GK Plug and Play

-

DATABASE (994)

-

ARTICLES (811)

Mahanusa Capital is a financial services company founded by Daniel Budiman. The firm provides investment banking and brokerage services through its subsidiaries, Mahanusa Securities and Magna Finance. It also manages major property assets in Indonesia, including the Pacific Place mall in Jakarta. Mahanusa Capital has invested in digital signature startup PrivyID and local event discovery app Goers.

Mahanusa Capital is a financial services company founded by Daniel Budiman. The firm provides investment banking and brokerage services through its subsidiaries, Mahanusa Securities and Magna Finance. It also manages major property assets in Indonesia, including the Pacific Place mall in Jakarta. Mahanusa Capital has invested in digital signature startup PrivyID and local event discovery app Goers.

Everhaus is a VC firm headquartered in Jakarta, investing primarily in southeast asian startups. The Everhaus team's expertise is primarily in data analytics and financial services, which it uses to "catalyze new retail and sharing economy" in the region. The VC has backed car-sharing startup HipCar, interactive video platform TADO and on-demand services provider Seekmi.

Everhaus is a VC firm headquartered in Jakarta, investing primarily in southeast asian startups. The Everhaus team's expertise is primarily in data analytics and financial services, which it uses to "catalyze new retail and sharing economy" in the region. The VC has backed car-sharing startup HipCar, interactive video platform TADO and on-demand services provider Seekmi.

TPG-SV China Ventures is a joint investment venture established in September 2018 by SoftBank Ventures Korea and private equity group TPG. With a fund of $300m, the VC is managed by TPG’s China team in the TMT industry and seeks early-stage investment opportunities in internet, technology and media.

TPG-SV China Ventures is a joint investment venture established in September 2018 by SoftBank Ventures Korea and private equity group TPG. With a fund of $300m, the VC is managed by TPG’s China team in the TMT industry and seeks early-stage investment opportunities in internet, technology and media.

Founded in Beijing in 2012, Ying Capital specializes in private equity investment in manufacturing in China. It has branch offices in Suzhou and Shenzhen. The firm mainly invests in the applications of intelligent technology, IoT and robots in manufacturing. It also has interests in supply chains, automobiles, electronics, new energy, textiles and garments.

Founded in Beijing in 2012, Ying Capital specializes in private equity investment in manufacturing in China. It has branch offices in Suzhou and Shenzhen. The firm mainly invests in the applications of intelligent technology, IoT and robots in manufacturing. It also has interests in supply chains, automobiles, electronics, new energy, textiles and garments.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

UNIQA Ventures is the venture capital arm of the UNIQA Group, a leading insurance entity headquartered in Austria and operating also across Central and Eastern Europe. With about 40 companies in 18 countries, the UNIQA group serves about 15.5 million customers. UNIQA Ventures' investment focus is in insurtech, fintech and digital health care.

UNIQA Ventures is the venture capital arm of the UNIQA Group, a leading insurance entity headquartered in Austria and operating also across Central and Eastern Europe. With about 40 companies in 18 countries, the UNIQA group serves about 15.5 million customers. UNIQA Ventures' investment focus is in insurtech, fintech and digital health care.

Based in Beijing, Xianghe Capital was founded in 2016. It runs a USD fund and an RMB fund. The founders of Xianghe Capital formerly led Baidu’s investment department. Xianghe Capital invests in the following areas: artificial intelligence, internet and traditional industries (e.g., online education, logistics, finance, medical care), B2B, culture, entertainment and enterprise services.

Based in Beijing, Xianghe Capital was founded in 2016. It runs a USD fund and an RMB fund. The founders of Xianghe Capital formerly led Baidu’s investment department. Xianghe Capital invests in the following areas: artificial intelligence, internet and traditional industries (e.g., online education, logistics, finance, medical care), B2B, culture, entertainment and enterprise services.

Toutiao is a mobile news aggregation platform. It has invested in over 30 startups for financial and strategic reasons. Because Toutiao requires a lot of content, it has invested heavily in content-based startups such as AI Era, Kuaikan, etc. It also invests in social media platforms and similar content providers, e.g., Dailyhunt.in, Flipagram and Musical.ly.

Toutiao is a mobile news aggregation platform. It has invested in over 30 startups for financial and strategic reasons. Because Toutiao requires a lot of content, it has invested heavily in content-based startups such as AI Era, Kuaikan, etc. It also invests in social media platforms and similar content providers, e.g., Dailyhunt.in, Flipagram and Musical.ly.

