GK Plug and Play

-

DATABASE (994)

-

ARTICLES (811)

China Minsheng Investment Group

China Minsheng Investment Group (CMIG) is the largest privately owned investment group in China, with RMB 50 billion in registered capital. It was initiated by the All-China Federation of Industry and Commerce, and its Global Advisory Council includes the former prime ministers of France, Italy and Pakistan, and various other global experts and Nobel Prize winners.

China Minsheng Investment Group (CMIG) is the largest privately owned investment group in China, with RMB 50 billion in registered capital. It was initiated by the All-China Federation of Industry and Commerce, and its Global Advisory Council includes the former prime ministers of France, Italy and Pakistan, and various other global experts and Nobel Prize winners.

Shangshi Capital was founded and headquartered in Beijing in 2014. It has branch offices in Shenzhen and San Francisco. The firm manages two US dollar funds and three RMB funds, totaling over RMB 1.5bn. It has invested in over 60 startups at home and abroad, mainly in digital healthcare, consumer goods, IoT and enterprise tech.

Shangshi Capital was founded and headquartered in Beijing in 2014. It has branch offices in Shenzhen and San Francisco. The firm manages two US dollar funds and three RMB funds, totaling over RMB 1.5bn. It has invested in over 60 startups at home and abroad, mainly in digital healthcare, consumer goods, IoT and enterprise tech.

Li Bin is the founder and CEO of BitAuto.com, China’s first NYSE-listed auto content and marketing online operator, and the founder and CEO of NextEV, an electric automobile development company that launched the world’s fastest electric car.

Li Bin is the founder and CEO of BitAuto.com, China’s first NYSE-listed auto content and marketing online operator, and the founder and CEO of NextEV, an electric automobile development company that launched the world’s fastest electric car.

Arthur Kosten is an adviser for Booking.com and other companies like Festicket and eVentures Africa Fund. He was the former CMO and co-founder of Booking.com. Together with other business angels and VCs, he generally invests about US$200,000 to US$1 million in various marketplace platforms for expansion in Europe. He is also an investor and board member of rentalcars.com, catawiki.com, treatwell, 8fit.com, festicket and healthcare.com.

Arthur Kosten is an adviser for Booking.com and other companies like Festicket and eVentures Africa Fund. He was the former CMO and co-founder of Booking.com. Together with other business angels and VCs, he generally invests about US$200,000 to US$1 million in various marketplace platforms for expansion in Europe. He is also an investor and board member of rentalcars.com, catawiki.com, treatwell, 8fit.com, festicket and healthcare.com.

Founded in 1996, LB Investment (formerly LG Venture Investment) is supported by LG, the Korean conglomerate, and developing into a private equity fund investment company. It focuses on venture investments in Korea and China, and investments in medium and large companies.

Founded in 1996, LB Investment (formerly LG Venture Investment) is supported by LG, the Korean conglomerate, and developing into a private equity fund investment company. It focuses on venture investments in Korea and China, and investments in medium and large companies.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

PT Juvisk Tri Swarna (JTS) was established in 2013 to provide technical project management, financial consultancy, site audits and other support services in diverse business sectors; ranging from infrastructure, civil engineering, construction and mineral mining. Juvisk is currently involved in the construction of radio and cellular towers and other related services. In 2016, Juvisk became an investor and business partner of Qlue.

PT Juvisk Tri Swarna (JTS) was established in 2013 to provide technical project management, financial consultancy, site audits and other support services in diverse business sectors; ranging from infrastructure, civil engineering, construction and mineral mining. Juvisk is currently involved in the construction of radio and cellular towers and other related services. In 2016, Juvisk became an investor and business partner of Qlue.

Capitana Venture Partners is a venture fund headquartered in Madrid with a presence across Spain, Germany, Italy and UK. The firm backs technology startups at their seed and early stage phase, investing between €200,000 and €500,000. Capitana's team comprises eight business angels and advisors with experience in corporate finance, investment banking and capital market financing.

Capitana Venture Partners is a venture fund headquartered in Madrid with a presence across Spain, Germany, Italy and UK. The firm backs technology startups at their seed and early stage phase, investing between €200,000 and €500,000. Capitana's team comprises eight business angels and advisors with experience in corporate finance, investment banking and capital market financing.

Formerly known as Google Ventures and established in 2009, GV is the VC arm of Alphabet, Inc. and stresses that it invests in the “best companies, not strategic investment for Google”. GV is headquartered in Mountain View, California, with offices in San Francisco, Boston, New York, and London and it currently has over US$3.5 billion under management. It has invested in more than 600 companies across different sectors and stages, with more than 160 as lead investor and has seen 120 exits. Its recent investments include in Lemonade and KeepTruckin's Series D rounds and in Harness' Series B.

