Garden Impact Investments

-

DATABASE (467)

-

ARTICLES (320)

Lugard Road Capital/ Luxor Capital

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Lugard Road Capital is a New York-based hedge fund under the Luxor Capital Group. The fund invests across market segments and geographies, with several late-stage investments included in its current portfolio of 11 startups.In 2021, Lugard and Luxor led the €450m Series F round for Spanish on-demand delivery app Glovo and also joined the $146m Series J round of Indian foodtech Zomato in 2020. Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the June 2021 $28.5m Series C round of Norwegian ocean and air freight benchmarking and market analytics platform Xeneta.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Founded in 2014 by internet/high-tech veteran and serial entrepreneur Huang Mingming, FutureCap focuses on early-stage investment of internet and high-tech startups. Differing from other early-stage investors, FutureCap conducts a more conservative investment strategy. With less than 20 investments a year, which are mostly from automotive, corporate services and hardware industries, FutureCap tries to avoid fintech and online-to-offline startups, citing the lack of business model in some and cash burning involved.

Founded in 2014 by internet/high-tech veteran and serial entrepreneur Huang Mingming, FutureCap focuses on early-stage investment of internet and high-tech startups. Differing from other early-stage investors, FutureCap conducts a more conservative investment strategy. With less than 20 investments a year, which are mostly from automotive, corporate services and hardware industries, FutureCap tries to avoid fintech and online-to-offline startups, citing the lack of business model in some and cash burning involved.

Ex-Alibaba executive who is now a key figure in the Zhejiang province internet technology startup scene. In 1999, Li Zhiguo (Frank Li) moved alone to Hangzhou and became the 46th employee of Alibaba. In 2004, he left Alibaba and founded the highly popular life services platform Koubei (later acquired by Alibaba). He is also an active investor, having co-founded early-stage VC fund Ameba Capital in 2011. Li’s investments in Chinese startups include Mogujie, Kuaidadi and Zhaocai.

Ex-Alibaba executive who is now a key figure in the Zhejiang province internet technology startup scene. In 1999, Li Zhiguo (Frank Li) moved alone to Hangzhou and became the 46th employee of Alibaba. In 2004, he left Alibaba and founded the highly popular life services platform Koubei (later acquired by Alibaba). He is also an active investor, having co-founded early-stage VC fund Ameba Capital in 2011. Li’s investments in Chinese startups include Mogujie, Kuaidadi and Zhaocai.

The VC arm of Tsinghua University, THG Ventures was founded in 2015. It is managed by the investment team from the state-owned Tsinghua Holdings Ltd., which has specialized in venture capital investments since 1999 and is one of the first China teams focused on RMB investment. The team also founded TusPark Incubator and TusPark Ventures.

The VC arm of Tsinghua University, THG Ventures was founded in 2015. It is managed by the investment team from the state-owned Tsinghua Holdings Ltd., which has specialized in venture capital investments since 1999 and is one of the first China teams focused on RMB investment. The team also founded TusPark Incubator and TusPark Ventures.

Insight Venture Partners is a US venture capital and private equity firm, headquartered in New York and founded in 1995. It holds over US$20 billion in assets under management, invested in more than 300 companies in 65 countries and has completed more than 200 mergers and acquisitions for its portfolio companies and 84 exits. It specializes in growth-round investments at all levels and has raised more than US$7.6 billion to invest in both minority and majority transactions.

Insight Venture Partners is a US venture capital and private equity firm, headquartered in New York and founded in 1995. It holds over US$20 billion in assets under management, invested in more than 300 companies in 65 countries and has completed more than 200 mergers and acquisitions for its portfolio companies and 84 exits. It specializes in growth-round investments at all levels and has raised more than US$7.6 billion to invest in both minority and majority transactions.

Headquartered in Silicon Valley, Lightspeed Venture Partners is an early-stage VC firm that focuses on the enterprise and consumer sectors. Over the past two decades, the firm has backed more than 300 companies globally. It currently has over US$4bn in committed capital. The firm invests mainly in the US, Israel, India and China. It also works in collaboration with Lightspeed China Partners, a China-focused venture capital firm, to make investments in China.

Headquartered in Silicon Valley, Lightspeed Venture Partners is an early-stage VC firm that focuses on the enterprise and consumer sectors. Over the past two decades, the firm has backed more than 300 companies globally. It currently has over US$4bn in committed capital. The firm invests mainly in the US, Israel, India and China. It also works in collaboration with Lightspeed China Partners, a China-focused venture capital firm, to make investments in China.

