Global Founders Capital

-

DATABASE (920)

-

ARTICLES (643)

Global Founders Capital is a global venture fund that invests in seed and Series A, or participates in later rounds. It typically does not invest in pre-launch. The venture fund was set up in 2013 by Rocket Internet chief Oliver Samwer, his brother Marc, and former Delivery Hero co-CEO Fabian Siegel as a €150 million fund for high-potential internet businesses.

Global Founders Capital is a global venture fund that invests in seed and Series A, or participates in later rounds. It typically does not invest in pre-launch. The venture fund was set up in 2013 by Rocket Internet chief Oliver Samwer, his brother Marc, and former Delivery Hero co-CEO Fabian Siegel as a €150 million fund for high-potential internet businesses.

Creator of the integrated supply chain management model, YH Global’s participation in the One Belt One Road Initiative gives it enormous growth potential.

Creator of the integrated supply chain management model, YH Global’s participation in the One Belt One Road Initiative gives it enormous growth potential.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

Indexa Capital is fast becoming Spain’s leading automated investment platform, managing funds worth €92 million in just over two years since its launch.

The late-stage venture capital and growth equity firm founded and led by Russian billionaire Yuri Milner manages about $10bn in assets. Among its well-known investments are Facebook, Twitter, Alibaba, Xiaomi, JD.com, Spotify, Flipkart and AirBnB.DST Global was founded in 2009 as a means for Milner’s Mail.ru to continue investing at scale, by separately managing investment activities from the Mail.ru primary business. In 2012, Milner stepped down from Mail.ru to focus on DST Global, and DST Global eventually became fully independent from Mail.ru.

The late-stage venture capital and growth equity firm founded and led by Russian billionaire Yuri Milner manages about $10bn in assets. Among its well-known investments are Facebook, Twitter, Alibaba, Xiaomi, JD.com, Spotify, Flipkart and AirBnB.DST Global was founded in 2009 as a means for Milner’s Mail.ru to continue investing at scale, by separately managing investment activities from the Mail.ru primary business. In 2012, Milner stepped down from Mail.ru to focus on DST Global, and DST Global eventually became fully independent from Mail.ru.

Bonsai VC invests in Spanish startups with global ambitions and mobile-focused business models. The founders and managers, including Javier Cebrián Monereo, Javier Cebrián Sagarriga, Luis González Buendía and Rafael Gutierrez de Calderón; own approximately 60% of the VC share capital.

Bonsai VC invests in Spanish startups with global ambitions and mobile-focused business models. The founders and managers, including Javier Cebrián Monereo, Javier Cebrián Sagarriga, Luis González Buendía and Rafael Gutierrez de Calderón; own approximately 60% of the VC share capital.

Beenext is a new venture fund started by Beenos founder and former CEO Teruhide “Teru” Sato. The fund describes itself as a “partnership of the founders, by the founders, for the founders”; bringing their wealth of global experience and capital backing to support promising entrepreneurs. Beenext has invested in nine countries, including India, Singapore and Indonesia.

Beenext is a new venture fund started by Beenos founder and former CEO Teruhide “Teru” Sato. The fund describes itself as a “partnership of the founders, by the founders, for the founders”; bringing their wealth of global experience and capital backing to support promising entrepreneurs. Beenext has invested in nine countries, including India, Singapore and Indonesia.

Established in 1995, Richmond Global Ventures is a global venture capital managed by Partners Peter Kellner and David Frazee.

Established in 1995, Richmond Global Ventures is a global venture capital managed by Partners Peter Kellner and David Frazee.

Founded by pioneering tech investor Ozi Amanat in 2015, K2 Global is a venture capital firm based in Silicon Valley and Singapore. Amanat, who moved to Singapore in 2012, is one of Twitter’s early backers, raising $25m to invest in the social media startup that later went public in 2013. The Harvard graduate in psychology and economics also invested in Uber, Spotify and Alibaba during his career as a venture capitalist. Amanat is the chief investment officer of K2 VC, K2 Global and Singapore-based Spice Global controlled by Indian billionaire B K Modi.In 2017, K2 also announced a $183m VC fund focusing on early-stage startups that aim to address global challenges. The majority of K2 limited partners are based outside the US in countries like Australia, Japan, Singapore, Hong Kong and Indonesia.

Founded by pioneering tech investor Ozi Amanat in 2015, K2 Global is a venture capital firm based in Silicon Valley and Singapore. Amanat, who moved to Singapore in 2012, is one of Twitter’s early backers, raising $25m to invest in the social media startup that later went public in 2013. The Harvard graduate in psychology and economics also invested in Uber, Spotify and Alibaba during his career as a venture capitalist. Amanat is the chief investment officer of K2 VC, K2 Global and Singapore-based Spice Global controlled by Indian billionaire B K Modi.In 2017, K2 also announced a $183m VC fund focusing on early-stage startups that aim to address global challenges. The majority of K2 limited partners are based outside the US in countries like Australia, Japan, Singapore, Hong Kong and Indonesia.

