GK Plug and Play

DATABASE (994)

ARTICLES (811)

Huayi Brothers Media Corporation

Established in 1994 by Wang Zhongjun and Wang Zhonglei, Huayi Brothers Media Corporation (H. Brothers) is a large media and entertainment group in mainland China. It focuses on three major areas: film, TV and celebrity management; commercial properties that promote entertainment companies’ IP such as theme parks and film-themed tourist destinations; and new media projects such as social media, online gaming and internet fan community management. Alibaba, Tencent Holdings and PingAn have all been shareholders in H. Brothers since 2014.

Established in 1994 by Wang Zhongjun and Wang Zhonglei, Huayi Brothers Media Corporation (H. Brothers) is a large media and entertainment group in mainland China. It focuses on three major areas: film, TV and celebrity management; commercial properties that promote entertainment companies’ IP such as theme parks and film-themed tourist destinations; and new media projects such as social media, online gaming and internet fan community management. Alibaba, Tencent Holdings and PingAn have all been shareholders in H. Brothers since 2014.

Founded by Matt Hu (former head of asset management, China Securities) and John Wu (ex-Alibaba CTO and angel investor), Fenghe runs its PE/VC and hedge fund businesses out of Singapore and Shanghai.

Founded by Matt Hu (former head of asset management, China Securities) and John Wu (ex-Alibaba CTO and angel investor), Fenghe runs its PE/VC and hedge fund businesses out of Singapore and Shanghai.

Angel Investment Network Indonesia (ANGIN)

ANGIN (Angel Investment Network Indonesia) is the first and largest network of angel investors in Indonesia. The funding and mentoring network comprises high net-worth individuals from diverse industry sectors, including venture capitalists, senior executives and celebrities. ANGIN also manages its own impact investment fund and a fund for women’s empowerment and entrepreneurship.

ANGIN (Angel Investment Network Indonesia) is the first and largest network of angel investors in Indonesia. The funding and mentoring network comprises high net-worth individuals from diverse industry sectors, including venture capitalists, senior executives and celebrities. ANGIN also manages its own impact investment fund and a fund for women’s empowerment and entrepreneurship.

Boyu Capital is a China-focused investment firm with offices in Beijing and Hong Kong. It manages tens of billions of US dollars and is one of the largest private equity investment firm in China, and mainly invests in sectors of consumer and retail, financial services, healthcare, media and technology.Boyu Capital was founded in 2011 by the late Ma Xuezheng (died in September 2019), former senior vice-president and financial director of Lenovo Group and managing director and partner of TPG, and Zhang Zixin (Louis Cheung), former general manager of Ping An Insurance. Boyu Capital's first chairman of the board was Jiang Zhicheng (Alvin Jiang), the grandson of former Chinese president Jiang Zemin.

Boyu Capital is a China-focused investment firm with offices in Beijing and Hong Kong. It manages tens of billions of US dollars and is one of the largest private equity investment firm in China, and mainly invests in sectors of consumer and retail, financial services, healthcare, media and technology.Boyu Capital was founded in 2011 by the late Ma Xuezheng (died in September 2019), former senior vice-president and financial director of Lenovo Group and managing director and partner of TPG, and Zhang Zixin (Louis Cheung), former general manager of Ping An Insurance. Boyu Capital's first chairman of the board was Jiang Zhicheng (Alvin Jiang), the grandson of former Chinese president Jiang Zemin.

Established in 1977, Matrix Partners is an American venture capital firm with offices in San Francisco and Cambridge in the US, as well as in Shanghai, Beijing, Mumbai and Bangalore, and has invested in prominent companies like Apple and FedEx. It participates in all stages of investment and, to date, has invested over US$4 billion and has over US$4 billion currently under management. The company has invested in more than 500 companies and was lead investor in over 150. It has seen more than 100 exits. Recent investments include US$11 million in Brightback Series A and in Klook's Series D.

Established in 1977, Matrix Partners is an American venture capital firm with offices in San Francisco and Cambridge in the US, as well as in Shanghai, Beijing, Mumbai and Bangalore, and has invested in prominent companies like Apple and FedEx. It participates in all stages of investment and, to date, has invested over US$4 billion and has over US$4 billion currently under management. The company has invested in more than 500 companies and was lead investor in over 150. It has seen more than 100 exits. Recent investments include US$11 million in Brightback Series A and in Klook's Series D.

