GK Plug and Play

-

DATABASE (994)

-

ARTICLES (811)

Josep Rius is Global Product Manager Digital Services at ABB and a private investor. He has a degree in Industrial Engineering. He also holds an MBA from ESADE Business School and has more than 20 years international experience in sales in multinational companies and high-tech digital transformation and industrial startups (HP, Asea Brown Boveri, Abrast, Logitek, Parkare, IMAGO light in motion and Nexiona). He co-founded Skinlight in 2002.

Josep Rius is Global Product Manager Digital Services at ABB and a private investor. He has a degree in Industrial Engineering. He also holds an MBA from ESADE Business School and has more than 20 years international experience in sales in multinational companies and high-tech digital transformation and industrial startups (HP, Asea Brown Boveri, Abrast, Logitek, Parkare, IMAGO light in motion and Nexiona). He co-founded Skinlight in 2002.

Elaia' focusses on digital and deeptech companies in their seed and growth phases. The firm’s portfolio includes 19 exited companies like Criteo and over 60 investments with a total of €350 million under management.The firm was founded in Paris in 2002 by a group of four professionals in the technology sector, private equity and operations with a cumulative experience of 75 years in investment and financing.

Elaia' focusses on digital and deeptech companies in their seed and growth phases. The firm’s portfolio includes 19 exited companies like Criteo and over 60 investments with a total of €350 million under management.The firm was founded in Paris in 2002 by a group of four professionals in the technology sector, private equity and operations with a cumulative experience of 75 years in investment and financing.

Eight Roads Ventures is the investment arm of Bermuda-based investment management giant Fidelity International Limited, which was founded in 1969. (It was formerly called Fidelity Growth Partners.) Its investment focus includes emerging technology and healthcare companies in North America, Europe and China in their go-to-market stage and early customer traction. It has offices in the UK, China, India and Japan and has seen 42 exits and has invested in over 300 companies to date. It also participates in Series A to D funding rounds and is a major investor in real estate.

Eight Roads Ventures is the investment arm of Bermuda-based investment management giant Fidelity International Limited, which was founded in 1969. (It was formerly called Fidelity Growth Partners.) Its investment focus includes emerging technology and healthcare companies in North America, Europe and China in their go-to-market stage and early customer traction. It has offices in the UK, China, India and Japan and has seen 42 exits and has invested in over 300 companies to date. It also participates in Series A to D funding rounds and is a major investor in real estate.

A Boston-based VC founded in 1984 with an impressive investment history, currently totaling US$9.5 billion. With offices in Boston, Menlo Park, California and London, Summit Partners has invested in more than 460 companies in technology, healthcare, life sciences and other high-growth industries, including as lead investor in 77 companies. It has seen 192 exits to date. Recent major investments include as lead investor in Red Points' Series C round and in Markforged's Series D round.The company also provides services, such as, recruitment of senior executives and board members and Peak Performance Groups to help companies’ identify and execute growth initiatives and operational efficiency.

A Boston-based VC founded in 1984 with an impressive investment history, currently totaling US$9.5 billion. With offices in Boston, Menlo Park, California and London, Summit Partners has invested in more than 460 companies in technology, healthcare, life sciences and other high-growth industries, including as lead investor in 77 companies. It has seen 192 exits to date. Recent major investments include as lead investor in Red Points' Series C round and in Markforged's Series D round.The company also provides services, such as, recruitment of senior executives and board members and Peak Performance Groups to help companies’ identify and execute growth initiatives and operational efficiency.

According to INADEM, Mexico's organization of entrepreneurs, DILA Capital is estimated to hold the largest and most valuable VC deal flows in Mexico. Headquartered in Mexico City and founded in 2004, the firm is dedicated to seed and early-stage investments in Latin American markets. Its latest and third fund saw 800 million pesos (US$41.7 million) invested in regional startups.Banking on a diverse and vast network of partners who are mentors and serial startup entrepreneurs, DILA also supports foreign companies in penetrating and establishing their position in the Mexican market. It has managed one exit to date: Petsy, a pet marketplace.

According to INADEM, Mexico's organization of entrepreneurs, DILA Capital is estimated to hold the largest and most valuable VC deal flows in Mexico. Headquartered in Mexico City and founded in 2004, the firm is dedicated to seed and early-stage investments in Latin American markets. Its latest and third fund saw 800 million pesos (US$41.7 million) invested in regional startups.Banking on a diverse and vast network of partners who are mentors and serial startup entrepreneurs, DILA also supports foreign companies in penetrating and establishing their position in the Mexican market. It has managed one exit to date: Petsy, a pet marketplace.

