General Atlantic

-

DATABASE (86)

-

ARTICLES (148)

General Atlantic was founded in 1980 as the investment arm of Atlantic Philanthropies, and claims to be the pioneer in growth equity. The US-based company has presence all over the world, including in Indonesia, UK, China, Mexico, and Singapore. As of August 2019, it manages US$35b in assets from global investors. Some major companies that were part of GA's portfolio includes Facebook, Alibaba, Meituan, Saxo Bank, and SEA. Edtech startup Ruangguru is GA's second investment in Indonesia; the first is MAP Boga Adiperkasa, a major F&B and lifestyle conglomerate.

General Atlantic was founded in 1980 as the investment arm of Atlantic Philanthropies, and claims to be the pioneer in growth equity. The US-based company has presence all over the world, including in Indonesia, UK, China, Mexico, and Singapore. As of August 2019, it manages US$35b in assets from global investors. Some major companies that were part of GA's portfolio includes Facebook, Alibaba, Meituan, Saxo Bank, and SEA. Edtech startup Ruangguru is GA's second investment in Indonesia; the first is MAP Boga Adiperkasa, a major F&B and lifestyle conglomerate.

Founded in Berlin in 2016, Atlantic Food Labs’ mission is to support startups with the potential to feed 10bn people by 2050. It has supported 20 companies to date and its most recent investments include in the German healthy last-minute delivery service Gorillas’ $290m Series B round and in the €5.9m seed round of B2B German retail connection service Magaloop in March 2021.

Founded in Berlin in 2016, Atlantic Food Labs’ mission is to support startups with the potential to feed 10bn people by 2050. It has supported 20 companies to date and its most recent investments include in the German healthy last-minute delivery service Gorillas’ $290m Series B round and in the €5.9m seed round of B2B German retail connection service Magaloop in March 2021.

Founded in Boston in 2020, General Catalyst backs startups across all market segements at every growth stage, making seed stage investments between $500,000 and $2m. It has backed some of the most successful startups including Airbnb, Stripe and Deliveroo, and, to date, has invested in 243 companies, with 193 in its portfolio currently. A prolific investor, often making 10 investments or more per month, its most recent investments include in the July 2021 $5m seed round of US medtech, Evvy, designers of a vaginal microbiome test. In the same week, the investor participated in the $150m Series B round of Remote, a Silicon Valley-based platform for remote worker management and administration.

Founded in Boston in 2020, General Catalyst backs startups across all market segements at every growth stage, making seed stage investments between $500,000 and $2m. It has backed some of the most successful startups including Airbnb, Stripe and Deliveroo, and, to date, has invested in 243 companies, with 193 in its portfolio currently. A prolific investor, often making 10 investments or more per month, its most recent investments include in the July 2021 $5m seed round of US medtech, Evvy, designers of a vaginal microbiome test. In the same week, the investor participated in the $150m Series B round of Remote, a Silicon Valley-based platform for remote worker management and administration.

Co-CEO and co-founder of Elio

Walton Hartanto graduated in Business Administration and Management at the University of Southern California in 2014. While in the US, he worked for over a year as a financial analyst at Houlihan Lokey, an American multinational independent investment bank and financial services company in San Francisco. In 2016, he worked as an analyst for private equity firm General Atlantic in Singapore. He returned to Jakarta in August 2018 and worked in business development for Wahyu Abadi, an Indonesian company that focused on printing, packaging, digital and supply chain technology. Walton and his older brother Waldo co-founded Elio in April 2018, an Indonesian online health clinic for men.

Walton Hartanto graduated in Business Administration and Management at the University of Southern California in 2014. While in the US, he worked for over a year as a financial analyst at Houlihan Lokey, an American multinational independent investment bank and financial services company in San Francisco. In 2016, he worked as an analyst for private equity firm General Atlantic in Singapore. He returned to Jakarta in August 2018 and worked in business development for Wahyu Abadi, an Indonesian company that focused on printing, packaging, digital and supply chain technology. Walton and his older brother Waldo co-founded Elio in April 2018, an Indonesian online health clinic for men.

