Founders Fund

-

DATABASE (482)

-

ARTICLES (410)

Founders Fund is a San Francisco-based VC set up in 2005 that currently has more than $3bn of assets under management. It invests across the tech, aerospace and biotechnology sectors and has been an early backer of some of the most impactful tech companies including Airbnb, Facebook, and SpaceX. It has a key interest in solving major problems such as the opioid crisis in the US.Its recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the July 2021 $80m Series C round of residential real estate platform Sundae. The company has managed over 80 exits including Facebook and Spotify and has made over 500 investments, leading approximately one-third of these.

Founders Fund is a San Francisco-based VC set up in 2005 that currently has more than $3bn of assets under management. It invests across the tech, aerospace and biotechnology sectors and has been an early backer of some of the most impactful tech companies including Airbnb, Facebook, and SpaceX. It has a key interest in solving major problems such as the opioid crisis in the US.Its recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the July 2021 $80m Series C round of residential real estate platform Sundae. The company has managed over 80 exits including Facebook and Spotify and has made over 500 investments, leading approximately one-third of these.

Global Founders Capital is a global venture fund that invests in seed and Series A, or participates in later rounds. It typically does not invest in pre-launch. The venture fund was set up in 2013 by Rocket Internet chief Oliver Samwer, his brother Marc, and former Delivery Hero co-CEO Fabian Siegel as a €150 million fund for high-potential internet businesses.

Global Founders Capital is a global venture fund that invests in seed and Series A, or participates in later rounds. It typically does not invest in pre-launch. The venture fund was set up in 2013 by Rocket Internet chief Oliver Samwer, his brother Marc, and former Delivery Hero co-CEO Fabian Siegel as a €150 million fund for high-potential internet businesses.

RiverHill Fund is a VC fund launched by one of Alibaba's founders Simon Xie (Xie Shihuang) in Hangzhou in 2014. With Alibaba as its biggest limited partner, RiverHill primarily invests in angel/seed and Series A funding rounds in sectors like AI, big data, O2O retail, entertainment and online education.

RiverHill Fund is a VC fund launched by one of Alibaba's founders Simon Xie (Xie Shihuang) in Hangzhou in 2014. With Alibaba as its biggest limited partner, RiverHill primarily invests in angel/seed and Series A funding rounds in sectors like AI, big data, O2O retail, entertainment and online education.

Beenext is a new venture fund started by Beenos founder and former CEO Teruhide “Teru” Sato. The fund describes itself as a “partnership of the founders, by the founders, for the founders”; bringing their wealth of global experience and capital backing to support promising entrepreneurs. Beenext has invested in nine countries, including India, Singapore and Indonesia.

Beenext is a new venture fund started by Beenos founder and former CEO Teruhide “Teru” Sato. The fund describes itself as a “partnership of the founders, by the founders, for the founders”; bringing their wealth of global experience and capital backing to support promising entrepreneurs. Beenext has invested in nine countries, including India, Singapore and Indonesia.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

Targeting Indonesia's masses, investment platform Tanamduit offers mutual funds and governments bonds through its platform and partners.

The first equity crowdfunding company to be licensed in Indonesia, Santara started locally in Yogyakarta to help SMEs in Indonesia, attract investors and raise capital.

The first equity crowdfunding company to be licensed in Indonesia, Santara started locally in Yogyakarta to help SMEs in Indonesia, attract investors and raise capital.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

Based in Beijing, Xianghe Capital was founded in 2016. It runs a USD fund and an RMB fund. The founders of Xianghe Capital formerly led Baidu’s investment department. Xianghe Capital invests in the following areas: artificial intelligence, internet and traditional industries (e.g., online education, logistics, finance, medical care), B2B, culture, entertainment and enterprise services.

Based in Beijing, Xianghe Capital was founded in 2016. It runs a USD fund and an RMB fund. The founders of Xianghe Capital formerly led Baidu’s investment department. Xianghe Capital invests in the following areas: artificial intelligence, internet and traditional industries (e.g., online education, logistics, finance, medical care), B2B, culture, entertainment and enterprise services.