Established in 1995 by Sean O'Sullivan, SOSV is a venture capital firm with six attached accelerator programs. Upon receiving investment from SOSV, portfolio companies join one of the accelerator programs that best suits their products. The accelerators are: Chinaccelerator, focused on the Chinese market; Indie Bio, supporting biotechnology and life sciences companies; Food-X, for food-tech and agriculture-focused companies; dlab, which supports startups exploring blockchain and decentralized tech; HAX, for IoT, robotics and other hardware-focused startups; and MOX, an accelerator specializing in mobile platforms and technologies. SOSV, along with the O'Sullivan Foundation, has also provided support for education initiatives such as Khan Academy and CoderDojo (which teaches coding skills to youth).

Established in 1995 by Sean O'Sullivan, SOSV is a venture capital firm with six attached accelerator programs. Upon receiving investment from SOSV, portfolio companies join one of the accelerator programs that best suits their products. The accelerators are: Chinaccelerator, focused on the Chinese market; Indie Bio, supporting biotechnology and life sciences companies; Food-X, for food-tech and agriculture-focused companies; dlab, which supports startups exploring blockchain and decentralized tech; HAX, for IoT, robotics and other hardware-focused startups; and MOX, an accelerator specializing in mobile platforms and technologies. SOSV, along with the O'Sullivan Foundation, has also provided support for education initiatives such as Khan Academy and CoderDojo (which teaches coding skills to youth).

Juan Jose Juste Ortega is an economist with a long career in the banking and financial sector. He held executive roles in multiple banks such as Lloyds Banking Group and Citi, and was Director of Chase and Société Générale in Madrid. For over 10 years, he worked as general subdirector in Caja Madrid. Concurrently, he was CEO and Executive President of the CIFI, a non-bank institution experienced in financing infrastructure and energy in Latin America and the Caribbean. From 2015 to 2018, Juste Ortega was Director of Read Madrid football clubHe is currently diversifying his investments by backing Spanish tech startups.

Juan Jose Juste Ortega is an economist with a long career in the banking and financial sector. He held executive roles in multiple banks such as Lloyds Banking Group and Citi, and was Director of Chase and Société Générale in Madrid. For over 10 years, he worked as general subdirector in Caja Madrid. Concurrently, he was CEO and Executive President of the CIFI, a non-bank institution experienced in financing infrastructure and energy in Latin America and the Caribbean. From 2015 to 2018, Juste Ortega was Director of Read Madrid football clubHe is currently diversifying his investments by backing Spanish tech startups.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

JJ VC is a joint initiative by JJ.cn and a group of investors specialized in TMT investment. JJ.cn is a leading developer and operator in online board and card games.

JJ VC is a joint initiative by JJ.cn and a group of investors specialized in TMT investment. JJ.cn is a leading developer and operator in online board and card games.

Early-stage-focused VC firm with a €24m first fund mainly investing in B2B and B2C digital startups headquartered in Spain. Initial investment amounts range between €70,000 and €300,000, and followup investment amounts go up to €1m per company. Describing themselves as “momentum investors” seeking quick time-to-market projects, Encomenda Smart Capital was founded in 2017 and managed by renowned Spanish angel investors Carlos Blanco, Oriol Juncosa and Miguel Sanz Sanchez, along with a network of angel investors Encomenda supports the growth of startups' portfolios and helps startups to scale at national and international levels. Encomenda invests 30% in SaaS and in projects with a recurring income model; 20% are fintech, and they also bet on the human resources, edtech and healthcare. Just two out of 25 investments have folded up between 2017 and 2020, with half the fund monies committed. Encomenda is seeking to launch a second fund in 2022 focusing on Spanish and Portuguese startups, of €40m–€50m, and multi-stage, by starting in the early-stage investments, with follow-through investments in subsequent stages.

Early-stage-focused VC firm with a €24m first fund mainly investing in B2B and B2C digital startups headquartered in Spain. Initial investment amounts range between €70,000 and €300,000, and followup investment amounts go up to €1m per company. Describing themselves as “momentum investors” seeking quick time-to-market projects, Encomenda Smart Capital was founded in 2017 and managed by renowned Spanish angel investors Carlos Blanco, Oriol Juncosa and Miguel Sanz Sanchez, along with a network of angel investors Encomenda supports the growth of startups' portfolios and helps startups to scale at national and international levels. Encomenda invests 30% in SaaS and in projects with a recurring income model; 20% are fintech, and they also bet on the human resources, edtech and healthcare. Just two out of 25 investments have folded up between 2017 and 2020, with half the fund monies committed. Encomenda is seeking to launch a second fund in 2022 focusing on Spanish and Portuguese startups, of €40m–€50m, and multi-stage, by starting in the early-stage investments, with follow-through investments in subsequent stages.

