Global Founders Capital

-

DATABASE (920)

-

ARTICLES (643)

Founded in 2001 with registered capital of RMB 50 million. Tangrong Capital manages more than RMB 3 billion in valued assets and focuses on the security market, private equity, real estate funds and accumulated resources from China and the overseas market.

Founded in 2001 with registered capital of RMB 50 million. Tangrong Capital manages more than RMB 3 billion in valued assets and focuses on the security market, private equity, real estate funds and accumulated resources from China and the overseas market.

Divine Capital was founded in Shanghai in 2009. The private equity fund manages total assets of RMB 3bn and mainly invests in consumer services, manufacturing, clean technology and mid-sized startups. Divine Capital has completed 20 investment deals to date.

Divine Capital was founded in Shanghai in 2009. The private equity fund manages total assets of RMB 3bn and mainly invests in consumer services, manufacturing, clean technology and mid-sized startups. Divine Capital has completed 20 investment deals to date.

Established in September 2016, Chobe Capital is based in Shanghai. The firm is a registered private equity manager, focusing on pre-IPO and VC projects. Chobe Capital mainly invests in various sectors like TMT, biotechnology, consumer products and environmental protection.

Established in September 2016, Chobe Capital is based in Shanghai. The firm is a registered private equity manager, focusing on pre-IPO and VC projects. Chobe Capital mainly invests in various sectors like TMT, biotechnology, consumer products and environmental protection.

Formerly known as CrunchFund, Tuesday Capital was founded in 2011 in San Francisco. The VC was rebranded as Tuesday Capital in 2019 and invests in the early stage rounds. Its investment focus includes SaaS, mobile and IT solutions.

Formerly known as CrunchFund, Tuesday Capital was founded in 2011 in San Francisco. The VC was rebranded as Tuesday Capital in 2019 and invests in the early stage rounds. Its investment focus includes SaaS, mobile and IT solutions.

Monarch Capital was founded in 2016 in Hangzhou. With RMB 360m worth of assets under management, it mainly invests in early-stage startups in sectors of supply chain and retailing. Monarch Capital has invested in 18 companies so far.

Monarch Capital was founded in 2016 in Hangzhou. With RMB 360m worth of assets under management, it mainly invests in early-stage startups in sectors of supply chain and retailing. Monarch Capital has invested in 18 companies so far.

Co-founder of Mindstores

Daniel Surya has almost 20 years of experience in the branding industry, having worked at agencies like Addison, Landor Associates and The Brand Union. He started AR&Co in 2009. The augmented reality branding startup was later renamed Slingshot.Daniel decided to invest in more ventures including DAV Global under the banner of the WIR Group. He is currently the CEO of WIR and the chairman of the Slingshot group that launched Mindstores.

Daniel Surya has almost 20 years of experience in the branding industry, having worked at agencies like Addison, Landor Associates and The Brand Union. He started AR&Co in 2009. The augmented reality branding startup was later renamed Slingshot.Daniel decided to invest in more ventures including DAV Global under the banner of the WIR Group. He is currently the CEO of WIR and the chairman of the Slingshot group that launched Mindstores.

Co-founder, COO and CFO of Karta

Tjokro Wimantara is a co-founder of motorcycle-mounted billboard startup Karta. In 2008, he graduated with a bachelor's in Mechatronics from the Swiss German University, an international university in Indonesia. He earned his MBA through the Tsinghua-MIT Global MBA program in 2012, winning the Outstanding Master's Dissertation Award on the topic of subliminal advertising. A certified financial advisor who has passed the CFA Level 3 exams, Tjokro holds the both the COO and CFO positions at Karta.

Tjokro Wimantara is a co-founder of motorcycle-mounted billboard startup Karta. In 2008, he graduated with a bachelor's in Mechatronics from the Swiss German University, an international university in Indonesia. He earned his MBA through the Tsinghua-MIT Global MBA program in 2012, winning the Outstanding Master's Dissertation Award on the topic of subliminal advertising. A certified financial advisor who has passed the CFA Level 3 exams, Tjokro holds the both the COO and CFO positions at Karta.

