Garden Impact Investments

-

DATABASE (467)

-

ARTICLES (320)

Part of the larger Sonae Group of companies, Sonae IM was launched in 2015 and is the corporate venture arm for tech-based investments. Since their launch, they have backed various companies particularly in the retail technology sector. These include StyleSage (fashion tech in predictive analytics) and InovRetail (demand forecasting for retailers).

Part of the larger Sonae Group of companies, Sonae IM was launched in 2015 and is the corporate venture arm for tech-based investments. Since their launch, they have backed various companies particularly in the retail technology sector. These include StyleSage (fashion tech in predictive analytics) and InovRetail (demand forecasting for retailers).

Frontline Ventures is a London-based VC firm that typically invests in early-stage B2B companies with the bulk of funding going toward European companies seeking a U.S. expansion. The current Fund II, worth €60 million, closed in 2016 and they are looking to make investments of between €200,000 and €3 million each.

Frontline Ventures is a London-based VC firm that typically invests in early-stage B2B companies with the bulk of funding going toward European companies seeking a U.S. expansion. The current Fund II, worth €60 million, closed in 2016 and they are looking to make investments of between €200,000 and €3 million each.

China Softbank Capital (SBCVC)

Established in 2000 and led by Chauncey Shey (Xue Cunhe), the SoftBank-backed VC/PE firm manages over US$2 billion, focusing on companies in the TMT, cleantech, healthcare, consumer/retail and advanced manufacturing sectors. Notable investments include Alibaba, Focus Media Holding, Wanguo Data, Shenwu Group, GDS, PPLive and Yooli.

Established in 2000 and led by Chauncey Shey (Xue Cunhe), the SoftBank-backed VC/PE firm manages over US$2 billion, focusing on companies in the TMT, cleantech, healthcare, consumer/retail and advanced manufacturing sectors. Notable investments include Alibaba, Focus Media Holding, Wanguo Data, Shenwu Group, GDS, PPLive and Yooli.

Skyview Fund is a venture capital firm that focuses on early-stage investments in TMT industries. Founded by Andrew Ren, Skyview raised over RMB 300 million for its first venture capital fund. On March 1, 2017, Alex Cong, a former partner at Matrix Partners, joined Skyview Fund as its second managing partner.

Skyview Fund is a venture capital firm that focuses on early-stage investments in TMT industries. Founded by Andrew Ren, Skyview raised over RMB 300 million for its first venture capital fund. On March 1, 2017, Alex Cong, a former partner at Matrix Partners, joined Skyview Fund as its second managing partner.

STI Financial Group is a Hong Kong-based investment firm. It specializes in hedge fund and private equity investments, managing the assets of clients through various investment instruments and structured products. The company also runs services to help clients set up trust funds for their heirs or family members.

STI Financial Group is a Hong Kong-based investment firm. It specializes in hedge fund and private equity investments, managing the assets of clients through various investment instruments and structured products. The company also runs services to help clients set up trust funds for their heirs or family members.

With a specific focus on clean energy, Innogy Innovation Hub was established in 2014 and currently has 53 startups in its portfolio spanning from Austria to Bangladesh. Recent investments include HypeLabs' US$3m seed round and the €4m Series A round of augmented and mixed reality solutions provider Holo-Light.

With a specific focus on clean energy, Innogy Innovation Hub was established in 2014 and currently has 53 startups in its portfolio spanning from Austria to Bangladesh. Recent investments include HypeLabs' US$3m seed round and the €4m Series A round of augmented and mixed reality solutions provider Holo-Light.

Acton Capital Partners is a Munich-based VC that focuses on late-stage investments. The firm invests primarily in the sectors of fintech, marketing and e-commerce and has invested over €350m across the three industries. It has backed prominent companies such as Toronto-based Chef’s Plate and online homemade crafts marketplace Etsy.

Acton Capital Partners is a Munich-based VC that focuses on late-stage investments. The firm invests primarily in the sectors of fintech, marketing and e-commerce and has invested over €350m across the three industries. It has backed prominent companies such as Toronto-based Chef’s Plate and online homemade crafts marketplace Etsy.

A prolific investor, Eddy Chan has been involved in venture investments for US companies like Paypal, SpaceX, and Palantir, as well as Indonesian ones like coworking space EV Hive (now CoHive), BeliMobilGue (used car marketplace) and Kata.ai (chatbot builder). He is also the founding partner of Intudo Ventures, an "Indonesia-only" VC firm.

