Garden Impact Investments

-

DATABASE (467)

-

ARTICLES (320)

Garden Impact Investments is an investment holding company based in Singapore. The company engages in impact investing, seeking startups that can create social and environmental benefits in their communities. Its portfolio includes companies in Indonesia, Thailand and Singapore, covering sectors ranging from agriculture, health and education.

Garden Impact Investments is an investment holding company based in Singapore. The company engages in impact investing, seeking startups that can create social and environmental benefits in their communities. Its portfolio includes companies in Indonesia, Thailand and Singapore, covering sectors ranging from agriculture, health and education.

Country Garden Venture Capital

Founded in 2019, Country Garden Venture Capital is the corporate venturing arm of Chinese real estate developer Country Garden. With its parent company as the cornerstone investor, it is focused on certain sectors of the supply chain, namely, technology, healthcare and consumption. As of March 2021, Country Garden Venture Capital has invested around RMB 10bn in over 50 companies with an average return above 80%. Among them, 15 have achieved unicorn status ($1bn in valuation), while four have successfully gone public.

Founded in 2019, Country Garden Venture Capital is the corporate venturing arm of Chinese real estate developer Country Garden. With its parent company as the cornerstone investor, it is focused on certain sectors of the supply chain, namely, technology, healthcare and consumption. As of March 2021, Country Garden Venture Capital has invested around RMB 10bn in over 50 companies with an average return above 80%. Among them, 15 have achieved unicorn status ($1bn in valuation), while four have successfully gone public.

Talk to your plants. Habibi Garden ensures crops are nourished at optimum levels by hi-tech sensors, automatic pumps and analytics.

Talk to your plants. Habibi Garden ensures crops are nourished at optimum levels by hi-tech sensors, automatic pumps and analytics.

Founded in 2011, Unitus Impact is a venture capital firm focusing on impact investments in Southeast Asia and India. With offices in Bangalore, Ho Chi Minh city and San Francisco, the VC will soon be renamed as Patamar Capital. It currently invests in scalable businesses that aim to improve the livelihoods of the poor in Asia.

Founded in 2011, Unitus Impact is a venture capital firm focusing on impact investments in Southeast Asia and India. With offices in Bangalore, Ho Chi Minh city and San Francisco, the VC will soon be renamed as Patamar Capital. It currently invests in scalable businesses that aim to improve the livelihoods of the poor in Asia.

Invested and used by BlackRock, the pioneer in AI-based qualitative analysis-recommendation SaaS for ESG investments covers 100k+ funds, 25k listed firms, with 1,000 indicators.

Invested and used by BlackRock, the pioneer in AI-based qualitative analysis-recommendation SaaS for ESG investments covers 100k+ funds, 25k listed firms, with 1,000 indicators.

Founded in Boston in 2015, Material Impact is a science-based investment fund backing products that make an impact on real-world problems. It currently has 10 companies in its portfolio, from seed to Series C investments. Its most recent investments have been in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2020 $12m Series A round of US electronics protective substance producer actnano.

Founded in Boston in 2015, Material Impact is a science-based investment fund backing products that make an impact on real-world problems. It currently has 10 companies in its portfolio, from seed to Series C investments. Its most recent investments have been in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2020 $12m Series A round of US electronics protective substance producer actnano.

Rubio Impact Ventures (formerly Social Impact Ventures)

Founded in Amsterdam in 2014, Rubio Impact Ventures was formerly known as Social Impact Ventures. The VC currently invests in sustainability-focused startups that are predominantly based in the Netherlands and north-western Europe. It currently has 27 portfolio companies including fair coffee brand Wakuli and cultured meat pioneer Masa Meat. The “Rubicon crossing” VC has just raised €110m for its second impact fund, Rubio Fund 2, in October 2021.Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the €3.6m seed round in July 2021 for Portuguese Arborea that uses micro-organisms in biotech for foodtech applications.

