GK Plug and Play

-

DATABASE (994)

-

ARTICLES (811)

The earliest backer of Xiaomi and an early investor in YY, Morningside Venture Capital started in 2008 and is part of HK real estate tycoon Ronnie Chan's Morningside Group. Today, led by Richard Liu, the early-stage investor has over US$1.5 billion under management and counts among its other successful investments Sohu, Ctrip, Xunlei and China Distance Education. It has offices in Shanghai, Beijing and Hong Kong.

The earliest backer of Xiaomi and an early investor in YY, Morningside Venture Capital started in 2008 and is part of HK real estate tycoon Ronnie Chan's Morningside Group. Today, led by Richard Liu, the early-stage investor has over US$1.5 billion under management and counts among its other successful investments Sohu, Ctrip, Xunlei and China Distance Education. It has offices in Shanghai, Beijing and Hong Kong.

Founded in 2011 by former Kingsoft CFO Wang Donghui (Kelvin Wang), Koubei and Wacai founder and former Alibaba executive Li Zhiguo (Frank Li) and another former top Alibaba executive (head of corporate finance and VP) Andrew Teoh (Zhao Hong). Ameba Capital is a seed/early stage VC fund managing over RMB 1 billion. It has invested in more than 60 startups, including Didi, Dianping and Mogujie.

Founded in 2011 by former Kingsoft CFO Wang Donghui (Kelvin Wang), Koubei and Wacai founder and former Alibaba executive Li Zhiguo (Frank Li) and another former top Alibaba executive (head of corporate finance and VP) Andrew Teoh (Zhao Hong). Ameba Capital is a seed/early stage VC fund managing over RMB 1 billion. It has invested in more than 60 startups, including Didi, Dianping and Mogujie.

Serial entrepreneur Cristina Fonseca co-founded VEEP and Bouncely in Lisbon, Portugal, and co-founded Talkdesk in San Francisco, California, US. She left Talkdesk in February 2016 and is currently a member of the World Economic Forum’s Global Agenda Council on Europe. Fonseca was listed on Forbes’s 30 under 30 in 2016. She received her bachelor’s and master’s degrees in Network and Telecommunications from Instituto Superior Tecnico.

Serial entrepreneur Cristina Fonseca co-founded VEEP and Bouncely in Lisbon, Portugal, and co-founded Talkdesk in San Francisco, California, US. She left Talkdesk in February 2016 and is currently a member of the World Economic Forum’s Global Agenda Council on Europe. Fonseca was listed on Forbes’s 30 under 30 in 2016. She received her bachelor’s and master’s degrees in Network and Telecommunications from Instituto Superior Tecnico.

Shenzhen-listed Oceanwide Holdings is part of the China Oceanwide empire founded and controlled by Lu Zhiqiang, one of China’s wealthiest billionaires. Oceanwide is also the founding and controlling shareholder of Minsheng Bank, the first private sector-backed commercial bank in China, and the third-largest shareholder of Legend Holdings, the investment group behind Lenovo. Its interests span globally across financial services, energy, culture and media, and real estate.

Shenzhen-listed Oceanwide Holdings is part of the China Oceanwide empire founded and controlled by Lu Zhiqiang, one of China’s wealthiest billionaires. Oceanwide is also the founding and controlling shareholder of Minsheng Bank, the first private sector-backed commercial bank in China, and the third-largest shareholder of Legend Holdings, the investment group behind Lenovo. Its interests span globally across financial services, energy, culture and media, and real estate.

BStartup is an initiative of Sabadell Bank that supports innovation and entrepreneurship in Spain. It focuses mainly on tech and digital ecosystems and has recently launched a new program BStartup Health to invest in the healthtech sector. The BStartup10 program allocates €1 million annually to support the seed and early-stage of development of 10 startups. The Sabadell Venture Capital provides Series A and Series B funding.

BStartup is an initiative of Sabadell Bank that supports innovation and entrepreneurship in Spain. It focuses mainly on tech and digital ecosystems and has recently launched a new program BStartup Health to invest in the healthtech sector. The BStartup10 program allocates €1 million annually to support the seed and early-stage of development of 10 startups. The Sabadell Venture Capital provides Series A and Series B funding.

