Forum of Young Global Leaders

-

DATABASE (996)

-

ARTICLES (811)

German-born Andreas “Andy” Bechtolsheim is chairman and co-founder of Arista Networks and was a co-founder at Sun Microsystems, which was acquired by Oracle in 2010 for $7.4bn. His main interest is in productivity software across market segments, as well as cybersecurity. He is also a billionaire investor, with much of his wealth coming from being the first angel investor in Google. Since then, he has been an occasional investor in startups, with his most recent disclosed investments occurring in 2020 when he invested in two companies. He has also participated in the $22m Series A round of US email security company Material Security and in the $21m Series A round of AI customer service platform Cresta.

German-born Andreas “Andy” Bechtolsheim is chairman and co-founder of Arista Networks and was a co-founder at Sun Microsystems, which was acquired by Oracle in 2010 for $7.4bn. His main interest is in productivity software across market segments, as well as cybersecurity. He is also a billionaire investor, with much of his wealth coming from being the first angel investor in Google. Since then, he has been an occasional investor in startups, with his most recent disclosed investments occurring in 2020 when he invested in two companies. He has also participated in the $22m Series A round of US email security company Material Security and in the $21m Series A round of AI customer service platform Cresta.

Co-Stone is one of the earliest venture capital firms in China, with about RMB 30 billion in assets under management today. It operates growth-stage investments and pre-IPO financings, focusing on TMT, biotechnology, consumer and services sectors in China. It has invested in more than 80 companies, where Co-Stone was the lead investor in over 60% of the financings.

Co-Stone is one of the earliest venture capital firms in China, with about RMB 30 billion in assets under management today. It operates growth-stage investments and pre-IPO financings, focusing on TMT, biotechnology, consumer and services sectors in China. It has invested in more than 80 companies, where Co-Stone was the lead investor in over 60% of the financings.

Omnes Capital is a Paris-based private equity firm founded within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.

Omnes Capital is a Paris-based private equity firm founded within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.

Augmentum Capital was formed in 2009 by Tim Levene and Richard Matthews, with the backing of RIT Capital Partners, the investment trust chaired by Lord Rothschild (whose family owns 18% of the trust). Based in London, the investment firm focuses on fast-growing fintech companies in the UK and Europe, typically supporting Series A and Series B funding rounds.

Augmentum Capital was formed in 2009 by Tim Levene and Richard Matthews, with the backing of RIT Capital Partners, the investment trust chaired by Lord Rothschild (whose family owns 18% of the trust). Based in London, the investment firm focuses on fast-growing fintech companies in the UK and Europe, typically supporting Series A and Series B funding rounds.

Founded in Shenzhen in 1993, Grandland Holdings comprises four companies - Grandland Group, Grandland Property, Grandland Capital, and Grandland Investment. It operates in the sectors of decoration, real estate, high-tech and finance. Grandland Holdings has total assets of RMB 30 billion, which are invested in more than 30 listed companies. It acquired the Permasteelisa Group, a leading Italian curtain wall corporation, for RMB 3.66 billion in 2017.

Founded in Shenzhen in 1993, Grandland Holdings comprises four companies - Grandland Group, Grandland Property, Grandland Capital, and Grandland Investment. It operates in the sectors of decoration, real estate, high-tech and finance. Grandland Holdings has total assets of RMB 30 billion, which are invested in more than 30 listed companies. It acquired the Permasteelisa Group, a leading Italian curtain wall corporation, for RMB 3.66 billion in 2017.

Orza focuses on direct investments in Basque startups looking to expand and internationalize. It is part of the Elkarkidetza and Geroa pension fund system and typically takes minority stakes, forking out between €1.5 million and €8 million per investment. It actively manages its investee companies while offering them access to its network of local and international contacts.

Orza focuses on direct investments in Basque startups looking to expand and internationalize. It is part of the Elkarkidetza and Geroa pension fund system and typically takes minority stakes, forking out between €1.5 million and €8 million per investment. It actively manages its investee companies while offering them access to its network of local and international contacts.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

Qinghan Fund was founded in 2017 by Crystal Stream, New Hope Group and Chinese celebrity Lu Han. Its largest shareholder is Wang Mengqiu, former vice president of Baidu. Qinghan Fund invests primarily in teams (e.g., small groups of people running a WeChat Official Account) that create professionally generated content, media and platforms which cater to the next generation's lifestyle and consumption upgrade needs.