Founded in 2010 and based in Lisbon, eggNEST is a seed capital fund targeting Portuguese startups in the fields of digital marketing and software engineering. eggNEST is partnered with VC firms such as Caixa Capital and Portugal Ventures, as well as accelerators such as Startup Lisboa and Startup Braga, to build the country’s startup ecosystem.

Founded in 2010 and based in Lisbon, eggNEST is a seed capital fund targeting Portuguese startups in the fields of digital marketing and software engineering. eggNEST is partnered with VC firms such as Caixa Capital and Portugal Ventures, as well as accelerators such as Startup Lisboa and Startup Braga, to build the country’s startup ecosystem.

Private equity fund and incubator Balancop Ventures Ltd was founded in 2009 by Herman Wang who is based in Shanghai, China. Balancop will also establish and invest in its own stable of startups, including a telematics service company in China, GM’s Onstar and Toyota’s G-book. Balancop also has offices in Hong Kong and Indonesia.

Private equity fund and incubator Balancop Ventures Ltd was founded in 2009 by Herman Wang who is based in Shanghai, China. Balancop will also establish and invest in its own stable of startups, including a telematics service company in China, GM’s Onstar and Toyota’s G-book. Balancop also has offices in Hong Kong and Indonesia.

K11 is a shopping mall brand based in Hong Kong. It was founded in 2008 by entrepreneur Adrian Cheng. Cheng’s family owns and controls Hong Kong conglomerate New World Development, which deals mainly in property, infrastructure and services, department stores and hotels, and jewelry group Chow Tai Fook.

K11 is a shopping mall brand based in Hong Kong. It was founded in 2008 by entrepreneur Adrian Cheng. Cheng’s family owns and controls Hong Kong conglomerate New World Development, which deals mainly in property, infrastructure and services, department stores and hotels, and jewelry group Chow Tai Fook.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

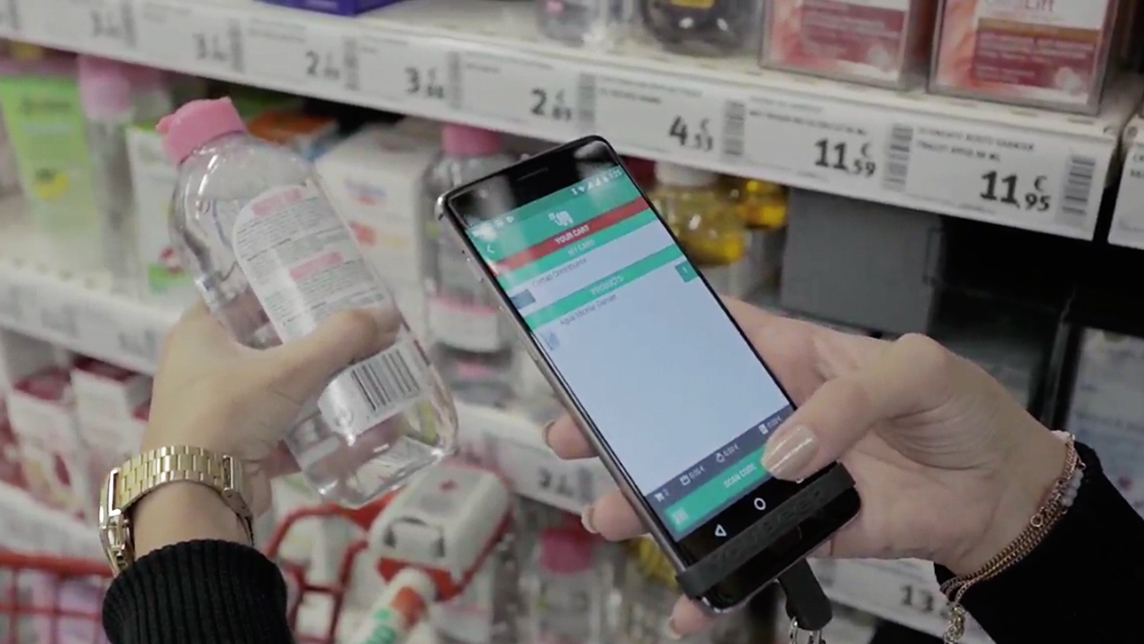

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

Plug-it and Drive-it with Wallbox’s EV quick chargers

Created by an ex-Tesla engineer, these generic chargers are fast and easy to use – just like recharging mobile phones