Formerly known as Google Ventures and established in 2009, GV is the VC arm of Alphabet, Inc. and stresses that it invests in the “best companies, not strategic investment for Google”. GV is headquartered in Mountain View, California, with offices in San Francisco, Boston, New York, and London and it currently has over US$3.5 billion under management. It has invested in more than 600 companies across different sectors and stages, with more than 160 as lead investor and has seen 120 exits. Its recent investments include in Lemonade and KeepTruckin's Series D rounds and in Harness' Series B.

Visa is a US-based financial services company best known for its electronic payment system used worldwide for credit and debit cards. As the operator of the payment service, it also provides security and risk management solutions. It is listed in the New York Stock Exchange under the ticker code V.The firm prefers to invest and partner with innovative early-stage firms in the payments, fintech and emerging technology spaces to advance Visa's strategic and financial objectives. Some of its investments include Indonesian ride-hailing and payment super-app Gojek, cybersecurity firms MagicCube and LoginID, payment platforms Klarna and Flutterwave, as well as digital banking platform Greenwood Bank.

Visa is a US-based financial services company best known for its electronic payment system used worldwide for credit and debit cards. As the operator of the payment service, it also provides security and risk management solutions. It is listed in the New York Stock Exchange under the ticker code V.The firm prefers to invest and partner with innovative early-stage firms in the payments, fintech and emerging technology spaces to advance Visa's strategic and financial objectives. Some of its investments include Indonesian ride-hailing and payment super-app Gojek, cybersecurity firms MagicCube and LoginID, payment platforms Klarna and Flutterwave, as well as digital banking platform Greenwood Bank.

Beijing-based Telescope Investments is a VC/PE firm, investing primarily in consumer, supply chain, education, and healthcare sectors. Telescope is founded by Du Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group. Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group. Telescope is founded by Du Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group.

Beijing-based Telescope Investments is a VC/PE firm, investing primarily in consumer, supply chain, education, and healthcare sectors. Telescope is founded by Du Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group. Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group. Telescope is founded by Du Yucun, former CEO of Tianjin HomeWorld Group, a Chinese supermarket chain, and SAIF Partners. Du Yucun is the son of Du Sha, one of China’s most well-known and respected entrepreneurs. Du Sha is the founder and chairman of Pacific Links, a former acclaimed Professor of Economics at the Nankai University, and founder of HomeWorld Group.

David Boronat is an internet enthusiast, with over 20 years of professional experience in the market. He is a mentor and advisor to tech startups in Spain and Latin America. He is passionate about digital strategies, UX and web analytics. Based in Mexico and the US, Boronat is currently managing two of his own businesses. In 2000, he became the CEO and founder of Multiplica, an international performance consultancy agency. In 2005, he founded Metriplica, a partner agency of Google Analytics, IBM, ComScore and Omniture. Metriplica offers digital measurement and data mining services.

David Boronat is an internet enthusiast, with over 20 years of professional experience in the market. He is a mentor and advisor to tech startups in Spain and Latin America. He is passionate about digital strategies, UX and web analytics. Based in Mexico and the US, Boronat is currently managing two of his own businesses. In 2000, he became the CEO and founder of Multiplica, an international performance consultancy agency. In 2005, he founded Metriplica, a partner agency of Google Analytics, IBM, ComScore and Omniture. Metriplica offers digital measurement and data mining services.

An entrepreneur and investor in new technologies and digital business, Manuel Serrano has extensive experience in the field of digital transformation and startups' mentoring.He is the managing director and founder of FHIOS Smart Knowledge, a company that specializes in consultancy services for digital innovation, where he has worked since 2012. Serrano is also a committee member of FC Barcelona, the city's famous soccer club, and an investor in fast-growing Spanish startups like Red Points, Wysee and CITIBOX. He has also managed and founded several IT companies in the Barcelona area.

An entrepreneur and investor in new technologies and digital business, Manuel Serrano has extensive experience in the field of digital transformation and startups' mentoring.He is the managing director and founder of FHIOS Smart Knowledge, a company that specializes in consultancy services for digital innovation, where he has worked since 2012. Serrano is also a committee member of FC Barcelona, the city's famous soccer club, and an investor in fast-growing Spanish startups like Red Points, Wysee and CITIBOX. He has also managed and founded several IT companies in the Barcelona area.

Nauta Capital is one of the oldest VC funds in Spain with offices in London, Munich and Barcelona. It focusses its investment on SaaS companies in Europe and the US east-coast, but the firm’s portfolio includes startups specialized in cyber security, retail, HR, marketplace and platform, marketing and social intelligence as well as big data and analytics.The firm usually participates in Series A rounds from €500,000 to €7 million with an average ticket for first investments of between €1 million and €3 million. Nauta Capital occasionally invests in late-seed and Series B rounds.