Qinghan Fund was founded in 2017 by Crystal Stream, New Hope Group and Chinese celebrity Lu Han. Its largest shareholder is Wang Mengqiu, former vice president of Baidu. Qinghan Fund invests primarily in teams (e.g., small groups of people running a WeChat Official Account) that create professionally generated content, media and platforms which cater to the next generation's lifestyle and consumption upgrade needs.

Singtel Innov8 is the venture arm of Singapore-based telecommunications company Singtel. It invests in companies that can potentially bolster Singtel's own capabilities in communications technologies, media services and customer experience. Innov8 has invested in companies at home and abroad, including in Indonesia, China, the USA and Israel. It has made exits through the sale of its portfolio companies (Viki and Tempo.AI) and via IPOs.

Singtel Innov8 is the venture arm of Singapore-based telecommunications company Singtel. It invests in companies that can potentially bolster Singtel's own capabilities in communications technologies, media services and customer experience. Innov8 has invested in companies at home and abroad, including in Indonesia, China, the USA and Israel. It has made exits through the sale of its portfolio companies (Viki and Tempo.AI) and via IPOs.

China Creation Ventures (CCV) was founded in 2017 by Wei Zhou, the former managing partner of KPCB China. Headquartered in Beijing, it invests mainly in early-stage startups in sectors such as finance and TMT. Series A funding accounts for around 70% of total investment. CCV manages USD and RMB funds collectively worth over RMB 3 billion.

China Creation Ventures (CCV) was founded in 2017 by Wei Zhou, the former managing partner of KPCB China. Headquartered in Beijing, it invests mainly in early-stage startups in sectors such as finance and TMT. Series A funding accounts for around 70% of total investment. CCV manages USD and RMB funds collectively worth over RMB 3 billion.

Established by Chinese Academy of Sciences Holdings Co., Ltd., and several other conglomerates in 2011, Cash Capital invests mainly in high-tech startups in the IoT, intelligent manufacturing, mobile internet, big data, artificial intelligence, fintech, healthcare, medical equipment and pharmaceutical sectors. The firm manages assets of more than RMB 10 billion and has invested in nearly 100 companies.

Established by Chinese Academy of Sciences Holdings Co., Ltd., and several other conglomerates in 2011, Cash Capital invests mainly in high-tech startups in the IoT, intelligent manufacturing, mobile internet, big data, artificial intelligence, fintech, healthcare, medical equipment and pharmaceutical sectors. The firm manages assets of more than RMB 10 billion and has invested in nearly 100 companies.

Albert Armengol is the CEO and co-founder of Doctoralia, an online platform for searching and booking medical assistance. He is also the founder of eConozco (sold to XING AG).Armengol has a healthcare and business background and developed his professional career in the healthcare and insurance sector. He later moved to technology and internet startups as an entrepreneur and angel investor.

Albert Armengol is the CEO and co-founder of Doctoralia, an online platform for searching and booking medical assistance. He is also the founder of eConozco (sold to XING AG).Armengol has a healthcare and business background and developed his professional career in the healthcare and insurance sector. He later moved to technology and internet startups as an entrepreneur and angel investor.

Based in Madrid, Ultano Kindelan works at US-based monetization platform Fyber as VP for Sales covering various regions. He has over 15 years of experience in digital advertising and adtech. He previously worked at Madrid-based Falk Realtime adtech. In 2017, he participated in the first seed round of Spanish AI-driven femtech WOOM, his only disclosed investment to date.

Based in Madrid, Ultano Kindelan works at US-based monetization platform Fyber as VP for Sales covering various regions. He has over 15 years of experience in digital advertising and adtech. He previously worked at Madrid-based Falk Realtime adtech. In 2017, he participated in the first seed round of Spanish AI-driven femtech WOOM, his only disclosed investment to date.

With New Hope Group, one of China’s biggest agriculture and food businesses, as its cornerstone investor, HosenCare Brothers had operated as a PE arm within the group for nearly a decade. In 2017, it began to operate under its current name. It currently manages assets worth more than RMB 3bn, and mainly invests in sectors of medtech, healthcare, biotechnology and smart manufacturing.

With New Hope Group, one of China’s biggest agriculture and food businesses, as its cornerstone investor, HosenCare Brothers had operated as a PE arm within the group for nearly a decade. In 2017, it began to operate under its current name. It currently manages assets worth more than RMB 3bn, and mainly invests in sectors of medtech, healthcare, biotechnology and smart manufacturing.

