Garden Impact Investments

-

DATABASE (467)

-

ARTICLES (320)

Tanijoy empowers farmers by connecting them to land, financial resources and markets, thereby improving their livelihoods while boosting local food production.

Tanijoy empowers farmers by connecting them to land, financial resources and markets, thereby improving their livelihoods while boosting local food production.

Nigerian investment bank and investor CardinalStone Partners was founded in 2008. It invests in enterprises with the potential to transform diverse sectors deemed to be strategic to the development of the economies in Nigeria, Ghana and other West African countries.The VC also reviews potential investments in relation to their ESG impact. CardinalStone currently has six companies in its portfolio including Nigerian gym chain i-Fitness and Nigerian fintech Appzone. In 2020, it raised $50m for a new private equity fund, CardinalStone Capital Advisers Growth Fund.

Nigerian investment bank and investor CardinalStone Partners was founded in 2008. It invests in enterprises with the potential to transform diverse sectors deemed to be strategic to the development of the economies in Nigeria, Ghana and other West African countries.The VC also reviews potential investments in relation to their ESG impact. CardinalStone currently has six companies in its portfolio including Nigerian gym chain i-Fitness and Nigerian fintech Appzone. In 2020, it raised $50m for a new private equity fund, CardinalStone Capital Advisers Growth Fund.

Based in Frankfurt, GreenTec Capital Partners is a German social impact investor that focuses on supporting African tech and non-tech startups. The VC plans to increase its investment portfolio to a total of 400 enterprises by 2023. Its current stake in 20 startups is estimated to be €32.5m. In 2020, GreenTec joined the pre-seed round of Nigerian online food cooperative Principally and seed round of Freshbag, a farmers’ marketplace in Cameroon. Recent investments also include AgroCenta’s seed funding in January 2021.

Based in Frankfurt, GreenTec Capital Partners is a German social impact investor that focuses on supporting African tech and non-tech startups. The VC plans to increase its investment portfolio to a total of 400 enterprises by 2023. Its current stake in 20 startups is estimated to be €32.5m. In 2020, GreenTec joined the pre-seed round of Nigerian online food cooperative Principally and seed round of Freshbag, a farmers’ marketplace in Cameroon. Recent investments also include AgroCenta’s seed funding in January 2021.

CEO and Founder of Reclamador.es

Pablo Rabanal holds a degree in Business Administration and Economics as well as one master's in Audiovisual Management and another in Internet Business.He started his career in the entertainment sector as a TV/movie producer and distributor for Esicma. He was CEO at Bwin and started a joint venture facilitating private investments in audiovisual products with British group Future Film.Since 2012, Rabanal has served as CEO and founder of Reclamador.es, a web platform that manages and automates consumer claims, which has over 25,000 clients and collected more than €40m in compensation for users to date.

Pablo Rabanal holds a degree in Business Administration and Economics as well as one master's in Audiovisual Management and another in Internet Business.He started his career in the entertainment sector as a TV/movie producer and distributor for Esicma. He was CEO at Bwin and started a joint venture facilitating private investments in audiovisual products with British group Future Film.Since 2012, Rabanal has served as CEO and founder of Reclamador.es, a web platform that manages and automates consumer claims, which has over 25,000 clients and collected more than €40m in compensation for users to date.

COO and Co-founder of GeoDB

Sacha Gordillo is a business management and finance graduate from Comillas Pontifical University (ICADE), with over 10 years of experience in financial trading, specializing in fixed income. Since 2006, he has worked as a trader at TransMarket Group LLC, OSTC Ltd and SM Investments. He is now the CIO and head trader at POW Partners that he co-founded in 2016 in Madrid.The cryptocurrency ecosystem has always fascinated the veteran trader. In 2018, Gordillo joined GeoDB as co-founder and COO. He is one of the key figures in the conceptualization of GeoDB, a global decentralized data marketplace based in Madrid.

Sacha Gordillo is a business management and finance graduate from Comillas Pontifical University (ICADE), with over 10 years of experience in financial trading, specializing in fixed income. Since 2006, he has worked as a trader at TransMarket Group LLC, OSTC Ltd and SM Investments. He is now the CIO and head trader at POW Partners that he co-founded in 2016 in Madrid.The cryptocurrency ecosystem has always fascinated the veteran trader. In 2018, Gordillo joined GeoDB as co-founder and COO. He is one of the key figures in the conceptualization of GeoDB, a global decentralized data marketplace based in Madrid.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Xange is the venture capital arm of Siparex Group, with offices in Paris and Munich. It is dedicated to supporting entrepreneurs in disruptive digital, deep tech and social impact. It has €450m under management and 65 startups in its portfolio.

Xange is the venture capital arm of Siparex Group, with offices in Paris and Munich. It is dedicated to supporting entrepreneurs in disruptive digital, deep tech and social impact. It has €450m under management and 65 startups in its portfolio.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Founder, CEO of Bewe (formerly MIORA)

Ballesteros is one of Spain's most prominent serial entrepreneurs and business angels, and the man behind some of the most successful acquisitions in Spain and Latin America. Cabify, Woom Fertility and co-investments with Seaya Ventures form part of his investment portfolio. His first entrepreneurial experience started in 1997 with online classified ads platform Ocioteca.com and MundoSalud (acquired by Sanitas of Bupa Group). One of his biggest successes has been on-demand food delivery platforms, SinDelantal in Spain and SinDelantal Mexico, both acquired by Just Eat in 2013 and 2015, respectively. He is currently sole founder of Bewe SaaS for beauty and wellness professionals.