Ocean Link is a private equity firm that mainly invests in consumer goods, tourism and TMT sectors in China. It currently manages two USD funds and one RMB fund. It has offices in Shanghai, Beijing and Hong Kong. The limited partners include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices. China’s largest online travel agency Trip.com and international private equity firm General Atlantic are strategic partners.In April 2020, Ocean Link proposed to acquire all of the outstanding ordinary shares of the Chinese online classifieds marketplace 58.com. The NYSE-listed company is in the process of evaluating the proposal.

Ocean Link is a private equity firm that mainly invests in consumer goods, tourism and TMT sectors in China. It currently manages two USD funds and one RMB fund. It has offices in Shanghai, Beijing and Hong Kong. The limited partners include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices. China’s largest online travel agency Trip.com and international private equity firm General Atlantic are strategic partners.In April 2020, Ocean Link proposed to acquire all of the outstanding ordinary shares of the Chinese online classifieds marketplace 58.com. The NYSE-listed company is in the process of evaluating the proposal.

Co-founder and CEO of GoWork

Vanessa Hendriadi Li is the founder of Rework, a coworking space operator in Jakarta. Following its merger with GoWork, she became the CEO of the company. Prior to Rework, she held managerial roles in her family's business the Mikatasa Group and its mineral water subsidiary PT Atlantic Biruraya. Vanessa holds a bachelor's degree in Chemical Engineering from the University of Wisconsin-Madison, USA, as well as an MBA from the University of Southern California.

Vanessa Hendriadi Li is the founder of Rework, a coworking space operator in Jakarta. Following its merger with GoWork, she became the CEO of the company. Prior to Rework, she held managerial roles in her family's business the Mikatasa Group and its mineral water subsidiary PT Atlantic Biruraya. Vanessa holds a bachelor's degree in Chemical Engineering from the University of Wisconsin-Madison, USA, as well as an MBA from the University of Southern California.

Mitsubishi Corporation is the general trading company of the Japanese conglomerate Mitsubishi Group. The corporation covers diverse industries, ranging from general business and financial services to metals and energy. Its largest business unit is the energy group, which trades and invests in oil and gas projects around the world.

Mitsubishi Corporation is the general trading company of the Japanese conglomerate Mitsubishi Group. The corporation covers diverse industries, ranging from general business and financial services to metals and energy. Its largest business unit is the energy group, which trades and invests in oil and gas projects around the world.

KK Fund is named after Koichi Saito and Kuan Hsu. Founder and general partner Koichi was formerly from IMJ Investment Partners and a private equity fund run by George Soros. Co-founder and general partner Kuan had previously worked at Goldman Sachs, Temasek Holdings and GREE Ventures.Another KK partner or LP is Masahiko Honma, co-founder and general partner of Incubate Fund based in Japan. KK Fund focuses mainly on internet and mobile startups in Southeast Asia, Hong Kong and Taiwan; with possible seed stage funding ranging from US$100,000 to US$400,000 per startup.

KK Fund is named after Koichi Saito and Kuan Hsu. Founder and general partner Koichi was formerly from IMJ Investment Partners and a private equity fund run by George Soros. Co-founder and general partner Kuan had previously worked at Goldman Sachs, Temasek Holdings and GREE Ventures.Another KK partner or LP is Masahiko Honma, co-founder and general partner of Incubate Fund based in Japan. KK Fund focuses mainly on internet and mobile startups in Southeast Asia, Hong Kong and Taiwan; with possible seed stage funding ranging from US$100,000 to US$400,000 per startup.

Cosmetic surgery becomes more affordable, with more choices and information on safety and quality, on this aesthetic services shopping and social platform.

Cosmetic surgery becomes more affordable, with more choices and information on safety and quality, on this aesthetic services shopping and social platform.

As consumers get more vocal and powerful online, Consumers Trust lets businesses view, track and respond to customers' complaints while offering related data for marketing.

As consumers get more vocal and powerful online, Consumers Trust lets businesses view, track and respond to customers' complaints while offering related data for marketing.

