Global Founders Capital

-

DATABASE (920)

-

ARTICLES (643)

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

PayPal is the US-based online payments company founded in 1999 and acquired by eBay in 2002. It is listed in NASDAQ under the ticker code PYPL.Besides facilitating online payments and money transfers for many e-commerce companies and other internet-based businesses, it is famous for its network of former founders and other alumni, many of whom went on to establish successful companies or became investors in the tech and internet industries. Some famous names linked to this network, sometimes called “PayPal Mafia”, include ex-CEO Peter Thiel, Elon Musk, Dave McClure (founder of 500 Startups), and Reid Hoffman (LinkedIn co-founder).PayPal has invested in several companies, including ride-hailing firms Gojek and Uber and e-commerce platform MercadoLibre. It has also established PayPal Ventures as a separate VC arm and PayPal Incubator to support early-stage startups.

PayPal is the US-based online payments company founded in 1999 and acquired by eBay in 2002. It is listed in NASDAQ under the ticker code PYPL.Besides facilitating online payments and money transfers for many e-commerce companies and other internet-based businesses, it is famous for its network of former founders and other alumni, many of whom went on to establish successful companies or became investors in the tech and internet industries. Some famous names linked to this network, sometimes called “PayPal Mafia”, include ex-CEO Peter Thiel, Elon Musk, Dave McClure (founder of 500 Startups), and Reid Hoffman (LinkedIn co-founder).PayPal has invested in several companies, including ride-hailing firms Gojek and Uber and e-commerce platform MercadoLibre. It has also established PayPal Ventures as a separate VC arm and PayPal Incubator to support early-stage startups.

Pau Molinas is an investor and board member in several technology companies. He was one of the first investors in Gestoos, a gesture recognition startup, of which he is currently advisor.Molinas developed his professional career at HP, where he was its global VP overseeing HP’s printer operations. He graduated in Mechanical Engineering and specialized in Business Management from INSEAD, the London Business School as well as Spanish business schools EADA and IESE.

Pau Molinas is an investor and board member in several technology companies. He was one of the first investors in Gestoos, a gesture recognition startup, of which he is currently advisor.Molinas developed his professional career at HP, where he was its global VP overseeing HP’s printer operations. He graduated in Mechanical Engineering and specialized in Business Management from INSEAD, the London Business School as well as Spanish business schools EADA and IESE.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

Based in New York, VectoIQ was formed in 2016 to fund startups in the smart mobility space. It is led by Steve Girsky, former vice-chairman of General Motors with more than 30 years in the automobile industry. Mary Chan is the managing partner, who also worked at GM as president of global connected consumer. The VC mainly invests in sectors relating to autonomous vehicles, connected car, smart mobility, MaaS, electrification and cybersecurity.

Based in New York, VectoIQ was formed in 2016 to fund startups in the smart mobility space. It is led by Steve Girsky, former vice-chairman of General Motors with more than 30 years in the automobile industry. Mary Chan is the managing partner, who also worked at GM as president of global connected consumer. The VC mainly invests in sectors relating to autonomous vehicles, connected car, smart mobility, MaaS, electrification and cybersecurity.

Founded in London in 1998, Kreos Capital is a pioneer growth debt provider. Kreos has completed over 630 deals worth over €3bn in pan-European countries and Israel. The Kreos Capital Group of companies and various funds are regulated by the Jersey Financial Services Commission.Kreos currently has 102 companies in its portfolio and has managed over 200 exits. Investee Riskified, an Israeli e-commerce fraud protection company, was listed on the NYSE at a $3.3bn valuation in August 2021. Kreos also joined recent investments in 2021 including the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed and the €9.5m round of Berlin-based HRtech expertlead.

Founded in London in 1998, Kreos Capital is a pioneer growth debt provider. Kreos has completed over 630 deals worth over €3bn in pan-European countries and Israel. The Kreos Capital Group of companies and various funds are regulated by the Jersey Financial Services Commission.Kreos currently has 102 companies in its portfolio and has managed over 200 exits. Investee Riskified, an Israeli e-commerce fraud protection company, was listed on the NYSE at a $3.3bn valuation in August 2021. Kreos also joined recent investments in 2021 including the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed and the €9.5m round of Berlin-based HRtech expertlead.