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

LocalGlobe is one of the most active VC firms in the UK. Founded by father and son Robin and Saul Klein in 1999 and focused on seed and early-stage fundings, the firm has undertaken over 200 investments to date.In 2019, LocalGlobe aims to launch a new sister fund called Latitude to help startups in their investment portfolio, to scale up and to continue after seed through later funding rounds. LocalGlobe has managed 28 exits to date including Graze, Bitly and Zoopla. Its recent investments include in Zencargo and Weengs' Series A rounds and in VOI Technology's Series B round.

Accel, formerly known as Accel Partners, is a US venture capital firm, with its headquarters in Palo Alto, California, and additional offices in San Francisco. It also operates funds for Europe and Israel, with offices in London, UK, and has funds for India and China. It was founded in 1983 and has backed some of the most successful startups including Facebook, Spotify and Dropbox, among hundreds of others. It typically invests at the Series A and B levels, but can get involved from seed level, and has seen 253 exits from its portfolio to date, across varied market segments.

Accel, formerly known as Accel Partners, is a US venture capital firm, with its headquarters in Palo Alto, California, and additional offices in San Francisco. It also operates funds for Europe and Israel, with offices in London, UK, and has funds for India and China. It was founded in 1983 and has backed some of the most successful startups including Facebook, Spotify and Dropbox, among hundreds of others. It typically invests at the Series A and B levels, but can get involved from seed level, and has seen 253 exits from its portfolio to date, across varied market segments.

Genesia Ventures is a Japanese VC firm founded and led by former CyberAgent Ventures executive Soichi Tajima. The company's name is a portmanteau word combining "genesis" and "Asia" and the fund focuses on seed and pre-Series A rounds. It has backed startups in new media and those implementing new technology to traditional sectors. Its portfolio includes Japanese companies Sukedachi and Linc Corporation as well as Southeast Asian startups Homedy and Bobobox.

Genesia Ventures is a Japanese VC firm founded and led by former CyberAgent Ventures executive Soichi Tajima. The company's name is a portmanteau word combining "genesis" and "Asia" and the fund focuses on seed and pre-Series A rounds. It has backed startups in new media and those implementing new technology to traditional sectors. Its portfolio includes Japanese companies Sukedachi and Linc Corporation as well as Southeast Asian startups Homedy and Bobobox.

Founded in August 2013, Paper Games engages in mobile games, animation and peripheral products, including the series Nikki Up2U, World Traveler, Miracle Nikki, Love and Producer, and Shining Nikki. Targeting female audience, the products focus on makeup and dressing games and love stories. Its third Nikki series story, Miracle Nikki, which was launched in 2015, has already collected more than 1m registered users worldwide. In July 2019, Paper Games signed an agreement with Japanese Animation Studio MAPPA and Emoto Entertainment to adapt Love and Producer into an animation production.

Founded in August 2013, Paper Games engages in mobile games, animation and peripheral products, including the series Nikki Up2U, World Traveler, Miracle Nikki, Love and Producer, and Shining Nikki. Targeting female audience, the products focus on makeup and dressing games and love stories. Its third Nikki series story, Miracle Nikki, which was launched in 2015, has already collected more than 1m registered users worldwide. In July 2019, Paper Games signed an agreement with Japanese Animation Studio MAPPA and Emoto Entertainment to adapt Love and Producer into an animation production.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

Lanai Partners is an angel investors group based in Barcelona.The network of investors was formed in 2016 by a group of Spanish business angels and backed by strong partners and entrepreneurs, such as Airbnb (Europe, Middle East and Africa) managing director Jeroen Merchiers, Viko Group president Rubén Ferreiro, Housell CEO Guillermo Llibre and SocialCar founder and CEO Mar Alarcón.Lanai Partners mainly invests in early-stage funding rounds with a maximum capital of €200,000 per startup and focusing on the SaaS, marketplace and digital health sectors.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

M Capital Partners is a leading private equity firm in the French small-cap market. It specializes in SME financing in the development and transmission phases. Based in Paris, the company has offices in Toulouse, Nice, Montepellier and Bordeaux. Founded 17 years ago, M Capital has €530m under active management. It is engaged in venture and capital investments, real estate, and impact investing. Recently it declared its aim to obtain the B Corp sustainability label, and created a foundation and several positive impact funds and moved to decarbonize its portfolio.

One of the world’s oldest venture capital firms, Greylock Partner was founded in 1965 in Cambridge, Massachusetts by Bill Elfers and Dan Gregory, and later Charlie Waite. It has offices in Silicon Valley, San Francisco and Wellesley and over US$3.5 billion under management. Focused on early-stage startups, Greylock has backed more than 120 profitable M&As and more than 170 IPOs, including Facebook, LinkedIn and Workday.

