GK Plug and Play

-

DATABASE (994)

-

ARTICLES (811)

Co-founder and CEO of Unbabel

Unbabel's Co-founder and CEO Vasco Pedro is a language technology expert and serial entrepreneur and holds a bachelor’s degree in Language and Knowledge Engineering from the University of Lisbon, and a Master’s and a Ph.D. in Language Technologies from Carnegie Mellon University. While at Carnegie Mellon, he interned at Siemens Medical Solutions and Google. Before co-founding Unbabel, he had co-founded adtechs Bueda and Dezine. He is also a Mentor and Associate at Beta-i startup promotion association in Lisbon.

Unbabel's Co-founder and CEO Vasco Pedro is a language technology expert and serial entrepreneur and holds a bachelor’s degree in Language and Knowledge Engineering from the University of Lisbon, and a Master’s and a Ph.D. in Language Technologies from Carnegie Mellon University. While at Carnegie Mellon, he interned at Siemens Medical Solutions and Google. Before co-founding Unbabel, he had co-founded adtechs Bueda and Dezine. He is also a Mentor and Associate at Beta-i startup promotion association in Lisbon.

Skype co-founder Toivo Annus currently is the founder and partner at Ambient Sound Investments (ASI) and has invested in 30 investments via ASI.

Skype co-founder Toivo Annus currently is the founder and partner at Ambient Sound Investments (ASI) and has invested in 30 investments via ASI.

Founded in 2003, Ginkgo conducts equity investments in companies from the consumer product and internet sectors (mainly e-commerce, new media and fintech).

Founded in 2003, Ginkgo conducts equity investments in companies from the consumer product and internet sectors (mainly e-commerce, new media and fintech).

Creandum invests in early-stage technology firms in the consumer internet, software and hardware sectors. The firm has grown from having 10 startups in its portfolio and an advisory team scattered across Sweden in 2007, to being headquartered in Stockholm with offices in Berlin, San Francisco and Guernsey and a total five funds raised worth over €700m. It's most recent fund raised €265m in 2019 and will ofcus on European startups. The company was the lead investor in more than a third of its almost 150 investments to date and was Spotify's first institutional investor. The most recent investments include in Spanish HR SaaS Factorial's €15m Series A round and in German tax assistant app Taxfix's US$65m Series C round.

Creandum invests in early-stage technology firms in the consumer internet, software and hardware sectors. The firm has grown from having 10 startups in its portfolio and an advisory team scattered across Sweden in 2007, to being headquartered in Stockholm with offices in Berlin, San Francisco and Guernsey and a total five funds raised worth over €700m. It's most recent fund raised €265m in 2019 and will ofcus on European startups. The company was the lead investor in more than a third of its almost 150 investments to date and was Spotify's first institutional investor. The most recent investments include in Spanish HR SaaS Factorial's €15m Series A round and in German tax assistant app Taxfix's US$65m Series C round.

Rothenberg Ventures is a Silicon Valley VC, also previously known as Frontier Technology Venture Capital. Based in San Francisco, the VC was also a spin-off from River Ecosystem. Founded with seed capital of $5m raised by Mike Rothenberg in 2012, the firm has invested in more than 100 startups in VR/AR, AI, machine learning, drones, robotics and space. In 2016, the VC and its founder were investigated by the US Securities and Exchange Commission. In 2018, Rothenberg himself and the VC were charged with fraud. Rothenberg has resigned from the firm and agreed to be barred from the brokerage and investment advisory business for five years. The SEC is seeking $18.8m disgorgement penalties and $9m civil penalty plus $3.7m pre-judgement interest.

Rothenberg Ventures is a Silicon Valley VC, also previously known as Frontier Technology Venture Capital. Based in San Francisco, the VC was also a spin-off from River Ecosystem. Founded with seed capital of $5m raised by Mike Rothenberg in 2012, the firm has invested in more than 100 startups in VR/AR, AI, machine learning, drones, robotics and space. In 2016, the VC and its founder were investigated by the US Securities and Exchange Commission. In 2018, Rothenberg himself and the VC were charged with fraud. Rothenberg has resigned from the firm and agreed to be barred from the brokerage and investment advisory business for five years. The SEC is seeking $18.8m disgorgement penalties and $9m civil penalty plus $3.7m pre-judgement interest.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

Based in the Netherlands, Prosus is a global investor in consumer tech and Internet companies. It is a subsidiary of South African tech investment company Naspers. In August 2021 the two companies completed a cross-holding agreement in which Naspers owns 57% of Prosus while Prosus owns 49% of Naspers. The two companies share a single board.Prosus is the largest shareholder in Chinese tech giant Tencent and Russian tech platform Mail.ru. Meanwhile, its venture division invests in a variety of fintech, food delivery, and other consumer tech companies. In Indonesia, it has invested in Bibit, a stock and mutual funds investment platform, as well as fishery trading and community development startup Aruna. It has also invested in edtech platforms like Indian executive learning platform Eruditus, and US-based coding education company SoloLearn.