CEO and Co-founder of 4D ShoeTech

Antonio Lin was admitted as a freshman of College of Mathematics and Informatics in South China Agricultural University in 2015. He also founded a 3D printing company in 2015. The business encountered financial problems and was later shut down.But in March 2016, the global entrepreneur incubator Blackbox picked Lin’s company as one of the ten teams with potential to be trained in Silicon Valley for a week. It was during this training program that Lin met Qiu Chen from Tsinghua University and Zhou Zhiheng, the general manager of Michael Antonio Footwear Group’s business in China.Lin quickly pivoted the focus of his company to 3D printing of footwear and became the CEO of 4D ShoeTech.

Antonio Lin was admitted as a freshman of College of Mathematics and Informatics in South China Agricultural University in 2015. He also founded a 3D printing company in 2015. The business encountered financial problems and was later shut down.But in March 2016, the global entrepreneur incubator Blackbox picked Lin’s company as one of the ten teams with potential to be trained in Silicon Valley for a week. It was during this training program that Lin met Qiu Chen from Tsinghua University and Zhou Zhiheng, the general manager of Michael Antonio Footwear Group’s business in China.Lin quickly pivoted the focus of his company to 3D printing of footwear and became the CEO of 4D ShoeTech.

CEO and Co-founder of Dipole Tech

Yang Kaikai graduated in 2013, majoring in English Language and Literature at Shanghai Ocean University.In March 2016, she joined Tencent Incubator to work as a marketing and business development manager. She left Tencent in October 2016 and co-founded Energo Labs as COO, responsible for the strategic and global expansion of the company in Asia. In September 2018, Yang also co-founded Dipole Tech, a blockchain-based renewable energy management and trading platform.Yang is co-chair of the Energy Blockchain Leadership Committee and founded the Asian Cleantech Entrepreneurs Community (ACTEC) to connect entrepreneurs focusing on sustainable development and the environment. In 2019, she was nominated as one of 600 entrepreneurs 30 under 30 by the Forbes China.

Yang Kaikai graduated in 2013, majoring in English Language and Literature at Shanghai Ocean University.In March 2016, she joined Tencent Incubator to work as a marketing and business development manager. She left Tencent in October 2016 and co-founded Energo Labs as COO, responsible for the strategic and global expansion of the company in Asia. In September 2018, Yang also co-founded Dipole Tech, a blockchain-based renewable energy management and trading platform.Yang is co-chair of the Energy Blockchain Leadership Committee and founded the Asian Cleantech Entrepreneurs Community (ACTEC) to connect entrepreneurs focusing on sustainable development and the environment. In 2019, she was nominated as one of 600 entrepreneurs 30 under 30 by the Forbes China.

CTO and Co-founder of Plastic Bank

Since 2008, after completing a business course at Royal Roads University in Canada, Shaun Frankson has been running his own consultancy Frankson Media in Vancouver.From 2009 to 2014, Frankson worked as VP at Nero Global Tracking, a SaaS platform for mobile vehicles founded by David Katz. In 2013, the duo co-founded Plastic Bank in 2013 to launch a “Social Plastic” movement to reduce ocean plastic and set up recycling centers to create jobs to improve the livelihood of locals in under-served coastal villages. The Canadian co-founder is now the CTO of Plastic Bank. In 2014, he also became an advisor at HeroX, a social network for innovation with over 2m members.

Since 2008, after completing a business course at Royal Roads University in Canada, Shaun Frankson has been running his own consultancy Frankson Media in Vancouver.From 2009 to 2014, Frankson worked as VP at Nero Global Tracking, a SaaS platform for mobile vehicles founded by David Katz. In 2013, the duo co-founded Plastic Bank in 2013 to launch a “Social Plastic” movement to reduce ocean plastic and set up recycling centers to create jobs to improve the livelihood of locals in under-served coastal villages. The Canadian co-founder is now the CTO of Plastic Bank. In 2014, he also became an advisor at HeroX, a social network for innovation with over 2m members.

Clime Capital is a clean energy-focused investment firm based in Singapore with a focus on early-stage companies. In June 2020, the VC launched the Southeast Asia Clean Energy Facility (SEACEF), a fund backed by philanthropic donors to support early-stage companies in commercializing clean energy solutions. The initial fund is valued at $10m. SEACEF’s first investment is in Xurya, an Indonesian startup providing solar power system leasing to commercial customers.

Clime Capital is a clean energy-focused investment firm based in Singapore with a focus on early-stage companies. In June 2020, the VC launched the Southeast Asia Clean Energy Facility (SEACEF), a fund backed by philanthropic donors to support early-stage companies in commercializing clean energy solutions. The initial fund is valued at $10m. SEACEF’s first investment is in Xurya, an Indonesian startup providing solar power system leasing to commercial customers.

