GK Plug and Play

-

DATABASE (994)

-

ARTICLES (811)

Founded in 2009, Andreessen Horowitz is based in Menlo Park in California. The numeronym is the first and last letter of the firm’s brand with the characters count in-between. Starting with initial capital of $300m, the VC quickly raised a second venture fund of $650m in 2010 and another worth $1.5bn in 2014. In 2019, a new office was set up in San Francisco.Founded by Marc Andreessen and Ben Horowitz, the firm has invested in tech pioneers like Skype, Facebook, Groupon and Twitter. Andreessen is the software engineer who pioneered web browser Mosaic and co-founded Netscape. In 1995, Horowitz joined Andreessen as product manager at Netscape that was sold to AOL for $4.2bn in 2016. He also co-founded Opsware (Loudcloud), an automation software company that was sold to Hewlett Packard for $1.6bn in 2007.

Founded in 2009, Andreessen Horowitz is based in Menlo Park in California. The numeronym is the first and last letter of the firm’s brand with the characters count in-between. Starting with initial capital of $300m, the VC quickly raised a second venture fund of $650m in 2010 and another worth $1.5bn in 2014. In 2019, a new office was set up in San Francisco.Founded by Marc Andreessen and Ben Horowitz, the firm has invested in tech pioneers like Skype, Facebook, Groupon and Twitter. Andreessen is the software engineer who pioneered web browser Mosaic and co-founded Netscape. In 1995, Horowitz joined Andreessen as product manager at Netscape that was sold to AOL for $4.2bn in 2016. He also co-founded Opsware (Loudcloud), an automation software company that was sold to Hewlett Packard for $1.6bn in 2007.

Silicon Valley-based investor Sapphire Ventures was formerly known as SAP Ventures, the investment arm of the software giant SAP SE, until 2011. It typically invests in mid-stage startups with at least $5–10m in annual revenue across market verticals, geographies and technologies. It typically invests $10–50m (with the flexibility to invest less or up to $100m) as part of its initial investment. With approximately $4bn in assets under active management and more than 50 startups in its portfolio at present, Sapphire has also managed more than 35 exits and 20 IPOs. Its most recent investments include co-leading the $153m Series D round of workplace skills training platform Degreed in April 2021, and, in March 2021, it invested in two new unicorns. Sapphire contributed to US digital home workout tech Tonal’s $250m Series E round and to the $200m Series D round of Portugal’s Feedzai, the world’s market-leading solution in fighting online fraud.

Silicon Valley-based investor Sapphire Ventures was formerly known as SAP Ventures, the investment arm of the software giant SAP SE, until 2011. It typically invests in mid-stage startups with at least $5–10m in annual revenue across market verticals, geographies and technologies. It typically invests $10–50m (with the flexibility to invest less or up to $100m) as part of its initial investment. With approximately $4bn in assets under active management and more than 50 startups in its portfolio at present, Sapphire has also managed more than 35 exits and 20 IPOs. Its most recent investments include co-leading the $153m Series D round of workplace skills training platform Degreed in April 2021, and, in March 2021, it invested in two new unicorns. Sapphire contributed to US digital home workout tech Tonal’s $250m Series E round and to the $200m Series D round of Portugal’s Feedzai, the world’s market-leading solution in fighting online fraud.

Owen van Natta was formerly COO of Facebook and CEO of MySpace, and also previously held senior positions in Amazon and Zynga. He is an angel investor, founder of 415 LLC as well as a founding partner of tech-focused VC firm Prefix Capital, and has invested in a number of startups to date. His disclosed investments include participation in the March 2017 $800,000 seed round of Irish water regulatory platform SwiftComply and the November 2015 undisclosed funding round of US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. No pic on SM

Owen van Natta was formerly COO of Facebook and CEO of MySpace, and also previously held senior positions in Amazon and Zynga. He is an angel investor, founder of 415 LLC as well as a founding partner of tech-focused VC firm Prefix Capital, and has invested in a number of startups to date. His disclosed investments include participation in the March 2017 $800,000 seed round of Irish water regulatory platform SwiftComply and the November 2015 undisclosed funding round of US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. No pic on SM

Silicon Valley-based Almaz Capital was co-founded in 2008 as a bridge VC fund by Alexander Galitsky, a serial techpreneur and former senior executive at the Soviet Space Agency and Defense Industry. Almaz also has an office in Berlin and partners with interests in the UK, Poland and Ukraine. The global fund has invested in over 30 startups and managed 15 exits within its portfolio.Recent investments in 2021 include co-leading the $54m Series B round of Refurbed with Evli Growth Partners in August. Almaz was also the lead investor for the $6m funding round for US-based precision audio software Sonarworks in July.

