GK Plug and Play

-

DATABASE (994)

-

ARTICLES (811)

Founded in 2006 by executives from the People’s Bank of China, the China Securities Regulatory Commission, commercial banks, brokerages, insurance companies, funds and other financial institutions, Sensegain Asset Management has AUM (assets under management) of RMB 69 billion. It focuses on private equity, venture capital investment, M&A, market value management for public companies and public equity investment. Sensegain has 150+ FTEs with strong financial backgrounds and a broad range of industry expertise.

Founded in 2006 by executives from the People’s Bank of China, the China Securities Regulatory Commission, commercial banks, brokerages, insurance companies, funds and other financial institutions, Sensegain Asset Management has AUM (assets under management) of RMB 69 billion. It focuses on private equity, venture capital investment, M&A, market value management for public companies and public equity investment. Sensegain has 150+ FTEs with strong financial backgrounds and a broad range of industry expertise.

A member of the family that founded the Zamora Company (which owns Spanish liquor brands Martin Miller, Ramón Bilbao and Licor 43), Ángel Zamora is currently an active entrepreneur, investor and strategy consultant for several European MNCs. He has explored investment opportunities within the Spanish technology ecosystem, backing startups with global ambitions and supporting them in their overseas expansion, especially to Latin American countries. Zamora is an MBA graduate from the Darden Business School in the US.

A member of the family that founded the Zamora Company (which owns Spanish liquor brands Martin Miller, Ramón Bilbao and Licor 43), Ángel Zamora is currently an active entrepreneur, investor and strategy consultant for several European MNCs. He has explored investment opportunities within the Spanish technology ecosystem, backing startups with global ambitions and supporting them in their overseas expansion, especially to Latin American countries. Zamora is an MBA graduate from the Darden Business School in the US.

TusPark Technology Asset Management Co., Ltd., and TusPark Business Incubator Co., Ltd., were both founded in 2001 as the investment arms of Tsinghua Science Park. Affiliated with Tsinghua University, Tsinghua Science Park promotes technology innovation and entrepreneurship. In 2007, the two companies were merged and became TusPark Ventures. The firm employs an “investment + incubation” model when investing in Chinese high-tech startups. TusPark Ventures currently manages over RMB 3 billion in assets.

TusPark Technology Asset Management Co., Ltd., and TusPark Business Incubator Co., Ltd., were both founded in 2001 as the investment arms of Tsinghua Science Park. Affiliated with Tsinghua University, Tsinghua Science Park promotes technology innovation and entrepreneurship. In 2007, the two companies were merged and became TusPark Ventures. The firm employs an “investment + incubation” model when investing in Chinese high-tech startups. TusPark Ventures currently manages over RMB 3 billion in assets.

Caixa Capital Risc is the venture capital branch of CriteriaCaixa, an investment holding company that manages La Caixa's banking funds. It was established in 2004 and has registered capital of €195 million. It is based in Barcelona, Spain and has invested in more than 100 Spanish companies in different sectors. It invests across sectors, requiring the startup to work with market-proven technology in a profitable and innovative proposition.

Caixa Capital Risc is the venture capital branch of CriteriaCaixa, an investment holding company that manages La Caixa's banking funds. It was established in 2004 and has registered capital of €195 million. It is based in Barcelona, Spain and has invested in more than 100 Spanish companies in different sectors. It invests across sectors, requiring the startup to work with market-proven technology in a profitable and innovative proposition.

Discovery Nusantara Capital is a venture capital firm with a focus on video gaming and related industries. The firm is backed by China's Zhexin IT and Indonesian angel investors keen to support the growth of the local game industry. Discovery Nusantara Capital has helped introduce games from Touchten, an Indonesian game development studio, to the Chinese market. Aside from video games, the firm has recently invested in NaoBun Project, an Indonesian comics publisher and intellectual property management agency.

Discovery Nusantara Capital is a venture capital firm with a focus on video gaming and related industries. The firm is backed by China's Zhexin IT and Indonesian angel investors keen to support the growth of the local game industry. Discovery Nusantara Capital has helped introduce games from Touchten, an Indonesian game development studio, to the Chinese market. Aside from video games, the firm has recently invested in NaoBun Project, an Indonesian comics publisher and intellectual property management agency.