Co-founded by Alibaba founder Jack Ma and Target Media founder David Yu in 2010, YF Capital focuses on the internet, technology, healthcare, media & entertainment, financial services, logistics and consumer sectors. Its Chinese name “Yunfeng” combines the first names of Jack Ma (Ma Yun) and David Yu (Yu Feng). Headquartered in Shanghai, it also has offices in Beijing, Hong Kong, Hangzhou and other Chinese cities; and manages both USD- and RMB-denominated and funds.

Co-founded by Alibaba founder Jack Ma and Target Media founder David Yu in 2010, YF Capital focuses on the internet, technology, healthcare, media & entertainment, financial services, logistics and consumer sectors. Its Chinese name “Yunfeng” combines the first names of Jack Ma (Ma Yun) and David Yu (Yu Feng). Headquartered in Shanghai, it also has offices in Beijing, Hong Kong, Hangzhou and other Chinese cities; and manages both USD- and RMB-denominated and funds.

Prospect Avenue Capital is an investment firm which focuses on Fintech.

Prospect Avenue Capital is an investment firm which focuses on Fintech.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

American investment capital firm Farallon Capital Management was established in 1986. The company manages equity capital for institutions, including college endowments, charitable foundations and pension plans, and funds for high net worth individuals. While most of its investments are in risk arbitrage and debt restructuring, it has also invested in startups across different verticals, such as Indonesian ride-hailing firm Gojek and a host of biotechnology, pharmaceuticals and medical technology companies.Farallon’s history with Indonesia began long before Gojek came into existence. In 2002, Farallon bought a controlling stake in Bank Central Asia (BCA), an Indonesian bank, during a time when investors avoided Indonesian banks that had been saddled with bad debt. With the controlling stake, Farallon installed a new bank chairman and reformed BCA. Over the next four years Farallon slowly divested in BCA and finally sold the remaining 4% stake in 2006 to earn a profit.

Cofounder and Managing Director of Hacktiv8

Ronald Ishak has been involved in tech startups since 2008 when he became Web Applications Manager, Online Trading at PT Ciptadana Capital and led a team of developers to build an online stock trading app for the Indonesian Stock Exchange. In August 2009, he became CTO at web developer company, PT Domikado, and left in January 2014 when the company was acquired. Meanwhile, in 2010, he co-founded his first (short-lived) company, which developed a photo sharing app for mobile platforms. For nine months from November 2014, he was CTO at PT Giftcard Indonesia, which distributes digital giftcards for brands. In 2016, he co-founded Hacktiv8, a training center that runs web development bootcamps and other programming courses, with Riza Fahmi and is its CEO. Ishak is also partner at RMKB Ventures, an Indonesian VC that has backed, among others, insurtech firm Qoala, “CTO-as-a-service” startup Rebel Works and Hacktiv8.

Ronald Ishak has been involved in tech startups since 2008 when he became Web Applications Manager, Online Trading at PT Ciptadana Capital and led a team of developers to build an online stock trading app for the Indonesian Stock Exchange. In August 2009, he became CTO at web developer company, PT Domikado, and left in January 2014 when the company was acquired. Meanwhile, in 2010, he co-founded his first (short-lived) company, which developed a photo sharing app for mobile platforms. For nine months from November 2014, he was CTO at PT Giftcard Indonesia, which distributes digital giftcards for brands. In 2016, he co-founded Hacktiv8, a training center that runs web development bootcamps and other programming courses, with Riza Fahmi and is its CEO. Ishak is also partner at RMKB Ventures, an Indonesian VC that has backed, among others, insurtech firm Qoala, “CTO-as-a-service” startup Rebel Works and Hacktiv8.

CFO and co-founder of StudentFinance

Marta Palmeiro graduated in Business Administration and Management at Portugal's Nova School of Business and Economics in 2007. She went to London to work at Credit Suisse as an intern and joined the bank's graduate program in 2007. She stayed in London until 2010 and went on to work at Credit Suisse in Madrid until July 2016. The VP of Investment Banking (Capital Markets) was primarily responsible for Iberian accounts.Based in Lisbon, she is now a partner at Pier Partners VC where she has worked since 2016. She has completed courses in fintech and blockchain business strategy run by Massachusetts Institute of Technology (MIT) and Oxford university's Said Business School respectively. In 2018, she became a board member of Portugal Fintech, an NGO overseeing the development of the country's fintech ecosystem. In August 2019, the mother-of-three became a fintech entrepreneur as the Portuguese co-founder and CFO of StudentFinance.