Founded in Amsterdam in 2014, Rubio Impact Ventures was formerly known as Social Impact Ventures. The VC currently invests in sustainability-focused startups that are predominantly based in the Netherlands and north-western Europe. It currently has 27 portfolio companies including fair coffee brand Wakuli and cultured meat pioneer Masa Meat. The “Rubicon crossing” VC has just raised €110m for its second impact fund, Rubio Fund 2, in October 2021.Recent investments include participation in the $43m Series B round of food-sharing app OLIO in September 2021 and the €3.6m seed round in July 2021 for Portuguese Arborea that uses micro-organisms in biotech for foodtech applications.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

Founded in 2018, Tilia Impact Ventures is the first social impact fund in the Czech Republic. Co-founding partner Silke Horáková has worked in private equity and is also a co-owner of Albatross Media. Co-founding partner Petr Vítek has worked for nine years as a Deloitte consultant. He is also co-founder of Impact Hub in Prague, Brno and Ostrava. Both have experience working in the social enterprise sector. About 23 investors have contributed to the impact fund. Tilia plans to have 10 local social impact companies in its portfolio, each with an expected investment life of five to seven years. The VC has invested in four companies to date: smart vending SaaS platform MIWA Technologies, data-mining startup Datlab, ready-made spectacles supplier DOT glasses and waste-to-resource marketplace Cyrkl.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

CEO and Founder of Clarity

A World Economic Forum Young Global Leader, Rebeca Minguela founded Blink, a hotel booking app that was acquired by Groupon, and Clarity.AI, a SaaS optimizing the social impact of investments. She holds an engineering degree from UPM (Technical University of Madrid) Escuela Técnica Superior de Ingenieros de Telecomunicación, and a master’s in Information Technology from the University of Stuttgart. After working at IBM, Siemens, the German Space Agency and BCG, she won a scholarship to pursue an MBA at Harvard Business School. She later led Santander Bank’s Global Digital Transformation Program. She was born in 1981 in Valladolid, Spain.

A World Economic Forum Young Global Leader, Rebeca Minguela founded Blink, a hotel booking app that was acquired by Groupon, and Clarity.AI, a SaaS optimizing the social impact of investments. She holds an engineering degree from UPM (Technical University of Madrid) Escuela Técnica Superior de Ingenieros de Telecomunicación, and a master’s in Information Technology from the University of Stuttgart. After working at IBM, Siemens, the German Space Agency and BCG, she won a scholarship to pursue an MBA at Harvard Business School. She later led Santander Bank’s Global Digital Transformation Program. She was born in 1981 in Valladolid, Spain.

Co-founder and CTO of Habibi Garden

Irsan Rajamin is a keen gardener and managed to rope in high school friend Dian Prayogi Susanto to develop more efficient crop farming systems using automated technology. The graduate from Sekolah Tinggi Teknologi Telkom (Telkom University) in Bandung is responsible for the agritech’s software development as the CTO and co-founder of Habibi Garden.

Irsan Rajamin is a keen gardener and managed to rope in high school friend Dian Prayogi Susanto to develop more efficient crop farming systems using automated technology. The graduate from Sekolah Tinggi Teknologi Telkom (Telkom University) in Bandung is responsible for the agritech’s software development as the CTO and co-founder of Habibi Garden.

Co-founder and CEO of Habibi Garden

Dian Prayogi Susanto graduated in 2007 from Institut Teknologi Bandung, Indonesia. He had previously worked as lead engineer for Schlumberger. After two failed attempts at entrepreneurship, he met high school friend Irsan Rajamin. The two developed an idea to automate farming through the use of sensors, automatic pumps and analytics. In 2016, their idea manifested into Habibi Garden, an IoT startup that aims to automate farming and solve crop nourishment issues.

Dian Prayogi Susanto graduated in 2007 from Institut Teknologi Bandung, Indonesia. He had previously worked as lead engineer for Schlumberger. After two failed attempts at entrepreneurship, he met high school friend Irsan Rajamin. The two developed an idea to automate farming through the use of sensors, automatic pumps and analytics. In 2016, their idea manifested into Habibi Garden, an IoT startup that aims to automate farming and solve crop nourishment issues.