La Famiglia is a Munich-based VC fund founded in 2016, comprising family businesses, tech entrepreneurs, business angels and industry experts led by Jeanette Fürstenberg and Robert Lacher. To date, it has managed one exit, API payroll engine, Rollbox. It has invested in 23 companies, including in OnTruck's Series B round and in the Series A round of CloudNC, Coya, Asana Rebel and FreightHub. Logistics and AI are two principal areas of interest for its investments.

La Famiglia is a Munich-based VC fund founded in 2016, comprising family businesses, tech entrepreneurs, business angels and industry experts led by Jeanette Fürstenberg and Robert Lacher. To date, it has managed one exit, API payroll engine, Rollbox. It has invested in 23 companies, including in OnTruck's Series B round and in the Series A round of CloudNC, Coya, Asana Rebel and FreightHub. Logistics and AI are two principal areas of interest for its investments.

Kinesys Group is an Indonesian VC founded in 2019 by startup ecosystem builder Yansen Kamto. The company made their debut investment in new retail F&B startup Wahyoo. They have also backed sweet-drinks chain Goola and online learning center Zenius. While the company has made at least five investments in Indonesian companies, they have not closed their first fund, for which they targeted to reach $20m. Kinesys targets seed rounds, contributing ticket sizes averaging around $500,000 per startup.

Kinesys Group is an Indonesian VC founded in 2019 by startup ecosystem builder Yansen Kamto. The company made their debut investment in new retail F&B startup Wahyoo. They have also backed sweet-drinks chain Goola and online learning center Zenius. While the company has made at least five investments in Indonesian companies, they have not closed their first fund, for which they targeted to reach $20m. Kinesys targets seed rounds, contributing ticket sizes averaging around $500,000 per startup.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

Founded in 2011, Ankur Capital is an early-stage venture capital fund based in Mumbai. The VC invests in Indian-based startups in diverse sectors like agritech, food, health and education. It has 15 startups in its investment portfolio and has managed one exit to date, Carmel Organics.Recent investments include seed funding for seafood supply chain platform Captain Fresh and agriproduce marketplace Vegrow, as well as participation in the $20m Series C round of predictive farming platform Cropin.

bp ventures is an investment arm of the energy group BP with an annual venture investment budget between $150m and $200m. The group invests in new energy solutions, with over 30 startups’ investments in its portfolio supporting BP’s core business in oil and gas.bp ventures has increasingly invested over the past years in carbon-management technologies, low-carbon products, and advanced mobility through EV charging companies like the Chinese Shanghai PowerShare Tech and the California-based FreeWire Technologies.

bp ventures is an investment arm of the energy group BP with an annual venture investment budget between $150m and $200m. The group invests in new energy solutions, with over 30 startups’ investments in its portfolio supporting BP’s core business in oil and gas.bp ventures has increasingly invested over the past years in carbon-management technologies, low-carbon products, and advanced mobility through EV charging companies like the Chinese Shanghai PowerShare Tech and the California-based FreeWire Technologies.

E²JDJ was founded in New Orleans in 2020 with an agtech and foodtech focus, including in the areas of cellular agriculture and synthetic biology. It has six startups in its portfolio and makes diverse investments. Its most recent disclosed investment was in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions.

E²JDJ was founded in New Orleans in 2020 with an agtech and foodtech focus, including in the areas of cellular agriculture and synthetic biology. It has six startups in its portfolio and makes diverse investments. Its most recent disclosed investment was in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions.

Palladium Capital is a London-based private investment firm, originally established in 2005 as an independent strategic and financial adviser focusing on Central and Eastern Europe.Since 2010, Palladium has expanded activities to include Western Europe, Middle East, North Africa and Turkey. In 2014, the firm started direct private equity investments, acting on behalf of private family-owned funds and strategic investment partners. In February 2018, the advisory business was transferred to the newly formed sister company XPX Partners.

Palladium Capital is a London-based private investment firm, originally established in 2005 as an independent strategic and financial adviser focusing on Central and Eastern Europe.Since 2010, Palladium has expanded activities to include Western Europe, Middle East, North Africa and Turkey. In 2014, the firm started direct private equity investments, acting on behalf of private family-owned funds and strategic investment partners. In February 2018, the advisory business was transferred to the newly formed sister company XPX Partners.