One of the world’s oldest venture capital firms, Greylock Partner was founded in 1965 in Cambridge, Massachusetts by Bill Elfers and Dan Gregory, and later Charlie Waite. It has offices in Silicon Valley, San Francisco and Wellesley and over US$3.5 billion under management. Focused on early-stage startups, Greylock has backed more than 120 profitable M&As and more than 170 IPOs, including Facebook, LinkedIn and Workday.

Volkswagen Group China is a division of German automobile manufacturer Volkswagen Group. Volkswagen Group China produces, sells and services cars, engines and transmission systems, as well as other parts and components. It runs more than 2,000 authorized dealerships and has 360,000 dealers on staff. Volkswagen Group China and its joint-venture companies plan to invest €15 billion by 2020 in developing autonomous and new energy vehicles.

Volkswagen Group China is a division of German automobile manufacturer Volkswagen Group. Volkswagen Group China produces, sells and services cars, engines and transmission systems, as well as other parts and components. It runs more than 2,000 authorized dealerships and has 360,000 dealers on staff. Volkswagen Group China and its joint-venture companies plan to invest €15 billion by 2020 in developing autonomous and new energy vehicles.

The Standards, Productivity and Innovation Board (SPRING Singapore) used to be a statutory board under the Ministry of Trade and Industry of Singapore. It was also the national standards and conformance body, tasked with developing and promoting internationally-recognized standards and quality assurance infrastructure.In April 2018, SPRING Singapore and International Enterprise Singapore were merged to form a single agency, Enterprise Singapore, a government agency championing enterprise development.

The Standards, Productivity and Innovation Board (SPRING Singapore) used to be a statutory board under the Ministry of Trade and Industry of Singapore. It was also the national standards and conformance body, tasked with developing and promoting internationally-recognized standards and quality assurance infrastructure.In April 2018, SPRING Singapore and International Enterprise Singapore were merged to form a single agency, Enterprise Singapore, a government agency championing enterprise development.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

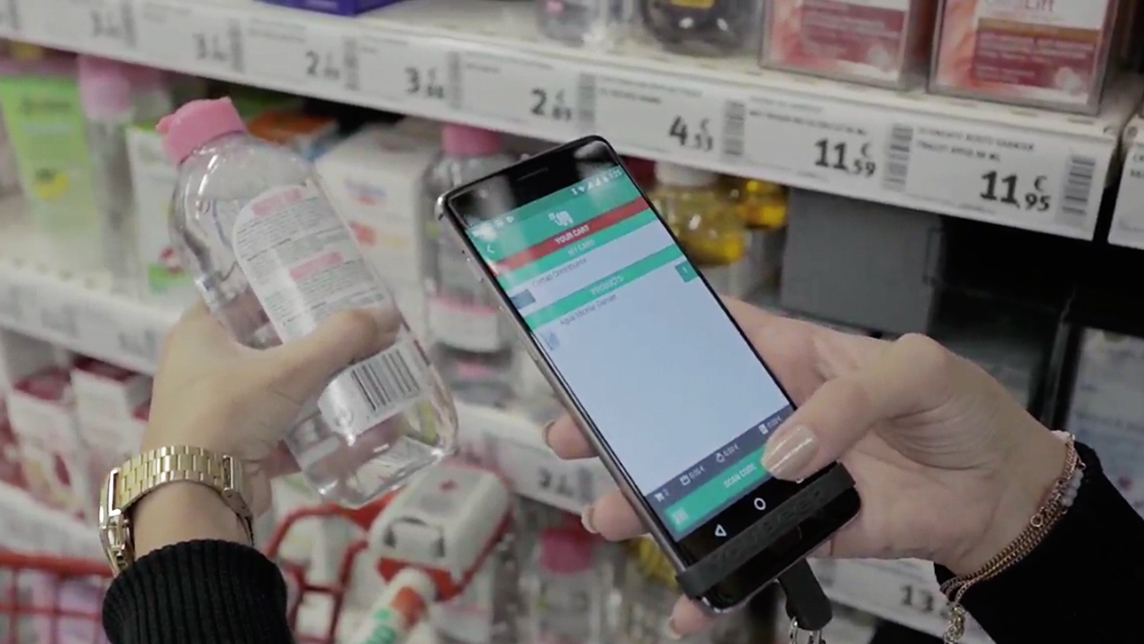

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

Plug-it and Drive-it with Wallbox’s EV quick chargers

Created by an ex-Tesla engineer, these generic chargers are fast and easy to use – just like recharging mobile phones

