GROW

-

DATABASE (16)

-

ARTICLES (270)

GROW is a Singapore-based food and agriculture technology accelerator for global impact-focused startups. It is financially backed by AgFunder, an agrifood tech venture investment through the AgFunder GROW Impact Fund. Grow is also supported by the Singapore Government and is an accredited mentor partner of Startup SG.

GROW is a Singapore-based food and agriculture technology accelerator for global impact-focused startups. It is financially backed by AgFunder, an agrifood tech venture investment through the AgFunder GROW Impact Fund. Grow is also supported by the Singapore Government and is an accredited mentor partner of Startup SG.

Co-founder of Printerous

Creative toy designer and photographer, Paulus Hyu Susanto is a busy entrepreneur often found at toy expos around the world. His twitter slogan, “We do not stop playing because we grow old, we grow old because we stop playing”, captures it all. Besides running a designer toy online shop Kurobokan, Paulus also works as a photographer at AXIOO that was co-founded with David Soong.

Creative toy designer and photographer, Paulus Hyu Susanto is a busy entrepreneur often found at toy expos around the world. His twitter slogan, “We do not stop playing because we grow old, we grow old because we stop playing”, captures it all. Besides running a designer toy online shop Kurobokan, Paulus also works as a photographer at AXIOO that was co-founded with David Soong.

Co-founder and CMO of Agate

Shieny Aprilia is one of Agate's original 18 members and has been with the company since it was established in 2009. She was originally tasked with managing the company's operations and finances while still working as a game programmer and producer. As Agate continued to grow, she took over the role of COO and eventually became Chief Marketing Officer.Like most of the other original members of Agate, Shieny graduated from the Bandung Institute of Technology with a bachelor's in Informatics Engineering.

Shieny Aprilia is one of Agate's original 18 members and has been with the company since it was established in 2009. She was originally tasked with managing the company's operations and finances while still working as a game programmer and producer. As Agate continued to grow, she took over the role of COO and eventually became Chief Marketing Officer.Like most of the other original members of Agate, Shieny graduated from the Bandung Institute of Technology with a bachelor's in Informatics Engineering.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

Renamed Defined.ai, DefinedCrowd has expanded into a marketplace for AI data, tools and models, with services for complex ML projects. NLP, computer vision focused.

Renamed Defined.ai, DefinedCrowd has expanded into a marketplace for AI data, tools and models, with services for complex ML projects. NLP, computer vision focused.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Plug and Play, the world’s largest startup accelerator, is a seed and early-stage investment firm. Based in Silicon Valley, Plug and Play invests in more than 160 of the 5,000 startups it reviews every year and runs industry-specific accelerator programs to help the startups it funds grow faster.

Plug and Play, the world’s largest startup accelerator, is a seed and early-stage investment firm. Based in Silicon Valley, Plug and Play invests in more than 160 of the 5,000 startups it reviews every year and runs industry-specific accelerator programs to help the startups it funds grow faster.

TreeFrog Therapeutics’ C-Stem technology mass-produces high-quality pluripotent stem cells in a 3D environment that mimics the way cells grow in the human body.

TreeFrog Therapeutics’ C-Stem technology mass-produces high-quality pluripotent stem cells in a 3D environment that mimics the way cells grow in the human body.

Sierra Ventures is an American, private-owned venture capital firm founded in 1982. The company now manages a $1.5bn fund with a focus on domestic consumer solutions and advanced technology. It has helped more than 200 companies around the globe to grow, having raised more than $1.9bn in capital. Since 2006, it has been actively investing in India and China.

Sierra Ventures is an American, private-owned venture capital firm founded in 1982. The company now manages a $1.5bn fund with a focus on domestic consumer solutions and advanced technology. It has helped more than 200 companies around the globe to grow, having raised more than $1.9bn in capital. Since 2006, it has been actively investing in India and China.

Established in 2003, COTEC Portugal is a business association which seeks to advance technological development and innovation cooperation. Its network comprises multinationals and SMEs operating across most sectors whose gross added value represents more than 16% of Portugal's national GDP and 8% of private employment. COTEC Portugal has an Innovative SME Network that seeks to promote public knowledge of its members, attract investment and help them grow internationally. The president of Portugal is the honorary president of COTEC Portugal.

Established in 2003, COTEC Portugal is a business association which seeks to advance technological development and innovation cooperation. Its network comprises multinationals and SMEs operating across most sectors whose gross added value represents more than 16% of Portugal's national GDP and 8% of private employment. COTEC Portugal has an Innovative SME Network that seeks to promote public knowledge of its members, attract investment and help them grow internationally. The president of Portugal is the honorary president of COTEC Portugal.