CEO and Co-founder of Oceanium

Karen Scofield Seal is the CEO and co-founder of Oceanium, a Scottish startup developing marine-safe bio packaging and plant-based food and nutrition products from sustainably farmed seaweed. During the 90s she lived in New York working as Senior Manager and Producer for the National Football League, as Production Supervisor and Event director at the US OPEN Tennis, and as Coordinating Producer at ABC News.She later moved to London with her husband, where she worked in Comic Relief and in RED, liaising with Apple, American Express and Converse partnerships. In 2009 she co-founded LUCZA, a luxury e-commerce active since 2014. There, she executed marketing and PR strategies including offline and online initiatives.

Karen Scofield Seal is the CEO and co-founder of Oceanium, a Scottish startup developing marine-safe bio packaging and plant-based food and nutrition products from sustainably farmed seaweed. During the 90s she lived in New York working as Senior Manager and Producer for the National Football League, as Production Supervisor and Event director at the US OPEN Tennis, and as Coordinating Producer at ABC News.She later moved to London with her husband, where she worked in Comic Relief and in RED, liaising with Apple, American Express and Converse partnerships. In 2009 she co-founded LUCZA, a luxury e-commerce active since 2014. There, she executed marketing and PR strategies including offline and online initiatives.

Co-founder and CEO of Wide Eyes

Luis Manent is a co-founder and CEO of Wide Eyes, a visual search engine for the fashion and retail industry. Manent had previously managed and consulted with both large companies and SMEs across a variety of industry sectors, from healthcare and logistics to retail and fashion. Manent holds an Executive MBA from Spain's IESE business school.

Luis Manent is a co-founder and CEO of Wide Eyes, a visual search engine for the fashion and retail industry. Manent had previously managed and consulted with both large companies and SMEs across a variety of industry sectors, from healthcare and logistics to retail and fashion. Manent holds an Executive MBA from Spain's IESE business school.

A spinoff from Chinese investment bank China International Capital Corp, CDH has its roots in private equity. It started in 2002, raising its first fund of US$102 million. As of end-2015, it had over US$15 billion in assets under management, spanning private equity, public equities, real estate and more. It has invested in more than 150 companies, including WH Group, Belle International, Mengniu Dairy, Qihoo 360 and Luye Pharma; and has offices in Beijing, Hong Kong, Shanghai, Shenzhen, Singapore and Jakarta.

A spinoff from Chinese investment bank China International Capital Corp, CDH has its roots in private equity. It started in 2002, raising its first fund of US$102 million. As of end-2015, it had over US$15 billion in assets under management, spanning private equity, public equities, real estate and more. It has invested in more than 150 companies, including WH Group, Belle International, Mengniu Dairy, Qihoo 360 and Luye Pharma; and has offices in Beijing, Hong Kong, Shanghai, Shenzhen, Singapore and Jakarta.

KapanLagi Network (KLN) is a media company that was co-founded in 2003 by Steve Christian and Eka Wiharto. Originally launched as KapanLagi.com, it was later expanded with the additions of specialist platforms such as the news portal Merdeka.com and football website Bola.net. KLN later merged with the Fimela Network of lifestyle websites in 2014, transforming the group into one of Indonesia’s major online content and media services player. KLN is 52% owned by Singapore’s MediaCorp, with well-known clients like Bank Mandiri, Telkomsel, Allianz and Nestle.

KapanLagi Network (KLN) is a media company that was co-founded in 2003 by Steve Christian and Eka Wiharto. Originally launched as KapanLagi.com, it was later expanded with the additions of specialist platforms such as the news portal Merdeka.com and football website Bola.net. KLN later merged with the Fimela Network of lifestyle websites in 2014, transforming the group into one of Indonesia’s major online content and media services player. KLN is 52% owned by Singapore’s MediaCorp, with well-known clients like Bank Mandiri, Telkomsel, Allianz and Nestle.

Palladium Capital is a London-based private investment firm, originally established in 2005 as an independent strategic and financial adviser focusing on Central and Eastern Europe.Since 2010, Palladium has expanded activities to include Western Europe, Middle East, North Africa and Turkey. In 2014, the firm started direct private equity investments, acting on behalf of private family-owned funds and strategic investment partners. In February 2018, the advisory business was transferred to the newly formed sister company XPX Partners.

Palladium Capital is a London-based private investment firm, originally established in 2005 as an independent strategic and financial adviser focusing on Central and Eastern Europe.Since 2010, Palladium has expanded activities to include Western Europe, Middle East, North Africa and Turkey. In 2014, the firm started direct private equity investments, acting on behalf of private family-owned funds and strategic investment partners. In February 2018, the advisory business was transferred to the newly formed sister company XPX Partners.

Kinzon Capital was co-founded by several former senior executives of Fosun Kinzon Capital (now called Fosun RZ Capital) in 2016. It invests primarily in early- and growth-stage TMT companies from China and the US. Kinzon Capital has offices in Beijing, Shanghai, Shenzhen and Silicon Valley and has invested RMB 2 billion in potential companies.