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

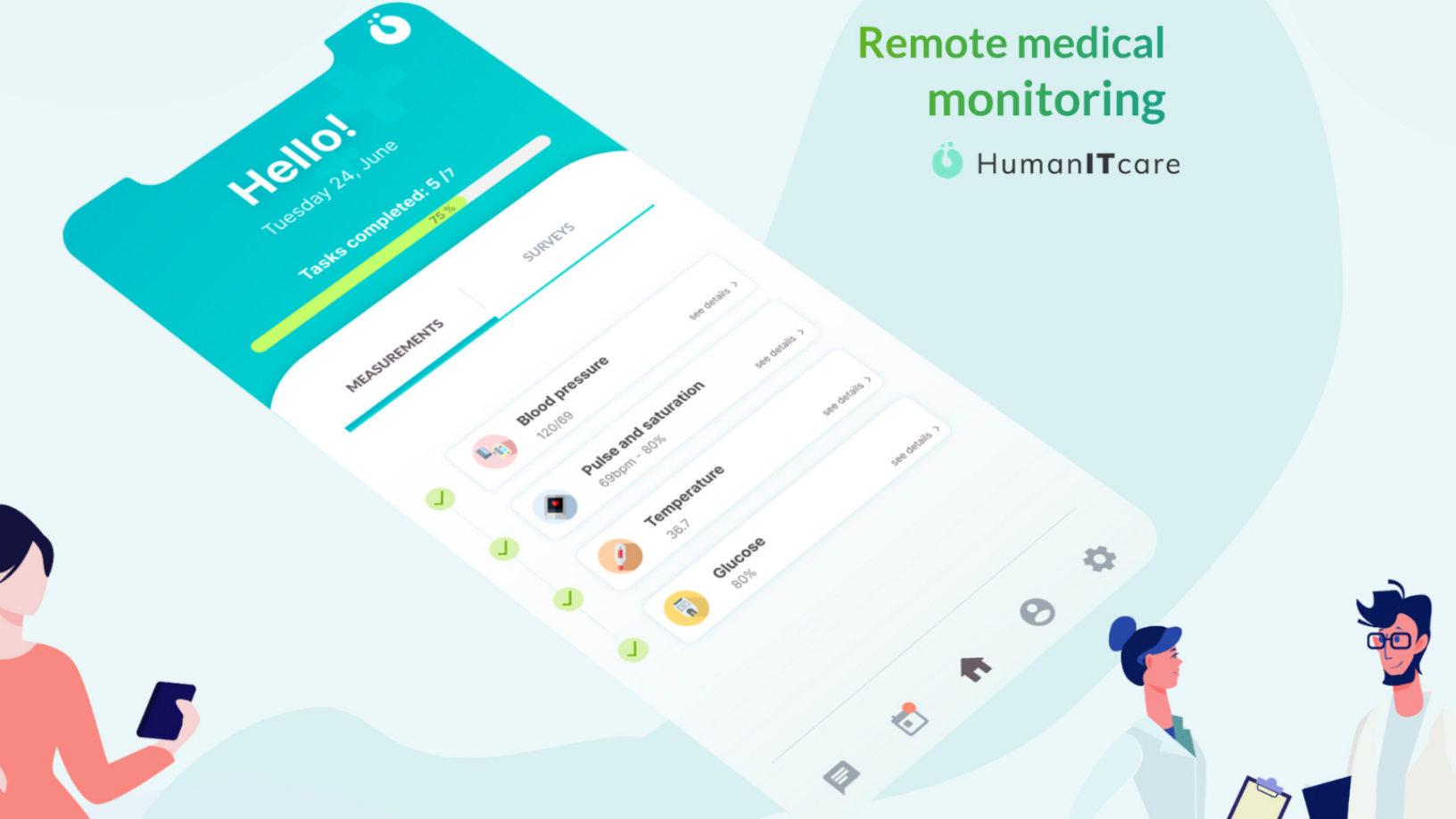

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

Alias Robotics: Award-winning cyber security pioneer reduces “clear and present danger” of robots

As machines become integral parts of daily life, Alias Robotics offers humans a way to solve the ever-increasing potential risks of robots

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Sorry, we couldn’t find any matches for“GK Plug and Play”.