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

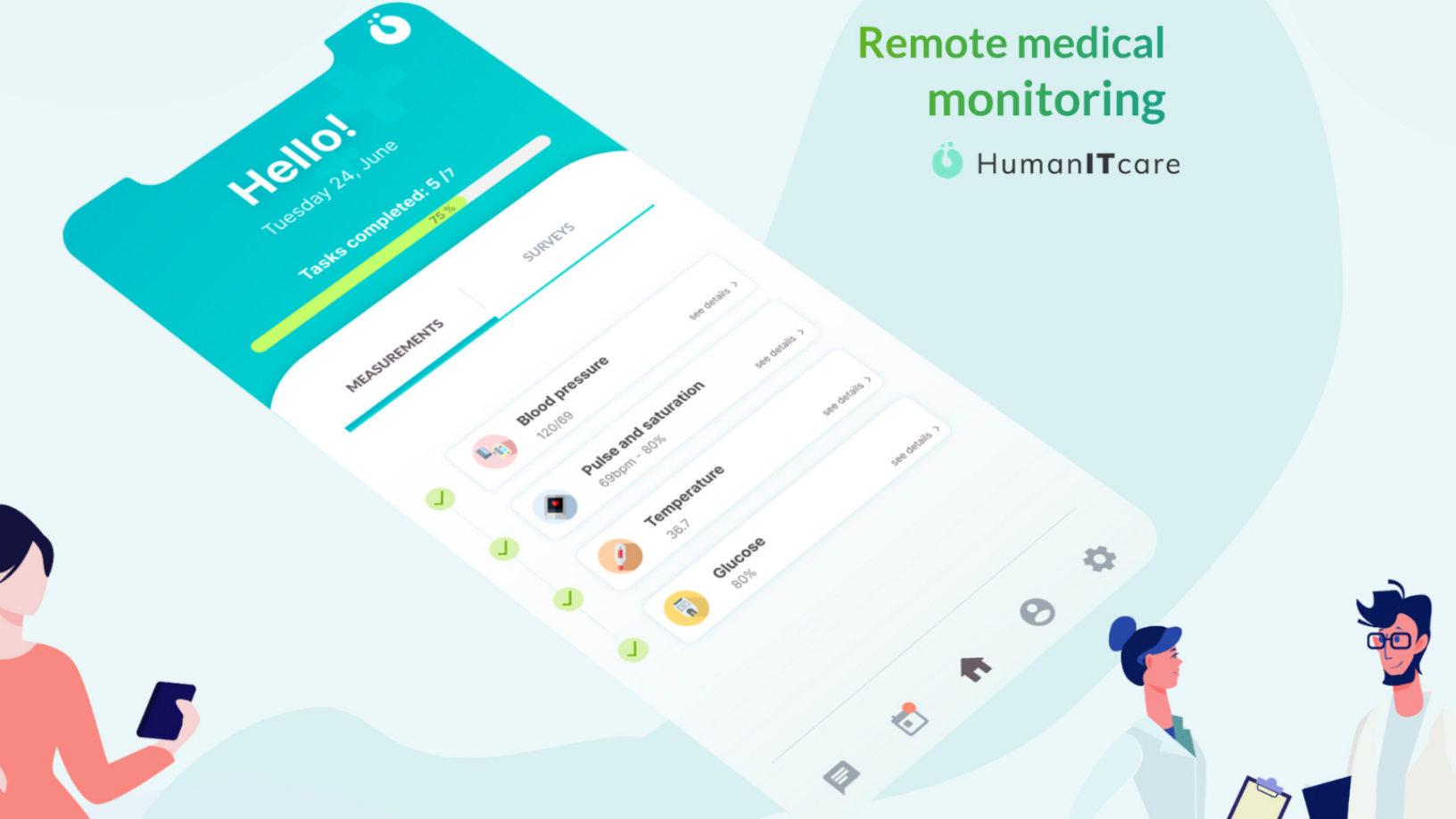

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

Alias Robotics: Award-winning cyber security pioneer reduces “clear and present danger” of robots

As machines become integral parts of daily life, Alias Robotics offers humans a way to solve the ever-increasing potential risks of robots

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Sorry, we couldn’t find any matches for“GK Plug and Play”.