Everis is a Madrid-based consulting firm that was acquired in 2014 by Japan's NTT Data, the sixth-largest IT services company in the world. With a turnover of €1.17bn, the company offers consultancy services in banking, healthcare, industry, insurance, media, public sector and telecommunications across Europe, in Latin America and the US. The company has established an innovation center, NextGen, focusing on technologies that drive business disruption, such as, Cloud models, Blockchain, Big Data, AI and Robotics.

Everis is a Madrid-based consulting firm that was acquired in 2014 by Japan's NTT Data, the sixth-largest IT services company in the world. With a turnover of €1.17bn, the company offers consultancy services in banking, healthcare, industry, insurance, media, public sector and telecommunications across Europe, in Latin America and the US. The company has established an innovation center, NextGen, focusing on technologies that drive business disruption, such as, Cloud models, Blockchain, Big Data, AI and Robotics.

CICFH was co-founded in 2013 by China Investment Securities, ZhongCai Financial Holding Investment and other companies. Based in Tianjin, the VC manages multiple funds worth over RMB 80bn in total.CICFH focuses on M&A in emerging industries and mainly invests in sectors of media, arts, entertainment, healthcare, fintech and environmental technology through multiple funds established with other enterprises. It has also set up multiple FoFs, partnering with provincial governments to spur the development of certain industries.

CICFH was co-founded in 2013 by China Investment Securities, ZhongCai Financial Holding Investment and other companies. Based in Tianjin, the VC manages multiple funds worth over RMB 80bn in total.CICFH focuses on M&A in emerging industries and mainly invests in sectors of media, arts, entertainment, healthcare, fintech and environmental technology through multiple funds established with other enterprises. It has also set up multiple FoFs, partnering with provincial governments to spur the development of certain industries.

The state-backed, Shanghai-based media and entertainment investment group controlled by media mogul Li Ruigang has made its name and fortune in China's most lucrative industries: media & entertainment, Internet & mobile, sport & lifestyle. CMC's portfolio includes Star China, IMAX China, Flagship Entertainment, Oriental DreamWorks, TVB, Whaley Technologies, Imagine Entertainment, Shaw Brothers, Caixin, Gewara, and more. Li, who started out as a lifestyle TV reporter, set up CMC in 2009 with a RMB 2 billion fund.

The state-backed, Shanghai-based media and entertainment investment group controlled by media mogul Li Ruigang has made its name and fortune in China's most lucrative industries: media & entertainment, Internet & mobile, sport & lifestyle. CMC's portfolio includes Star China, IMAX China, Flagship Entertainment, Oriental DreamWorks, TVB, Whaley Technologies, Imagine Entertainment, Shaw Brothers, Caixin, Gewara, and more. Li, who started out as a lifestyle TV reporter, set up CMC in 2009 with a RMB 2 billion fund.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

Founded in 2016, Wave Ventures is a student-run Nordic investor supported by VC partners, angel investors and tech founders as advisors. Based in Helsinki, the VC provides pre-seed and early-stage funding to promote startup innovations for future generations. Its current portfolio of 17 startups includes participation in the SEK 2m pre-seed round of Swedish power-bank sharing startup Brick Technology in March 2021 and seed funding of German co-working space proprietor Twostay in January 2021.

Founded in 2016, Wave Ventures is a student-run Nordic investor supported by VC partners, angel investors and tech founders as advisors. Based in Helsinki, the VC provides pre-seed and early-stage funding to promote startup innovations for future generations. Its current portfolio of 17 startups includes participation in the SEK 2m pre-seed round of Swedish power-bank sharing startup Brick Technology in March 2021 and seed funding of German co-working space proprietor Twostay in January 2021.

Founded in 2004 by Liu Qiangdong (Richard Liu) with about 30 staff, JD.com (JD stands for Jingdong) has grown to become Alibaba's biggest rival and is backed by Tencent. Similar to Amazon, the NASDAQ-listed JD.com builds and controls its own distribution/logistics network, giving it an advantage in a country used to poor package delivery services. It is an investor in Indonesian ride-hailing company Gojek, and also operates an Indonesian version of its e-commerce platform, JD.id.