Kinzon Capital was co-founded by several former senior executives of Fosun Kinzon Capital (now called Fosun RZ Capital) in 2016. It invests primarily in early- and growth-stage TMT companies from China and the US. Kinzon Capital has offices in Beijing, Shanghai, Shenzhen and Silicon Valley and has invested RMB 2 billion in potential companies.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

Plug-it and Drive-it with Wallbox’s EV quick chargers

Created by an ex-Tesla engineer, these generic chargers are fast and easy to use – just like recharging mobile phones

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

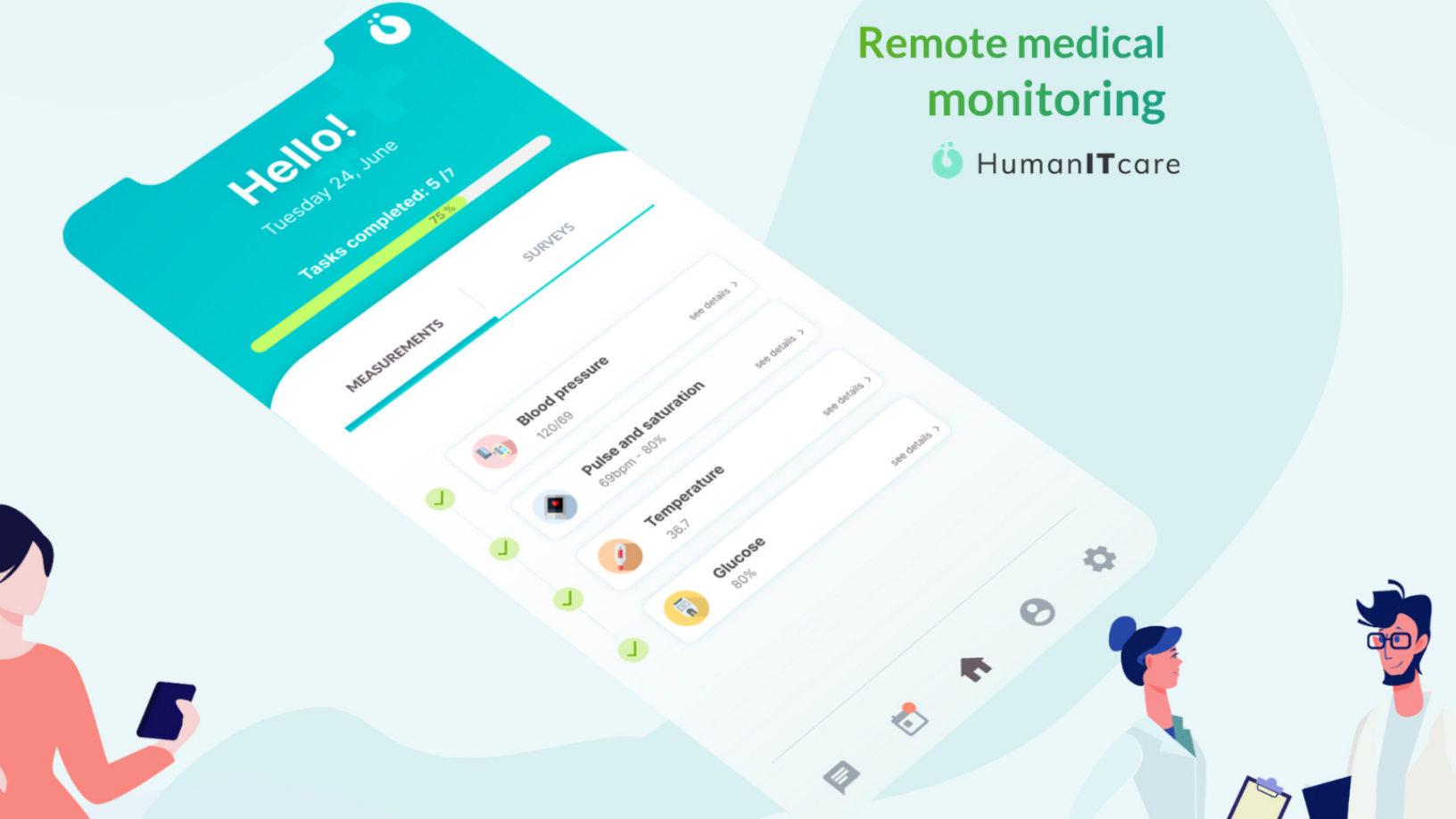

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

Alias Robotics: Award-winning cyber security pioneer reduces “clear and present danger” of robots

As machines become integral parts of daily life, Alias Robotics offers humans a way to solve the ever-increasing potential risks of robots

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Sorry, we couldn’t find any matches for“GK Plug and Play”.