Ping An is China's second largest insurer, with over US$645 billion worth of assets (2015).

Ping An is China's second largest insurer, with over US$645 billion worth of assets (2015).

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

In Spain, women are busy launching startups

Official data show women-led startups are on the rise in Spain. We take you to some of the biggest names in the game

Ciweishixi: HR startup helps Chinese youth pursue rewarding careers

Ciweishixi uses the Western internship model to help young people discover their true passion, online and offline

Cristina Fonseca: On a one-woman mission to make Portugal more innovative

The co-founder of Portugal's third unicorn, Talkdesk, is now an influential investor and AI authority

Xu Jinghong: Champion of young entrepreneurs and high-tech startups

Under Xu Jinghong’s leadership, Tsinghua Holdings grew its assets sevenfold and incubated over 10,000 businesses. In his new role as VC investor, Xu wants to nurture startups into future global leaders

Clear Plate: Anti-food waste AI that rewards the diners who finish their food

Taking little steps to make a big difference in fighting food waste, Clear Plate engages with digital natives to spread the message

Jesús Encinar: The Man Behind Idealista and 11870.com

Entrepreneur, angel investor and down-to-earth idealist

SWITCH Singapore: Embracing a circular economy, the whys and the hows

Its benefits for the environment aside, going circular could also lead to new economic growth, better public health and higher value-add employment, experts say

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

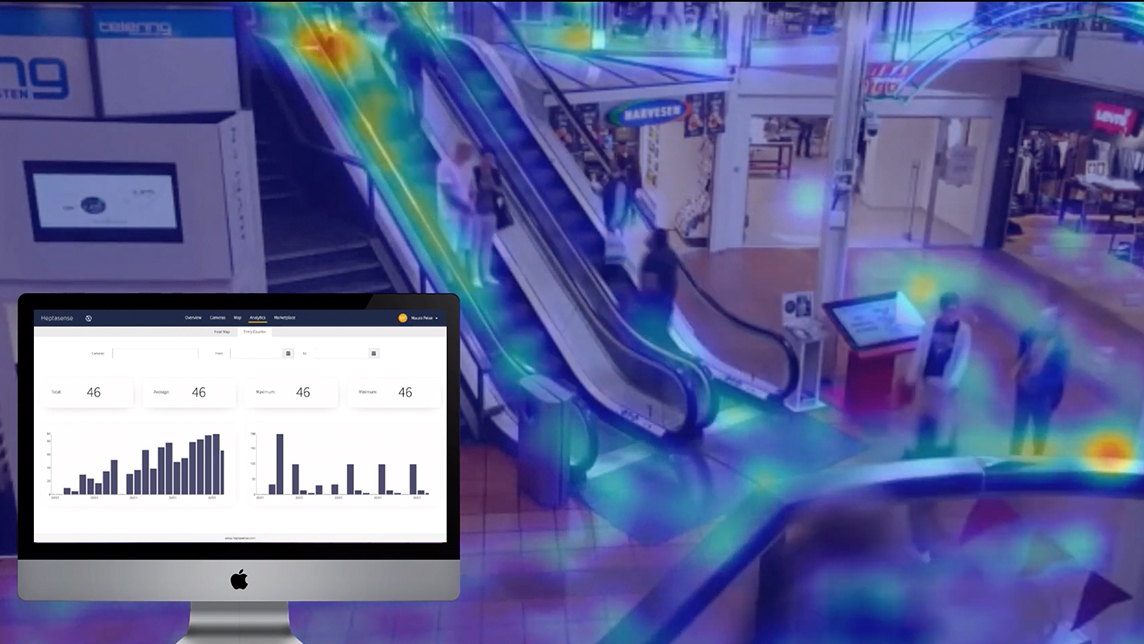

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Yali Bio: Recreating a juicy steak in plant-based alternatives

Founded by the former head of Impossible Foods’ pilot plant, this Bay Area genomics and foodtech startup is one of the first to engineer a better fat for plant-based meat

This e-retailer uses influencers to sell niche brand cosmetics in high-growth markets

Huajuan Mall is a popular makeup e-mall for young women in smaller Chinese cities, turning little-known local brands into big hits

Sorry, we couldn’t find any matches for“Forum of Young Global Leaders”.