investment funds, totaling US$1.1bn, including a US$125m European-dedicated fund established in June 2019.

Established in San Francisco in 1998, global VC firm e.ventures now has offices and teams in the US, Brazil, Germany, China and Japan. The company invests from seed stage to later stages in sums ranging from US$500,000 to US$30m. It has invested in over 275 companies to date, as lead investor in 70, and has managed 42 exits, including Groupon and Farfetch. Recent investments include cloud-based contract management company Icertis's US$115m Series E round and workforce app Staffbase's Series C round. The VC has six investment funds, totaling US$1.1bn, including a US$125m European-dedicated fund established in June 2019.

Miguel Arias received an MSc in Civil Engineering from Universidad Politécnica de Madrid in 2002 and an MBA from IE Business School in 2005. He has served as global entrepreneurship director at Telefónica since 2018.Arias began his career as an engineer. In 2003, he founded IMASTE (since acquired by US communications firm ON24), a virtual events startup, where he served as CTO for nine years.Arias is an active angel investor in the Spanish tech ecosystem. He co-founded Chamberí Valley, which promotes networking initiatives among tech entrepreneurs, and mentors at programs such as the IE Venture Lab and Wayra Academy.

Miguel Arias received an MSc in Civil Engineering from Universidad Politécnica de Madrid in 2002 and an MBA from IE Business School in 2005. He has served as global entrepreneurship director at Telefónica since 2018.Arias began his career as an engineer. In 2003, he founded IMASTE (since acquired by US communications firm ON24), a virtual events startup, where he served as CTO for nine years.Arias is an active angel investor in the Spanish tech ecosystem. He co-founded Chamberí Valley, which promotes networking initiatives among tech entrepreneurs, and mentors at programs such as the IE Venture Lab and Wayra Academy.

Founded in 2013, Visionnaire Ventures is based in San Francisco and invests globally in innovative technologies in diverse sectors like AI and ML, digital health, Big Data, IoT, mobile and agriculture. The firm is managed by a team of serial entrepreneurs and executives involved in global internet, game and online media companies.The VC is co-founded by managing partners Taizo Son, Keith Nilsson and Susan Choe who also founded Katalyst Ventures. Son is the brother of SoftBank’s Masayoshi Son based in Japan. Taizo founded Gungho Online in 2002, a major online gaming company that became public-listed in 2005. With a vision to create a Silicon Valley-like venture eco-system in East Asia, he also founded MOVIDA JAPAN in 2009. He also founded Mistletoe Inc as CEO in 2013 to support entrepreneurs and provide startup ecosystem development activities.

Founded in 2013, Visionnaire Ventures is based in San Francisco and invests globally in innovative technologies in diverse sectors like AI and ML, digital health, Big Data, IoT, mobile and agriculture. The firm is managed by a team of serial entrepreneurs and executives involved in global internet, game and online media companies.The VC is co-founded by managing partners Taizo Son, Keith Nilsson and Susan Choe who also founded Katalyst Ventures. Son is the brother of SoftBank’s Masayoshi Son based in Japan. Taizo founded Gungho Online in 2002, a major online gaming company that became public-listed in 2005. With a vision to create a Silicon Valley-like venture eco-system in East Asia, he also founded MOVIDA JAPAN in 2009. He also founded Mistletoe Inc as CEO in 2013 to support entrepreneurs and provide startup ecosystem development activities.

Co-founder of Psquared

Argentinian native Jorge Araujo Müller is co-founder and investor at Psquared, Spain’s first flexible workplace management and design company, Psquared, for hybrid workspaces, where he has worked since its foundation in April 2019. Psquared is a spin-off of startup innovation hub CoBuilder, founded one year earlier and which Araujo co-founded. He has several other roles. Since 2020, he is a co-founder at startup development agency We Are Grit and advisor of a talent agency for Latin Americans in Spain, Base España. He is also an investor and advisor at e-commerce recruitment agency RSV Outsourcing. Araujo also holds part-time educational roles, speaking on innovation at Barcelona’s ESADE institution to MBA students and as a mentor at Mexico’s chapter of the MassChallenge accelerator. Earlier, Araujo worked as a business advisor to the digital agency JustDigital, and was co-founder and sales director at the digital talent agency Bandit, for a year. Before that, from 2012–2016, he was CSO and co-founder of Barcelona-based startup Nubelo – a tech recruitment agency for freelancers – until it was acquired by Freelancer.com. Prior to this, Araujo worked for two years as a business researcher at JP Morgan Chase and for almost two years at West Side Consultants, both in Argentina. Araujo holds a business administration qualification from CEMA University, Buenos Aires.In 2013, Araujo and his brother were named in Forbes Argentina’s 30 Promesas list of young entrepreneurs.