Jointly managed by Fondo de Fondos and Sun Mountain Capital, Mexico Ventures leads venture capital strategies in Mexico and USA. The VC offers solutions to add value to diverse business portfolios. Starting with minimum investments of US$1 million, the firm has interests in companies and other funds. It is based at the offices of the Mexican Capital Investment Corporation in Mexico City and also has operations in Santa Fe and New Mexico.

Jointly managed by Fondo de Fondos and Sun Mountain Capital, Mexico Ventures leads venture capital strategies in Mexico and USA. The VC offers solutions to add value to diverse business portfolios. Starting with minimum investments of US$1 million, the firm has interests in companies and other funds. It is based at the offices of the Mexican Capital Investment Corporation in Mexico City and also has operations in Santa Fe and New Mexico.

Catalan Finance Institute (ICF)

Owned by the Catalan Government, the Catalan Finance Institute (ICF) is a public institution that offers a range of financing solutions, including loans and venture capital. ICF aims to boost private angel and seed investments within the Catalan entrepreneurial ecosystem, while diversifying its investment sources. In 2012, ICF started investing in early-stage startups based in the Catalan territory, providing equity loans of between €50,000 and €200,000. It also participates in syndicated funding within a network of Catalan business angels.

Owned by the Catalan Government, the Catalan Finance Institute (ICF) is a public institution that offers a range of financing solutions, including loans and venture capital. ICF aims to boost private angel and seed investments within the Catalan entrepreneurial ecosystem, while diversifying its investment sources. In 2012, ICF started investing in early-stage startups based in the Catalan territory, providing equity loans of between €50,000 and €200,000. It also participates in syndicated funding within a network of Catalan business angels.

Education for all: Interview with DANAdidik CEO Dipo Satria

The student loan startup is narrowing its focus to funding students planning on healthcare careers, and it also hopes to attract more financing from impact investors

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

agroSingularity: Turning discarded fruits and vegetables into usable powder to fix food waste

Closing €1.2m new funding will help the Murcia-based foodtech to build its own technology and facilities, expand into new markets

Lluvia Sólida: An economic lifeline for farmers in drier, unpredictable climate conditions

Reducing the need for watering by up to 90%, this Mexican startup’s polymer-based water retention technology is a potential game-changer for farming worldwide