Athos Capital is a venture capital firm established in 2017 with offices in Barcelona and Madrid. It currently operates a €1 million fund and has a portfolio of 10 Spain-based startups across the digital technology ecosystem (excluding real estate, biotech and healthcare). The team comprises Fernando Castiñeras, Robert Tomas, Giovanni Bologna and Elisabet Garriga, who have prior experience as venture capitalists, business consultants and entrepreneurs.

Athos Capital is a venture capital firm established in 2017 with offices in Barcelona and Madrid. It currently operates a €1 million fund and has a portfolio of 10 Spain-based startups across the digital technology ecosystem (excluding real estate, biotech and healthcare). The team comprises Fernando Castiñeras, Robert Tomas, Giovanni Bologna and Elisabet Garriga, who have prior experience as venture capitalists, business consultants and entrepreneurs.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Founded in 2017, Rekanext Capital Partners Pte Ltd is an early-stage VC firm based in Singapore and Jakarta. The VC focuses on scaling high potential startups in Southeast Asia to expand regionally by providing expertise, industry experience and networks. Its diverse investment portfolio includes agri-crowdfunding platform iGrow, chat and customer service developer Qiscus and architecture-focused VR Collab that has operations in Singapore and China.

Founded in 2017, Rekanext Capital Partners Pte Ltd is an early-stage VC firm based in Singapore and Jakarta. The VC focuses on scaling high potential startups in Southeast Asia to expand regionally by providing expertise, industry experience and networks. Its diverse investment portfolio includes agri-crowdfunding platform iGrow, chat and customer service developer Qiscus and architecture-focused VR Collab that has operations in Singapore and China.

Kingfisher is a privately owned, and independently managed financial services firm active for nearly three decades. The firm was established in Charlotte in the US in 1989 and acquired by WealthTrust, LLC in 2004. In 2009, it returned to operate as an independent investment adviser under the name of Kingfisher Capital, LLC and purchased all outstanding ownership interest from WealthTrust LLC. Kingfisher has supported affluent families, professionals, business owners, and institutions through financial advisory, smart investments and personalized client service.The firm is currently led by managing partners and co-founders Alexander Miles and H K Hallett. Prior to founding Kingfisher, Miles worked at WealthTrust Advisors, the Myers Limited Partnerships and Lehman Brothers in New York. Hallett worked for Trust Company Bank of Georgia and Peoples Bank of North Carolina before joining Carolina Securities Corporation, where he co-managed the Charlotte office.

Kingfisher is a privately owned, and independently managed financial services firm active for nearly three decades. The firm was established in Charlotte in the US in 1989 and acquired by WealthTrust, LLC in 2004. In 2009, it returned to operate as an independent investment adviser under the name of Kingfisher Capital, LLC and purchased all outstanding ownership interest from WealthTrust LLC. Kingfisher has supported affluent families, professionals, business owners, and institutions through financial advisory, smart investments and personalized client service.The firm is currently led by managing partners and co-founders Alexander Miles and H K Hallett. Prior to founding Kingfisher, Miles worked at WealthTrust Advisors, the Myers Limited Partnerships and Lehman Brothers in New York. Hallett worked for Trust Company Bank of Georgia and Peoples Bank of North Carolina before joining Carolina Securities Corporation, where he co-managed the Charlotte office.

The owner of WeChat, Tencent is China's biggest online entertainment and social network company. While the company is best known for QQ and WeChat (with 846m active users, and counting), online gaming is actually its biggest money-spinner. Within China, Tencent is the distributor of various international online game titles, such as League of Legends and Call of Duty Online. The company also publishes Honor of Kings, known as Arena of Valor outside China, which regularly tops the list of highest-grossing mobile games globally.Tencent has invested in various gaming-related companies, including Epic Games (creator of Fortnite and the Unreal Engine creation framework), PlatinumGames (Japanese game developer), and Riot Games (creator of League of Legends). Outside of video games, it has developed and invested in products related to video streaming, such as bilibili and Kuaishou, music (JOOX), and even healthcare.