Based in the Netherlands, Prosus is a global investor in consumer tech and Internet companies. It is a subsidiary of South African tech investment company Naspers. In August 2021 the two companies completed a cross-holding agreement in which Naspers owns 57% of Prosus while Prosus owns 49% of Naspers. The two companies share a single board.Prosus is the largest shareholder in Chinese tech giant Tencent and Russian tech platform Mail.ru. Meanwhile, its venture division invests in a variety of fintech, food delivery, and other consumer tech companies. In Indonesia, it has invested in Bibit, a stock and mutual funds investment platform, as well as fishery trading and community development startup Aruna. It has also invested in edtech platforms like Indian executive learning platform Eruditus, and US-based coding education company SoloLearn.

Founded in 2013 by board chairman of Longfor Properties Wu Yajun, Wu Capital conducts multistages investments and focuses on TMT, healthcare, fintech, consumption, culture and entertainment sectors. It has also co-founded Cloud Angel Fund with China Broadband Capital, Sequoia Capital China, Northern Light Venture Capital and GSR Ventures.

Founded in 2013 by board chairman of Longfor Properties Wu Yajun, Wu Capital conducts multistages investments and focuses on TMT, healthcare, fintech, consumption, culture and entertainment sectors. It has also co-founded Cloud Angel Fund with China Broadband Capital, Sequoia Capital China, Northern Light Venture Capital and GSR Ventures.

Ex-Yahoo COO Henrique De Castro is currently on the board of Target Corp. His work experience includes Google, Dell and McKinsey. He received his bachelor’s degree in Economics and Business from the Instituto Superior de Economia e Gestão, and his MBA from the International Institute for Management Development.

Ex-Yahoo COO Henrique De Castro is currently on the board of Target Corp. His work experience includes Google, Dell and McKinsey. He received his bachelor’s degree in Economics and Business from the Instituto Superior de Economia e Gestão, and his MBA from the International Institute for Management Development.

A Shanghai and Hong Kong-listed brokerage and investment bank, China Merchants Securities is one of China’s largest players, and part of the state-owned conglomerate, China Merchants Group.

A Shanghai and Hong Kong-listed brokerage and investment bank, China Merchants Securities is one of China’s largest players, and part of the state-owned conglomerate, China Merchants Group.

Captii Ventures focuses on building Southeast Asian based startups by providing access to entrepreneurial expertise and experience to support business growth and development. It is a multi stage investor, with a special interest in mobile tech startups, marketplace platforms that facilitate better matching of supply and demand and in new media that disrupts traditional communication channels. It likes startups that use technology to solve age old problems.

Captii Ventures focuses on building Southeast Asian based startups by providing access to entrepreneurial expertise and experience to support business growth and development. It is a multi stage investor, with a special interest in mobile tech startups, marketplace platforms that facilitate better matching of supply and demand and in new media that disrupts traditional communication channels. It likes startups that use technology to solve age old problems.

Coatue is a tech sector hedge fund that invests in public and private equity markets. It is run by Philippe Laffont, who founded the hedge fund after leaving Tiger Management in 1999. Coatue is based in New York City and has several other offices around the globe. Its Beijing office was set up in 2014 and has since invested in several notable Chinese startups, including Didi Chuxing, Mafengwo and Kuaikan Comic.

Coatue is a tech sector hedge fund that invests in public and private equity markets. It is run by Philippe Laffont, who founded the hedge fund after leaving Tiger Management in 1999. Coatue is based in New York City and has several other offices around the globe. Its Beijing office was set up in 2014 and has since invested in several notable Chinese startups, including Didi Chuxing, Mafengwo and Kuaikan Comic.

The Madrid-based JME Venture Capital invests mostly in early-stage Spanish technology startups, from seed to Series A rounds. The fund was launched in 2016, worth €50 million, and is headed by CEO Javier Alarcó and CIO Samuel Gil.JME VC is part of the Fundación José Manuel Entrecanales, an innovation and entrepreneurship foundation started and headed by José Manuel Entrecanales Domecq, the boss of Spanish infrastructure giant Acciona.

