Gojek Xcelerate

-

DATABASE (22)

-

ARTICLES (43)

Founded in 2004 by Liu Qiangdong (Richard Liu) with about 30 staff, JD.com (JD stands for Jingdong) has grown to become Alibaba's biggest rival and is backed by Tencent. Similar to Amazon, the NASDAQ-listed JD.com builds and controls its own distribution/logistics network, giving it an advantage in a country used to poor package delivery services. It is an investor in Indonesian ride-hailing company Gojek, and also operates an Indonesian version of its e-commerce platform, JD.id.

Founded in 2004 by Liu Qiangdong (Richard Liu) with about 30 staff, JD.com (JD stands for Jingdong) has grown to become Alibaba's biggest rival and is backed by Tencent. Similar to Amazon, the NASDAQ-listed JD.com builds and controls its own distribution/logistics network, giving it an advantage in a country used to poor package delivery services. It is an investor in Indonesian ride-hailing company Gojek, and also operates an Indonesian version of its e-commerce platform, JD.id.

Co-founder and CEO of Kopi Kenangan

Edward Tirtanata is best known for establishing Kopi Kenangan, the popular grab-and-go coffee chain. Prior to that, however, the finance and accounting graduate from Northeastern University, USA, had established Lewis & Carroll, a premium establishment serving artisanal tea. Unfortunately, the brand struggled to grow among Indonesia's budget-conscious youths, who preferred the cheaper bubble tea. Learning from the experience, he decided to eschew the Starbucks-style “third home” retail concept and opted for grab-and-go stalls that are cheaper to establish, but without abandoning the quality of the coffee served. The concept proved to be a hit, and Tirtanata's new venture became a nationwide sensation.Aside from his role as CEO of Kopi Kenangan, Tirtanata is getting more deeply involved in the F&B startup ecosystem. In February 2020, he joined Gojek and startup ecosystem builder Digitaraya in establishing Digitarasa, a new accelerator program for F&B businesses.

Edward Tirtanata is best known for establishing Kopi Kenangan, the popular grab-and-go coffee chain. Prior to that, however, the finance and accounting graduate from Northeastern University, USA, had established Lewis & Carroll, a premium establishment serving artisanal tea. Unfortunately, the brand struggled to grow among Indonesia's budget-conscious youths, who preferred the cheaper bubble tea. Learning from the experience, he decided to eschew the Starbucks-style “third home” retail concept and opted for grab-and-go stalls that are cheaper to establish, but without abandoning the quality of the coffee served. The concept proved to be a hit, and Tirtanata's new venture became a nationwide sensation.Aside from his role as CEO of Kopi Kenangan, Tirtanata is getting more deeply involved in the F&B startup ecosystem. In February 2020, he joined Gojek and startup ecosystem builder Digitaraya in establishing Digitarasa, a new accelerator program for F&B businesses.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Founded in 1976, KKR is an American private equity firm headquartered in New York City, USA. The company currently oversees investment opportunities in various industries in America, Europe and Asia, ranging from venture capital to hedge funds. As of March 2021, it has $367bn assets under management, with more than 100 companies in their investment portfolio.Its investment portfolio in Asia-Pacific includes major corporations like Panasonic, COFCO Meat and GenesisCare, as well as startups like Gojek. Elsewhere, it has invested in companies like ride-hailing startup Lyft (which has gone for an IPO), historic guitar maker Gibson, and combat sport broadcasting company UFC (Ultimate Fighting Championship).

Founded in 1976, KKR is an American private equity firm headquartered in New York City, USA. The company currently oversees investment opportunities in various industries in America, Europe and Asia, ranging from venture capital to hedge funds. As of March 2021, it has $367bn assets under management, with more than 100 companies in their investment portfolio.Its investment portfolio in Asia-Pacific includes major corporations like Panasonic, COFCO Meat and GenesisCare, as well as startups like Gojek. Elsewhere, it has invested in companies like ride-hailing startup Lyft (which has gone for an IPO), historic guitar maker Gibson, and combat sport broadcasting company UFC (Ultimate Fighting Championship).

Since its founding in 1972, American venture capital firm Sequoia Capital has partnered with the founders of companies that now have an aggregate, public market value of over $1.4tn. Sequoia Capital acquired Indian venture capital firm Westbridge Capital Partners in 2006, and later became the foundation for Sequoia Capital India. Sequoia Capital India focuses primarily in India and Southeast Asia. It has invested in many major tech companies in the region, including Indian edtech firm Byju’s, budget accommodation network OYO, and Indonesian ride-hailing unicorn Gojek. In 2019, it launched Surge, an accelerator program for early-stage startups in Southeast Asia and India.

