Future Food Asia

DATABASE (361)

ARTICLES (575)

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

Established in 1990, JAFCO Asia is a private equity and venture capital firm with US$650m assets under management. It has offices in Singapore, Taipei, Seoul, Beijing and Shanghai. Its parent company, JAFCO Co., Ltd., is Japan's largest venture capital firm. JAFCO Asia has invested in more than 480 companies, 110 of which have been publicly listed.

Established in 1990, JAFCO Asia is a private equity and venture capital firm with US$650m assets under management. It has offices in Singapore, Taipei, Seoul, Beijing and Shanghai. Its parent company, JAFCO Co., Ltd., is Japan's largest venture capital firm. JAFCO Asia has invested in more than 480 companies, 110 of which have been publicly listed.

Silicon Valley Future Capital is a venture capital firm that invests primarily in early stage and growth stage companies with disruptive technologies or innovative business models. Founding partner Dr. Hong Miao used to be managing partner of CLI Ventures, senior VP of CheerLand Investment Group, executive president of the CL Institute of Innovation, and chairman of Zen Water Capital in Silicon Valley. The firm invests primarily in innovations in high-tech, including artificial intelligence, machine learning, big data, cloud computing, robotics, life science, biotech, precision medicine and other disruptive technologies.

Silicon Valley Future Capital is a venture capital firm that invests primarily in early stage and growth stage companies with disruptive technologies or innovative business models. Founding partner Dr. Hong Miao used to be managing partner of CLI Ventures, senior VP of CheerLand Investment Group, executive president of the CL Institute of Innovation, and chairman of Zen Water Capital in Silicon Valley. The firm invests primarily in innovations in high-tech, including artificial intelligence, machine learning, big data, cloud computing, robotics, life science, biotech, precision medicine and other disruptive technologies.

Founded in 2013 in Singapore, VVNP is a future-food solutions-orientated investor with a special interest in science-based companies that have the ability to scale global solutions, especially within Asia. It invests from seed stage to Series C level. Typical investments range from $300,000 to $3m and the investor has launched two funds to date. The first raised $40m and invested in seven companies globally, while the second was created in 2020, targeting $150m in total investment.The VC’s most recent investments include a €271,000 pre-seed investment round in Dutch poultry animal welfare biotech In Ovo in March 2021, and leading the as-yet-uncompleted 6m Swiss franc (approximately $6.56m) seed round in Swiss biotech SwissDeCode in January 2021 – a company that applies DNA testing to food traceability.

Founded in 2013 in Singapore, VVNP is a future-food solutions-orientated investor with a special interest in science-based companies that have the ability to scale global solutions, especially within Asia. It invests from seed stage to Series C level. Typical investments range from $300,000 to $3m and the investor has launched two funds to date. The first raised $40m and invested in seven companies globally, while the second was created in 2020, targeting $150m in total investment.The VC’s most recent investments include a €271,000 pre-seed investment round in Dutch poultry animal welfare biotech In Ovo in March 2021, and leading the as-yet-uncompleted 6m Swiss franc (approximately $6.56m) seed round in Swiss biotech SwissDeCode in January 2021 – a company that applies DNA testing to food traceability.

Backed by Israeli-Russian billionaire Yuri Milner, Apoletto Asia is managed by Russia’s DST Global, a VC firm that funds late-stage internet startups.

Backed by Israeli-Russian billionaire Yuri Milner, Apoletto Asia is managed by Russia’s DST Global, a VC firm that funds late-stage internet startups.

Founded in Berlin in 2016, Atlantic Food Labs’ mission is to support startups with the potential to feed 10bn people by 2050. It has supported 20 companies to date and its most recent investments include in the German healthy last-minute delivery service Gorillas’ $290m Series B round and in the €5.9m seed round of B2B German retail connection service Magaloop in March 2021.