The Madrid-based JME Venture Capital invests mostly in early-stage Spanish technology startups, from seed to Series A rounds. The fund was launched in 2016, worth €50 million, and is headed by CEO Javier Alarcó and CIO Samuel Gil.JME VC is part of the Fundación José Manuel Entrecanales, an innovation and entrepreneurship foundation started and headed by José Manuel Entrecanales Domecq, the boss of Spanish infrastructure giant Acciona.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

Plug-it and Drive-it with Wallbox’s EV quick chargers

Created by an ex-Tesla engineer, these generic chargers are fast and easy to use – just like recharging mobile phones

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

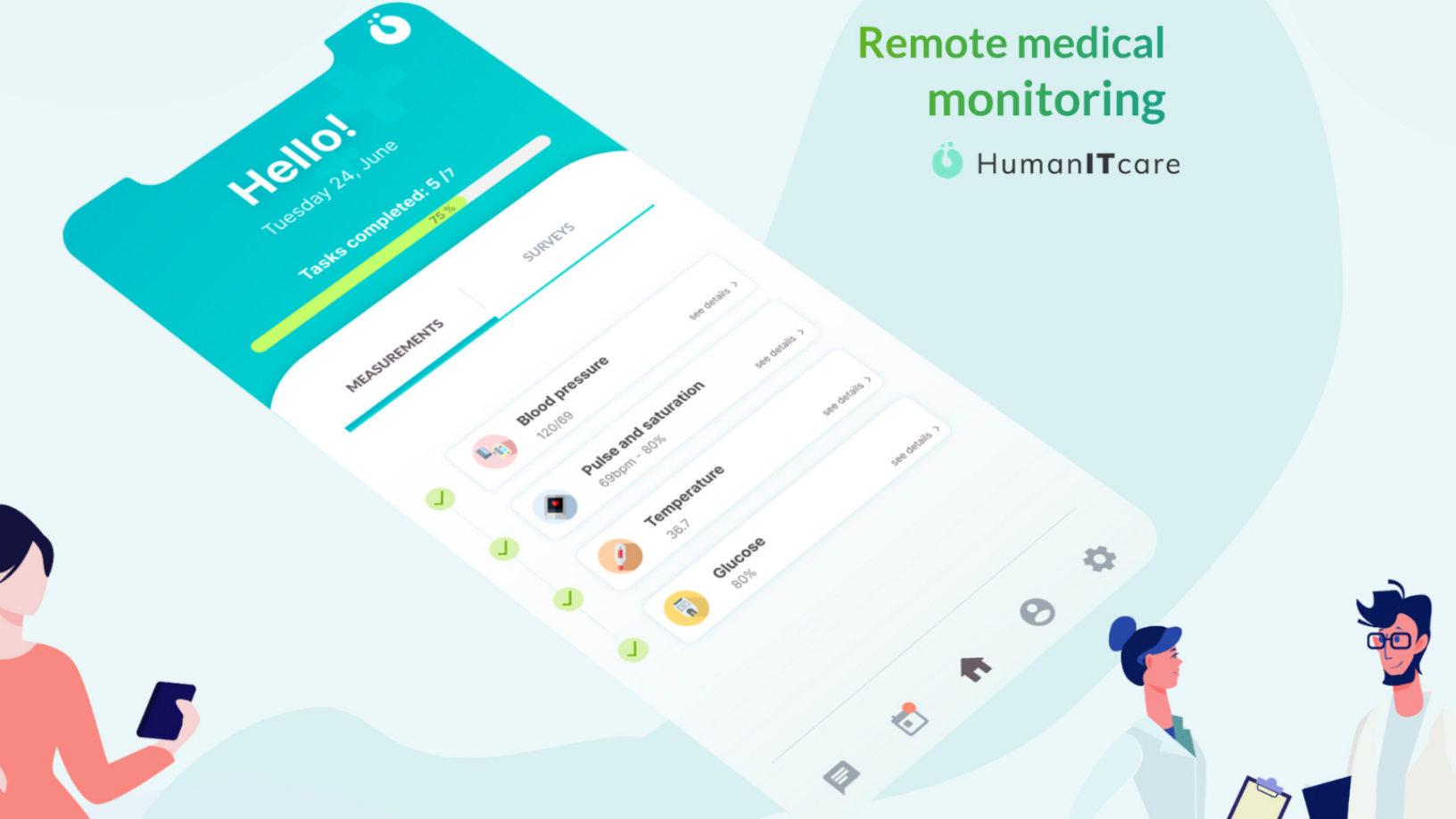

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

Alias Robotics: Award-winning cyber security pioneer reduces “clear and present danger” of robots

As machines become integral parts of daily life, Alias Robotics offers humans a way to solve the ever-increasing potential risks of robots

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Sorry, we couldn’t find any matches for“GK Plug and Play”.