GK Plug and Play

-

DATABASE (994)

-

ARTICLES (811)

All Iron Ventures, inspired by the “alliron” cry of the Biscay province in Spain, is a venture capital firm based in Bilbao. The VC was established by Ander Michelena and Jon Uriarte, the co-founders of Ticketbis who sold the business to eBay in 2016 for €165 million. The VC invests in capital-efficient and fast-growing e-commerce and marketplaces in Europe and the US.

All Iron Ventures, inspired by the “alliron” cry of the Biscay province in Spain, is a venture capital firm based in Bilbao. The VC was established by Ander Michelena and Jon Uriarte, the co-founders of Ticketbis who sold the business to eBay in 2016 for €165 million. The VC invests in capital-efficient and fast-growing e-commerce and marketplaces in Europe and the US.

Founded in 2007 in Shanghai, CTC Capital currently has branches in Beijing, Suzhou and Taipei. The company invests in both US dollars and RMB and has three funds under its management. It mainly targets the TMT, clean energy and consumer product sectors. Half of its management team have many years experience working in Taiwan’s semiconductor industry. In 2019, CTC Capital set up the Guodiao Guoxin Zhixin Fund to invest in the semiconductor integrated circuit sector.

Founded in 2007 in Shanghai, CTC Capital currently has branches in Beijing, Suzhou and Taipei. The company invests in both US dollars and RMB and has three funds under its management. It mainly targets the TMT, clean energy and consumer product sectors. Half of its management team have many years experience working in Taiwan’s semiconductor industry. In 2019, CTC Capital set up the Guodiao Guoxin Zhixin Fund to invest in the semiconductor integrated circuit sector.

BAN madri+d is a network of angel investors specializing in finding and backing technology-based startups in their seed stage of development and also headquartered in Madrid .With over 116 active investors, the institution aims to establish a competitive entrepreneurial ecosystem through collaboration with business experts, research centers and public institutions.To date, BAN madri+d has already invested (directly and indirectly) more than €70,000 across 480 projects.

BAN madri+d is a network of angel investors specializing in finding and backing technology-based startups in their seed stage of development and also headquartered in Madrid .With over 116 active investors, the institution aims to establish a competitive entrepreneurial ecosystem through collaboration with business experts, research centers and public institutions.To date, BAN madri+d has already invested (directly and indirectly) more than €70,000 across 480 projects.

Founded in October 1995, CITIC Securities is China's first securities company listed in Shanghai and the Hong Kong. CITIC is its major shareholder, with 15.47% stake in it. The company provides services from securities trading, brokerage, asset management to investment banking. In 2013, CITIC Securities acquired CLSA to extend its international businesses. With branches in 13 countries and regions, it now has over 40,000 business clients and more than 10.3m individual customers home and abroad.

Founded in October 1995, CITIC Securities is China's first securities company listed in Shanghai and the Hong Kong. CITIC is its major shareholder, with 15.47% stake in it. The company provides services from securities trading, brokerage, asset management to investment banking. In 2013, CITIC Securities acquired CLSA to extend its international businesses. With branches in 13 countries and regions, it now has over 40,000 business clients and more than 10.3m individual customers home and abroad.

Subtraction Capital is a VC founded by managing partner Jason Portnoy who was previously VP of Financial Planning and Analysis at PayPal Inc.Portnoy supports portfolio companies in their scale-up and hyper-growth stage, working with their CEOs to raise capital, navigate complex negotiations, build and manage teams. The firm typically invests in SaaS startups in the San Francisco Bay Area and Salt Lake City.

Subtraction Capital is a VC founded by managing partner Jason Portnoy who was previously VP of Financial Planning and Analysis at PayPal Inc.Portnoy supports portfolio companies in their scale-up and hyper-growth stage, working with their CEOs to raise capital, navigate complex negotiations, build and manage teams. The firm typically invests in SaaS startups in the San Francisco Bay Area and Salt Lake City.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

Co-founder & CFO of Triporate

Francisco Vieira is a co-founder and the CFO of Triporate, a startup that applies AI to corporate travel planning. He had also co-founded HelpUp, a digital platform that connects people with companies and non-governmental organizations. Viera has worked at PwC, Digitex and Isolux Corsan and has experience in auditing as well as financial control and reporting across Spain and Latin America. Vieria graduated with double bachelor degrees in Business Administration and Law and holds a master’s in Finance and Auditing.

Francisco Vieira is a co-founder and the CFO of Triporate, a startup that applies AI to corporate travel planning. He had also co-founded HelpUp, a digital platform that connects people with companies and non-governmental organizations. Viera has worked at PwC, Digitex and Isolux Corsan and has experience in auditing as well as financial control and reporting across Spain and Latin America. Vieria graduated with double bachelor degrees in Business Administration and Law and holds a master’s in Finance and Auditing.