Since its founding in 1972, American venture capital firm Sequoia Capital has partnered with the founders of companies that now have an aggregate, public market value of over $1.4tn. Sequoia Capital acquired Indian venture capital firm Westbridge Capital Partners in 2006, and later became the foundation for Sequoia Capital India. Sequoia Capital India focuses primarily in India and Southeast Asia. It has invested in many major tech companies in the region, including Indian edtech firm Byju’s, budget accommodation network OYO, and Indonesian ride-hailing unicorn Gojek. In 2019, it launched Surge, an accelerator program for early-stage startups in Southeast Asia and India.

Visa is a US-based financial services company best known for its electronic payment system used worldwide for credit and debit cards. As the operator of the payment service, it also provides security and risk management solutions. It is listed in the New York Stock Exchange under the ticker code V.The firm prefers to invest and partner with innovative early-stage firms in the payments, fintech and emerging technology spaces to advance Visa's strategic and financial objectives. Some of its investments include Indonesian ride-hailing and payment super-app Gojek, cybersecurity firms MagicCube and LoginID, payment platforms Klarna and Flutterwave, as well as digital banking platform Greenwood Bank.

Visa is a US-based financial services company best known for its electronic payment system used worldwide for credit and debit cards. As the operator of the payment service, it also provides security and risk management solutions. It is listed in the New York Stock Exchange under the ticker code V.The firm prefers to invest and partner with innovative early-stage firms in the payments, fintech and emerging technology spaces to advance Visa's strategic and financial objectives. Some of its investments include Indonesian ride-hailing and payment super-app Gojek, cybersecurity firms MagicCube and LoginID, payment platforms Klarna and Flutterwave, as well as digital banking platform Greenwood Bank.

PayPal is the US-based online payments company founded in 1999 and acquired by eBay in 2002. It is listed in NASDAQ under the ticker code PYPL.Besides facilitating online payments and money transfers for many e-commerce companies and other internet-based businesses, it is famous for its network of former founders and other alumni, many of whom went on to establish successful companies or became investors in the tech and internet industries. Some famous names linked to this network, sometimes called “PayPal Mafia”, include ex-CEO Peter Thiel, Elon Musk, Dave McClure (founder of 500 Startups), and Reid Hoffman (LinkedIn co-founder).PayPal has invested in several companies, including ride-hailing firms Gojek and Uber and e-commerce platform MercadoLibre. It has also established PayPal Ventures as a separate VC arm and PayPal Incubator to support early-stage startups.

PayPal is the US-based online payments company founded in 1999 and acquired by eBay in 2002. It is listed in NASDAQ under the ticker code PYPL.Besides facilitating online payments and money transfers for many e-commerce companies and other internet-based businesses, it is famous for its network of former founders and other alumni, many of whom went on to establish successful companies or became investors in the tech and internet industries. Some famous names linked to this network, sometimes called “PayPal Mafia”, include ex-CEO Peter Thiel, Elon Musk, Dave McClure (founder of 500 Startups), and Reid Hoffman (LinkedIn co-founder).PayPal has invested in several companies, including ride-hailing firms Gojek and Uber and e-commerce platform MercadoLibre. It has also established PayPal Ventures as a separate VC arm and PayPal Incubator to support early-stage startups.

- 1

- 2

GetGo pivots from cashierless kiosks to B2B e-commerce with a visual search engine

Covid-19 changed GetGo’s fortunes, but quick thinking and networking created a new opportunity

Using sensors and machine learning, Jejak.in wants to make conservation programs count

Launched this year, Jejak.in is helping big corporates like Danone-Aqua in environmental projects and a major B2C carbon-offsetting partnership is next

Gojek and Tokopedia merge to form GoTo

The new entity, now Indonesia’s largest tech group, plans to go public in Indonesia and the US, targeting a $40bn valuation

Gojek CEO resigns to join Indonesia's new cabinet; named education minister

Nadiem Makarim was confirmed as Indonesia's education and culture minister and will become "a passive shareholder" in Gojek