Marta Palmeiro graduated in Business Administration and Management at Portugal's Nova School of Business and Economics in 2007. She went to London to work at Credit Suisse as an intern and joined the bank's graduate program in 2007. She stayed in London until 2010 and went on to work at Credit Suisse in Madrid until July 2016. The VP of Investment Banking (Capital Markets) was primarily responsible for Iberian accounts.Based in Lisbon, she is now a partner at Pier Partners VC where she has worked since 2016. She has completed courses in fintech and blockchain business strategy run by Massachusetts Institute of Technology (MIT) and Oxford university's Said Business School respectively. In 2018, she became a board member of Portugal Fintech, an NGO overseeing the development of the country's fintech ecosystem. In August 2019, the mother-of-three became a fintech entrepreneur as the Portuguese co-founder and CFO of StudentFinance.

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

Analysing and leveraging data: Interview with Datanest co-founders

From credit scoring to demand forecasting, Datanest has built many machine-learning products and looks to raise new funding, expand beyond Indonesia

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

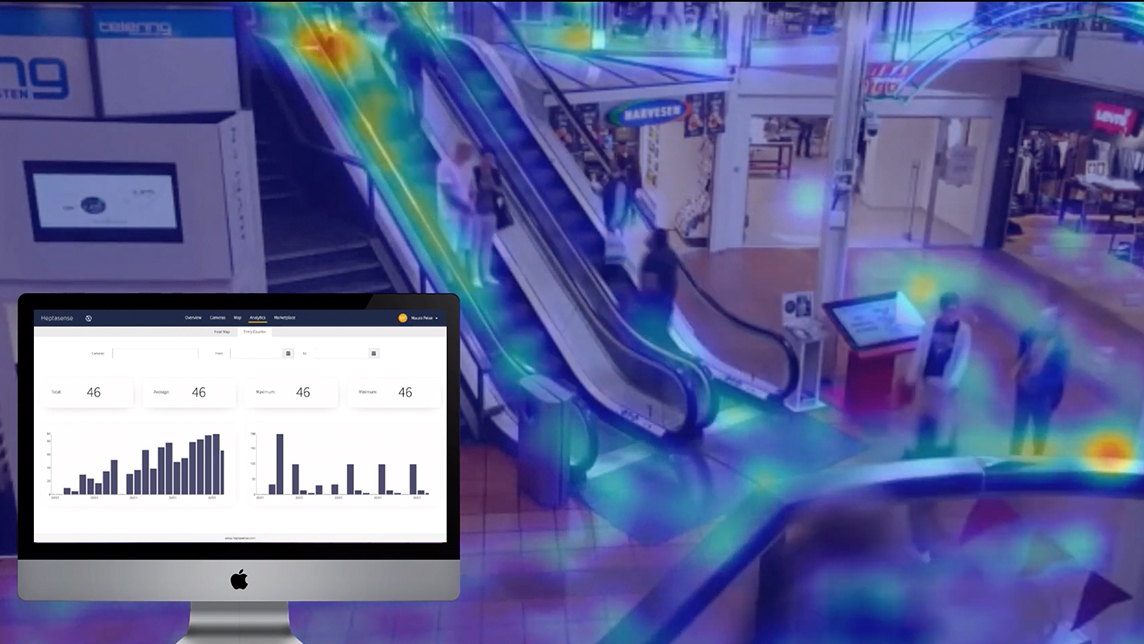

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

SWITCH Singapore: VCs urge startups to think beyond Covid-19

VCs also discuss prospects of a current tech bubble, and whether new working and hiring practices sparked by the pandemic could end Silicon Valley dominance

FMCG supply chain solution KlikDaily simplifies life for mom-and-pop stores in Indonesia

KlikDaily, which raised Series A funding this week, is helping small businesses streamline supply of FMCG and reduce prices by eliminating several links in the supply chain

Mediktor: AI medical diagnosis app wants to improve global health outcomes

NLP-based triage and diagnosis tool has achieved a 91% accuracy rate in clinical trials and raised €3 million funding

GoWithFlow: Scaling ERP platform for sustainable mobility in global transportation markets

Portugal’s CEiiA spin-off leads the way to manage smart transportation systems of cities and corporations to boost fleet performance by reducing CO2 emissions and maintenance costs

Sorry, we couldn’t find any matches for“Global Founders Capital”.