GK Plug and Play

-

DATABASE (994)

-

ARTICLES (811)

Lugard Road Capital/ Luxor Capital

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Founder and CEO of Guanjiabang

A holder of six IT patents, Fu Yansheng was a manager in internet and business development at state-owned China Telecom. He is a Changchun Institute of Posts and Telecommunications computer science graduate (class of 1989); and holds a master’s in Communications and Information Systems from Tianjin University. He is also vice-chairman of China Home Service Association.

A holder of six IT patents, Fu Yansheng was a manager in internet and business development at state-owned China Telecom. He is a Changchun Institute of Posts and Telecommunications computer science graduate (class of 1989); and holds a master’s in Communications and Information Systems from Tianjin University. He is also vice-chairman of China Home Service Association.

Co-founder and Operations Manager of Taralite

Abednego Pramudito is a graduate from Indonesia’s Trisakti University and a former banking colleague of Taralite co-founder Abraham Viktor. He is Taralite’s operations manager and also a product manager at Smart Dent Dental Supply. Abednego originally joined Wedlite as a co-founder and stayed on when the wedding finance concept was transformed into a bigger consumer and business loans platform Taralite.

Abednego Pramudito is a graduate from Indonesia’s Trisakti University and a former banking colleague of Taralite co-founder Abraham Viktor. He is Taralite’s operations manager and also a product manager at Smart Dent Dental Supply. Abednego originally joined Wedlite as a co-founder and stayed on when the wedding finance concept was transformed into a bigger consumer and business loans platform Taralite.

CPO and co-founder of Tezign

Wang is a computer engineer and SaaS expert. He received his bachelor’s degree in Electronic Engineering from Zhejiang University and his master’s degree in Computer Science from Columbia University. He once worked as an in-house engineer for WorkMarket, an American startup that businesses of all sizes trust to find, manage and pay their freelancers and independent contractors.

Wang is a computer engineer and SaaS expert. He received his bachelor’s degree in Electronic Engineering from Zhejiang University and his master’s degree in Computer Science from Columbia University. He once worked as an in-house engineer for WorkMarket, an American startup that businesses of all sizes trust to find, manage and pay their freelancers and independent contractors.

Co-founder of Digital Happiness

Vanadi is co-founder of Digital Happiness, an Indonesian video game development studio. He directed the studio’s commercially successful title and popular video game, DreadOut and its sequel and related titles. Vanadi was also responsible for the storytelling in those titles. He is self-taught and works primarily with the gaming engine, Unreal. Digital Happiness is his first professional endeavor.

Vanadi is co-founder of Digital Happiness, an Indonesian video game development studio. He directed the studio’s commercially successful title and popular video game, DreadOut and its sequel and related titles. Vanadi was also responsible for the storytelling in those titles. He is self-taught and works primarily with the gaming engine, Unreal. Digital Happiness is his first professional endeavor.

Co-founder and AI Product Architect of Get.AI

Shadow Chi graduated with a bachelor's degree in design from Shanghai Jiao Tong University in 2008 and received his master‘s degree in computer-aided design from Tongji University in 2013. He specializes in innovative product design and development, and has worked at ZTE Corporation, China Merchants Bank, and ARKIE as product architect and designer. He founded online community MixLab in 2016 and has built it into an interdisciplinary hub for more than 35,000 designers and programmers. After co-founding Get.AI in 2018, he has served as its AI Product Architect.

Shadow Chi graduated with a bachelor's degree in design from Shanghai Jiao Tong University in 2008 and received his master‘s degree in computer-aided design from Tongji University in 2013. He specializes in innovative product design and development, and has worked at ZTE Corporation, China Merchants Bank, and ARKIE as product architect and designer. He founded online community MixLab in 2016 and has built it into an interdisciplinary hub for more than 35,000 designers and programmers. After co-founding Get.AI in 2018, he has served as its AI Product Architect.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

Healthcare-focused investment firm Vivo Capital was formed in 1996. Today it has over US$1.8 billion under management, making investments into private and public healthcare companies in the US and Greater China, as well as into promising early-stage innovative healthcare companies.

Healthcare-focused investment firm Vivo Capital was formed in 1996. Today it has over US$1.8 billion under management, making investments into private and public healthcare companies in the US and Greater China, as well as into promising early-stage innovative healthcare companies.

Fenghou Capital is a venture capital firm focusing on early-stage investment in entertainment, industrial internet and fintech. It has invested in more than 80 companies since its inception in 2013 and has about RMB 500 million in assets under management.

Fenghou Capital is a venture capital firm focusing on early-stage investment in entertainment, industrial internet and fintech. It has invested in more than 80 companies since its inception in 2013 and has about RMB 500 million in assets under management.