The owner of WeChat, Tencent is China's biggest online entertainment and social network company. While the company is best known for QQ and WeChat (with 846m active users, and counting), online gaming is actually its biggest money-spinner. Within China, Tencent is the distributor of various international online game titles, such as League of Legends and Call of Duty Online. The company also publishes Honor of Kings, known as Arena of Valor outside China, which regularly tops the list of highest-grossing mobile games globally.Tencent has invested in various gaming-related companies, including Epic Games (creator of Fortnite and the Unreal Engine creation framework), PlatinumGames (Japanese game developer), and Riot Games (creator of League of Legends). Outside of video games, it has developed and invested in products related to video streaming, such as bilibili and Kuaishou, music (JOOX), and even healthcare.

PayPal is the US-based online payments company founded in 1999 and acquired by eBay in 2002. It is listed in NASDAQ under the ticker code PYPL.Besides facilitating online payments and money transfers for many e-commerce companies and other internet-based businesses, it is famous for its network of former founders and other alumni, many of whom went on to establish successful companies or became investors in the tech and internet industries. Some famous names linked to this network, sometimes called “PayPal Mafia”, include ex-CEO Peter Thiel, Elon Musk, Dave McClure (founder of 500 Startups), and Reid Hoffman (LinkedIn co-founder).PayPal has invested in several companies, including ride-hailing firms Gojek and Uber and e-commerce platform MercadoLibre. It has also established PayPal Ventures as a separate VC arm and PayPal Incubator to support early-stage startups.

PayPal is the US-based online payments company founded in 1999 and acquired by eBay in 2002. It is listed in NASDAQ under the ticker code PYPL.Besides facilitating online payments and money transfers for many e-commerce companies and other internet-based businesses, it is famous for its network of former founders and other alumni, many of whom went on to establish successful companies or became investors in the tech and internet industries. Some famous names linked to this network, sometimes called “PayPal Mafia”, include ex-CEO Peter Thiel, Elon Musk, Dave McClure (founder of 500 Startups), and Reid Hoffman (LinkedIn co-founder).PayPal has invested in several companies, including ride-hailing firms Gojek and Uber and e-commerce platform MercadoLibre. It has also established PayPal Ventures as a separate VC arm and PayPal Incubator to support early-stage startups.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

SVB Financial Group has been involved in Asian markets since the early 1990s and in the Chinese market since 1999. For more than a decade, SVB has been building relationships with technology companies, entrepreneurs and venture capitalists to help clients work with businesses in Asia and sell to a variety of foreign markets. SVB established its first China subsidiary, SVB Business Partners Shanghai, in 2005 and its second, SVB Business Partners Beijing, in 2010. They provide local technology companies and venture capital investors with in-market client service support and advisory services.

SVB Financial Group has been involved in Asian markets since the early 1990s and in the Chinese market since 1999. For more than a decade, SVB has been building relationships with technology companies, entrepreneurs and venture capitalists to help clients work with businesses in Asia and sell to a variety of foreign markets. SVB established its first China subsidiary, SVB Business Partners Shanghai, in 2005 and its second, SVB Business Partners Beijing, in 2010. They provide local technology companies and venture capital investors with in-market client service support and advisory services.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

Polaroo: An expense app that finds the best deals and automates payments

Take control of your finances and save money and time with Polaroo's personalized expenses app

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

FarmCloud: Effective husbandry management to help feed the world

Global meat consumption is increasing and, consequently, so is intensive farming, meaning FarmCloud's one-stop animal husbandry management solution comes at the right moment

Soon, a cute robot will bring you your online shopping

Using robots to automate last-mile delivery, Zhen Robotics wants to help the logistics industry slash costs and boost customer satisfaction.