Silicon Valley-based Almaz Capital was co-founded in 2008 as a bridge VC fund by Alexander Galitsky, a serial techpreneur and former senior executive at the Soviet Space Agency and Defense Industry. Almaz also has an office in Berlin and partners with interests in the UK, Poland and Ukraine. The global fund has invested in over 30 startups and managed 15 exits within its portfolio.Recent investments in 2021 include co-leading the $54m Series B round of Refurbed with Evli Growth Partners in August. Almaz was also the lead investor for the $6m funding round for US-based precision audio software Sonarworks in July.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Founded in Amsterdam in 2011, Rockstart is a global accelerator-VC focusing on sustainability startups across market segments. Rockstart also runs specialist programs like agrifood in Copenhagen, healthcare in the Dutch town of Nijmegen and also in emerging tech in Bogota, Colombia. It specializes in developing business relationships for portfolio startups with global corporates such as Maersk, Shell and the Dutch Ministry of Health. Rockstart has invested in more than 250 startups, valued at €750m in total.Launched in 2019, Rockstart’s €22m agrifood fund secured investment partners including Vaekstfonden’s Green Future Fund and global dairy cooperative Arla Foods. It has invested in 20 food enterprises like Swiss zero-waste supermarket Lyfa and Danish alt-leather startup Beyond Leather Materials in 2021. Rockstart’s energy fund recently invested in the €730,000 pre-seed round of Danish carbon sequestration corporate marketplace, Klimate, in September 2021. Exits include Wercker, iClinic, Brincr and 3D Hubs.

Founded in Amsterdam in 2011, Rockstart is a global accelerator-VC focusing on sustainability startups across market segments. Rockstart also runs specialist programs like agrifood in Copenhagen, healthcare in the Dutch town of Nijmegen and also in emerging tech in Bogota, Colombia. It specializes in developing business relationships for portfolio startups with global corporates such as Maersk, Shell and the Dutch Ministry of Health. Rockstart has invested in more than 250 startups, valued at €750m in total.Launched in 2019, Rockstart’s €22m agrifood fund secured investment partners including Vaekstfonden’s Green Future Fund and global dairy cooperative Arla Foods. It has invested in 20 food enterprises like Swiss zero-waste supermarket Lyfa and Danish alt-leather startup Beyond Leather Materials in 2021. Rockstart’s energy fund recently invested in the €730,000 pre-seed round of Danish carbon sequestration corporate marketplace, Klimate, in September 2021. Exits include Wercker, iClinic, Brincr and 3D Hubs.

Founder and CEO of Neetip

Antonius Stefanus is the founder and CEO of Neetip, a peer-to-peer shopping and courier platform. He took part in the Jakarta Founder Institute idea accelerator programme in 2016 and visited Silicon Valley with fellow Founder Institute graduates.

Antonius Stefanus is the founder and CEO of Neetip, a peer-to-peer shopping and courier platform. He took part in the Jakarta Founder Institute idea accelerator programme in 2016 and visited Silicon Valley with fellow Founder Institute graduates.

Co-founder and CMO of Blackfish

Before joining Blackfish as co-founder and CMO in 2017, Chen was CMO and one of the key founding members of NASDAQ-listed online travel site Tuniu, where was responsible for branding, marketing and PR.

Before joining Blackfish as co-founder and CMO in 2017, Chen was CMO and one of the key founding members of NASDAQ-listed online travel site Tuniu, where was responsible for branding, marketing and PR.

Co-founder and Vice President of Tiger Brokers

Co-founder and Vice President of Tiger Brokers. She used to work for Baidu and Tencent.

Co-founder and Vice President of Tiger Brokers. She used to work for Baidu and Tencent.

Co-founder and CEO of Sego

A graduate of University of Science & Technology of China and Cranfield University (UK), Jiang Xinlian’s work experience spans eight years in overseas sales support and product planning at Huawei and ZTE. He was born in the 1970s.

A graduate of University of Science & Technology of China and Cranfield University (UK), Jiang Xinlian’s work experience spans eight years in overseas sales support and product planning at Huawei and ZTE. He was born in the 1970s.

Co-founder and CEO of Codacy

Software engineer Jaime Jorge holds bachelor’s and master’s degrees in Computer Science and Software Engineering from the Instituto Superior Técnico. Before co-founding Codacy, Jorge was a research associate at INESC-ID and a software engineer at Instituto Superior Técnico.

Software engineer Jaime Jorge holds bachelor’s and master’s degrees in Computer Science and Software Engineering from the Instituto Superior Técnico. Before co-founding Codacy, Jorge was a research associate at INESC-ID and a software engineer at Instituto Superior Técnico.