Established in 1953, Gunung Sewu is a privately owned Indonesian conglomerate and investment management group that operates diversified businesses in insurance, food, real estate, consumer and resources. Founded by Om Go Soei Kie, aka Dasuki Angkosubroto, Gunung Sewu was originally a commodity trading enterprise.

Established in 1953, Gunung Sewu is a privately owned Indonesian conglomerate and investment management group that operates diversified businesses in insurance, food, real estate, consumer and resources. Founded by Om Go Soei Kie, aka Dasuki Angkosubroto, Gunung Sewu was originally a commodity trading enterprise.

Established in 2002, the Edge Group focuses on real estate investment and venture capital holdings. Headed by José Luis Pinto Basto, its investment strategy is based on the “triple bottom line” philosophy: reaching the optimal balance between economic, social and environmental sustainability.

Established in 2002, the Edge Group focuses on real estate investment and venture capital holdings. Headed by José Luis Pinto Basto, its investment strategy is based on the “triple bottom line” philosophy: reaching the optimal balance between economic, social and environmental sustainability.

Based in Berlin, Point Nine Capital is a seed/early-stage VC that has invested in companies across Europe, the US, New Zealand and Asia. The firm typically invests between a few hundred thousand and US$1m in startups from many different sectors.

Based in Berlin, Point Nine Capital is a seed/early-stage VC that has invested in companies across Europe, the US, New Zealand and Asia. The firm typically invests between a few hundred thousand and US$1m in startups from many different sectors.

Johan Tahardi is one of the co-founders of MailTarget, a SaaS company that helps SMEs automate email-based marketing. He is also an angel investor and advisor to Infra Digital Nusantara, a new payment gateway that digitizes school fee and apartment bill payments.

Johan Tahardi is one of the co-founders of MailTarget, a SaaS company that helps SMEs automate email-based marketing. He is also an angel investor and advisor to Infra Digital Nusantara, a new payment gateway that digitizes school fee and apartment bill payments.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

China Reform Capital Corporation, Ltd.

China Reform Capital Corporation, Ltd. is a wholly-owned subsidiary of China Reform Holdings Corporation, Ltd. It was established in August 2014 in Beijing and has registered capital RMB 10 billion. Its business includes equity investment, project investment, investment management, asset management and investment consulting.

China Reform Capital Corporation, Ltd. is a wholly-owned subsidiary of China Reform Holdings Corporation, Ltd. It was established in August 2014 in Beijing and has registered capital RMB 10 billion. Its business includes equity investment, project investment, investment management, asset management and investment consulting.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

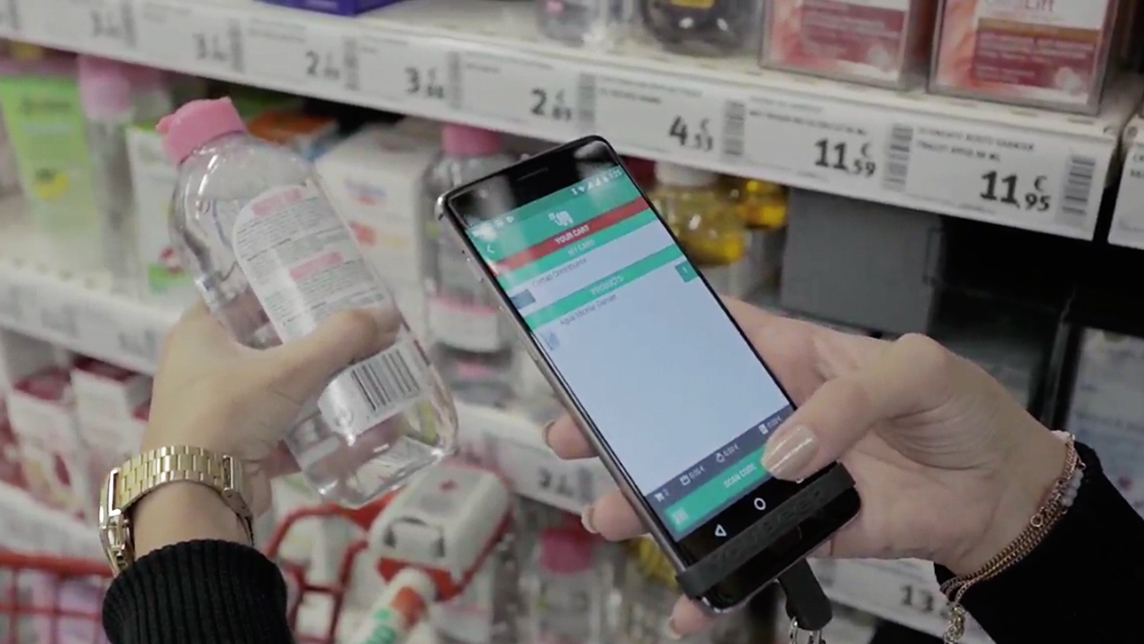

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

Plug-it and Drive-it with Wallbox’s EV quick chargers

Created by an ex-Tesla engineer, these generic chargers are fast and easy to use – just like recharging mobile phones

