Giza Venture Capital

-

DATABASE (830)

-

ARTICLES (427)

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Founder and CEO of Zhinanmao

Former partner, Mount Venture Capital; vice president, Power Capital. The economics graduate from Jiangsu University is an avid backpacker and certified tour guide. A serial entrepreneur too (with previous startups in bicycle rental, education and training, e-commerce, F&B).

Former partner, Mount Venture Capital; vice president, Power Capital. The economics graduate from Jiangsu University is an avid backpacker and certified tour guide. A serial entrepreneur too (with previous startups in bicycle rental, education and training, e-commerce, F&B).

Founded in 2011, Newsion Venture Capital is a seed and early-stage venture capital in China focusing on information technology, consumption and services industries.

Founded in 2011, Newsion Venture Capital is a seed and early-stage venture capital in China focusing on information technology, consumption and services industries.

As an early investment fund, Jifu Venture Capital invested in Guangfa Securities, Liaoning Chengda and other companies. It has realized returns of more than 2,000% for its shareholders. Jifu Venture Capital was authorized by the Shenzhen city government in September 2004.

As an early investment fund, Jifu Venture Capital invested in Guangfa Securities, Liaoning Chengda and other companies. It has realized returns of more than 2,000% for its shareholders. Jifu Venture Capital was authorized by the Shenzhen city government in September 2004.

Wei Venture Capital is a VC fund jointly launched in November 2010 by Sina Corporation, Sequoia Capital China, IDG Capital, Sinovation Ventures, YF Capital and DFJ Dragon Fund. Sina contributed half of Wei's RMB 200m fund, with the other five partners contributing RMB 20m each. The fund is managed by Beijing Weimeng Innovation Venture Capital Management Co Ltd.

Wei Venture Capital is a VC fund jointly launched in November 2010 by Sina Corporation, Sequoia Capital China, IDG Capital, Sinovation Ventures, YF Capital and DFJ Dragon Fund. Sina contributed half of Wei's RMB 200m fund, with the other five partners contributing RMB 20m each. The fund is managed by Beijing Weimeng Innovation Venture Capital Management Co Ltd.

Co-founder and Co-CEO of Dianrong

Former private equity partner and intellectual property lawyer with over a decade of experience, whose clients included Google, Microsoft, and venture capital funds. A councilor of the Shanghai branch of the All-China Youth Federation, Guo holds an EMBA from PBC School of Finance, Tsinghua University.

Former private equity partner and intellectual property lawyer with over a decade of experience, whose clients included Google, Microsoft, and venture capital funds. A councilor of the Shanghai branch of the All-China Youth Federation, Guo holds an EMBA from PBC School of Finance, Tsinghua University.

Zhejiang Jinke Venture Capital

Founded in 2000, Zhejiang Jinke Venture Capital is a private venture capital enterprise. It specializes in capital investment, capital management, real estate investment and startup investment.

Founded in 2000, Zhejiang Jinke Venture Capital is a private venture capital enterprise. It specializes in capital investment, capital management, real estate investment and startup investment.

Mount Venture Capital is an early-stage investment firm focusing on the mobile Internet, consumer Internet, big data, and cloud computing sectors.

Mount Venture Capital is an early-stage investment firm focusing on the mobile Internet, consumer Internet, big data, and cloud computing sectors.

Zhangjiang Torch Venture Capital

Founded as the investment arm of Spinnotec, a state-owned venture capital firm, in November 2008, Zhangjiang Torch Venture Capital is a state-owned financial investment company. It invests primarily in early-stage tech startups.

Founded as the investment arm of Spinnotec, a state-owned venture capital firm, in November 2008, Zhangjiang Torch Venture Capital is a state-owned financial investment company. It invests primarily in early-stage tech startups.

Established in 1985, venture capital firm DFJ has invested in more than 300 companies throughout the world. Its core funds have raised US$4 billion to date.