Co-founder and CEO of Kopi Kenangan

Edward Tirtanata is best known for establishing Kopi Kenangan, the popular grab-and-go coffee chain. Prior to that, however, the finance and accounting graduate from Northeastern University, USA, had established Lewis & Carroll, a premium establishment serving artisanal tea. Unfortunately, the brand struggled to grow among Indonesia's budget-conscious youths, who preferred the cheaper bubble tea. Learning from the experience, he decided to eschew the Starbucks-style “third home” retail concept and opted for grab-and-go stalls that are cheaper to establish, but without abandoning the quality of the coffee served. The concept proved to be a hit, and Tirtanata's new venture became a nationwide sensation.Aside from his role as CEO of Kopi Kenangan, Tirtanata is getting more deeply involved in the F&B startup ecosystem. In February 2020, he joined Gojek and startup ecosystem builder Digitaraya in establishing Digitarasa, a new accelerator program for F&B businesses.

Edward Tirtanata is best known for establishing Kopi Kenangan, the popular grab-and-go coffee chain. Prior to that, however, the finance and accounting graduate from Northeastern University, USA, had established Lewis & Carroll, a premium establishment serving artisanal tea. Unfortunately, the brand struggled to grow among Indonesia's budget-conscious youths, who preferred the cheaper bubble tea. Learning from the experience, he decided to eschew the Starbucks-style “third home” retail concept and opted for grab-and-go stalls that are cheaper to establish, but without abandoning the quality of the coffee served. The concept proved to be a hit, and Tirtanata's new venture became a nationwide sensation.Aside from his role as CEO of Kopi Kenangan, Tirtanata is getting more deeply involved in the F&B startup ecosystem. In February 2020, he joined Gojek and startup ecosystem builder Digitaraya in establishing Digitarasa, a new accelerator program for F&B businesses.

Angels Capital is an investment vehicle created by Juan Roig as part of the Marina of Companies network in Valencia. Its mission is to grow startups within the Lanzadera accelerator, as well as external projects that facilitate the creation of a strong entrepreneurial ecosystem in Valencia. Angels Capital has 13 current investment projects, seven of which it is lead investor in and, since 2014, it has invested €15.5 million in capital. Recent investments include a €1 million venture round for cloud-based workflow platform SheetGo, and €360,000 in seed funding for bank aggregation system Afterbanks.

Angels Capital is an investment vehicle created by Juan Roig as part of the Marina of Companies network in Valencia. Its mission is to grow startups within the Lanzadera accelerator, as well as external projects that facilitate the creation of a strong entrepreneurial ecosystem in Valencia. Angels Capital has 13 current investment projects, seven of which it is lead investor in and, since 2014, it has invested €15.5 million in capital. Recent investments include a €1 million venture round for cloud-based workflow platform SheetGo, and €360,000 in seed funding for bank aggregation system Afterbanks.

Via ID is a business incubator and investor with a presence in France, the US, Singapore, and Germany. Its focus is on startups that develop “new modes of mobility”, which includes businesses ranging from bike-sharing and ride-hailing to vehicle marketplaces, garage comparisons and last-mile deliveries. Besides helping startups grow their business through incubation and investment, Via ID also connects various businesses, from startups to corporates and VCs, to develop synergies. One of its initiatives is The Mobility Club, a “private club” for mobility companies and investors to interact and gain industry insights.

Via ID is a business incubator and investor with a presence in France, the US, Singapore, and Germany. Its focus is on startups that develop “new modes of mobility”, which includes businesses ranging from bike-sharing and ride-hailing to vehicle marketplaces, garage comparisons and last-mile deliveries. Besides helping startups grow their business through incubation and investment, Via ID also connects various businesses, from startups to corporates and VCs, to develop synergies. One of its initiatives is The Mobility Club, a “private club” for mobility companies and investors to interact and gain industry insights.

Speedinvest is a pan-European, early-stage venture capital firm with offices in Vienna, Munich, San Francisco, Berlin, London and Paris. The firm helps startups grow internationally. Its raised its third and latest fund of €190m in Feburary 2020, bringing total AUM to over €400m. Each investment ticket size starts from €50,000 and goes up to €1.5m. Founded by Austrian Oliver Holle, a former entrepreneur who founded his business in the 2000s and went on to work another tech startup in Silicon Valley. With conviction that "European founders can win big in the Valley and beyond,” Rolle started Speedinvest with a €10m fund in 2011.The firm mainly invests in pan-European fintech startups, digital health, consumer tech, B2B SaaS and deep tech startups.

Speedinvest is a pan-European, early-stage venture capital firm with offices in Vienna, Munich, San Francisco, Berlin, London and Paris. The firm helps startups grow internationally. Its raised its third and latest fund of €190m in Feburary 2020, bringing total AUM to over €400m. Each investment ticket size starts from €50,000 and goes up to €1.5m. Founded by Austrian Oliver Holle, a former entrepreneur who founded his business in the 2000s and went on to work another tech startup in Silicon Valley. With conviction that "European founders can win big in the Valley and beyond,” Rolle started Speedinvest with a €10m fund in 2011.The firm mainly invests in pan-European fintech startups, digital health, consumer tech, B2B SaaS and deep tech startups.