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

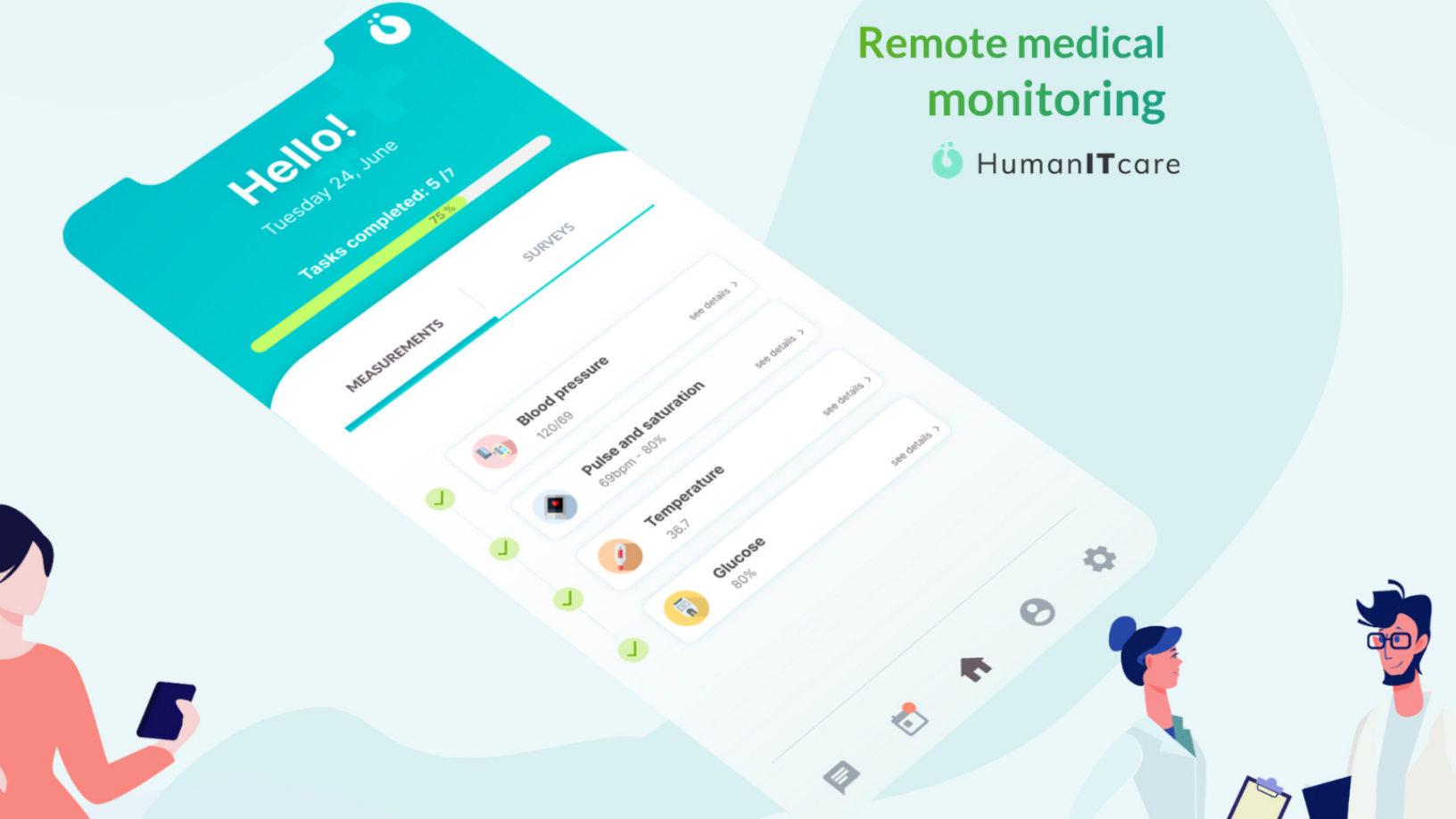

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

Alias Robotics: Award-winning cyber security pioneer reduces “clear and present danger” of robots

As machines become integral parts of daily life, Alias Robotics offers humans a way to solve the ever-increasing potential risks of robots

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Sorry, we couldn’t find any matches for“GK Plug and Play”.