Global Founders Capital

-

DATABASE (920)

-

ARTICLES (643)

Alison Gelb Pincus is an entrepreneur who co-founded One King’s Lane, a direct-to-consumer home decor company which was sold to Bed, Bath & Beyond, and more recently, sustainable packaging start-up kari.earth. She is also an angel investor and founder of Short List Capital, a San Francisco-based early-stage VC collective run by women. Short List Capital currently lists 20 companies in its portfolio, which has a focus on investing in e-commerce platforms with healthy, user-friendly or sustainable products. Gelb Pincus’s recent investments included participation in the May 2020 $5.3m seed round of US cookware maker Caraway and a 2015 investment in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.Alison Gelb Pincus was married to Mark Pincus, the co-founder of Zynga and a founding investor in Facebook, Snapchat, Twitter, and Xiaomi.

Alison Gelb Pincus is an entrepreneur who co-founded One King’s Lane, a direct-to-consumer home decor company which was sold to Bed, Bath & Beyond, and more recently, sustainable packaging start-up kari.earth. She is also an angel investor and founder of Short List Capital, a San Francisco-based early-stage VC collective run by women. Short List Capital currently lists 20 companies in its portfolio, which has a focus on investing in e-commerce platforms with healthy, user-friendly or sustainable products. Gelb Pincus’s recent investments included participation in the May 2020 $5.3m seed round of US cookware maker Caraway and a 2015 investment in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.Alison Gelb Pincus was married to Mark Pincus, the co-founder of Zynga and a founding investor in Facebook, Snapchat, Twitter, and Xiaomi.

NewMargin Ventures is a venture capital management firm in China focused on the IT, sustainable growth technology, biomedicine and high margin manufacturing sectors. Its Chinese investors include China Foundation of Science & Technology for Development (a joint venture between the National Development and Reform Commission, the Ministry of Commerce and Chinese Academy of Sciences) and Shanghai Alliance Investment Co. (an investment firm founded by Jiang Mianheng, son of the former Chinese President Jiang Zemin); and its foreign investors include GIC, Kerry Group, K.Wah Group, SUNeVision, JAFCO, Motorola and Alcatel. NewMargin Ventures has invested more than US$1.7 billion in 160 companies, including 40 IPOs.

NewMargin Ventures is a venture capital management firm in China focused on the IT, sustainable growth technology, biomedicine and high margin manufacturing sectors. Its Chinese investors include China Foundation of Science & Technology for Development (a joint venture between the National Development and Reform Commission, the Ministry of Commerce and Chinese Academy of Sciences) and Shanghai Alliance Investment Co. (an investment firm founded by Jiang Mianheng, son of the former Chinese President Jiang Zemin); and its foreign investors include GIC, Kerry Group, K.Wah Group, SUNeVision, JAFCO, Motorola and Alcatel. NewMargin Ventures has invested more than US$1.7 billion in 160 companies, including 40 IPOs.

Established in 1977, Matrix Partners is an American venture capital firm with offices in San Francisco and Cambridge in the US, as well as in Shanghai, Beijing, Mumbai and Bangalore, and has invested in prominent companies like Apple and FedEx. It participates in all stages of investment and, to date, has invested over US$4 billion and has over US$4 billion currently under management. The company has invested in more than 500 companies and was lead investor in over 150. It has seen more than 100 exits. Recent investments include US$11 million in Brightback Series A and in Klook's Series D.

Established in 1977, Matrix Partners is an American venture capital firm with offices in San Francisco and Cambridge in the US, as well as in Shanghai, Beijing, Mumbai and Bangalore, and has invested in prominent companies like Apple and FedEx. It participates in all stages of investment and, to date, has invested over US$4 billion and has over US$4 billion currently under management. The company has invested in more than 500 companies and was lead investor in over 150. It has seen more than 100 exits. Recent investments include US$11 million in Brightback Series A and in Klook's Series D.