ACA Investments is the Singapore-based affiliate of Asia Capital Alliance, a Japanese investment firm group. The group’s investment focus is on Japan and Southeast Asia, done by combining Japanese intellectual property and Southeast Asia’s growing markets and startup ecosystems. Its investments range from secondhand bookstore Book-Off, F&B brand owner HotLand Corporation (which operates Tsujiki Gindako), and Southeast Asian price comparison site iPrice.ACA Investments is also an affiliate of Japanese investment bank Daiwa Securities Group, which is Japan’s second-largest securities brokerage. In 2018, ACA Group announced that Daiwa Securities Group acquired a 34% stake in ACA Investments as part of a wider strategic alliance between ACA and Daiwa.

ACA Investments is the Singapore-based affiliate of Asia Capital Alliance, a Japanese investment firm group. The group’s investment focus is on Japan and Southeast Asia, done by combining Japanese intellectual property and Southeast Asia’s growing markets and startup ecosystems. Its investments range from secondhand bookstore Book-Off, F&B brand owner HotLand Corporation (which operates Tsujiki Gindako), and Southeast Asian price comparison site iPrice.ACA Investments is also an affiliate of Japanese investment bank Daiwa Securities Group, which is Japan’s second-largest securities brokerage. In 2018, ACA Group announced that Daiwa Securities Group acquired a 34% stake in ACA Investments as part of a wider strategic alliance between ACA and Daiwa.

The Rise Fund is a $2bn impact investing fund co-founded by U2 front man Bono, Bill McGlashan and Jeff Skoll. The fund has partnered with nonprofit consultancy The Bridgespan Group to develop an evidence-based model for quantifying the impact of the firm’s investments.The global impact investment vehicle is managed by TPGGrowth, part of the multibillion-dollar investment firm TPG that focuses on growth equity investments and mid-market buyouts. As of December 2019, the fund has deployed $1.4bn across its investment portfolio.

The Rise Fund is a $2bn impact investing fund co-founded by U2 front man Bono, Bill McGlashan and Jeff Skoll. The fund has partnered with nonprofit consultancy The Bridgespan Group to develop an evidence-based model for quantifying the impact of the firm’s investments.The global impact investment vehicle is managed by TPGGrowth, part of the multibillion-dollar investment firm TPG that focuses on growth equity investments and mid-market buyouts. As of December 2019, the fund has deployed $1.4bn across its investment portfolio.

STIC Investments is a South Korean private equity firm. It primarily invests in local companies and M&As, but has also branched overseas with its investment in EV Hive.

STIC Investments is a South Korean private equity firm. It primarily invests in local companies and M&As, but has also branched overseas with its investment in EV Hive.

Airhopping: Breakthrough in the OTA sector for millennials

Offering cheap and flexible multi-destination flight packages is helping the platform become the go-to reservation agent for budget travelers

Keep: Social fitness app bags $80m Series E as Covid-19 lockdown fuels demand for virtual gyms

Keep becomes China’s first sports tech unicorn as number of fitness app users in the country almost doubled to 89m amid home confinement and gym closures

8villages to refocus business, shelve B2C agri-ecommerce ops as Covid boost proves short-lived

Despite a spike in B2C demand during Indonesia’s initial lockdowns, 8villages customers returned to shopping offline once restrictions eased

SWITCH Singapore: Investors highlight Vietnam startup ecosystem's potential and resilience

The quality of Vietnam’s local talent remains one of its biggest strengths, but foreign investors also need to be patient and be familiar with the local regulatory landscape

Jorge Dobón of Demium Startups: Precocious founder who prizes risk and failure

Thanks to its unique pre-incubation model, Jorge Dobón’s Demium Startups has supported hundreds of startups in less than six years, with a portfolio worth €130 million