Ballesteros is one of Spain's most prominent serial entrepreneurs and business angels, and the man behind some of the most successful acquisitions in Spain and Latin America. Cabify, Woom Fertility and co-investments with Seaya Ventures form part of his investment portfolio. His first entrepreneurial experience started in 1997 with online classified ads platform Ocioteca.com and MundoSalud (acquired by Sanitas of Bupa Group). One of his biggest successes has been on-demand food delivery platforms, SinDelantal in Spain and SinDelantal Mexico, both acquired by Just Eat in 2013 and 2015, respectively. He is currently sole founder of Bewe SaaS for beauty and wellness professionals.

CEO and founder of Plantruption

Jennifer O'Brien qualified as a financial advisor at University College Dublin in 2010. She started her banking career in 2007 at AIB where she spent six years working with SMEs and investments. In 2013, she joined KBC Bank Ireland as a restructures executive and went on to work as an asset manager at Link Asset Services in 2016. O’Brien also worked in asset management for two years at O’Dwyer Real Estate Management while completing an MBA at Trinity College Dublin. She left the realty company in 2019 to realize her dream to create alt-protein seafood using locally sourced seaweed.

Jennifer O'Brien qualified as a financial advisor at University College Dublin in 2010. She started her banking career in 2007 at AIB where she spent six years working with SMEs and investments. In 2013, she joined KBC Bank Ireland as a restructures executive and went on to work as an asset manager at Link Asset Services in 2016. O’Brien also worked in asset management for two years at O’Dwyer Real Estate Management while completing an MBA at Trinity College Dublin. She left the realty company in 2019 to realize her dream to create alt-protein seafood using locally sourced seaweed.

Growpal’s investment crowdfunding platform offers investors the opportunity to participate in one of the world’s top aquaculture and fishery export markets.

Growpal’s investment crowdfunding platform offers investors the opportunity to participate in one of the world’s top aquaculture and fishery export markets.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Education for all: Interview with DANAdidik CEO Dipo Satria

The student loan startup is narrowing its focus to funding students planning on healthcare careers, and it also hopes to attract more financing from impact investors

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

agroSingularity: Turning discarded fruits and vegetables into usable powder to fix food waste

Closing €1.2m new funding will help the Murcia-based foodtech to build its own technology and facilities, expand into new markets

Lluvia Sólida: An economic lifeline for farmers in drier, unpredictable climate conditions

Reducing the need for watering by up to 90%, this Mexican startup’s polymer-based water retention technology is a potential game-changer for farming worldwide

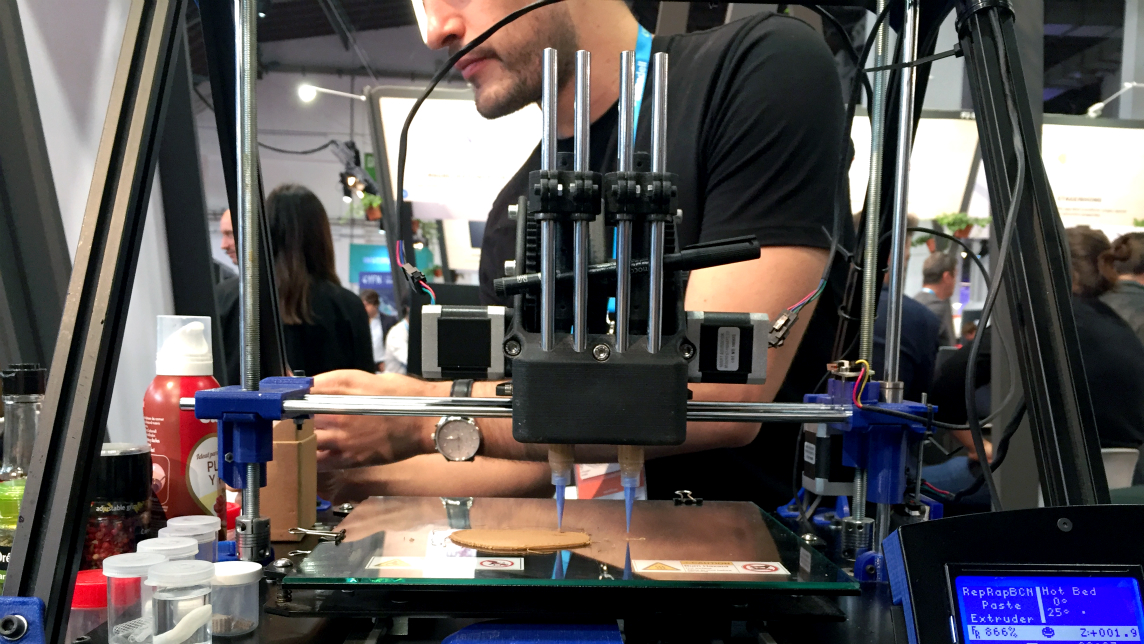

Novameat: 3D printing tech to develop meat substitute products

Italian scientist Giuseppe Scionti has repurposed bioprinting technology used to create an artificial human ear to develop a plant-based "steak"

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

Bioo’s green power: Electricity, Wi-Fi from a flower pot

The Spanish startup has won accolades and fundings for its NASA-inspired fuel cells and energy-producing plants

Neurafarm: Putting an AI plant doctor in farmers' hands

This startup is riding on Indonesia’s urban farming trend with its planting kit and an AI-powered app that identifies plant diseases from photos of unhealthy leaves

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Sorry, we couldn’t find any matches for“Garden Impact Investments”.