Established in 2009, Shenzhen-based Guoxin Fund was formerly a subsidiary of Tianjin Chongshi Equity Investment Fund Management Co. Ltd. It became an independent entity in 2013, focusing on private fund management. As a state-controlled firm, Guoxin Fund now has over 10 branches and owns or controls shares in more than 20 companies whose business lines include industrial investment, fund management, financial lease, asset management, wealth management and fintech.

Established in 2009, Shenzhen-based Guoxin Fund was formerly a subsidiary of Tianjin Chongshi Equity Investment Fund Management Co. Ltd. It became an independent entity in 2013, focusing on private fund management. As a state-controlled firm, Guoxin Fund now has over 10 branches and owns or controls shares in more than 20 companies whose business lines include industrial investment, fund management, financial lease, asset management, wealth management and fintech.

42CAP is a German VC fund established in 2016 for seed and early-stage investments in European startups. Alex Meyer and Thomas Wilke, both founders of eCircle, one of Europe’s largest SaaS companies that was sold to Teradata in 2012, are co-founders and partners of 42CAP. They have taken advantage of 42CAP’s success to invest in international AI-powered startups. To date, the company has made 21 investments, most recently in the Series A rounds of streaming analytics integration software company Crosser, in customer data and engagement platform CrossEngage and in the Series B round of marketing platform Adversity.

42CAP is a German VC fund established in 2016 for seed and early-stage investments in European startups. Alex Meyer and Thomas Wilke, both founders of eCircle, one of Europe’s largest SaaS companies that was sold to Teradata in 2012, are co-founders and partners of 42CAP. They have taken advantage of 42CAP’s success to invest in international AI-powered startups. To date, the company has made 21 investments, most recently in the Series A rounds of streaming analytics integration software company Crosser, in customer data and engagement platform CrossEngage and in the Series B round of marketing platform Adversity.

Skyview Fund is a venture capital firm that focuses on early-stage investments in TMT industries. Founded by Andrew Ren, Skyview raised over RMB 300 million for its first venture capital fund. On March 1, 2017, Alex Cong, a former partner at Matrix Partners, joined Skyview Fund as its second managing partner.

Skyview Fund is a venture capital firm that focuses on early-stage investments in TMT industries. Founded by Andrew Ren, Skyview raised over RMB 300 million for its first venture capital fund. On March 1, 2017, Alex Cong, a former partner at Matrix Partners, joined Skyview Fund as its second managing partner.

Cosun Fund is a wholly-owned subsidiary of Cosun, an electronic communication devices manufacturer. Founded in 2014, Cosun Fund is based in Huizhou, Guangdong province.

Cosun Fund is a wholly-owned subsidiary of Cosun, an electronic communication devices manufacturer. Founded in 2014, Cosun Fund is based in Huizhou, Guangdong province.

Established in 2011, ShouTaiJinXin Fund is the institutional manager of a private fund under Shoutai Group. Qualified for private securities investment, equity investment and venture capital investment, ShouTaiJinXin Fund invests in the fields of education, automobile, transportation, healthcare, entertainment, corporate services, among others. By the end of 2016, it had managed funds worth RMB 60 billion in total.

Established in 2011, ShouTaiJinXin Fund is the institutional manager of a private fund under Shoutai Group. Qualified for private securities investment, equity investment and venture capital investment, ShouTaiJinXin Fund invests in the fields of education, automobile, transportation, healthcare, entertainment, corporate services, among others. By the end of 2016, it had managed funds worth RMB 60 billion in total.

KK Fund is named after Koichi Saito and Kuan Hsu. Founder and general partner Koichi was formerly from IMJ Investment Partners and a private equity fund run by George Soros. Co-founder and general partner Kuan had previously worked at Goldman Sachs, Temasek Holdings and GREE Ventures.Another KK partner or LP is Masahiko Honma, co-founder and general partner of Incubate Fund based in Japan. KK Fund focuses mainly on internet and mobile startups in Southeast Asia, Hong Kong and Taiwan; with possible seed stage funding ranging from US$100,000 to US$400,000 per startup.