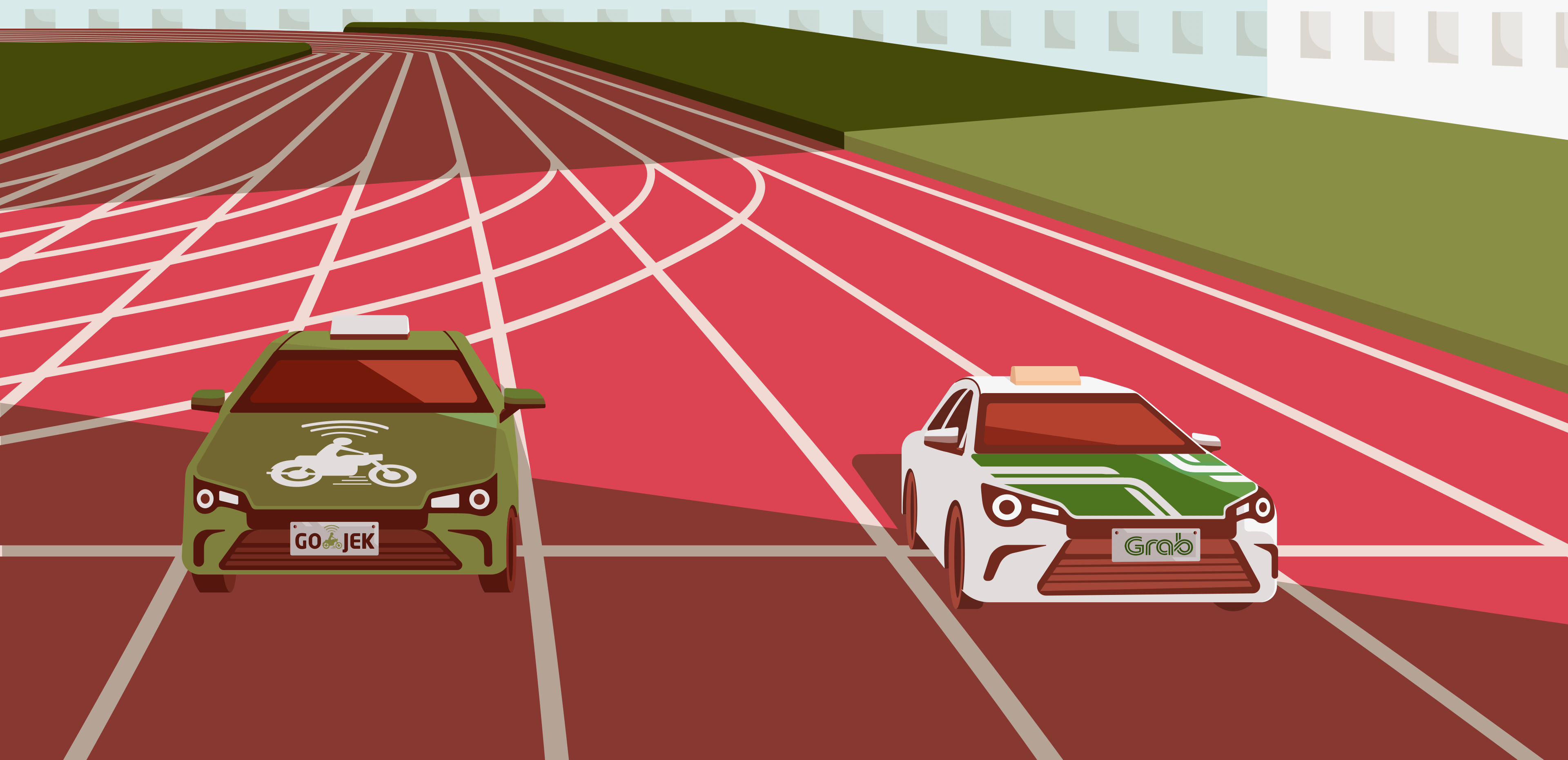

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

Pintek: Fintech offers wide variety of loans to improve Indonesians' access to education

Pintek is expanding into Islamic finance with new Sharia-compliant loans for students at Islamic schools and universities

Narasi TV: Creating a better media experience for Indonesia

Spearheaded by a popular talkshow host, this new media startup seeks to cultivate a more positive online media environment

Tipped for unicorn status, BeON Energy is making solar power accessible to the masses

BeON Energy plans to raise the energy sector's largest Series A investment round in 2020

Xurya: Pioneering solar power as a service in Indonesia with a leasing model

Targeting corporate customers without need for any upfront payment, two-year-old Xurya has already attracted major clients, and investment from Clime Capital’s impact investment fund SEACEF