Plug-it and Drive-it with Wallbox’s EV quick chargers

Created by an ex-Tesla engineer, these generic chargers are fast and easy to use – just like recharging mobile phones

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

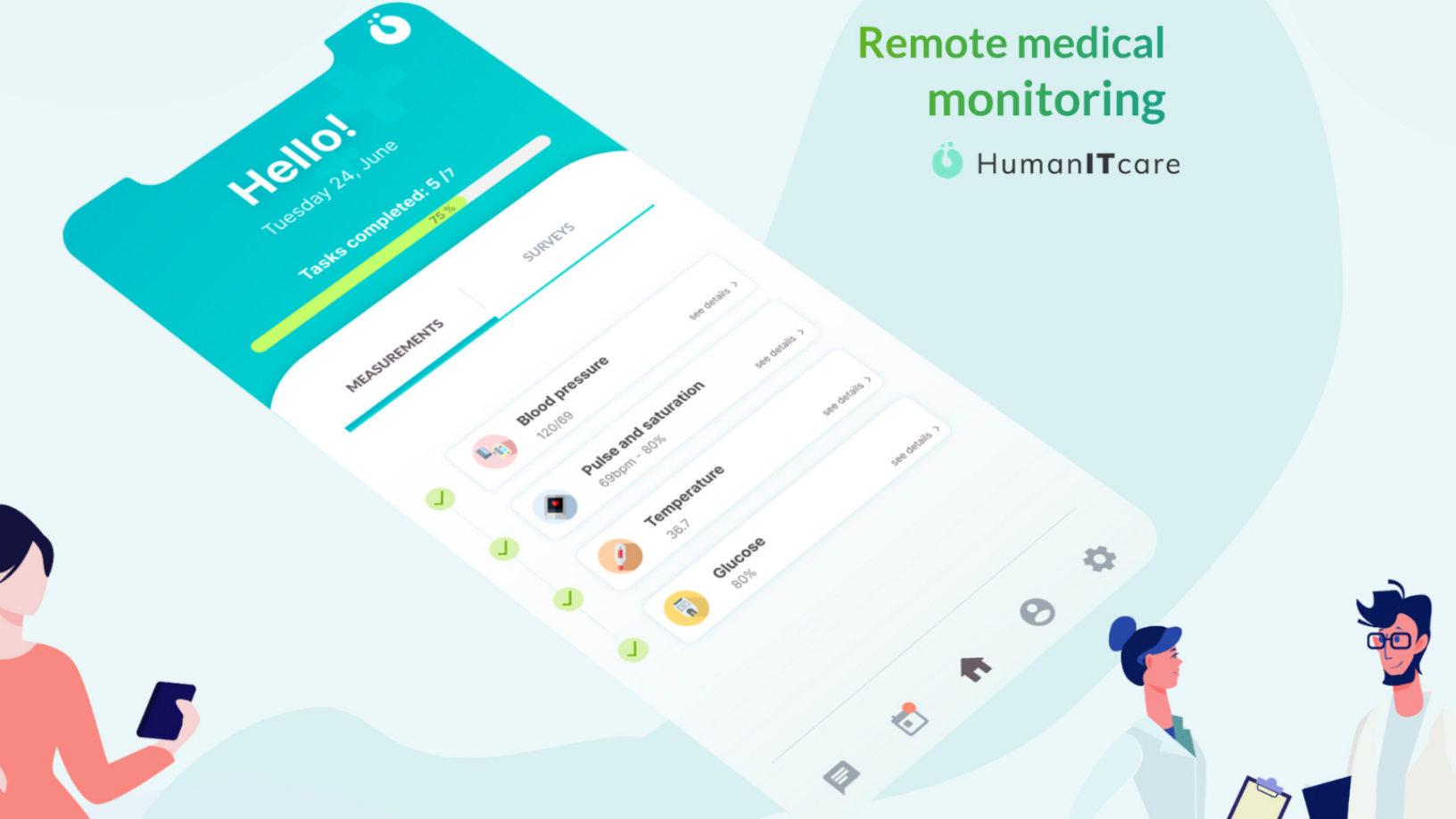

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

CoolFarm: Why did Microsoft Portugal's Startup of the Year go bust?