Co-founder and Chief Product Officer of Advotics

Thanks to the Singapore-MIT Alliance Fellowship Program, Jeffry William Tani was able to join a four-year postgrad PhD in Manufacturing System and Technology after graduating in 2009 with a Mechanical Engineering degree at Nanyang Technological University (NTU) in Singapore.In 2013, he joined Schlumberger as a new product development engineer. He left the Singapore-based oilfield mining services company in 2017 and returned to Indonesia to become the CPO of PT Advotics Teknologi Global.

Thanks to the Singapore-MIT Alliance Fellowship Program, Jeffry William Tani was able to join a four-year postgrad PhD in Manufacturing System and Technology after graduating in 2009 with a Mechanical Engineering degree at Nanyang Technological University (NTU) in Singapore.In 2013, he joined Schlumberger as a new product development engineer. He left the Singapore-based oilfield mining services company in 2017 and returned to Indonesia to become the CPO of PT Advotics Teknologi Global.

Founded in 2014 by Cao Yi, formerly of Sequoia Capital and Ceyuan Ventures, Source Code Capital currently manages about US$500 million of capital, focusing on early-stage TMT (especially fintech, O2O, e-commerce) investments. Notable investments have included Qufenqi, Meituan, and PPzuche. Source Code Capital is part of the Sequoia Capital China.

Founded in 2014 by Cao Yi, formerly of Sequoia Capital and Ceyuan Ventures, Source Code Capital currently manages about US$500 million of capital, focusing on early-stage TMT (especially fintech, O2O, e-commerce) investments. Notable investments have included Qufenqi, Meituan, and PPzuche. Source Code Capital is part of the Sequoia Capital China.

Roshni Mahtani graduated from the University of Upper Iowa, USA, with a bachelor’s in Mass Communication and Marketing in 2004. In 2009, Roshni founded a digital media company Tickled Media that manages the popular parenting portal TheAsianparent. She was also the executive producer of Untouchable: Children of God, a film that explores the stories of the most vulnerable people in Nepal and India. In 2014, she also co-founded a nonprofit organization Female Network to accelerate the ecosystem for female founders in Singapore to increase the percentage of female founded startups from 5% to 20% by 2020.

Roshni Mahtani graduated from the University of Upper Iowa, USA, with a bachelor’s in Mass Communication and Marketing in 2004. In 2009, Roshni founded a digital media company Tickled Media that manages the popular parenting portal TheAsianparent. She was also the executive producer of Untouchable: Children of God, a film that explores the stories of the most vulnerable people in Nepal and India. In 2014, she also co-founded a nonprofit organization Female Network to accelerate the ecosystem for female founders in Singapore to increase the percentage of female founded startups from 5% to 20% by 2020.

Fenghou Capital is a venture capital firm focusing on early-stage investment in entertainment, industrial internet and fintech. It has invested in more than 80 companies since its inception in 2013 and has about RMB 500 million in assets under management.

Fenghou Capital is a venture capital firm focusing on early-stage investment in entertainment, industrial internet and fintech. It has invested in more than 80 companies since its inception in 2013 and has about RMB 500 million in assets under management.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Founded by Tencent co-founder Zeng Liqing in 2007, Decent Capital had invested in some 150 companies as of mid-2017. With its roots in Tencent, Decent Capital tends to favor Tencent alumni-entrepreneurs in its investments.

Founded by Tencent co-founder Zeng Liqing in 2007, Decent Capital had invested in some 150 companies as of mid-2017. With its roots in Tencent, Decent Capital tends to favor Tencent alumni-entrepreneurs in its investments.

Wei Venture Capital is a VC fund jointly launched in November 2010 by Sina Corporation, Sequoia Capital China, IDG Capital, Sinovation Ventures, YF Capital and DFJ Dragon Fund. Sina contributed half of Wei's RMB 200m fund, with the other five partners contributing RMB 20m each. The fund is managed by Beijing Weimeng Innovation Venture Capital Management Co Ltd.