Founded in 2004 by Liu Qiangdong (Richard Liu) with about 30 staff, JD.com (JD stands for Jingdong) has grown to become Alibaba's biggest rival and is backed by Tencent. Similar to Amazon, the NASDAQ-listed JD.com builds and controls its own distribution/logistics network, giving it an advantage in a country used to poor package delivery services. It is an investor in Indonesian ride-hailing company Gojek, and also operates an Indonesian version of its e-commerce platform, JD.id.

American private equity firm Warburg Pincus was established in 1966 and has since invested more than $55bn in more than 750 companies in more than 40 countries around the world. So far, the company has raised 19 private equity funds with over $90bn in assets under management. Its investment portfolio can be divided geographically into Asia, Europe, and the Americas. Its Asian portfolio includes tech companies, real estate, healthcare and more verticals, with many Chinese companies featured on the list.

American private equity firm Warburg Pincus was established in 1966 and has since invested more than $55bn in more than 750 companies in more than 40 countries around the world. So far, the company has raised 19 private equity funds with over $90bn in assets under management. Its investment portfolio can be divided geographically into Asia, Europe, and the Americas. Its Asian portfolio includes tech companies, real estate, healthcare and more verticals, with many Chinese companies featured on the list.

One of China’s most famous angel investors and a prolific speaker, Xu Xiaoping (b.1960) is the managing partner of ZhenFund, a TMT-focused seed fund he founded with close friend and business partner Wang Qiang, in collaboration with Sequoia Capital China, in 2011. Xu began investing in 2006, after the New Oriental Education & Technology Group he co-founded became the first Chinese education company to list on NYSE. Trained as a professional musician, Xu plays the piano, violin, and oboe, and composes music as a hobby. He is also the author of more than 10 books. He studied at the Beijing Central Conservatory of Music and holds a master's in Music from the University of Saskatchewan.

One of China’s most famous angel investors and a prolific speaker, Xu Xiaoping (b.1960) is the managing partner of ZhenFund, a TMT-focused seed fund he founded with close friend and business partner Wang Qiang, in collaboration with Sequoia Capital China, in 2011. Xu began investing in 2006, after the New Oriental Education & Technology Group he co-founded became the first Chinese education company to list on NYSE. Trained as a professional musician, Xu plays the piano, violin, and oboe, and composes music as a hobby. He is also the author of more than 10 books. He studied at the Beijing Central Conservatory of Music and holds a master's in Music from the University of Saskatchewan.

This Luxembourg-based venture capital firm was established in 2004 and has offices in Silicon Valley and Madrid, managing over €170 million in capital. It invests in early-stage, deeptech companies in the Iberian peninsula, France, the UK, and Ireland. The VC has a particular focus on AI, cybersecurity and big data. In 2019, it won the Spanish VC Deal of the Year 2019, alongside Caixa Capital Risc, for the sale of PlayGiga.Adara Ventures currently has 15 companies in its portfolio following eight exits totalling $1.2bn in value. Its most recent investments include leading the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and in the €8m seed round of biotech startup QUIBIM – both Spanish companies.

This Luxembourg-based venture capital firm was established in 2004 and has offices in Silicon Valley and Madrid, managing over €170 million in capital. It invests in early-stage, deeptech companies in the Iberian peninsula, France, the UK, and Ireland. The VC has a particular focus on AI, cybersecurity and big data. In 2019, it won the Spanish VC Deal of the Year 2019, alongside Caixa Capital Risc, for the sale of PlayGiga.Adara Ventures currently has 15 companies in its portfolio following eight exits totalling $1.2bn in value. Its most recent investments include leading the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and in the €8m seed round of biotech startup QUIBIM – both Spanish companies.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

Plug-it and Drive-it with Wallbox’s EV quick chargers

Created by an ex-Tesla engineer, these generic chargers are fast and easy to use – just like recharging mobile phones