The indoor-gardening tech startup went from winning awards to closing down with debts of close to €1m four years after its founding

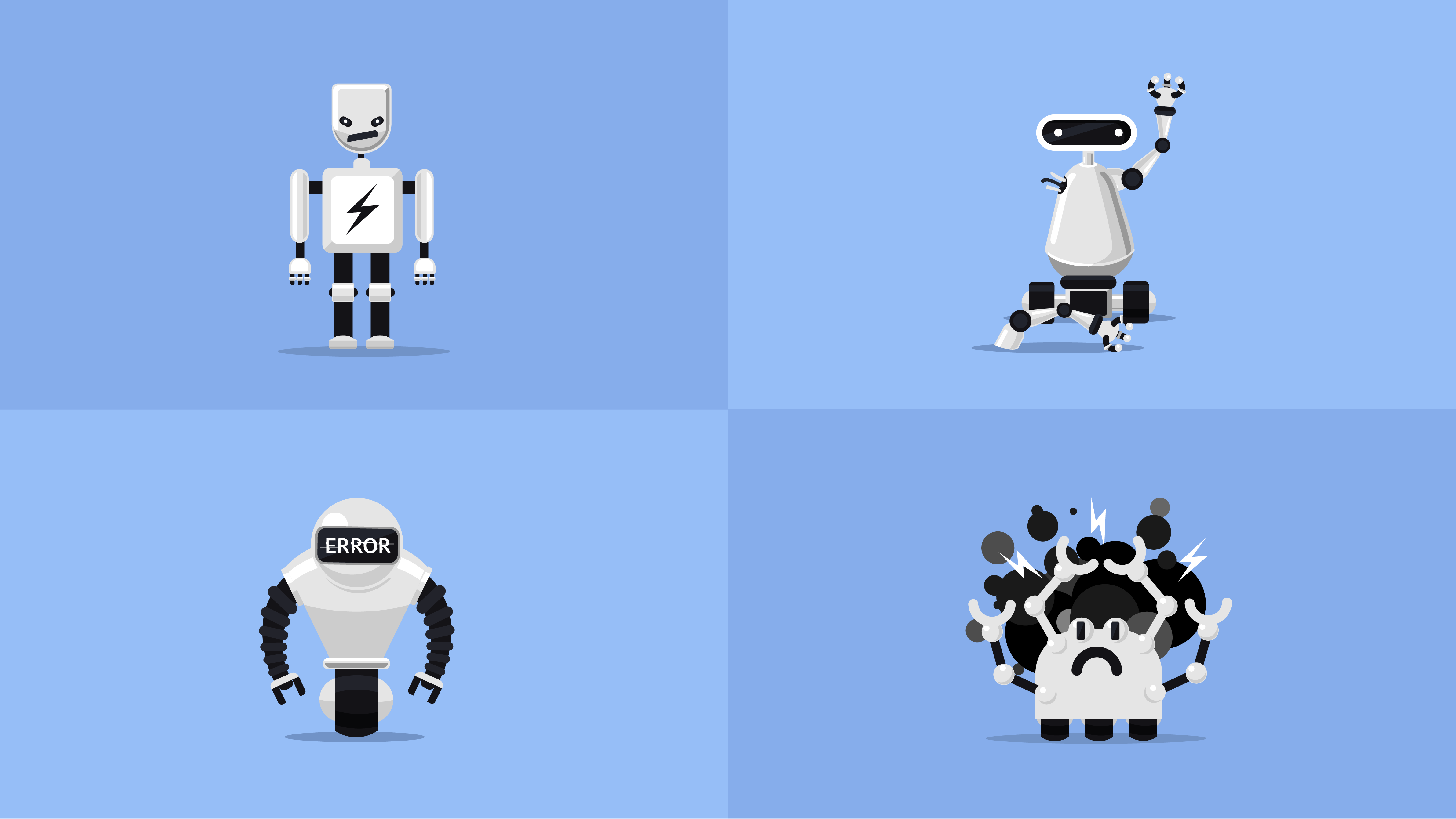

Alias Robotics: Award-winning cyber security pioneer reduces “clear and present danger” of robots

As machines become integral parts of daily life, Alias Robotics offers humans a way to solve the ever-increasing potential risks of robots

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Sorry, we couldn’t find any matches for“GK Plug and Play”.