Based in Madrid, K Fund is a VC firm founded in July 2016 by Ian Noel and Iñaki Arrola, focusing on seed and early-stage investments in digital technology startups. It has to date raised one fund of €50m. As of 1Q 2020, K Fund had invested in 25 companies, with its most recent investments including HR platform Factorial's €15m Series A round and in open source platform Frontity's €1m seed round.Noel represents Bonsai VC while Arrola is a serial entrepreneur (Coches.com and Vitamina K). A third co-founder is Carina Szpilka from ING Direct. Other team members include Ignacio Larrú (IE Business School), Pablo Ventura (JME Ventures) and technology journalist Jaime Novoa (Novobrief, Tech.eu). K Fund’s other investors include public institutions such as EIF and private investors.

Based in Madrid, K Fund is a VC firm founded in July 2016 by Ian Noel and Iñaki Arrola, focusing on seed and early-stage investments in digital technology startups. It has to date raised one fund of €50m. As of 1Q 2020, K Fund had invested in 25 companies, with its most recent investments including HR platform Factorial's €15m Series A round and in open source platform Frontity's €1m seed round.Noel represents Bonsai VC while Arrola is a serial entrepreneur (Coches.com and Vitamina K). A third co-founder is Carina Szpilka from ING Direct. Other team members include Ignacio Larrú (IE Business School), Pablo Ventura (JME Ventures) and technology journalist Jaime Novoa (Novobrief, Tech.eu). K Fund’s other investors include public institutions such as EIF and private investors.

Juan García Perrote is an IESE Business School MBA graduate with over 10 years of experience in executive marketing roles. He is also serial entrepreneur in marketplace and digital marketing startups. He was the co-founder of Tick4all, the “last-minute of movie-tickets,” offering discounted seats at local cinemas, and COO of the referral marketing platform Fulltip. He was also partner and CEO of the digital marketing company Smart Client.Currently, he is CEO and founder of Ketplace, a marketplace sales management consultancy advising companies how to get the best sales performance in leading marketplaces such as Amazon, eBay, and AliExpress. García Perrote is also a partner and advisor in The Beemine Lab, the first biotechnology company in Spain to produce cannabidiol-based cosmetics.

Juan García Perrote is an IESE Business School MBA graduate with over 10 years of experience in executive marketing roles. He is also serial entrepreneur in marketplace and digital marketing startups. He was the co-founder of Tick4all, the “last-minute of movie-tickets,” offering discounted seats at local cinemas, and COO of the referral marketing platform Fulltip. He was also partner and CEO of the digital marketing company Smart Client.Currently, he is CEO and founder of Ketplace, a marketplace sales management consultancy advising companies how to get the best sales performance in leading marketplaces such as Amazon, eBay, and AliExpress. García Perrote is also a partner and advisor in The Beemine Lab, the first biotechnology company in Spain to produce cannabidiol-based cosmetics.

Tony Fadell is the inventor of the iPod, co-inventor of the iPhone, and former CEO and founder of Nest Labs, which was later acquired by Google. He is also an angel investor and head of Paris-based deeptech advisory and investing firm Future Shape, which has over 200 companies in its portfolio and a focus on issues like the electrification and digital connection of things, biomanufacturing and the eradication of waste. Fadell has invested in at least 10 startups, with his most recent disclosed investments having taken place in 4Q20. These included his participation in the $7m seed round of London-based consumer technology and conceptual design house Nothing, the $45m Series B round of US biotech firm and vegan leather maker MycoWorks, well as the $31m Series A round of video call effects and presentation tools company mmhmm.

Tony Fadell is the inventor of the iPod, co-inventor of the iPhone, and former CEO and founder of Nest Labs, which was later acquired by Google. He is also an angel investor and head of Paris-based deeptech advisory and investing firm Future Shape, which has over 200 companies in its portfolio and a focus on issues like the electrification and digital connection of things, biomanufacturing and the eradication of waste. Fadell has invested in at least 10 startups, with his most recent disclosed investments having taken place in 4Q20. These included his participation in the $7m seed round of London-based consumer technology and conceptual design house Nothing, the $45m Series B round of US biotech firm and vegan leather maker MycoWorks, well as the $31m Series A round of video call effects and presentation tools company mmhmm.