Founder of Fenghou Capital and Secretary-General of China Young Angel Investor Leader Association (founded in 2013 by China’s leading angel investors such as Bob Xu and Yang Ning).

Founder of Fenghou Capital and Secretary-General of China Young Angel Investor Leader Association (founded in 2013 by China’s leading angel investors such as Bob Xu and Yang Ning).

Co-founder and CEO of Mobike

Marketing specialist Wang Xiaofeng was Uber’s former General Manager of Shanghai area and a former marketing general manager at Tencent SOSO. He also spent nine years at P&G China, before joining Google as its first staff in the Shanghai office, where he built Google’s advertising channels in East China. He joined Mobike as co-founder and CEO in late 2015.

Marketing specialist Wang Xiaofeng was Uber’s former General Manager of Shanghai area and a former marketing general manager at Tencent SOSO. He also spent nine years at P&G China, before joining Google as its first staff in the Shanghai office, where he built Google’s advertising channels in East China. He joined Mobike as co-founder and CEO in late 2015.

The Graduate Syndicate is led by Harvard Business School senior lecturer Jeff Bussgang. The fund primarily invests in startups founded by Harvard graduates, particularly HBS alumni. It is linked to Flybridge Capital Partners, where Jeff Bussgang has served as a general partner since 2003.

The Graduate Syndicate is led by Harvard Business School senior lecturer Jeff Bussgang. The fund primarily invests in startups founded by Harvard graduates, particularly HBS alumni. It is linked to Flybridge Capital Partners, where Jeff Bussgang has served as a general partner since 2003.

Co-founder of Luoji Siwei

After graduating from Nanjing University in 1995 with a bachelor’s degree in Tourism Management, Wu worked for a number of e-commerce firms. He was vice president at VANCL, senior vice president at JD.com and general consultant at lefeng.com. Wu, an original co-founder, left Luoji Siwei in 2013. He moved on from Luoji Siwei to serve as general consultant at media firm Fleet Entertainment. Wu founded Context Lab, a corporate services platform, in 2015. He is also the author of three popular business insight books.

After graduating from Nanjing University in 1995 with a bachelor’s degree in Tourism Management, Wu worked for a number of e-commerce firms. He was vice president at VANCL, senior vice president at JD.com and general consultant at lefeng.com. Wu, an original co-founder, left Luoji Siwei in 2013. He moved on from Luoji Siwei to serve as general consultant at media firm Fleet Entertainment. Wu founded Context Lab, a corporate services platform, in 2015. He is also the author of three popular business insight books.

Spanish startups and investors rethink strategies as Covid-19 hits funding, valuations

Investors and startups in Spain say most funding has stalled, and share their strategies and advice for coping with the downturn

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

Lesielle: Award-winning personalized cosmetics that adapt to changing skincare needs

This Spanish AI-powered device combines with a mobile app to track the daily condition of your skin and tailor-make cosmetics for each customer

Can AI make ethical decisions? Ethyka by Acuilae wants to train AI systems to reason like humans

Ethyka, an AI training module, sets the ethical principles and conditioning for AI systems in applications ranging from chatbots to autonomous cars

Future Food Asia: Covid-19 sparked dramatic shifts in agriculture in China and India

Key Chinese players from e-commerce giant Pinduoduo and and agritech VC Omnivore share their insights at last week’s agrifood conference by ID Capital

Indonesia 2021 outlook: VCs "cautiously optimistic" on Southeast Asia's largest country

Investors expect Indonesian startups to regain their growth opportunities when the economy reopens with the Covid-19 vaccine rollout, even as some online living and working habits have stuck

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Knokcare: Telemedicine app connects you to doctors in 30 minutes

Seeking funding of over €1m, Portugal’s digital healthcare pioneer is expanding its SaaS to tap new markets in Europe, Africa and Latin America