Global Brain Corporation is an early stage venture capital fund based in Tokyo, Japan. It was founded in 1998 and has expanded globally, with offices in South Korea’s Seoul, Southeast Asia and Silicon Valley, USA. Leveraging its global network, the company aims to nurture world-class venture companies through investments and hands-on support. It also offers corporate venture capital fund management services and currently manages three such funds.

Global Brain Corporation is an early stage venture capital fund based in Tokyo, Japan. It was founded in 1998 and has expanded globally, with offices in South Korea’s Seoul, Southeast Asia and Silicon Valley, USA. Leveraging its global network, the company aims to nurture world-class venture companies through investments and hands-on support. It also offers corporate venture capital fund management services and currently manages three such funds.

Founders Fund is a San Francisco-based VC set up in 2005 that currently has more than $3bn of assets under management. It invests across the tech, aerospace and biotechnology sectors and has been an early backer of some of the most impactful tech companies including Airbnb, Facebook, and SpaceX. It has a key interest in solving major problems such as the opioid crisis in the US.Its recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the July 2021 $80m Series C round of residential real estate platform Sundae. The company has managed over 80 exits including Facebook and Spotify and has made over 500 investments, leading approximately one-third of these.

Founders Fund is a San Francisco-based VC set up in 2005 that currently has more than $3bn of assets under management. It invests across the tech, aerospace and biotechnology sectors and has been an early backer of some of the most impactful tech companies including Airbnb, Facebook, and SpaceX. It has a key interest in solving major problems such as the opioid crisis in the US.Its recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the July 2021 $80m Series C round of residential real estate platform Sundae. The company has managed over 80 exits including Facebook and Spotify and has made over 500 investments, leading approximately one-third of these.

Target Global is an international venture capital firm based in Berlin with offices in London, Tel Aviv and Barcelona.The firm has a total of more than €800m in assets under management, investing mainly in fast-growing tech startups across multiple investment stages and focusing on trillion-euro markets.

Target Global is an international venture capital firm based in Berlin with offices in London, Tel Aviv and Barcelona.The firm has a total of more than €800m in assets under management, investing mainly in fast-growing tech startups across multiple investment stages and focusing on trillion-euro markets.

Co-founder of 4D ShoeTech

Zhou Zhiheng worked for Michael Antonio Footwear Group as general manager in China. In 2016, Zhou met fellow co-founders Antonio Lin and Qiu Chen at a training program held in Silicon Valley, organized by the global entrepreneur incubator Blackbox. He left his GM job and co-founded 4D ShoeTech in 2017.

Zhou Zhiheng worked for Michael Antonio Footwear Group as general manager in China. In 2016, Zhou met fellow co-founders Antonio Lin and Qiu Chen at a training program held in Silicon Valley, organized by the global entrepreneur incubator Blackbox. He left his GM job and co-founded 4D ShoeTech in 2017.

Based in Singapore, Antler is a venture capital firm that runs a global five-month venture building program. Aside from funding and company building, Antler matches founders and the talent they need prior to the start of the program. Antler's programs are run in Singapore, Stockholm, Sydney, Amsterdam and London. Antler was founded by former managing director of Zalora, Magnus Grimeland.

Based in Singapore, Antler is a venture capital firm that runs a global five-month venture building program. Aside from funding and company building, Antler matches founders and the talent they need prior to the start of the program. Antler's programs are run in Singapore, Stockholm, Sydney, Amsterdam and London. Antler was founded by former managing director of Zalora, Magnus Grimeland.

Co-founder and CTO of Cakap by Squline

Yohan Limerta is one of the co-founders of Squline (now known as Cakap) and is the currently the company's CTO. Since 2016, he has also been concurrently a managing partner at software development and outsourcing company Erporate Solusi Global. in 2009, Yohan met Squline co-founder Tomy Yunus at the Beijing Chinese Language and Culture Center, where both were studying Chinese. After completing the course, Yohan returned to Indonesia to pursue his own business. Yohan holds a bachelor's in Software Engineering and Computer Science from Deakin University, Australia.

Yohan Limerta is one of the co-founders of Squline (now known as Cakap) and is the currently the company's CTO. Since 2016, he has also been concurrently a managing partner at software development and outsourcing company Erporate Solusi Global. in 2009, Yohan met Squline co-founder Tomy Yunus at the Beijing Chinese Language and Culture Center, where both were studying Chinese. After completing the course, Yohan returned to Indonesia to pursue his own business. Yohan holds a bachelor's in Software Engineering and Computer Science from Deakin University, Australia.