Wei Venture Capital is a VC fund jointly launched in November 2010 by Sina Corporation, Sequoia Capital China, IDG Capital, Sinovation Ventures, YF Capital and DFJ Dragon Fund. Sina contributed half of Wei's RMB 200m fund, with the other five partners contributing RMB 20m each. The fund is managed by Beijing Weimeng Innovation Venture Capital Management Co Ltd.

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

Analysing and leveraging data: Interview with Datanest co-founders

From credit scoring to demand forecasting, Datanest has built many machine-learning products and looks to raise new funding, expand beyond Indonesia

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

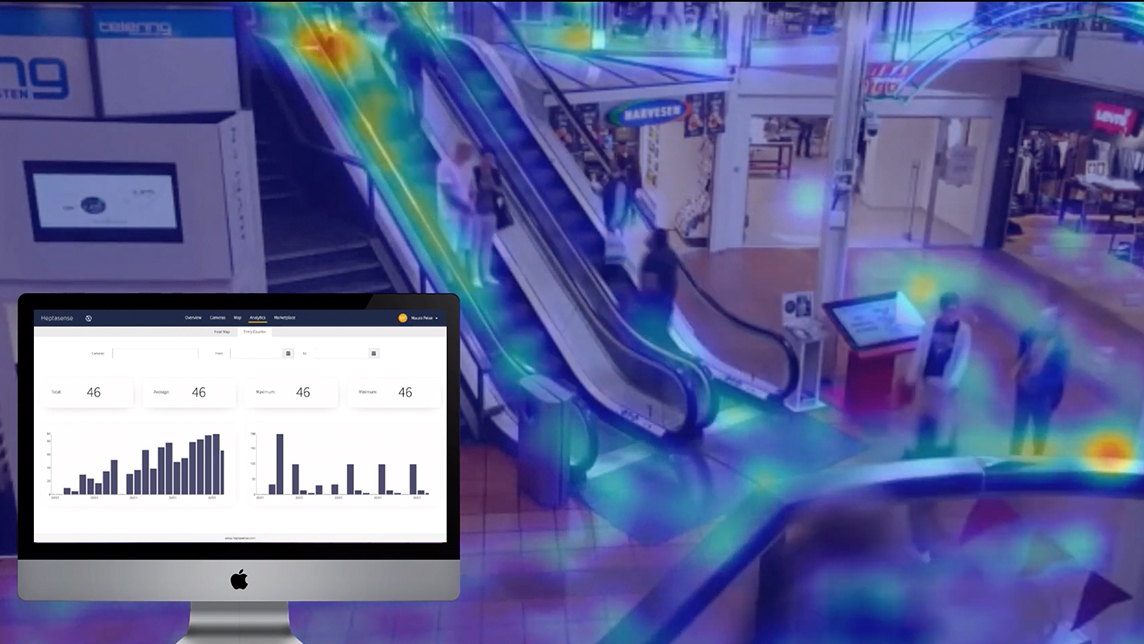

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

SWITCH Singapore: VCs urge startups to think beyond Covid-19

VCs also discuss prospects of a current tech bubble, and whether new working and hiring practices sparked by the pandemic could end Silicon Valley dominance

FMCG supply chain solution KlikDaily simplifies life for mom-and-pop stores in Indonesia

KlikDaily, which raised Series A funding this week, is helping small businesses streamline supply of FMCG and reduce prices by eliminating several links in the supply chain

Mediktor: AI medical diagnosis app wants to improve global health outcomes

NLP-based triage and diagnosis tool has achieved a 91% accuracy rate in clinical trials and raised €3 million funding

GoWithFlow: Scaling ERP platform for sustainable mobility in global transportation markets

Portugal’s CEiiA spin-off leads the way to manage smart transportation systems of cities and corporations to boost fleet performance by reducing CO2 emissions and maintenance costs

Sorry, we couldn’t find any matches for“Global Founders Capital”.