Argentinian native Jorge Araujo Müller is co-founder and investor at Psquared, Spain’s first flexible workplace management and design company, Psquared, for hybrid workspaces, where he has worked since its foundation in April 2019. Psquared is a spin-off of startup innovation hub CoBuilder, founded one year earlier and which Araujo co-founded. He has several other roles. Since 2020, he is a co-founder at startup development agency We Are Grit and advisor of a talent agency for Latin Americans in Spain, Base España. He is also an investor and advisor at e-commerce recruitment agency RSV Outsourcing. Araujo also holds part-time educational roles, speaking on innovation at Barcelona’s ESADE institution to MBA students and as a mentor at Mexico’s chapter of the MassChallenge accelerator. Earlier, Araujo worked as a business advisor to the digital agency JustDigital, and was co-founder and sales director at the digital talent agency Bandit, for a year. Before that, from 2012–2016, he was CSO and co-founder of Barcelona-based startup Nubelo – a tech recruitment agency for freelancers – until it was acquired by Freelancer.com. Prior to this, Araujo worked for two years as a business researcher at JP Morgan Chase and for almost two years at West Side Consultants, both in Argentina. Araujo holds a business administration qualification from CEMA University, Buenos Aires.In 2013, Araujo and his brother were named in Forbes Argentina’s 30 Promesas list of young entrepreneurs.

Based in San Mateo California, KBW Ventures was founded by HRH Prince Khaled bin Alwaleed bin Talal Al Saud. The asset management firm’s CEO is also the chairman of KBW Investments that was founded in 2013 in Dubai in the United Arab Emirates (UAE).KBW Ventures is part of the KBW Group and mainly invests in companies involved in sustainable food, artificial intelligence, blockchain technologies and fintech. In 2019, the VC had already invested in 24 companies in sectors like e-gaming, drones, e-commerce and plant-based proteins. Recently, it also increased its stakes in two Californian biotechs BlueNalu and TurtleTree Labs. The aim is to open up the Middle East markets to global tech companies.

Based in San Mateo California, KBW Ventures was founded by HRH Prince Khaled bin Alwaleed bin Talal Al Saud. The asset management firm’s CEO is also the chairman of KBW Investments that was founded in 2013 in Dubai in the United Arab Emirates (UAE).KBW Ventures is part of the KBW Group and mainly invests in companies involved in sustainable food, artificial intelligence, blockchain technologies and fintech. In 2019, the VC had already invested in 24 companies in sectors like e-gaming, drones, e-commerce and plant-based proteins. Recently, it also increased its stakes in two Californian biotechs BlueNalu and TurtleTree Labs. The aim is to open up the Middle East markets to global tech companies.

The investment arm of Taikang Insurance Group, Taikang Asset Management (Taikang Asset) manages RMB 1.9tn worth of assets, including RMB 1.1tn third-party assets, RMB 420bn alternative investment and RMB 440bn pension funds as of June 2020. Investments are mainly in infrastructure sectors such as transportation, energy, utilities, environmental protection, telecoms and real estate.Taikang Asset is an important platform for Taikang Insurance Group to carry out global business. In November 2007, its wholly-owned unit Hong Kong was set up and has received licenses from the Hong Kong stock exchange for businesses including securities dealing, advisory and asset management. In September 2016, Taikang Asset founded Taikang Asset (Beijing), a new equity investment platform, and raised RMB 2bn for its Phase I Industrial Development Fund by May 2017. Apart from managing and utilizing self-owned and insurance capital, the company manages assets for clients and provides advice on asset management. It also issues public security investment funds among other asset management businesses.

The investment arm of Taikang Insurance Group, Taikang Asset Management (Taikang Asset) manages RMB 1.9tn worth of assets, including RMB 1.1tn third-party assets, RMB 420bn alternative investment and RMB 440bn pension funds as of June 2020. Investments are mainly in infrastructure sectors such as transportation, energy, utilities, environmental protection, telecoms and real estate.Taikang Asset is an important platform for Taikang Insurance Group to carry out global business. In November 2007, its wholly-owned unit Hong Kong was set up and has received licenses from the Hong Kong stock exchange for businesses including securities dealing, advisory and asset management. In September 2016, Taikang Asset founded Taikang Asset (Beijing), a new equity investment platform, and raised RMB 2bn for its Phase I Industrial Development Fund by May 2017. Apart from managing and utilizing self-owned and insurance capital, the company manages assets for clients and provides advice on asset management. It also issues public security investment funds among other asset management businesses.

Entrepreneur First is a global entrepreneur incubator program and early-startup investor. The incubator is an intensive six-month program for founders and aspiring entrepreneurs to help them develop ideas that can go into building their own companies. The program is held in six cities around the world: Bangalore; Berlin, London, Paris, Singapore and Toronto (Canada).Participants do not need to have a startup or a specific business idea to participate, and those who have established their own companies can seek partners or co-founders at the program. Roughly 40-50% of the cohort reach the “Launch” phase, where the participants have established their own companies and received investments from Entrepreneur First and potentially other VCs. Entrepreneur First can invest in a startup built by program participants in exchange for 10% equity. The exact amount invested varies: £80,000 for the European programs; S$75,000 for the Singapore and Bangalore programs; and C$100,000 for the Canada program.