Established in 1985, venture capital firm DFJ has invested in more than 300 companies throughout the world. Its core funds have raised US$4 billion to date.

Founder of GirlUp

New media and branding pro Wu Jing is a graduate of Beijing University of Aeronautics and Astronautics (now named BeiHang University), and a former staff of ELLE magazine and leading advertising agency BBDO. The founder of GirlUp is also a co-founder of Happy Together (Chunguangli), a startup incubator and venture capital firm focusing on internet projects.

New media and branding pro Wu Jing is a graduate of Beijing University of Aeronautics and Astronautics (now named BeiHang University), and a former staff of ELLE magazine and leading advertising agency BBDO. The founder of GirlUp is also a co-founder of Happy Together (Chunguangli), a startup incubator and venture capital firm focusing on internet projects.

Cambrian Venture Capital was founded in Shanghai in 2016 and focuses on early-stage investments. It has invested in over 80 startups in edtech, B2B, internet and consumer sectors.

Cambrian Venture Capital was founded in Shanghai in 2016 and focuses on early-stage investments. It has invested in over 80 startups in edtech, B2B, internet and consumer sectors.

Established in Shanghai in 2014, Wuqiong Venture Capital is an early-stage investment firm, having backed more than 10 startups in China including Beautysite, CeCelife and Orange-social.

Established in Shanghai in 2014, Wuqiong Venture Capital is an early-stage investment firm, having backed more than 10 startups in China including Beautysite, CeCelife and Orange-social.

Once the darling of investors, unmanned shelf startups are going through a hard time in China

Startups are being forced to transform their business models to survive

Chinese DIY robotics startup Makeblock enters the classroom

Present in more than 140 countries, this ambitious startup is taking global STEM education by storm

Zhongzheng Information: Big data and fully integrated services for smart office buildings

Joining the Microsoft for Startups program will boost Zhongzheng's R&D and business expansion in China

Bekraf: Growing a creative, productive Indonesia

Established to support Indonesia's creative industries as a whole, Bekraf is also an important link between government and the burgeoning startup landscape

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

FMCG supply chain solution KlikDaily simplifies life for mom-and-pop stores in Indonesia

KlikDaily, which raised Series A funding this week, is helping small businesses streamline supply of FMCG and reduce prices by eliminating several links in the supply chain

Insights on tech and the Indonesian diaspora in Silicon Valley

Navigating the different diaspora communities, one tech event at a time

Bukalapak to raise IDR 21tn in Indonesia's biggest IPO yet

Although trailing rivals Tokopedia and Shopee in market share, Bukalapak cut its losses last year and will be Indonesia’s first unicorn to go public

Portugal's health & medtech startups: Taking innovation and disruption to heart

Backed by local and foreign money, Portugal’s healthcare and medical technology startups are hungry to go global

Innovate big or go home: logistics unicorn YH Global eyes “Belt and Road” gold

The world’s first logistics firm to become a unicorn at Series A is a model of innovation in China. More overseas growth is next

Venturra Capital's Raditya Pramana interview (Part II): "We need to prioritize progress"

In part two of an interview, Indonesian VC Raditya Pramana discusses foreign investment in the local ecosystem, the qualities of startups that attract him and more

Solatom plans overseas expansion with backing from energy giants, impact investor

With a US patent in hand, the Valencian startup is banking on international sales of its concentrated solar power modules, targeting €1m in revenue by end-2021

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Venturra Capital's Raditya Pramana: Bear market "very close now"

In an interview, the Indonesian VC firm's newest partner also charts out the course for their new fund, Venturra Discovery