Billed as the world’s first online venture capital platform, launched in 2012 in San Francisco, FundersClub is a marketplace that allows accredited investors to become equity holders in managed venture funds, which then fund pre-screened private companies. It has invested in more than 340 companies to date, valued at more than US$7.6 billion and has seen 35 exits. The platform has invested more than US$115 million to date across sectors and technologies in companies from 21 different countries. Recent investments include in SendBird's Series B, that raised US$52 million, and Zentail's Series A that raised US$5 million.

Billed as the world’s first online venture capital platform, launched in 2012 in San Francisco, FundersClub is a marketplace that allows accredited investors to become equity holders in managed venture funds, which then fund pre-screened private companies. It has invested in more than 340 companies to date, valued at more than US$7.6 billion and has seen 35 exits. The platform has invested more than US$115 million to date across sectors and technologies in companies from 21 different countries. Recent investments include in SendBird's Series B, that raised US$52 million, and Zentail's Series A that raised US$5 million.

Multimedia and telecoms postgrad Carlos Blanco Vázquez is a serial entrepreneur, business angel and VC managing partner. He had worked in IT until 1996 when he founded OACE Servicios Informaticos SL. A sports fanatic, he also became a football talent scout (u15-u17) for RCD Espanyol de Barcelona S.A.D.His most profitable venture is his social gaming platform Akamon Entertainment that was sold for € 23.7 million to Imperus in 2015. He co-founded Nuclio Venture Builder to manage all his business interests, while VC firm Encomenda Smart Capital manages an investment fund of €20 million.

Multimedia and telecoms postgrad Carlos Blanco Vázquez is a serial entrepreneur, business angel and VC managing partner. He had worked in IT until 1996 when he founded OACE Servicios Informaticos SL. A sports fanatic, he also became a football talent scout (u15-u17) for RCD Espanyol de Barcelona S.A.D.His most profitable venture is his social gaming platform Akamon Entertainment that was sold for € 23.7 million to Imperus in 2015. He co-founded Nuclio Venture Builder to manage all his business interests, while VC firm Encomenda Smart Capital manages an investment fund of €20 million.

Francesc Mora Sagués was the president of MoraBanc based in Andorra for 15 years. He was also the CEO of Morsa Group and adviser at property group Inmobiliaria Colonial. Since 2017, he has been a business angel, partner and founder of Kensington Capital SL, an investment firm headquartered in Andorra and focuses on emerging deep technology startups. In June 2016, Andorra had the second largest number of electric vehicles in the Iberian peninsula. Andorra’s 6% market share of electric and hybrid vehicles was mainly due to the Principality’s strong public policy for renewable energy and eco-friendly transportation.

Francesc Mora Sagués was the president of MoraBanc based in Andorra for 15 years. He was also the CEO of Morsa Group and adviser at property group Inmobiliaria Colonial. Since 2017, he has been a business angel, partner and founder of Kensington Capital SL, an investment firm headquartered in Andorra and focuses on emerging deep technology startups. In June 2016, Andorra had the second largest number of electric vehicles in the Iberian peninsula. Andorra’s 6% market share of electric and hybrid vehicles was mainly due to the Principality’s strong public policy for renewable energy and eco-friendly transportation.

Kibo Ventures is a Madrid-based venture capital firm founded in 2011 by Alquilino Peña, Jose Maria Amusategui and Javier Torremocha with €114 million under management. The firm is supported by a network of 31 international co-investors who offer access to foreign markets, especially to the US and Latin America, as well as digital-savvy operating partners who provide guidance on technology matters. As of July 2018, Kibo had invested in 44 companies, five of which it has successfully exited, including Blink Booking (acquired by Groupon in 2013), Ducksboard (acquired by New Relic in 2014) and Trip4real (acquired by AirBnB in 2016).

Kibo Ventures is a Madrid-based venture capital firm founded in 2011 by Alquilino Peña, Jose Maria Amusategui and Javier Torremocha with €114 million under management. The firm is supported by a network of 31 international co-investors who offer access to foreign markets, especially to the US and Latin America, as well as digital-savvy operating partners who provide guidance on technology matters. As of July 2018, Kibo had invested in 44 companies, five of which it has successfully exited, including Blink Booking (acquired by Groupon in 2013), Ducksboard (acquired by New Relic in 2014) and Trip4real (acquired by AirBnB in 2016).