A prolific investor, Eddy Chan has been involved in venture investments for US companies like Paypal, SpaceX, and Palantir, as well as Indonesian ones like coworking space EV Hive (now CoHive), BeliMobilGue (used car marketplace) and Kata.ai (chatbot builder). He is also the founding partner of Intudo Ventures, an "Indonesia-only" VC firm.

Khosla Ventures is a Silicon Valley-based VC, founded in 2004 by Indian-born founder of tech pioneer Sun Microsystems Vinod Khosla. The company has no specific interest in terms of sector but heavily favors “large problems that are amenable to technology solutions” and invests in so-called high potential 'black swans´. Healthcare is a strong focus and its most recent investments include in the Portuguese home physiotherapy tech solution SWORD Health's 2021 $85m Series C and $25m Series B rounds besides its 2020 $17m Series A round which it led. Khosla has over $5bn under management and more than 70 staff, with investments in more than 700 startups, leading more than one-third. Other recent investments include in the July 2021 $75m Series C round of Indian personal health and fitness app HealthifyMe and, the same month, in the $12.5m Series A round of US commercial real estate app for tenants and property managers Jones.

Khosla Ventures is a Silicon Valley-based VC, founded in 2004 by Indian-born founder of tech pioneer Sun Microsystems Vinod Khosla. The company has no specific interest in terms of sector but heavily favors “large problems that are amenable to technology solutions” and invests in so-called high potential 'black swans´. Healthcare is a strong focus and its most recent investments include in the Portuguese home physiotherapy tech solution SWORD Health's 2021 $85m Series C and $25m Series B rounds besides its 2020 $17m Series A round which it led. Khosla has over $5bn under management and more than 70 staff, with investments in more than 700 startups, leading more than one-third. Other recent investments include in the July 2021 $75m Series C round of Indian personal health and fitness app HealthifyMe and, the same month, in the $12.5m Series A round of US commercial real estate app for tenants and property managers Jones.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

Founded in 2013 in Singapore, VVNP is a future-food solutions-orientated investor with a special interest in science-based companies that have the ability to scale global solutions, especially within Asia. It invests from seed stage to Series C level. Typical investments range from $300,000 to $3m and the investor has launched two funds to date. The first raised $40m and invested in seven companies globally, while the second was created in 2020, targeting $150m in total investment.The VC’s most recent investments include a €271,000 pre-seed investment round in Dutch poultry animal welfare biotech In Ovo in March 2021, and leading the as-yet-uncompleted 6m Swiss franc (approximately $6.56m) seed round in Swiss biotech SwissDeCode in January 2021 – a company that applies DNA testing to food traceability.

Founded in 2013 in Singapore, VVNP is a future-food solutions-orientated investor with a special interest in science-based companies that have the ability to scale global solutions, especially within Asia. It invests from seed stage to Series C level. Typical investments range from $300,000 to $3m and the investor has launched two funds to date. The first raised $40m and invested in seven companies globally, while the second was created in 2020, targeting $150m in total investment.The VC’s most recent investments include a €271,000 pre-seed investment round in Dutch poultry animal welfare biotech In Ovo in March 2021, and leading the as-yet-uncompleted 6m Swiss franc (approximately $6.56m) seed round in Swiss biotech SwissDeCode in January 2021 – a company that applies DNA testing to food traceability.

HGI Finaves China is initiated by HGI Capital, a Hong Kong-based investment fund, and CEIBS, a business school established under an agreement between China’s trade ministry and the European Commission. It makes seed/angel round as well as Series A investments in the TMT, culture and creative, and consumer-related sectors in China.

HGI Finaves China is initiated by HGI Capital, a Hong Kong-based investment fund, and CEIBS, a business school established under an agreement between China’s trade ministry and the European Commission. It makes seed/angel round as well as Series A investments in the TMT, culture and creative, and consumer-related sectors in China.

Founded in 2008, Bertelsmann Asia Investments (BAI) is an evergreen fund wholly owned by Bertelsmann focusing on private equity investment in the Greater China Region. With over US$1 billion under management, BAI mainly invests in high-growth startups in industries including consumer upgrades, mobile sea, online education, financial services, mobile health and enterprise services.