KK Fund is named after Koichi Saito and Kuan Hsu. Founder and general partner Koichi was formerly from IMJ Investment Partners and a private equity fund run by George Soros. Co-founder and general partner Kuan had previously worked at Goldman Sachs, Temasek Holdings and GREE Ventures.Another KK partner or LP is Masahiko Honma, co-founder and general partner of Incubate Fund based in Japan. KK Fund focuses mainly on internet and mobile startups in Southeast Asia, Hong Kong and Taiwan; with possible seed stage funding ranging from US$100,000 to US$400,000 per startup.

Co-founder and CEO of Indexa Capital

With over 15 years of experience in the financial services, CFA professional Unai Ansejo Barra is a fixed-income fund manager at a government employees’ pension fund Itzarri EPSV. He is also a lecturer in risk management at the University of Basque Country, with a PhD in Finance and a Physics degree from the same university.He entered the tech scene in 2014 as co-founder and CEO of Bewa7er, an online platform to promote the economic rights of startups. He also co-founded the automated investment manager platform Indexa Capital in 2015.

With over 15 years of experience in the financial services, CFA professional Unai Ansejo Barra is a fixed-income fund manager at a government employees’ pension fund Itzarri EPSV. He is also a lecturer in risk management at the University of Basque Country, with a PhD in Finance and a Physics degree from the same university.He entered the tech scene in 2014 as co-founder and CEO of Bewa7er, an online platform to promote the economic rights of startups. He also co-founded the automated investment manager platform Indexa Capital in 2015.