Entrepreneur First is a global entrepreneur incubator program and early-startup investor. The incubator is an intensive six-month program for founders and aspiring entrepreneurs to help them develop ideas that can go into building their own companies. The program is held in six cities around the world: Bangalore; Berlin, London, Paris, Singapore and Toronto (Canada).Participants do not need to have a startup or a specific business idea to participate, and those who have established their own companies can seek partners or co-founders at the program. Roughly 40-50% of the cohort reach the “Launch” phase, where the participants have established their own companies and received investments from Entrepreneur First and potentially other VCs. Entrepreneur First can invest in a startup built by program participants in exchange for 10% equity. The exact amount invested varies: £80,000 for the European programs; S$75,000 for the Singapore and Bangalore programs; and C$100,000 for the Canada program.

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

In Spain, women are busy launching startups

Official data show women-led startups are on the rise in Spain. We take you to some of the biggest names in the game

Ciweishixi: HR startup helps Chinese youth pursue rewarding careers

Ciweishixi uses the Western internship model to help young people discover their true passion, online and offline

Cristina Fonseca: On a one-woman mission to make Portugal more innovative

The co-founder of Portugal's third unicorn, Talkdesk, is now an influential investor and AI authority

Xu Jinghong: Champion of young entrepreneurs and high-tech startups

Under Xu Jinghong’s leadership, Tsinghua Holdings grew its assets sevenfold and incubated over 10,000 businesses. In his new role as VC investor, Xu wants to nurture startups into future global leaders

Clear Plate: Anti-food waste AI that rewards the diners who finish their food

Taking little steps to make a big difference in fighting food waste, Clear Plate engages with digital natives to spread the message

Jesús Encinar: The Man Behind Idealista and 11870.com

Entrepreneur, angel investor and down-to-earth idealist

SWITCH Singapore: Embracing a circular economy, the whys and the hows

Its benefits for the environment aside, going circular could also lead to new economic growth, better public health and higher value-add employment, experts say

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

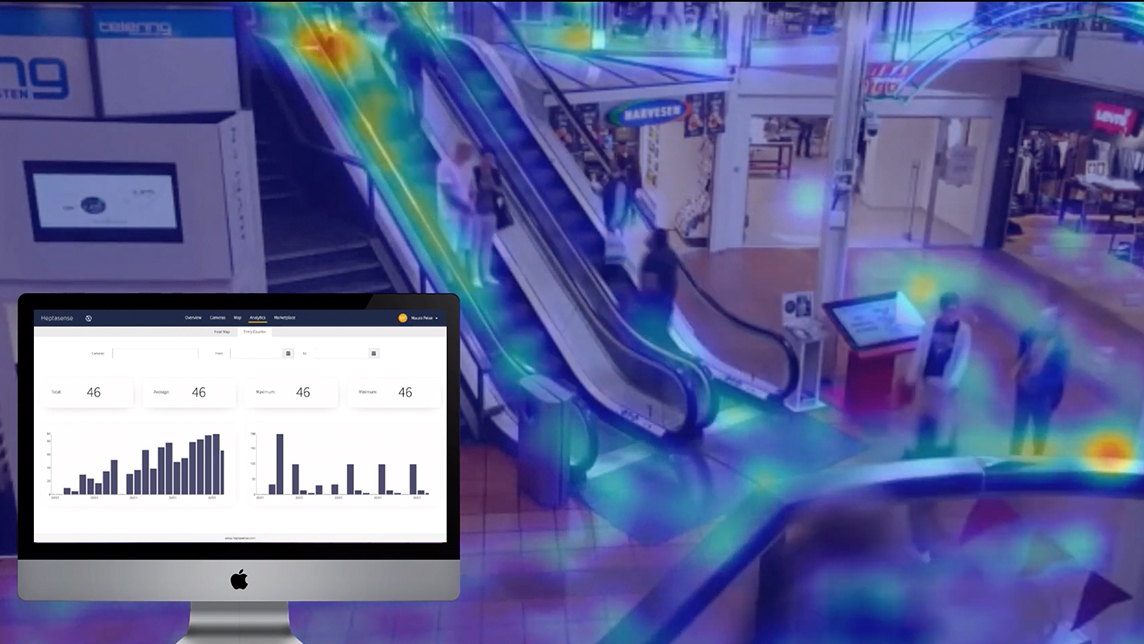

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Yali Bio: Recreating a juicy steak in plant-based alternatives

Founded by the former head of Impossible Foods’ pilot plant, this Bay Area genomics and foodtech startup is one of the first to engineer a better fat for plant-based meat

This e-retailer uses influencers to sell niche brand cosmetics in high-growth markets

Huajuan Mall is a popular makeup e-mall for young women in smaller Chinese cities, turning little-known local brands into big hits

Sorry, we couldn’t find any matches for“Forum of Young Global Leaders”.