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

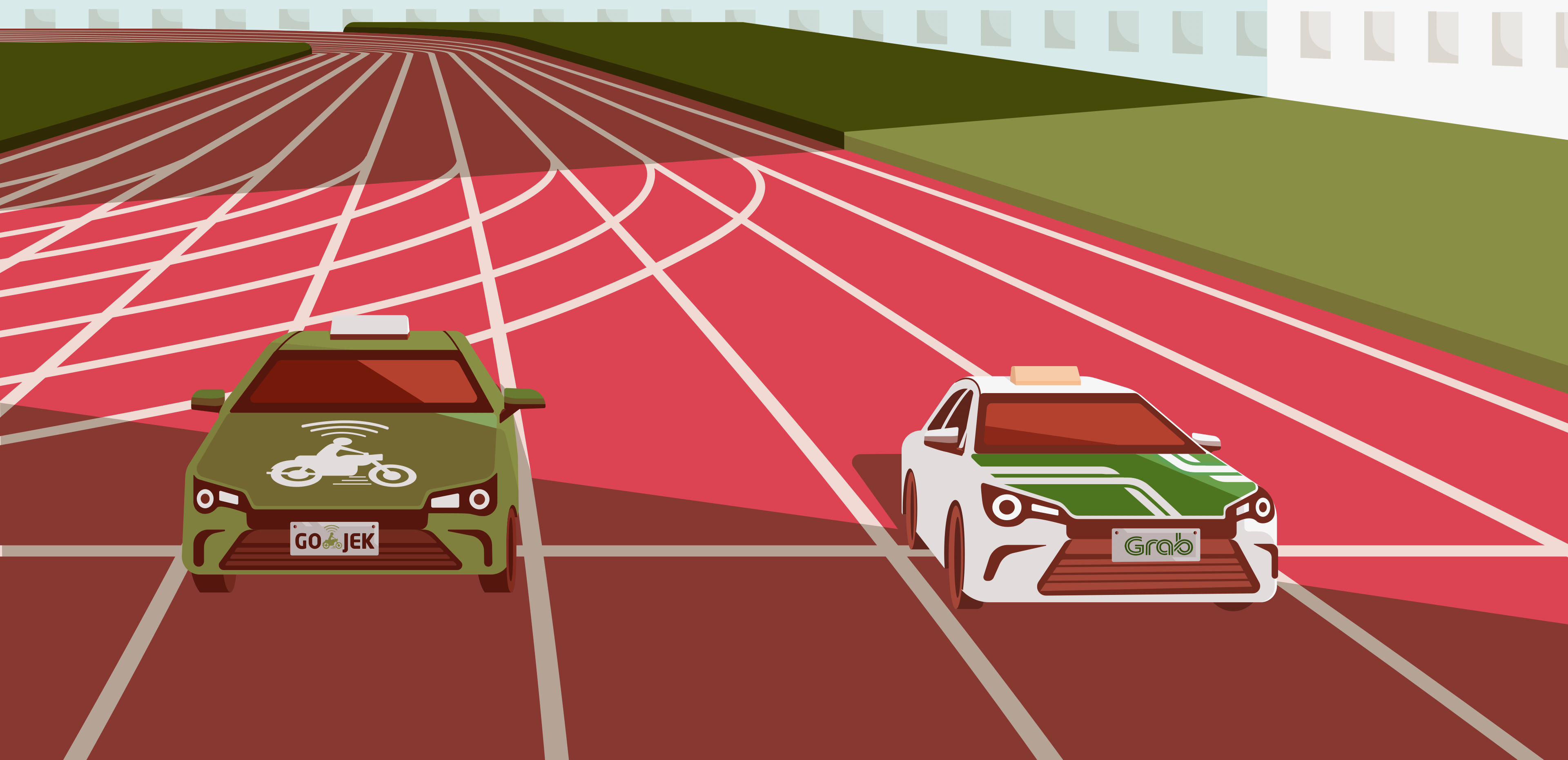

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

After emulating Chinese business models, Indonesian startups seek success abroad

Indonesia adapted and furthered the successful business models that created unicorns in China. Now, it's exporting its own to the rest of Southeast Asia, even beyond

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

UPDATED - Coronavirus: Indonesian startups launch tracking and healthcare tools, financial support

Amid a weak public health system, Indonesia's startups try to plug the gap with healthcare and monitoring tech solutions, while edtech and other online platforms see surge in demand amid social distancing

Get fit and healthy with these Indonesian wellness startups

The wellness lifestyle trend continues to grow in popularity in Indonesia, and startups want a piece of the action

For Indonesia’s gig workers, Sampingan provides side jobs that matter

Besides helping businesses gather data and scale at a bargain, Sampingan wants to help its workers level up and perform more complex tasks

Oper Indonesia: On-demand drivers give car owners a break from endless traffic jams

Oper offers on-demand chauffeurs and car valets for stressed-out drivers and busy vehicle-owners

Bukalapak to raise IDR 21tn in Indonesia's biggest IPO yet

Although trailing rivals Tokopedia and Shopee in market share, Bukalapak cut its losses last year and will be Indonesia’s first unicorn to go public

Sorry, we couldn’t find any matches for“Gojek Xcelerate”.