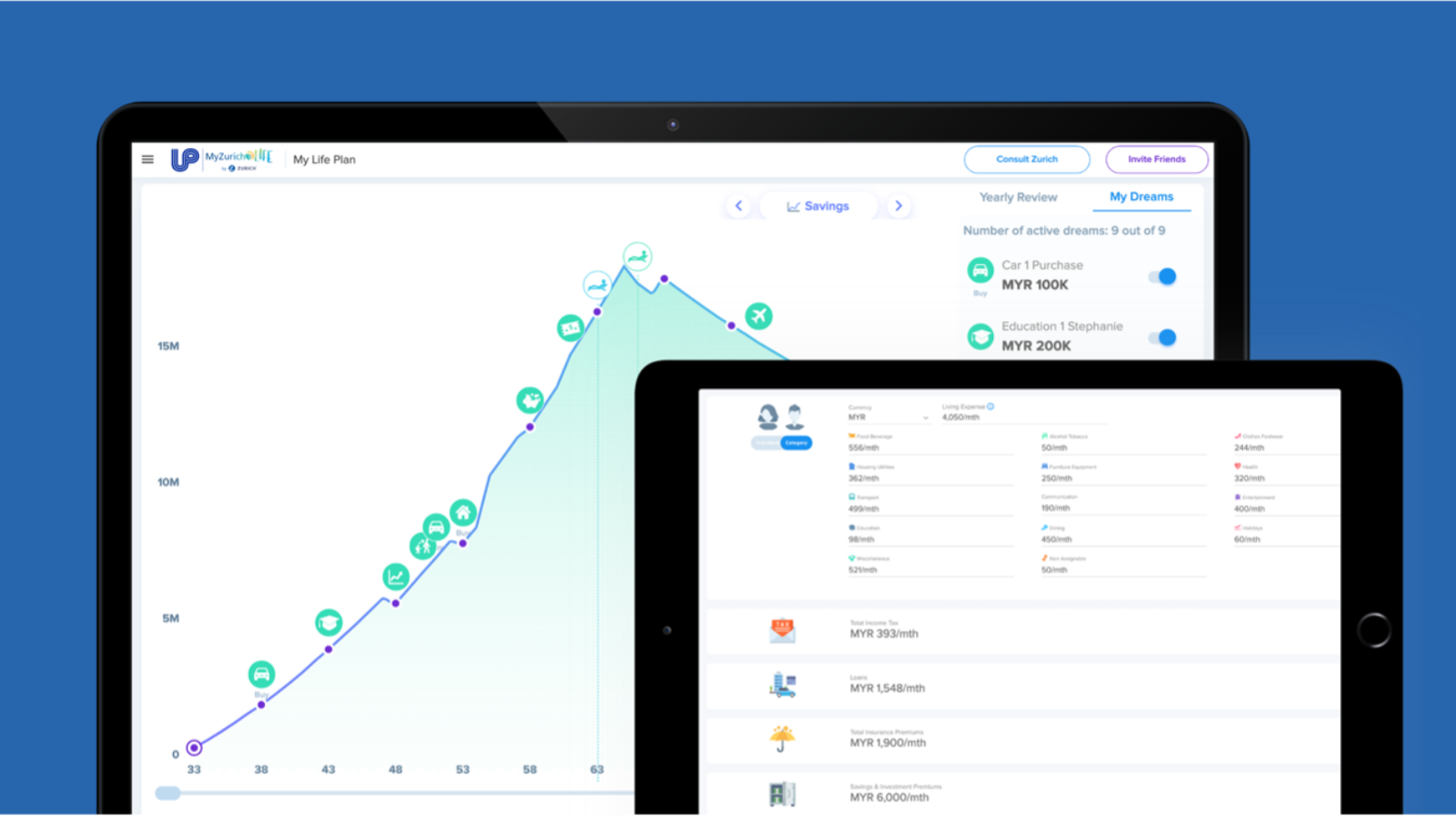

BetterTradeOff: Taking the pain out of financial planning

The Singapore-based startup’s user numbers rose sharply during Covid-19. It wants to raise $11.5m by year-end, is planning a launch in Australia and is eyeing the US market