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

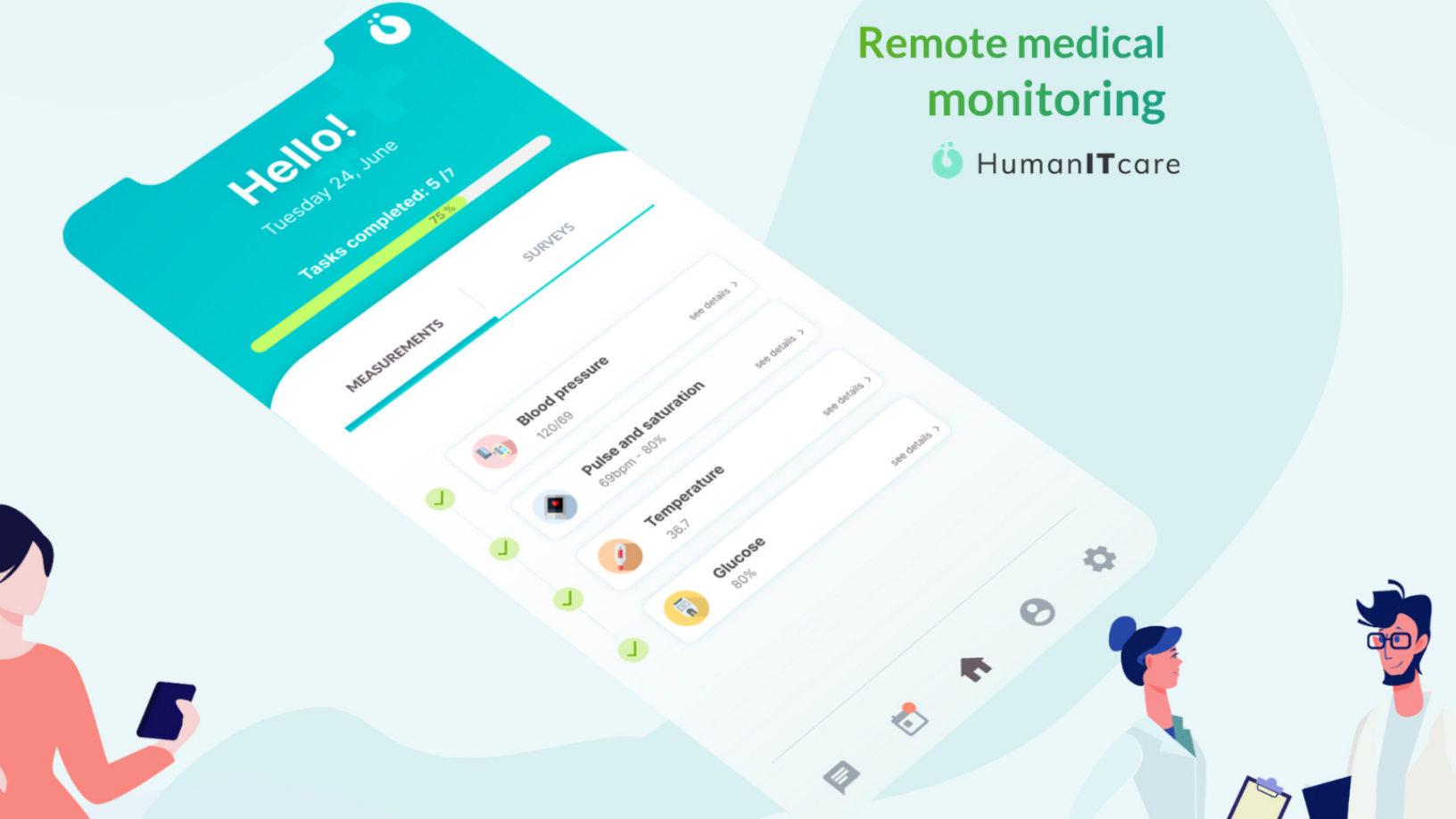

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

Alias Robotics: Award-winning cyber security pioneer reduces “clear and present danger” of robots

As machines become integral parts of daily life, Alias Robotics offers humans a way to solve the ever-increasing potential risks of robots

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Sorry, we couldn’t find any matches for“GK Plug and Play”.