Established in August 2017, Insignia Ventures Partners is a newly-founded VC by former Sequoia Capital partner Yinglan Tan, a Stanford and Carnegie Mellon alumnus who joined Sequoia in 2012. He had also worked for 3i, Taiwanese AI startup Appier and has been with Indonesia’s Tokopedia since 2014.Starting with maiden funds worth US$120 million, Insignia has invested US$1 million in Indonesia’s B2B platform for the F&B sector Stoqo. Its lead round of US$3.5 million, for co-working spaces EV Hive in September 2017, was joined by Intudo Ventures, Pandu Sjahrir and other prominent angel investors.

Established in August 2017, Insignia Ventures Partners is a newly-founded VC by former Sequoia Capital partner Yinglan Tan, a Stanford and Carnegie Mellon alumnus who joined Sequoia in 2012. He had also worked for 3i, Taiwanese AI startup Appier and has been with Indonesia’s Tokopedia since 2014.Starting with maiden funds worth US$120 million, Insignia has invested US$1 million in Indonesia’s B2B platform for the F&B sector Stoqo. Its lead round of US$3.5 million, for co-working spaces EV Hive in September 2017, was joined by Intudo Ventures, Pandu Sjahrir and other prominent angel investors.

Tim Hart is an investor and consultant at Charlotte Street Capital, focusing on early stage and general tech businesses. He became a non-executive director at Nixplay and Creedon Technologies Limited in 2017. He joined the advisory board of Chorus Intelligence Ltd in 2016. He has acquired a wide range of finance and trading experience since 1989 when he started work as a junior trader at James Capel. He has also served as VP at Robert Fleming, a director at Merrill Lynch and MD of Deutsche Bank.

Tim Hart is an investor and consultant at Charlotte Street Capital, focusing on early stage and general tech businesses. He became a non-executive director at Nixplay and Creedon Technologies Limited in 2017. He joined the advisory board of Chorus Intelligence Ltd in 2016. He has acquired a wide range of finance and trading experience since 1989 when he started work as a junior trader at James Capel. He has also served as VP at Robert Fleming, a director at Merrill Lynch and MD of Deutsche Bank.

Jesus Monleon started his professional career in the financial sector, but left soon after to become an entrepreneur. He founded eMagister.com, a consulting firm dedicated to the IT management market. He also established Offerum that is now part of Groupalia. Another venture Glamourum was acquired by JolieBox in 2012. He is currently a leading advisor and business angel within the Spanish startup ecosystem. In 2008, he co-founded the famous Spanish accelerator SeedRocket. Together with several other investors, he also set up a €12-million fund to establish SeedRocket 4Founders Capital in 2017.

Jesus Monleon started his professional career in the financial sector, but left soon after to become an entrepreneur. He founded eMagister.com, a consulting firm dedicated to the IT management market. He also established Offerum that is now part of Groupalia. Another venture Glamourum was acquired by JolieBox in 2012. He is currently a leading advisor and business angel within the Spanish startup ecosystem. In 2008, he co-founded the famous Spanish accelerator SeedRocket. Together with several other investors, he also set up a €12-million fund to establish SeedRocket 4Founders Capital in 2017.

Gan is best known for being the 67th employee of Alibaba and the former COO of Meituan-Dianping. Before joining Alibaba in 1999, Gan had worked at a state-owned coal trading enterprise for five years. At Alibaba, he served in multiple roles, including as director of online operation, director of marketing, regional manager and vice president. Gan left Alibaba to become COO of Meituan in 2011. In 2016, he was named the first president of Meituan-Dianping's Internet Plus University, which was founded to train company employees. Gan resigned from Meituan-Dianping in 2017 to join Hillhouse Capital as managing partner.