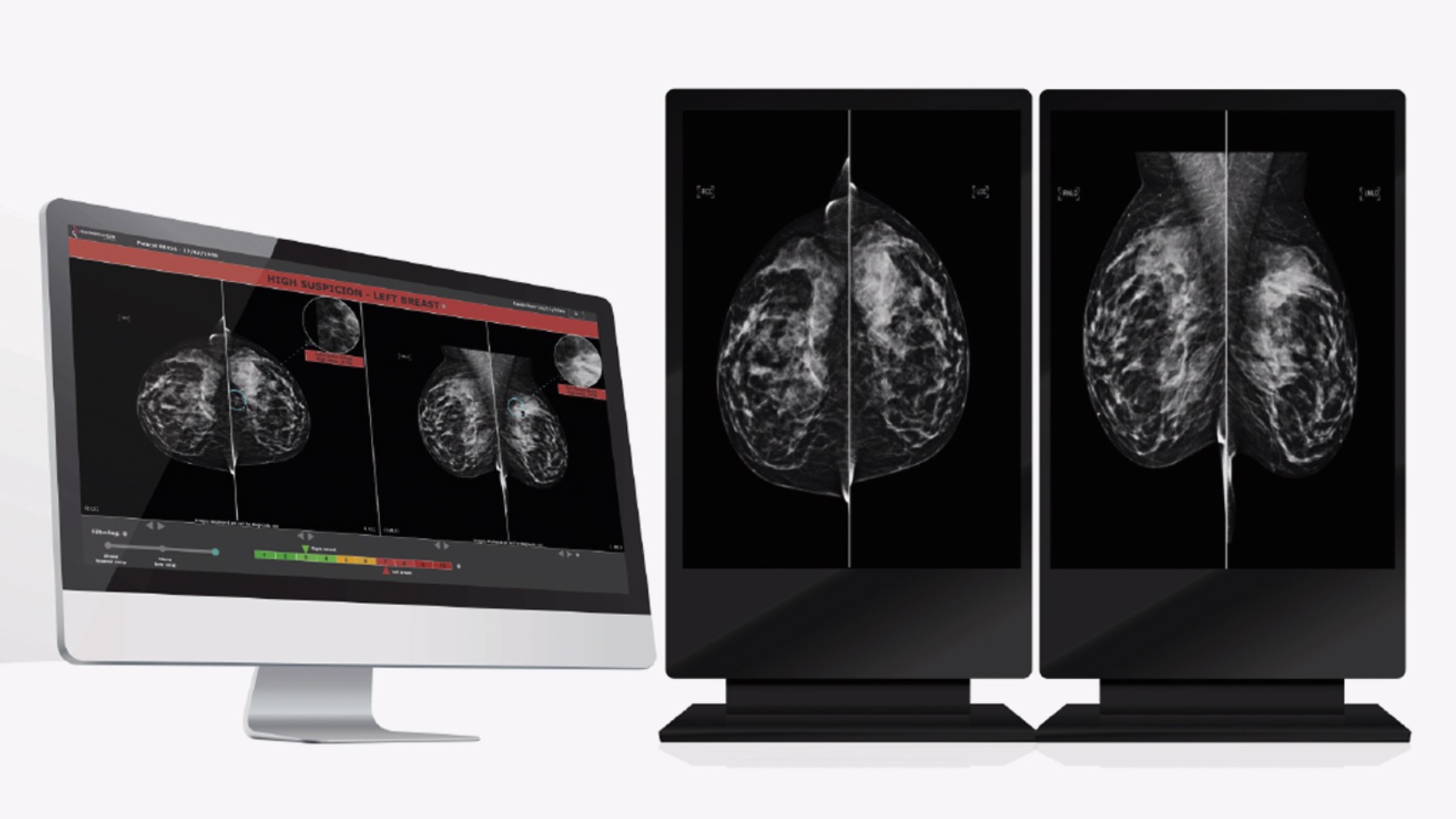

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

South Summit 2021: Martin Varavsky, Leandro Sigman on post-Covid healthcare trends

Serial entrepreneur Martin Varavsky and Insud Pharma Chairman Leandro Sigman share their thoughts and projections on the future of health tech

No dine-in, no problem: Hangry’s cloud kitchens thrive amid Covid-19

Learning from global F&B franchises has helped Hangry expand rapidly, maintain quality and set expansion goals despite the pandemic

Infraspeak to raise up to €12m in Series A funding to accelerate European expansion

CEO Felipe Ávila da Costa discusses his rapidly growing facilities management platform that's helping airports, malls and hospitals run smoothly from Brazil to Mozambique

SWITCH Singapore 2021: Driving renewable energy impact through better business models

Startups need to communicate the business benefits of green solutions to their customers, rather than just pitching the hi-tech

In a united move, Portuguese startups fight to mitigate Covid-19 impact in unprecedented crisis

As strong growth of previous years falters, Portugal's startups were quick to mobilize themselves to detail the help they would need from the state to deal with their biggest challenge yet

HeartGenetics: Using genetic data and AI to improve predictive health outcomes

Amid growing demand for personalized health and wellness solutions, the Portuguese startup is seeking €2m to expand to Germany and the UK

Nucaps Nanotechnology: New encapsulation tech for nutritional and pharmaceutical sectors

Nucaps Nanotechnology is growing through a mix of accelerating market penetration and continuous R&D

Brazilian edtech Blox seeks to upgrade university education across Latin America

Blox plans to raise over $1m in 2021 to expand across Brazil and Mexico, giving more choices to students to personalize degree programs with its AI curriculum management SaaS

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Node: Fighting deforestation with fashionable footwear from agricultural waste

Using patented technology developed with Indonesia’s Ministry of Agriculture, Node turns farm waste and plant materials into biodegradable vegan footwear and shoe components to help fight deforestation.

Foot Analytics: Turning pedestrian footfall into data for smart cities and retail

Applying sensors and proprietary algorithms to digitalize spaces, Foot Analytics gathers data and insights on customer behavior in retail spaces, stadia and airports

Circular economy: Discarded goods get a new lease of life in Spain

From e-chargers inside phone booths, recycling chatbots to refurbished stadium seats from Atlético Madrid, the offbeat magic of the circular economy is fast becoming a lucrative business in Spain

Sorry, we couldn’t find any matches for“Founders Fund”.