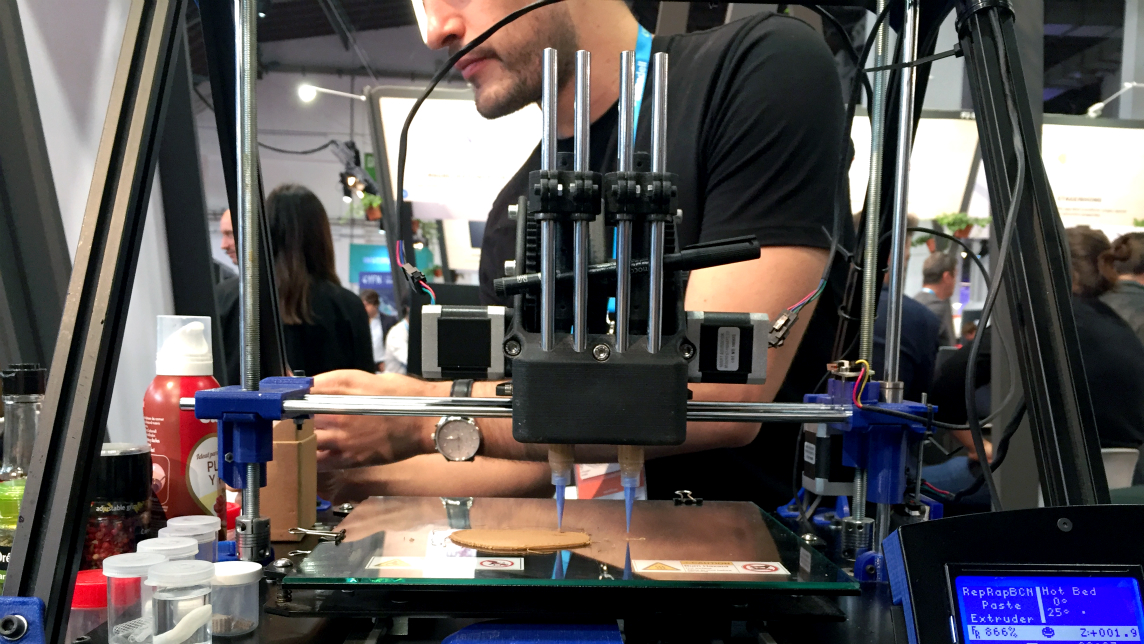

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

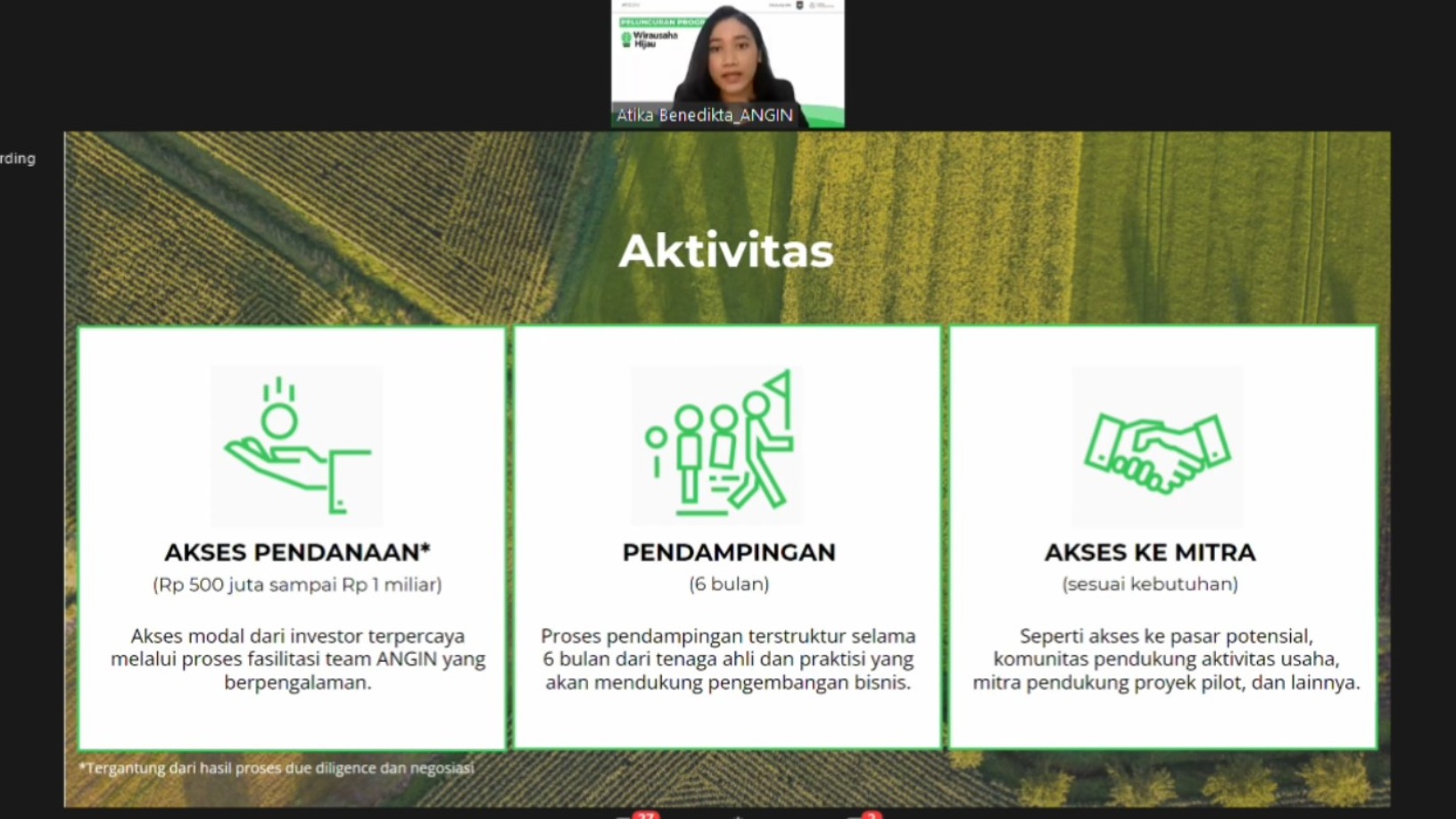

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

Bioo’s green power: Electricity, Wi-Fi from a flower pot

The Spanish startup has won accolades and fundings for its NASA-inspired fuel cells and energy-producing plants

Neurafarm: Putting an AI plant doctor in farmers' hands

This startup is riding on Indonesia’s urban farming trend with its planting kit and an AI-powered app that identifies plant diseases from photos of unhealthy leaves

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sorry, we couldn’t find any matches for“Garden Impact Investments”.