Founded in Berlin in 2016, Atlantic Food Labs’ mission is to support startups with the potential to feed 10bn people by 2050. It has supported 20 companies to date and its most recent investments include in the German healthy last-minute delivery service Gorillas’ $290m Series B round and in the €5.9m seed round of B2B German retail connection service Magaloop in March 2021.

Among the first private equity firms to invest in Asia, TPG Capital Asia is the regional investment arm of US private equity firm TPG Capital. With offices in Beijing, Hong Kong, Melbourne, Mumbai and Singapore, it currently has about $9.9bn in assets under management.

Among the first private equity firms to invest in Asia, TPG Capital Asia is the regional investment arm of US private equity firm TPG Capital. With offices in Beijing, Hong Kong, Melbourne, Mumbai and Singapore, it currently has about $9.9bn in assets under management.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

SoftBank Ventures Asia, founded in 2000, is a subsidiary of SoftBank Korea and part of the SoftBank Group. It is SoftBank’s early stage venture arm, with a geographical focus in Asia, the US, Europe and Israel. It was previously known as SoftBank Ventures Korea.SoftBank Ventures Asia links early-stage startups with SoftBank’s wider network of partners and businesses, which include Yahoo Japan and Alibaba (both of which SoftBank has stakes in), components manufacturers ARM and nVidia, and Indonesian e-commerce platform Tokopedia, which SoftBank has invested in. Outside of its focus areas of AI, robotics and IoT, SoftBank Ventures has invested in companies like sports analytics company bepro11, telehealth service Alodokter, and property rental management Mamikos.

Based in London, CPT Capital is the venture arm of private equity pioneer Jeremy Coller's private family office. Coller is the founder of Europe’s first private equity for secondaries in 1990. The British philanthropist has also established several business schools and the Jeremy Coller Foundation that aims to eliminate factory farming. In 2017, CPT Capital was founded to disrupt the food industry with investments in the alt-protein sector to create the “future of food and materials” like plant-based, recombinant and cell-cultured proteins.

Based in London, CPT Capital is the venture arm of private equity pioneer Jeremy Coller's private family office. Coller is the founder of Europe’s first private equity for secondaries in 1990. The British philanthropist has also established several business schools and the Jeremy Coller Foundation that aims to eliminate factory farming. In 2017, CPT Capital was founded to disrupt the food industry with investments in the alt-protein sector to create the “future of food and materials” like plant-based, recombinant and cell-cultured proteins.

Lynx Asia is an investment advisory firm based in Singapore. Its investments cover a broad range of industries, from retail and real estate to energy and manufacturing.

Lynx Asia is an investment advisory firm based in Singapore. Its investments cover a broad range of industries, from retail and real estate to energy and manufacturing.

CTO and Co-founder of Jeff

Adrian Lorenzo Alonso is a Spanish computer engineer and co-founder/CTO of Mr. Jeff, an online dry cleaning and laundry service with a presence in Europe, Asia and Latin America.He previously worked as CTO in www.thefoodpoint.com, a B2B food market.

Adrian Lorenzo Alonso is a Spanish computer engineer and co-founder/CTO of Mr. Jeff, an online dry cleaning and laundry service with a presence in Europe, Asia and Latin America.He previously worked as CTO in www.thefoodpoint.com, a B2B food market.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Advanced sous-vide aseptic packaging (ASAP) technology extending the shelf-life of food to two years without refrigeration, preservatives or chemicals, potentially disrupting cold chain logistics

Advanced sous-vide aseptic packaging (ASAP) technology extending the shelf-life of food to two years without refrigeration, preservatives or chemicals, potentially disrupting cold chain logistics

Clear Plate: Anti-food waste AI that rewards the diners who finish their food

Taking little steps to make a big difference in fighting food waste, Clear Plate engages with digital natives to spread the message

From Porto to Phnom Penh: Last2Ticket expands to Asia

Their first stop is Cambodia, where tourism-related ticketing is big business yet underserved by technology. Emilía Simões, founder and CEO of the Portuguese e-ticketing startup, tells us more