- 1

- 2

Creatio Energy Systems: From personal hobby to Iberian enabler of IoT technology

Creatio develops fully compatible sensors with a matching SaaS platform, meeting fast-growing IoT demand in Spain, where there are only a few local players

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

Girls in Tech Indonesia: Inspiring the geek in every girl

Girls in Tech Indonesia aims to put the country's women at the forefront of its tech and startup world

B’Smart: Innovative IoT systems add ML for smart fleet management

Pivoting from Wi-Fi systems to smart fleet management, B'Smart is expanding rapidly to tap the US$12.7bn IoT for logistics market

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

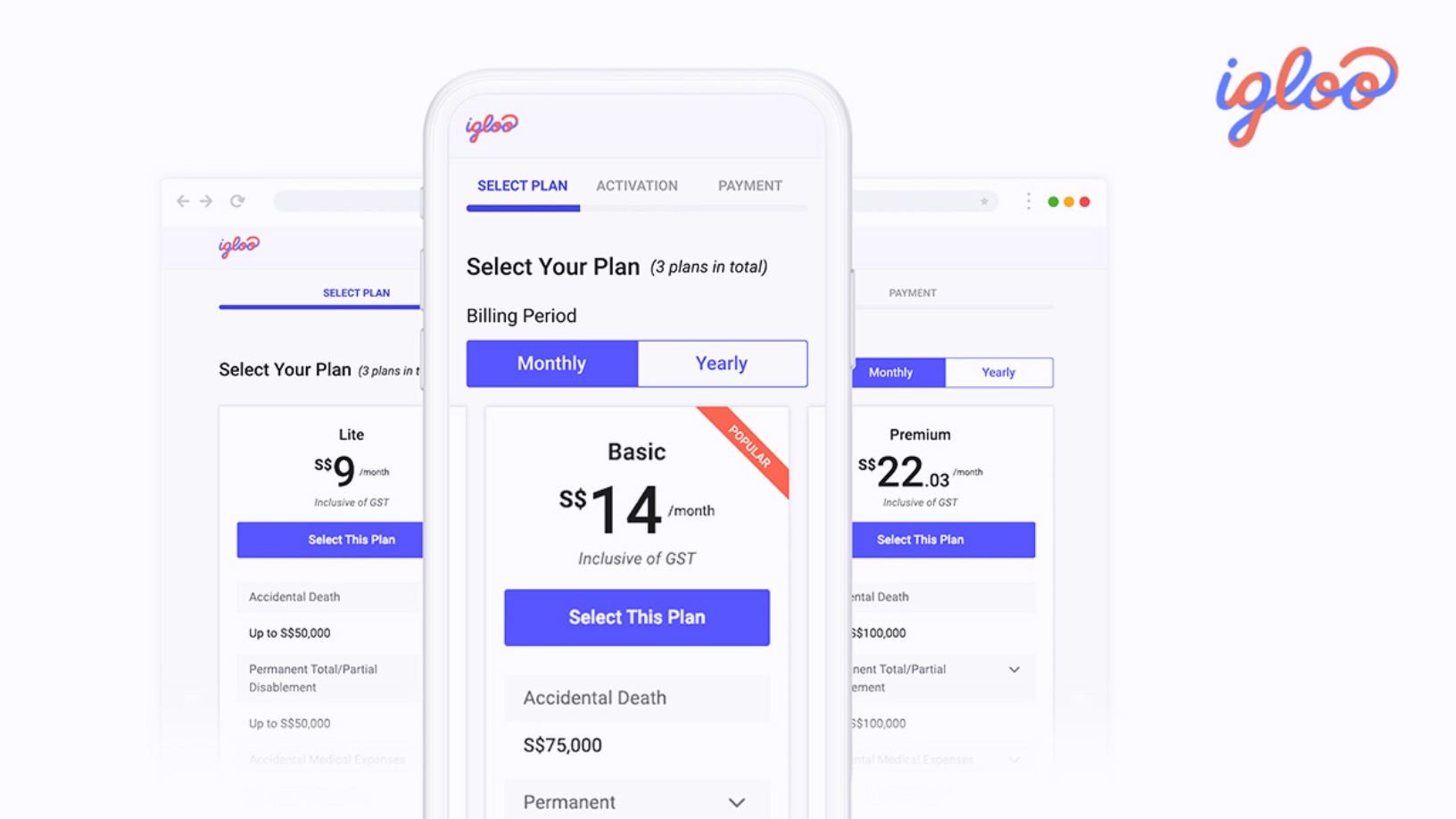

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

P2P lender Investree collaborates with eFishery to provide loans for aquaculture SMEs

Access to quick financing would be a welcome relief to fish farmers, whose incomes have been battered by Covid-19, but can’t get bank loans

eCooltra CEO: Offline-to-online leader in two-wheel sharing economy

Timo Buetefisch, the CEO and co-founder of Europe's largest scooter rental firm Cooltra, discusses the successful offline-to-online shift to scooter-sharing app eCooltra

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

Kantox: Value for corporates, headache for banks

Moving beyond its initial remit of currency exchange, Europe's fourth-fastest growing fintech Kantox has garnered awards and financial sector hostility as it differentiates itself in a crowded marketplace

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

Sorry, we couldn’t find any matches for“GROW”.