Gan is best known for being the 67th employee of Alibaba and the former COO of Meituan-Dianping. Before joining Alibaba in 1999, Gan had worked at a state-owned coal trading enterprise for five years. At Alibaba, he served in multiple roles, including as director of online operation, director of marketing, regional manager and vice president. Gan left Alibaba to become COO of Meituan in 2011. In 2016, he was named the first president of Meituan-Dianping's Internet Plus University, which was founded to train company employees. Gan resigned from Meituan-Dianping in 2017 to join Hillhouse Capital as managing partner.

Brad Bao (Bao Zhoujia) graduated in International Marketing at Wuhan University in 1997 and obtained an MBA from UC Berkeley in 2005. He worked in marketing at FORMICA from January 1997 to March 1998 and went on to work at Kodak until April 2000. He was at IBM until April 2001 when he finally decided to become an entrepreneur and co-founded NORICT in Beijing.He was also the GM and VP of the US branch for Tencent from 2005–2012. He joined Kinzon Capital as managing partner in September 2013 and co-founded LimeBike in the US in November 2016.

Brad Bao (Bao Zhoujia) graduated in International Marketing at Wuhan University in 1997 and obtained an MBA from UC Berkeley in 2005. He worked in marketing at FORMICA from January 1997 to March 1998 and went on to work at Kodak until April 2000. He was at IBM until April 2001 when he finally decided to become an entrepreneur and co-founded NORICT in Beijing.He was also the GM and VP of the US branch for Tencent from 2005–2012. He joined Kinzon Capital as managing partner in September 2013 and co-founded LimeBike in the US in November 2016.

Toro Ventures is a VC fund based in Monterrey, Mexico, with offices in San Francisco. Led by entrepreneurs Elsa Treviño and Tuto Assad, the fund helps tech startups raise seed capital as well as build a network of family offices and business angels interested in investment opportunities in the Latin American tech ecosystem.Toro Ventures also supports big companies looking to innovate by connecting them with startups from relevant industry verticals. In December 2018, it made its biggest investment to date: €2 million in Spain's BEWE. Established in December 2016, the company has invested in nine startups, to date.

Toro Ventures is a VC fund based in Monterrey, Mexico, with offices in San Francisco. Led by entrepreneurs Elsa Treviño and Tuto Assad, the fund helps tech startups raise seed capital as well as build a network of family offices and business angels interested in investment opportunities in the Latin American tech ecosystem.Toro Ventures also supports big companies looking to innovate by connecting them with startups from relevant industry verticals. In December 2018, it made its biggest investment to date: €2 million in Spain's BEWE. Established in December 2016, the company has invested in nine startups, to date.

Total Energy Ventures is a corporate venture capital arm of French multinational energy company Total. Headquartered in Paris with offices in San Francisco, its investment focus is in startups committed to reducing CO2 emissions through groundbreaking technologies and innovative models applied to clean-tech and sustainable energy, transport and waste management.Total Energy Ventures invests mainly by acquiring minority stakes in backed companies. The company has invested a total of US$200 million in more than 30 companies, with three exits to date. Recent investments include in Peg and Sunfire's Series C rounds and in Tado's Series F round that raised US$50 million.

Total Energy Ventures is a corporate venture capital arm of French multinational energy company Total. Headquartered in Paris with offices in San Francisco, its investment focus is in startups committed to reducing CO2 emissions through groundbreaking technologies and innovative models applied to clean-tech and sustainable energy, transport and waste management.Total Energy Ventures invests mainly by acquiring minority stakes in backed companies. The company has invested a total of US$200 million in more than 30 companies, with three exits to date. Recent investments include in Peg and Sunfire's Series C rounds and in Tado's Series F round that raised US$50 million.

GF Qianhe is an equity investment company launched by GF Securities in May 2012. Incorporated as Guangfa Qianhe Investments Co Ltd, with a registered capital of RMB 500m, the company was one of the earliest alternative investment companies to gain approval from the Securities Commission of China. As of late 2018, GF Qianhe has invested in 86 equity-related projects, among which four have gone public. By the end of 2014, its total investment value reached almost RMB 2bn and revenues of over RMB 340m.