InnovationRCA is the Royal College of Art’s center for entrepreneurship and commercialization. It supports RCA students, alumni and employees looking to turn their ideas into new businesses. The center was established in 2004 and is based in London.The centre’s activities include providing startup incubation and acceleration services to potential RCA spin-offs. This includes coaching and business mentoring based on RCA’s design-led, user-centric approach, as well as intellectual property advice and support. In addition, the center offers access to office and workshop space, as well as funding. InnovationRCA runs its own angel investor network, AngelClubRCA. It has also partnered with a UK-based VC, Venrex Investment Management, to improve RCA startups’ access to private funding. In addition, the centre conducts programmes for external entrepreneurs and organisations looking to promote innovation and entrepreneurship worldwide.McKinsey has called InnovationRCA a “world-class spinout incubator", praising its work as a "significant driver of entrepreneurial growth” along with its ”impressive results". In July 2019, the UK Business Angels Association also named InnovationRCA its Accelerator of the Year.

InnovationRCA is the Royal College of Art’s center for entrepreneurship and commercialization. It supports RCA students, alumni and employees looking to turn their ideas into new businesses. The center was established in 2004 and is based in London.The centre’s activities include providing startup incubation and acceleration services to potential RCA spin-offs. This includes coaching and business mentoring based on RCA’s design-led, user-centric approach, as well as intellectual property advice and support. In addition, the center offers access to office and workshop space, as well as funding. InnovationRCA runs its own angel investor network, AngelClubRCA. It has also partnered with a UK-based VC, Venrex Investment Management, to improve RCA startups’ access to private funding. In addition, the centre conducts programmes for external entrepreneurs and organisations looking to promote innovation and entrepreneurship worldwide.McKinsey has called InnovationRCA a “world-class spinout incubator", praising its work as a "significant driver of entrepreneurial growth” along with its ”impressive results". In July 2019, the UK Business Angels Association also named InnovationRCA its Accelerator of the Year.

Established in San Francisco in 1998, global VC firm e.ventures now has offices and teams in the US, Brazil, Germany, China and Japan. The company invests from seed stage to later stages in sums ranging from US$500,000 to US$30m. It has invested in over 275 companies to date, as lead investor in 70, and has managed 42 exits, including Groupon and Farfetch. Recent investments include cloud-based contract management company Icertis's US$115m Series E round and workforce app Staffbase's Series C round. The VC has six investment funds, totaling US$1.1bn, including a US$125m European-dedicated fund established in June 2019.

Established in San Francisco in 1998, global VC firm e.ventures now has offices and teams in the US, Brazil, Germany, China and Japan. The company invests from seed stage to later stages in sums ranging from US$500,000 to US$30m. It has invested in over 275 companies to date, as lead investor in 70, and has managed 42 exits, including Groupon and Farfetch. Recent investments include cloud-based contract management company Icertis's US$115m Series E round and workforce app Staffbase's Series C round. The VC has six investment funds, totaling US$1.1bn, including a US$125m European-dedicated fund established in June 2019.

Based in Porto, Nuno Miller joined Sonae as head of digital channels in 2015 and eventually became the chief digital and information officer at Sonae S&F in March 2018. He was CIO at Farfetch for three years until 2014 when he was named as European CIO of the year by CIONET and INSEAD.Graduating as an IT engineer in 1994, Miller initially worked as a systems engineer at DTTI for four years before joining Deloitte's as a business unit manager. He completed an executive MBA at EUDEM in 2002 and became the CIO and director of Organtex.

Based in Porto, Nuno Miller joined Sonae as head of digital channels in 2015 and eventually became the chief digital and information officer at Sonae S&F in March 2018. He was CIO at Farfetch for three years until 2014 when he was named as European CIO of the year by CIONET and INSEAD.Graduating as an IT engineer in 1994, Miller initially worked as a systems engineer at DTTI for four years before joining Deloitte's as a business unit manager. He completed an executive MBA at EUDEM in 2002 and became the CIO and director of Organtex.

Based in Barcelona, Javier Sánchez Marco founded investment consultancy Obersis in 2007. He has also co-founded various startups as CEO including Furgo, Tapnex and Eventoprix. He has vast experience in the internet, mobile and FMCG industries. Passionate about new tech innovations, he is also an angel investor and supported Glovo in 2015.He graduated in agribusiness and marketing in 1994 and worked in the industry for over eight years at Grupo Ybarra Alimentacion. He has also worked in Mexico as director for Bravo Game Studios (Genera Games) until 2010. He returned to Spain as general manager for the company until 2012.