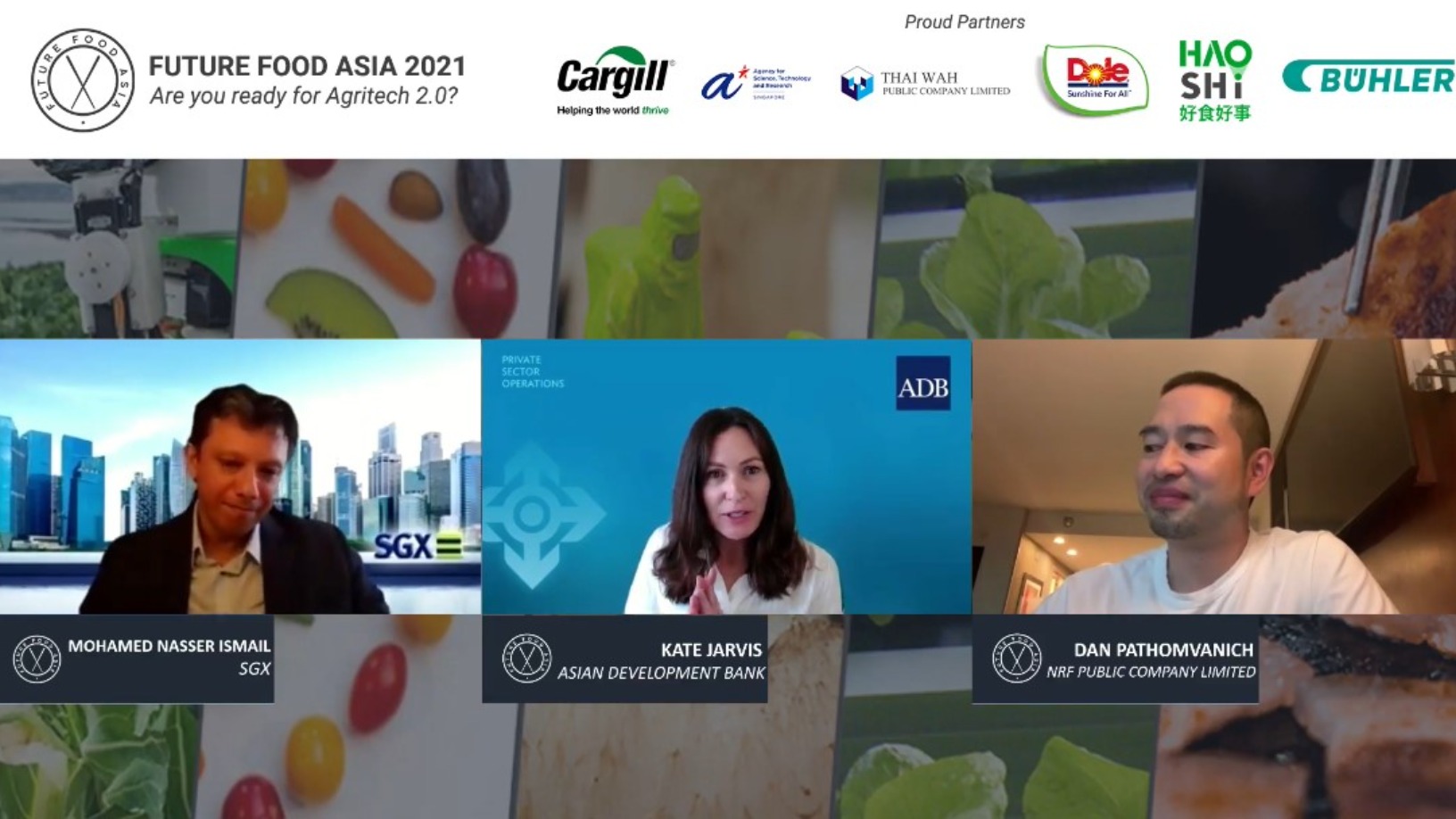

Future Food Asia 2021: Agrifood tech at an inflection point

Agrifood tech startups urged to harness consumer, investor and government feedback to create plentiful, nutritious food through sustainable means, but exercise caution when considering IPOs

Sorry, we couldn’t find any matches for“Giza Venture Capital”.