Nauta Capital is one of the oldest VC funds in Spain with offices in London, Munich and Barcelona. It focusses its investment on SaaS companies in Europe and the US east-coast, but the firm’s portfolio includes startups specialized in cyber security, retail, HR, marketplace and platform, marketing and social intelligence as well as big data and analytics.The firm usually participates in Series A rounds from €500,000 to €7 million with an average ticket for first investments of between €1 million and €3 million. Nauta Capital occasionally invests in late-seed and Series B rounds.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

Plug-it and Drive-it with Wallbox’s EV quick chargers

Created by an ex-Tesla engineer, these generic chargers are fast and easy to use – just like recharging mobile phones

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

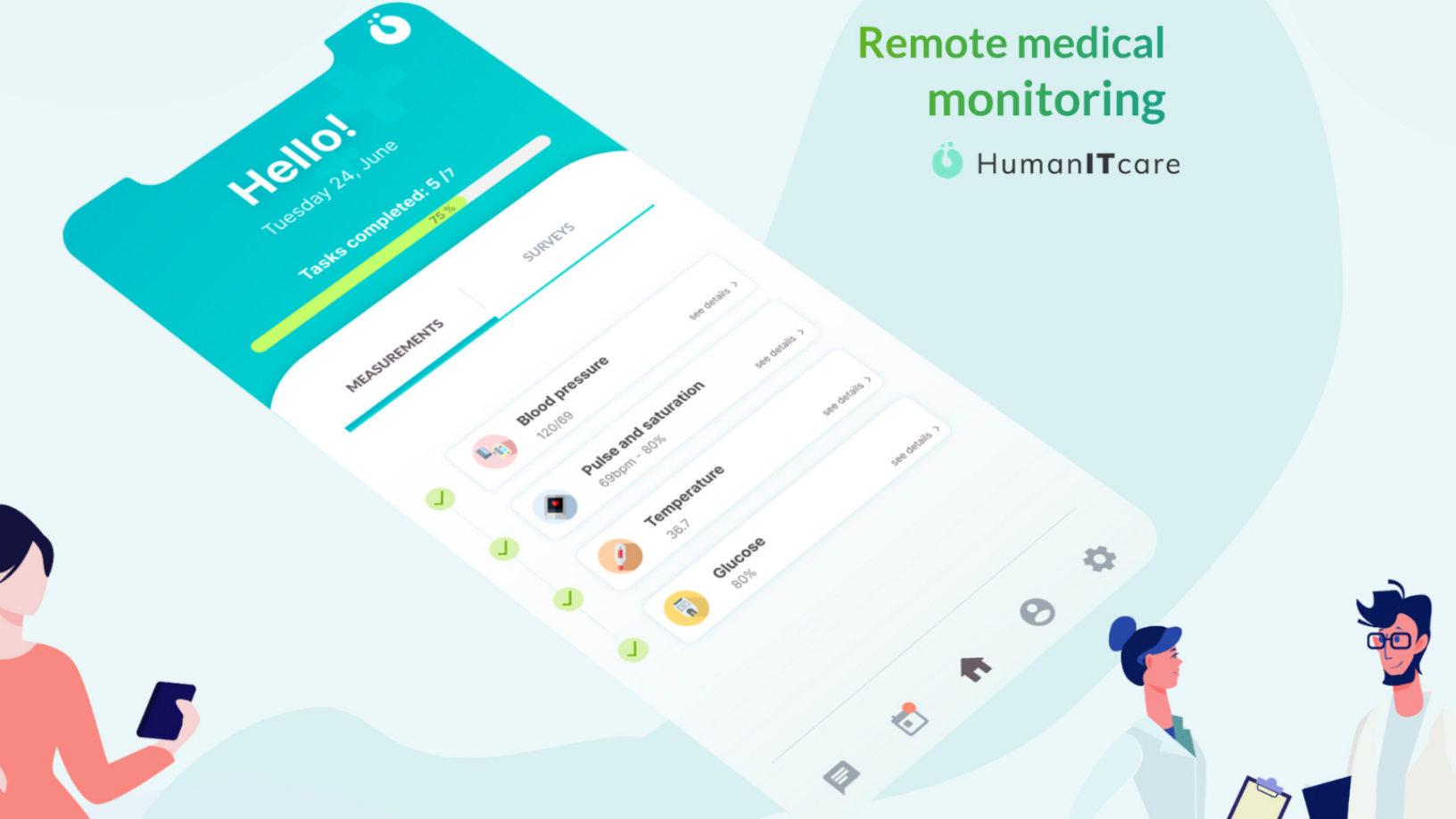

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

Alias Robotics: Award-winning cyber security pioneer reduces “clear and present danger” of robots

As machines become integral parts of daily life, Alias Robotics offers humans a way to solve the ever-increasing potential risks of robots

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Sorry, we couldn’t find any matches for“GK Plug and Play”.