GF Qianhe is an equity investment company launched by GF Securities in May 2012. Incorporated as Guangfa Qianhe Investments Co Ltd, with a registered capital of RMB 500m, the company was one of the earliest alternative investment companies to gain approval from the Securities Commission of China. As of late 2018, GF Qianhe has invested in 86 equity-related projects, among which four have gone public. By the end of 2014, its total investment value reached almost RMB 2bn and revenues of over RMB 340m.

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

Analysing and leveraging data: Interview with Datanest co-founders

From credit scoring to demand forecasting, Datanest has built many machine-learning products and looks to raise new funding, expand beyond Indonesia

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

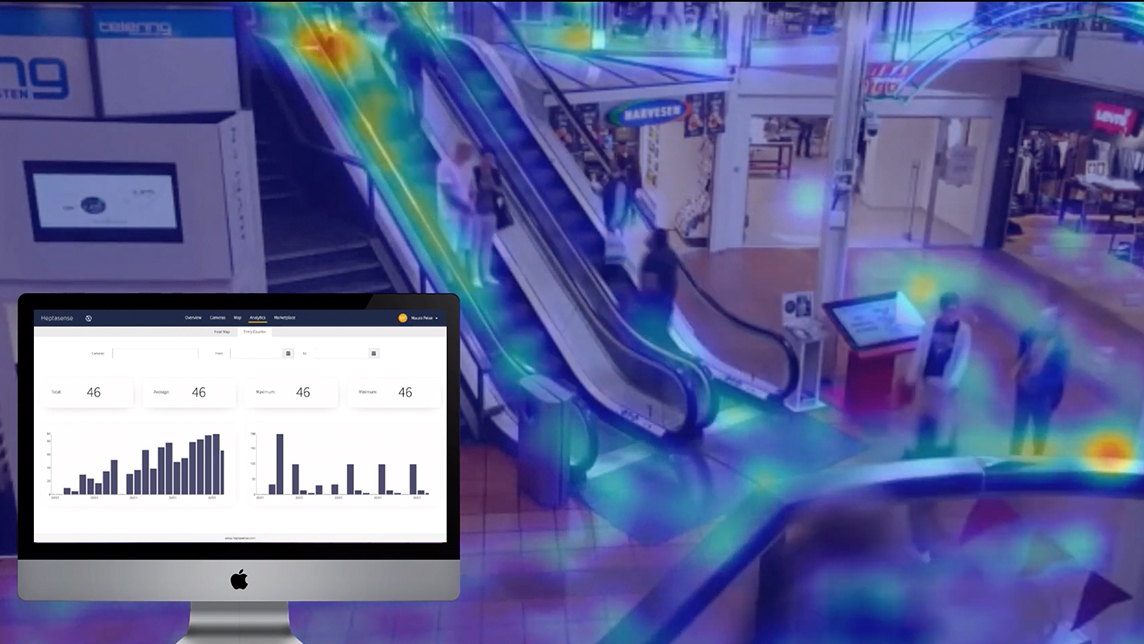

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

SWITCH Singapore: VCs urge startups to think beyond Covid-19

VCs also discuss prospects of a current tech bubble, and whether new working and hiring practices sparked by the pandemic could end Silicon Valley dominance

FMCG supply chain solution KlikDaily simplifies life for mom-and-pop stores in Indonesia

KlikDaily, which raised Series A funding this week, is helping small businesses streamline supply of FMCG and reduce prices by eliminating several links in the supply chain

Mediktor: AI medical diagnosis app wants to improve global health outcomes

NLP-based triage and diagnosis tool has achieved a 91% accuracy rate in clinical trials and raised €3 million funding

GoWithFlow: Scaling ERP platform for sustainable mobility in global transportation markets

Portugal’s CEiiA spin-off leads the way to manage smart transportation systems of cities and corporations to boost fleet performance by reducing CO2 emissions and maintenance costs

Sorry, we couldn’t find any matches for“Global Founders Capital”.