Koinpack tackles Indonesia's sachet waste problem with refillable bottles

Partnering with FMCG companies, Koinpack is making small amounts of household consumables available to lower-income groups without using traditional sachet packaging

Feedect provides nutritional insect protein to feed the future

Feedect farms insects to produce high-quality protein alternatives for animal and human food

Indonesian online basic food startups like Sayurbox and Wahyoo have had as much as a fivefold jump in orders and are working to sustain strong sales post-social distancing

Get fit and healthy with these Indonesian wellness startups

The wellness lifestyle trend continues to grow in popularity in Indonesia, and startups want a piece of the action

Pula: Pioneering insurtech helps to improve Africa's food security

With Kenyan insurtech Pula’s micro-insurance products, millions of farmers no longer have to bear the full risk of losses from natural disasters and crop failures

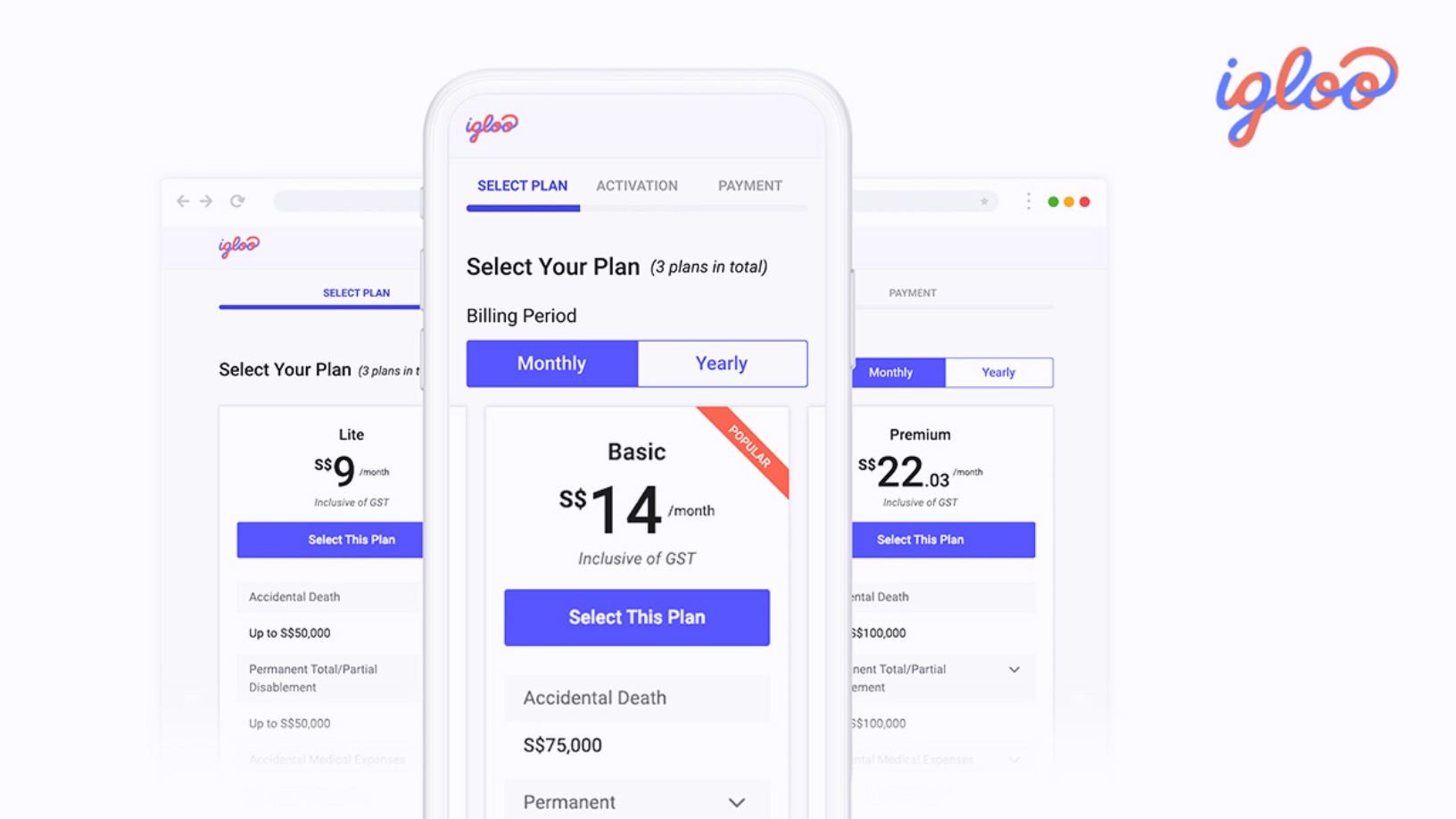

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic

More Asian men are into skincare and health products, and Elio is here to help (discreetly)

Elio believes offering privacy, free online consultations and discreet product packaging will encourage more men to take better care of their health

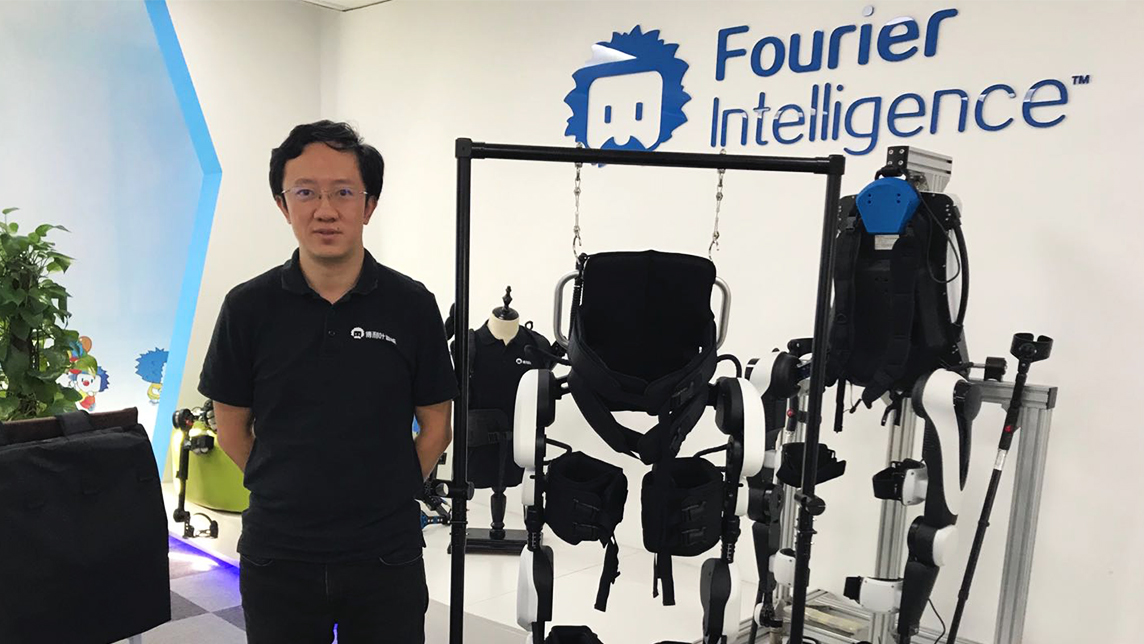

Fourier Intelligence: Quality rehabilitation robots at affordable prices

The startup has also launched an open-source platform to boost rehabilitation robotics and exoskeleton R&D and collaboration

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

Ento: Making cookies and burger patties from crickets

From whole-roasted crickets and granola bars to sausages and meatballs, Ento aims to tap the growing market for insect-based alternative proteins, targeting enthusiasts and early adopters

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Dronak looks beyond the skies to a future of robotics

Dronak CEO Fabia Silva wants to make the world a better place through robotics innovation, but needs funding so the company can spread its tech wings past drones

Sorry, we couldn’t find any matches for“Future Food Asia”.