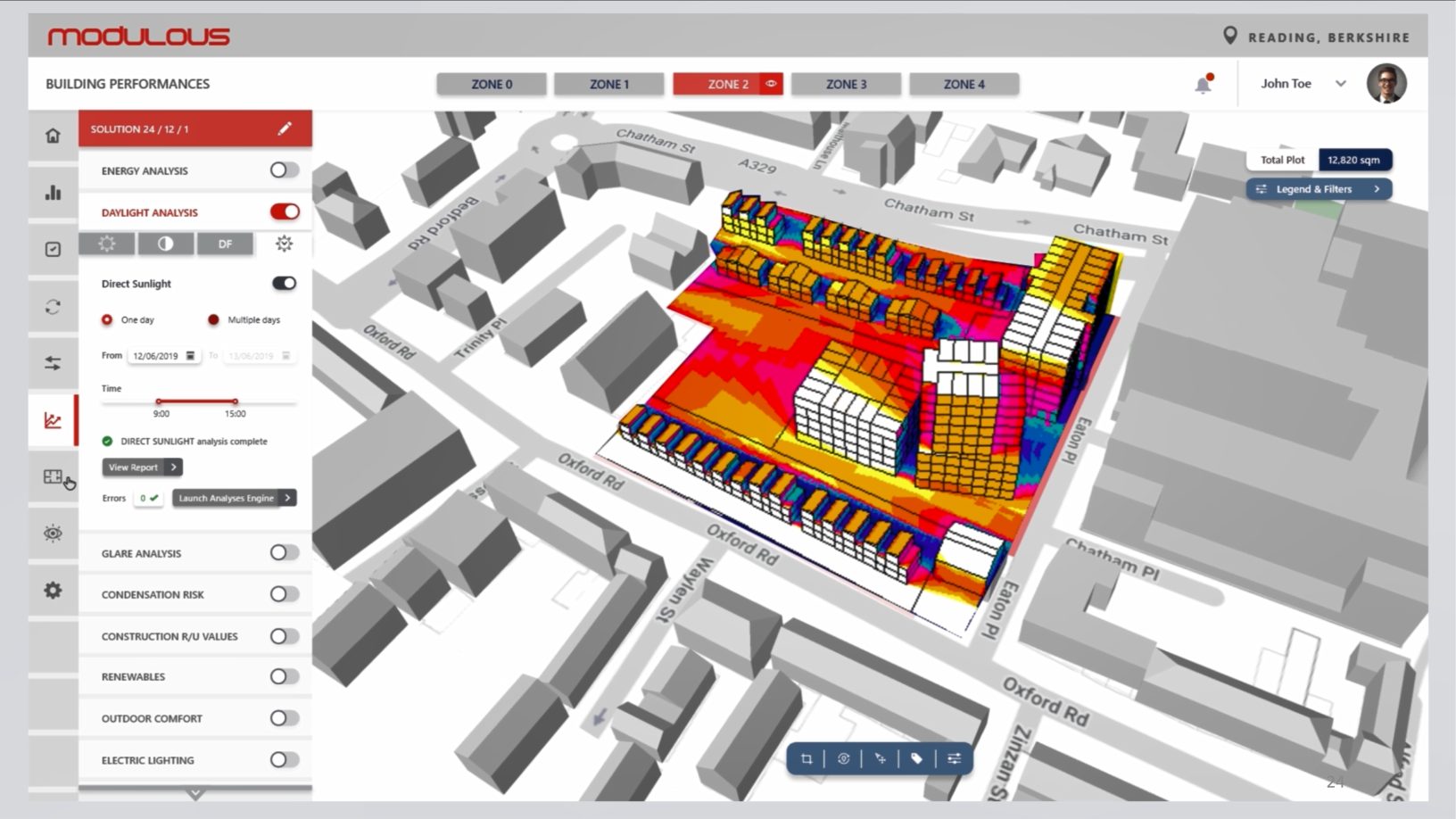

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

Tonic App: Just the tonic for overburdened doctors

CEO Daniela Seixas and COO Gonçalo Vilaça discussed Tonic App, their free solution for streamlining administrative tasks in the medical sector

SWITCH Singapore: Alternative protein sure to take off in Asia, with Singapore as innovation hotbed

In an in-depth discussion, food industry experts say products made with alternative protein in hybrid forms could offer the fastest route to commercialization

Sorry, we couldn’t find any matches for“General Atlantic”.