Co-founder of Knokcare (formerly Knok Healthcare)

A licensed pharmacist, Carolina Relvas graduated from the University of Lisbon and has an MBA from the University of Cambridge, UK. She started her career at GSK and is currently a manager at ZS Associates, a pharmaceutical and healthcare consultancy.Relvas co-founded medical consultation app Knokcare, previously known as Knok Healthcare. She was the CMO of Knokcare from 2015 until late 2018.

A licensed pharmacist, Carolina Relvas graduated from the University of Lisbon and has an MBA from the University of Cambridge, UK. She started her career at GSK and is currently a manager at ZS Associates, a pharmaceutical and healthcare consultancy.Relvas co-founded medical consultation app Knokcare, previously known as Knok Healthcare. She was the CMO of Knokcare from 2015 until late 2018.

Co-founder, Partner of FarmCloud

Miguel Carvalho is a Portuguese entrepreneur and co-founder of FarmCloud, where he is partner and advisor. Since 2010, he has also been a partner at hosting platform startup CloudNode and at web development firm Multiweb since 1999.

Miguel Carvalho is a Portuguese entrepreneur and co-founder of FarmCloud, where he is partner and advisor. Since 2010, he has also been a partner at hosting platform startup CloudNode and at web development firm Multiweb since 1999.

Co-founder of Jide Technology (Remix)

Another “haigui” (Chinese overseas returnee), Ben Luk (or Lu Yunsheng) had worked at Microsoft and Oracle before joining Google in 2003. At Google, he held different positions in the US global headquarters, and the Beijing and HK offices. Luk led the development of Google Maps APAC. He holds a BS in Computer Science, Cornell University; and an MS in Computer Engineering, Stanford University.

Another “haigui” (Chinese overseas returnee), Ben Luk (or Lu Yunsheng) had worked at Microsoft and Oracle before joining Google in 2003. At Google, he held different positions in the US global headquarters, and the Beijing and HK offices. Luk led the development of Google Maps APAC. He holds a BS in Computer Science, Cornell University; and an MS in Computer Engineering, Stanford University.

CTO and Co-founder of Meicai

A teenage prodigy who was admitted to the University of Science and Technology of China at aged 14, graduating at aged 18, Xu Xueyin built his career at leading tech names before co-founding Meicai. He held IT development jobs at eBay and Baidu, and in July 2010, joined ex-Googler Lee Kai-fu’s incubator Innovation Works as program founder and CTO.

A teenage prodigy who was admitted to the University of Science and Technology of China at aged 14, graduating at aged 18, Xu Xueyin built his career at leading tech names before co-founding Meicai. He held IT development jobs at eBay and Baidu, and in July 2010, joined ex-Googler Lee Kai-fu’s incubator Innovation Works as program founder and CTO.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

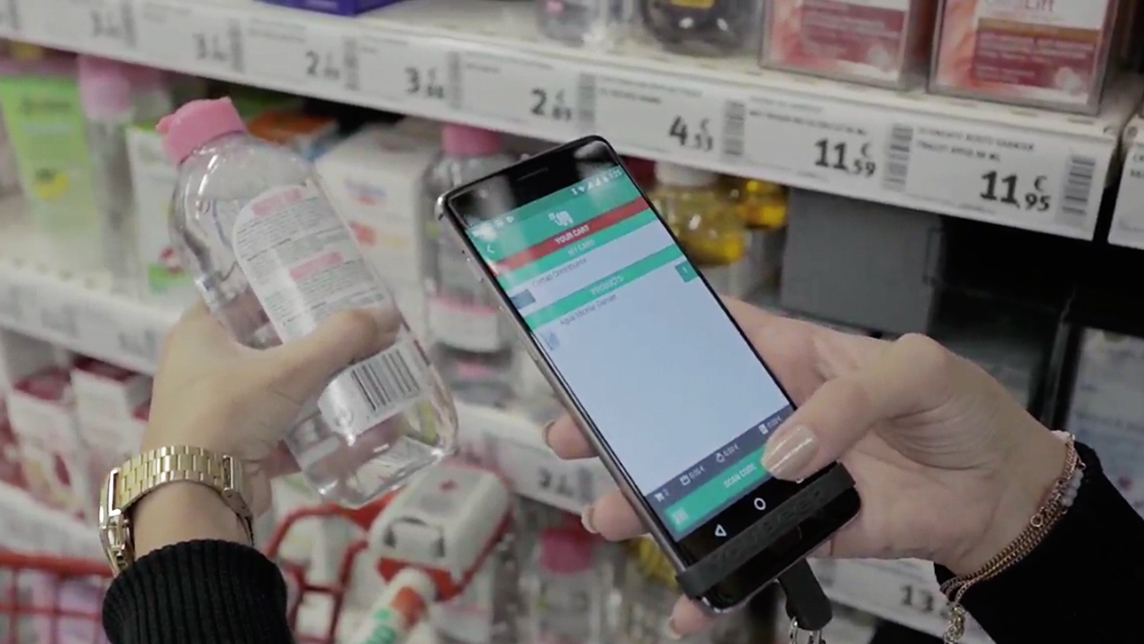

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

Plug-it and Drive-it with Wallbox’s EV quick chargers

Created by an ex-Tesla engineer, these generic chargers are fast and easy to use – just like recharging mobile phones