Founded in 2008, Bertelsmann Asia Investments (BAI) is an evergreen fund wholly owned by Bertelsmann focusing on private equity investment in the Greater China Region. With over US$1 billion under management, BAI mainly invests in high-growth startups in industries including consumer upgrades, mobile sea, online education, financial services, mobile health and enterprise services.

Founded in 2014, Desun Capital is the largest private investment firm in Sichuan province. With over RMB 1 billion under management, Desun conducts investments across all stages from seed/angel to IPO. It plans to go public in the next five years and become one of the most influential investment firms in China.

Founded in 2014, Desun Capital is the largest private investment firm in Sichuan province. With over RMB 1 billion under management, Desun conducts investments across all stages from seed/angel to IPO. It plans to go public in the next five years and become one of the most influential investment firms in China.

Yueyin Venture Capital was founded in 2015 in Beijing. It manages total assets worth US$300m, with investments in 22 companies. The VC focuses mainly in the healthcare, pharmaceutical and biotech sectors.

Yueyin Venture Capital was founded in 2015 in Beijing. It manages total assets worth US$300m, with investments in 22 companies. The VC focuses mainly in the healthcare, pharmaceutical and biotech sectors.

Education for all: Interview with DANAdidik CEO Dipo Satria

The student loan startup is narrowing its focus to funding students planning on healthcare careers, and it also hopes to attract more financing from impact investors

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

agroSingularity: Turning discarded fruits and vegetables into usable powder to fix food waste

Closing €1.2m new funding will help the Murcia-based foodtech to build its own technology and facilities, expand into new markets

Lluvia Sólida: An economic lifeline for farmers in drier, unpredictable climate conditions

Reducing the need for watering by up to 90%, this Mexican startup’s polymer-based water retention technology is a potential game-changer for farming worldwide