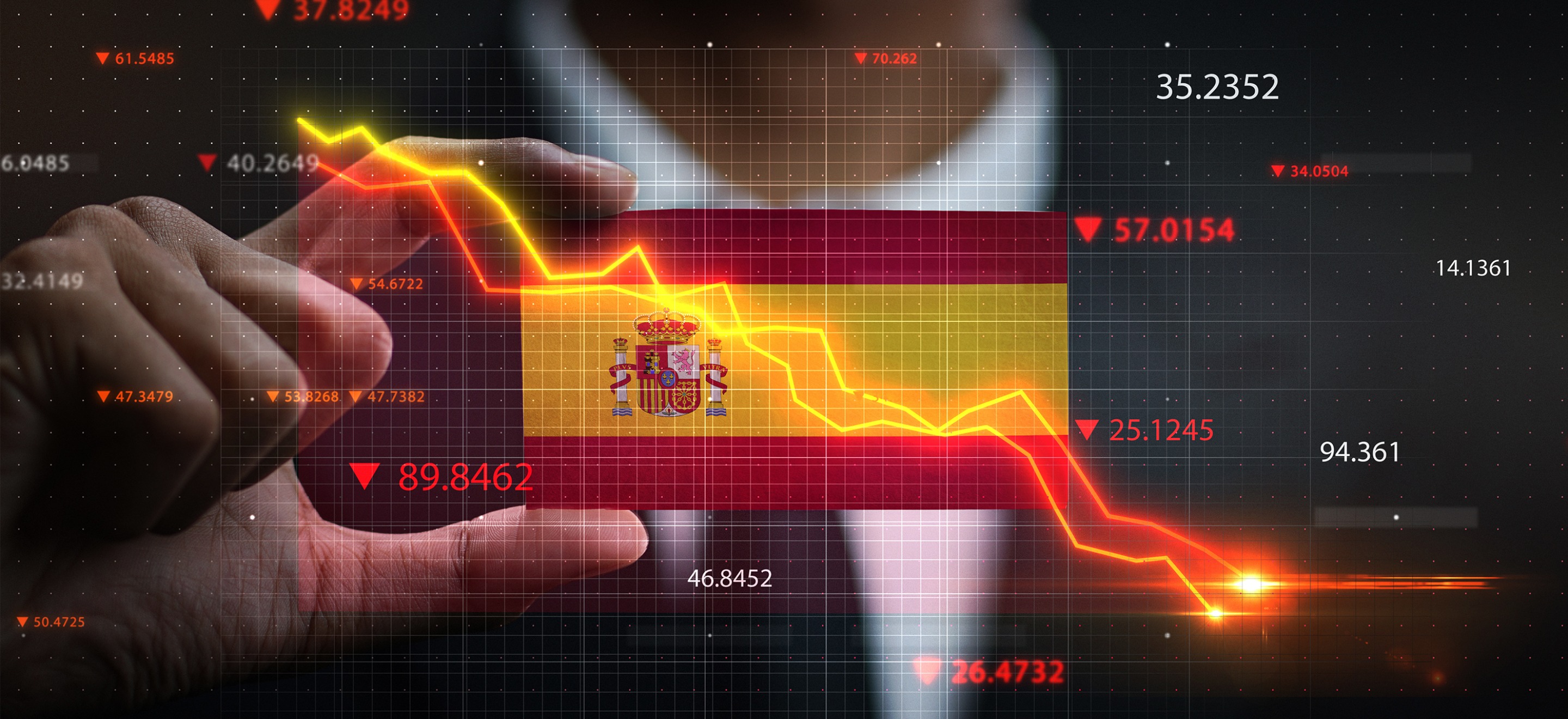

Spanish startups protest the lack of relevant aid, compared with other EU countries; investors warn of “disastrous” new foreign investment restriction

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

Bewe: From LatAm to the US, scaling fitness and wellness business globally post-Covid

Serial entrepreneur Diego Ballesteros’s latest venture Bewe seeks to disrupt the lucrative US wellness and fitness market with more competitive pricing

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Sorry, we couldn’t find any matches for“Garden Impact Investments”.