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

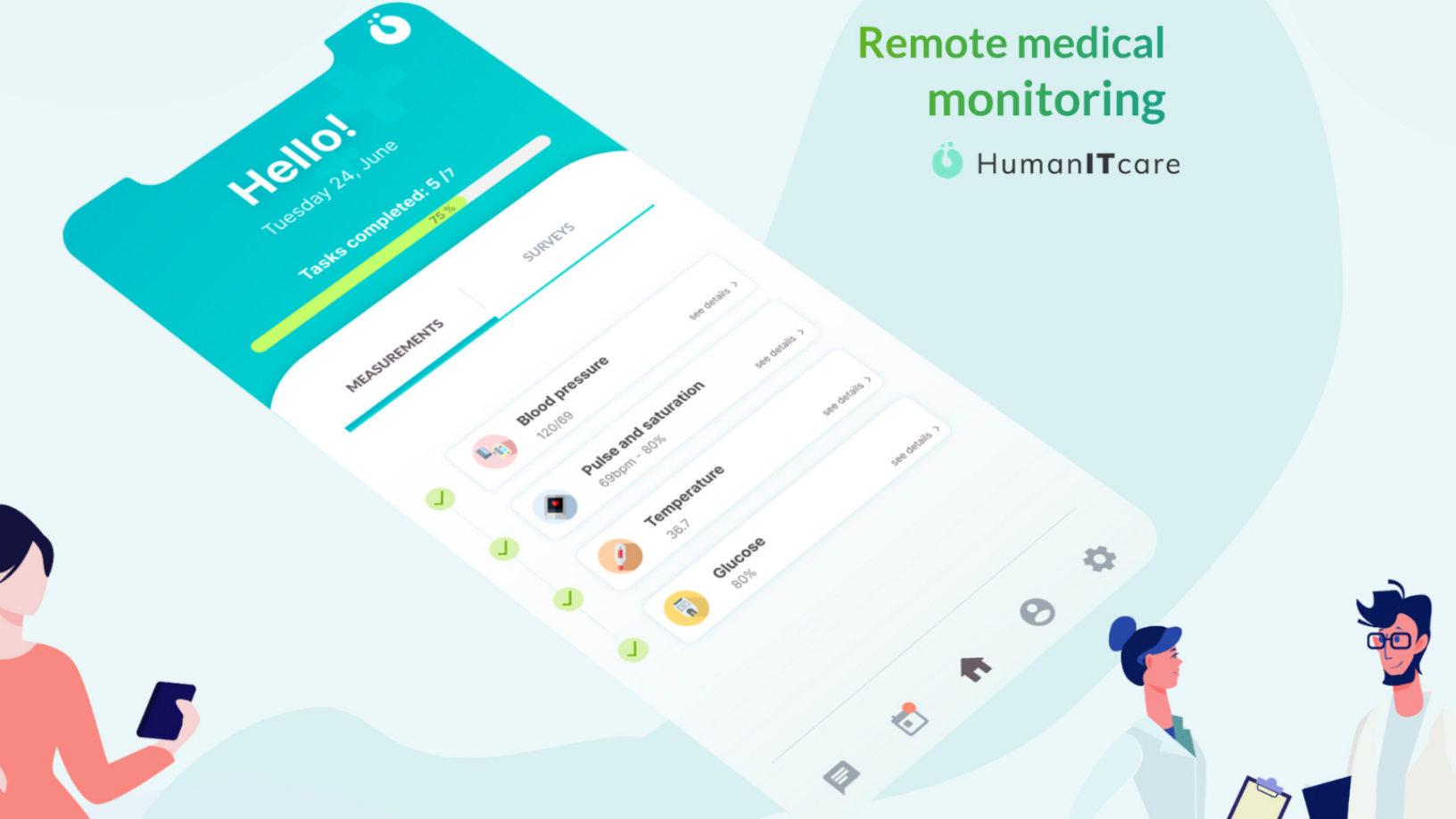

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

Alias Robotics: Award-winning cyber security pioneer reduces “clear and present danger” of robots

As machines become integral parts of daily life, Alias Robotics offers humans a way to solve the ever-increasing potential risks of robots

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Sorry, we couldn’t find any matches for“GK Plug and Play”.