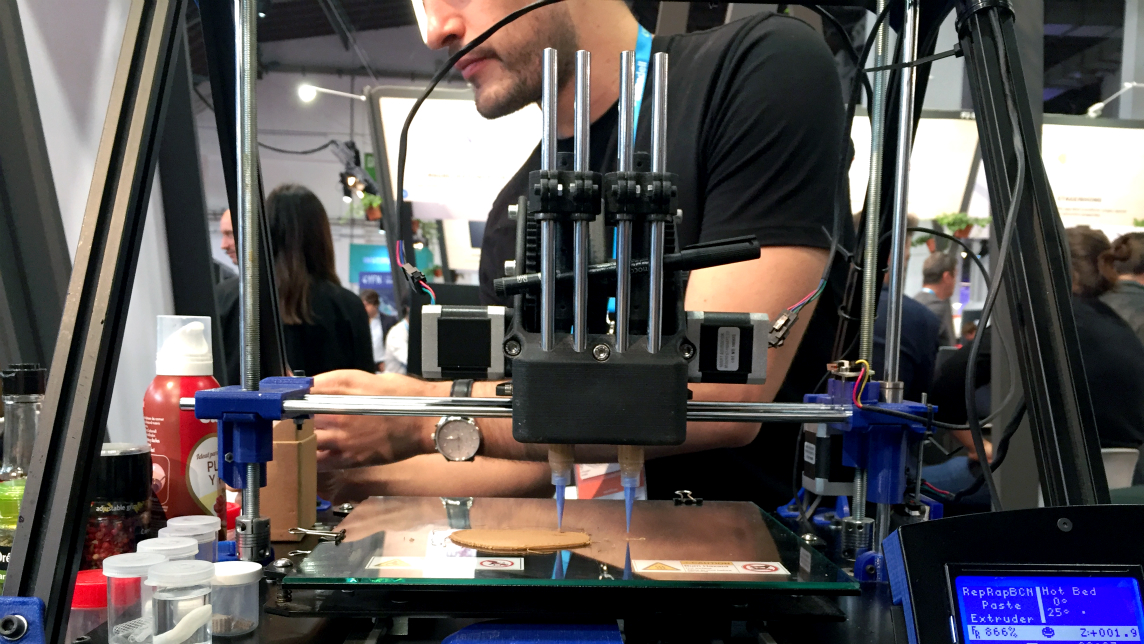

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

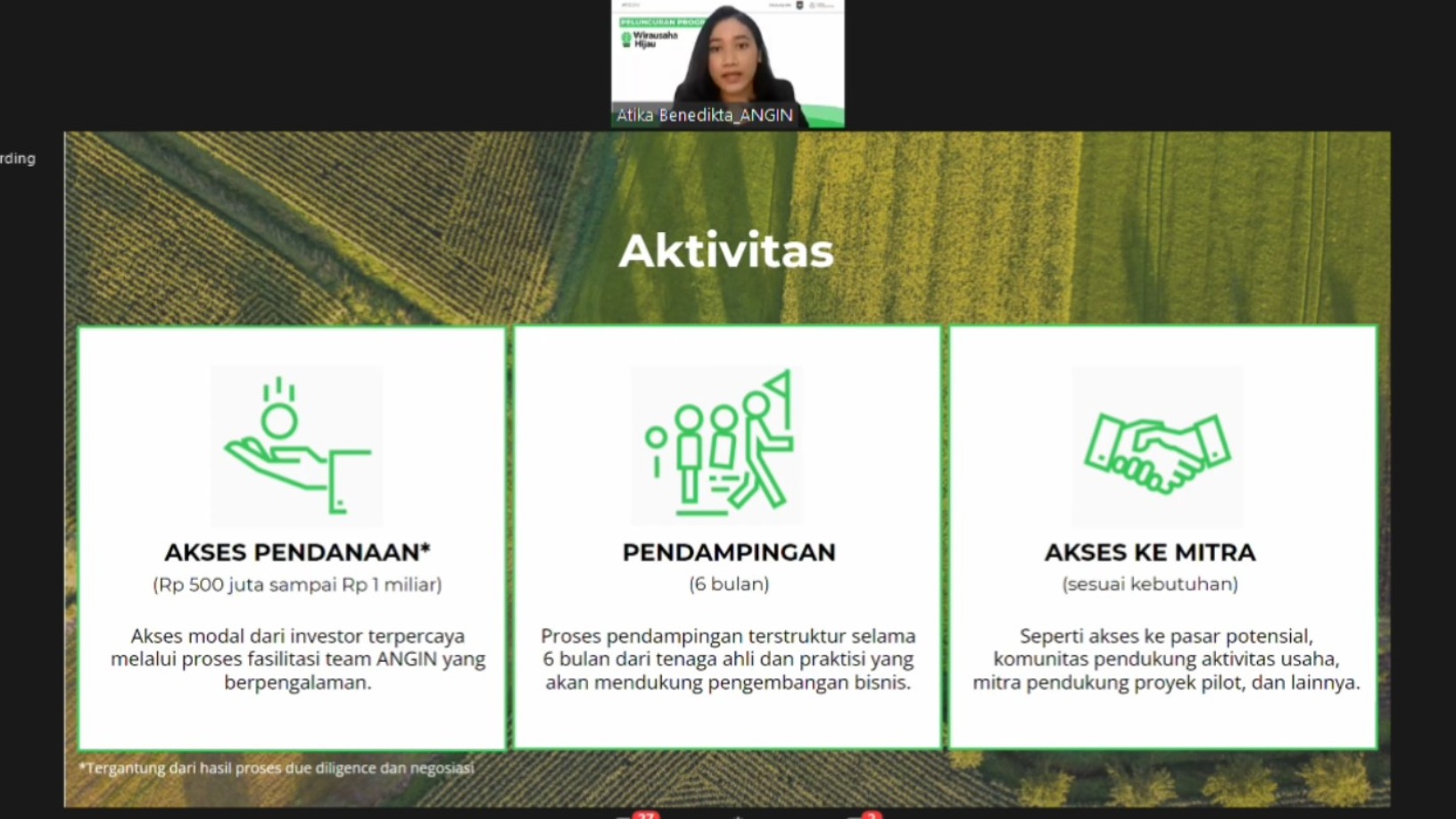

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

Bioo’s green power: Electricity, Wi-Fi from a flower pot

The Spanish startup has won accolades and fundings for its NASA-inspired fuel cells and energy-producing plants

Neurafarm: Putting an AI plant doctor in farmers' hands

This startup is riding on Indonesia’s urban farming trend with its planting kit and an AI-powered app that identifies plant diseases from photos of unhealthy leaves

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sorry, we couldn’t find any matches for“Garden Impact Investments”.