With about US$20 billion under management worldwide, New York-headquartered Tiger Global Management was founded in 2000 with US$25 million by billionaire Charles "Chase“ Coleman. Part private equity manager, part hedge fund manager, Tiger Global is known for its big bets on tech startups, including some of today's leading names Facebook, LinkedIn, Zynga and Uber.

With about US$20 billion under management worldwide, New York-headquartered Tiger Global Management was founded in 2000 with US$25 million by billionaire Charles "Chase“ Coleman. Part private equity manager, part hedge fund manager, Tiger Global is known for its big bets on tech startups, including some of today's leading names Facebook, LinkedIn, Zynga and Uber.

VUE Vlog: Short-video editing app wants to be China’s Instagram of vlogs

From starting as a short-video editing tool to a vlogging community today, VUE is talking to potential advertisers to help its vloggers make money

Growing together: a look at the Indonesia Fintech Association (Aftech)

The Indonesia Fintech Association sets an example of how professional associations can help new industries grow faster and better

Carlos Melo Brito: Driving force behind Porto's innovation boom

The professor has overseen the creation and growth of the University of Porto-based UPTEC incubator, birthplace of many of Portugal's most successful startups

Poliloop: Tackling pollution crisis with plastic-eating bacteria for industrial use

Hungarian biotech Poliloop is closing $2m seed funding for “bacteria cocktail” that breaks down plastic into organic waste quickly, enabling more affordable and eco-friendly waste management

East Ventures raises funds, teams up with state agency to produce Covid-19 tests for Indonesia

East Ventures investee Nusantics has been working with state researchers to produce the prototype; expects mass production of the test kits soon

agroSingularity: Turning discarded fruits and vegetables into usable powder to fix food waste

Closing €1.2m new funding will help the Murcia-based foodtech to build its own technology and facilities, expand into new markets

Triditive: Enabling SME manufacturers to catch up, thrive in Industry 4.0

An Asturian startup has created the first automated additive manufacturing technology for round-the-clock industrial production

Koinpack tackles Indonesia's sachet waste problem with refillable bottles

Partnering with FMCG companies, Koinpack is making small amounts of household consumables available to lower-income groups without using traditional sachet packaging