Based in Barcelona, Javier Sánchez Marco founded investment consultancy Obersis in 2007. He has also co-founded various startups as CEO including Furgo, Tapnex and Eventoprix. He has vast experience in the internet, mobile and FMCG industries. Passionate about new tech innovations, he is also an angel investor and supported Glovo in 2015.He graduated in agribusiness and marketing in 1994 and worked in the industry for over eight years at Grupo Ybarra Alimentacion. He has also worked in Mexico as director for Bravo Game Studios (Genera Games) until 2010. He returned to Spain as general manager for the company until 2012.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

Plug-it and Drive-it with Wallbox’s EV quick chargers

Created by an ex-Tesla engineer, these generic chargers are fast and easy to use – just like recharging mobile phones

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

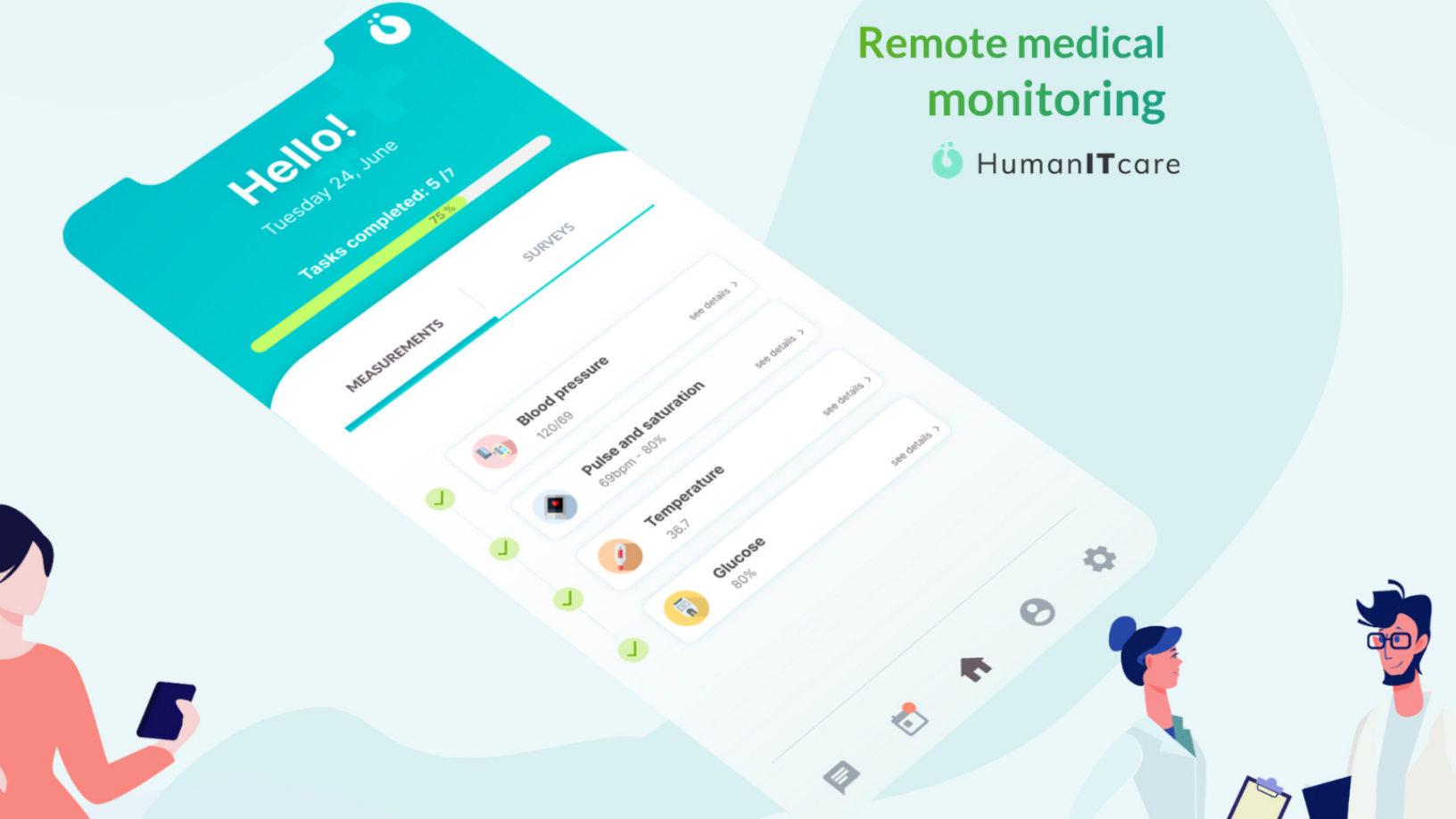

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

Alias Robotics: Award-winning cyber security pioneer reduces “clear and present danger” of robots

As machines become integral parts of daily life, Alias Robotics offers humans a way to solve the ever-increasing potential risks of robots

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Sorry, we couldn’t find any matches for“GK Plug and Play”.