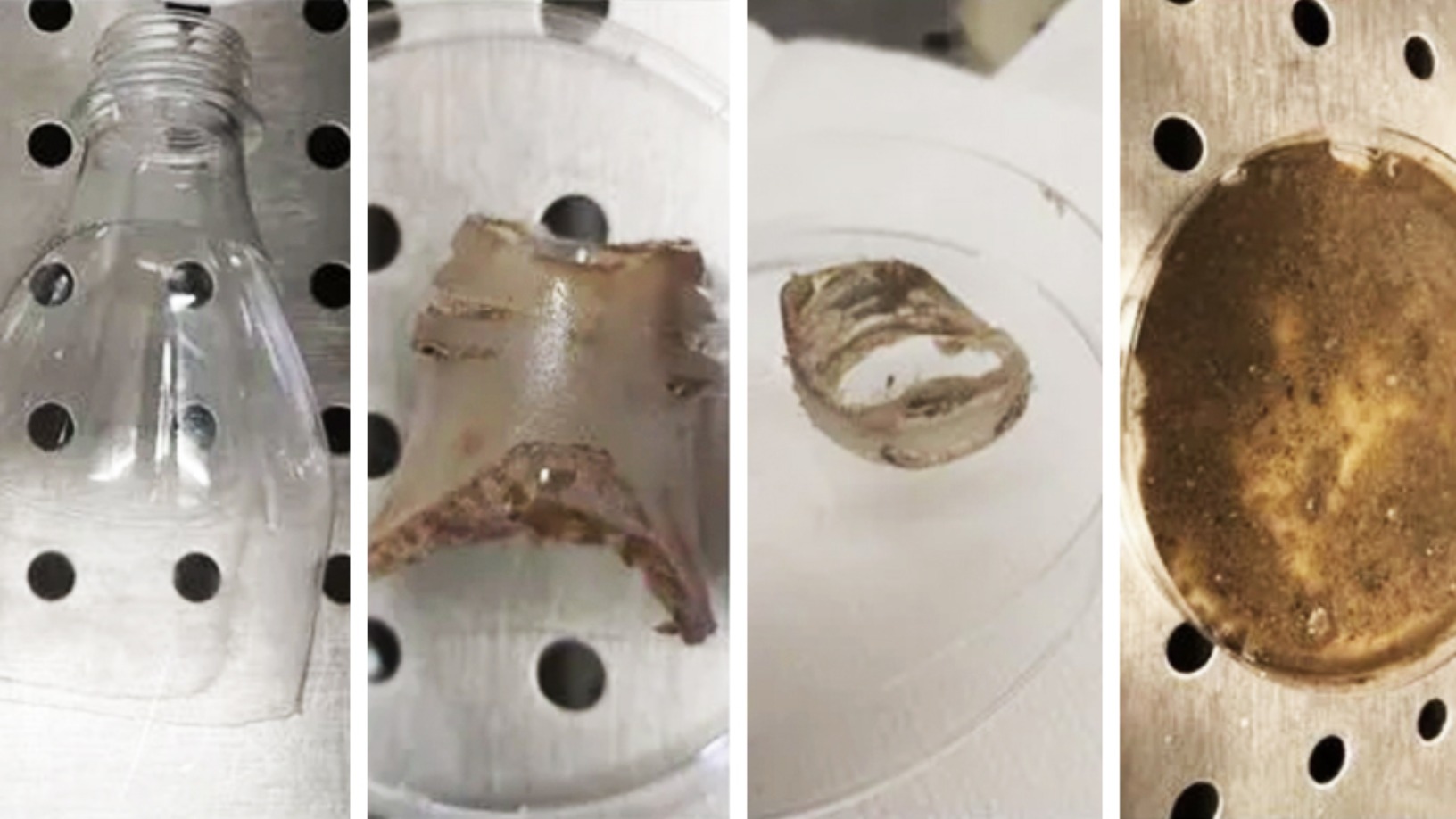

Qorium: Lab-grown premium leather for the future of luxury

The Dutch biotech startup co-founded by cell-based meat pioneer Mark Post is targeting the luxury goods market with its “clean leather” sheets made from cultivating bovine skin cells, and plans to raise up to €100m

Vadecity: Stop bicycle theft with an intelligent bike-parking system

The Barcelona-based startup wants more people to bike by offering flexible, affordable parking with its Vadebike solution

Allread MLT: SaaS that auto detects and turns text, codes and symbols into data

Helping quick digitalization of industries and supply chains, Allread MLT is disrupting traditional OCR with its computer vision technology and neural networks

Sonic Boom: Using sound wave technology to understand shopper behaviour

Sonic Boom's solution, which enables data to be captured from mobile devices without needing an internet connection, is eyeing Indonesia's huge retail market

Meituan, the “Amazon for local services”

Now worth over US$50 billion, the company has always focused on one end-goal: help consumers eat better, live better

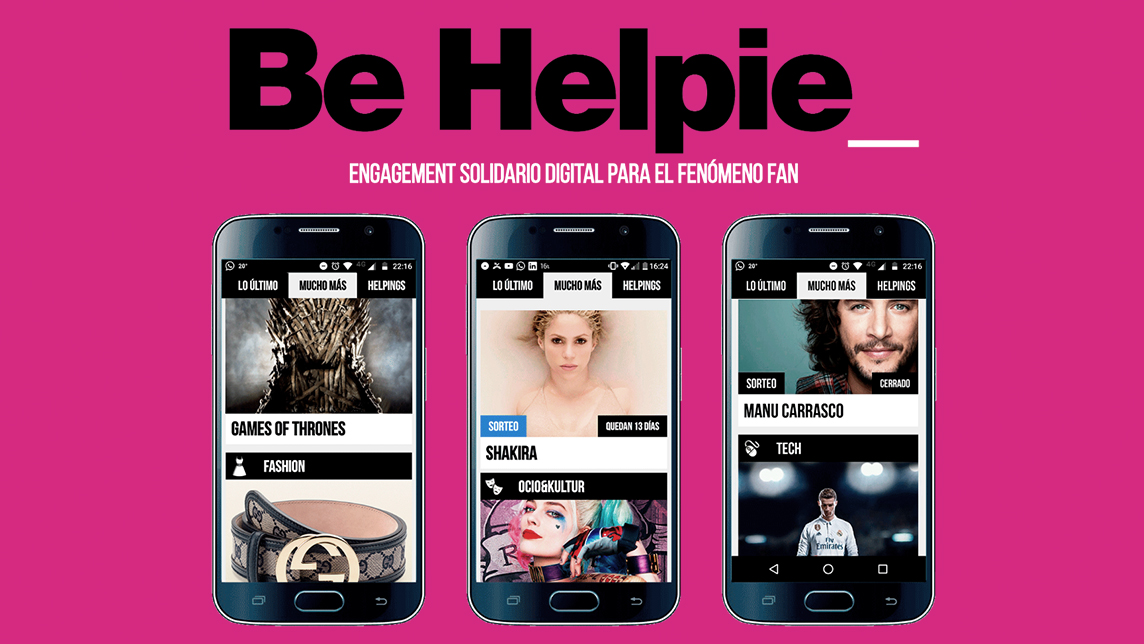

Be Helpie: Fundraising designed for Gen Z

CEO of Pamplona-based startup Be Helpie, Miguel Pueyo, tells CompassList at the Madrid South Summit about revolutionizing fundraising by engaging teens and young adults

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

Sorry, we couldn’t find any matches for“Global Founders Capital”.