Good Company

-

DATABASE (830)

-

ARTICLES (755)

Formerly known as hoopCHINA.com, Hupu is a sports news portal founded by Yang Bing and Cheng Hang at the end of 2003. Its business has expanded to include social networking, e-commerce and sports marketing. In June 2019, Hupu raised RMB1.26 billion in its pre-IPO funding round from ByteDance, TikTok's parent company. Hupu has incubated e-marketplace for trending sports gears Shihuo and sneakers resale platform Poizon. The latter became an independent business as a spin-off from Hupu in 2018. Poizon became a unicorn when its valuation exceeded US$1 billion in April 2019 due to a Series A funding round led by DST Global.

Formerly known as hoopCHINA.com, Hupu is a sports news portal founded by Yang Bing and Cheng Hang at the end of 2003. Its business has expanded to include social networking, e-commerce and sports marketing. In June 2019, Hupu raised RMB1.26 billion in its pre-IPO funding round from ByteDance, TikTok's parent company. Hupu has incubated e-marketplace for trending sports gears Shihuo and sneakers resale platform Poizon. The latter became an independent business as a spin-off from Hupu in 2018. Poizon became a unicorn when its valuation exceeded US$1 billion in April 2019 due to a Series A funding round led by DST Global.

The investment arm of Taikang Insurance Group, Taikang Asset Management (Taikang Asset) manages RMB 1.9tn worth of assets, including RMB 1.1tn third-party assets, RMB 420bn alternative investment and RMB 440bn pension funds as of June 2020. Investments are mainly in infrastructure sectors such as transportation, energy, utilities, environmental protection, telecoms and real estate.Taikang Asset is an important platform for Taikang Insurance Group to carry out global business. In November 2007, its wholly-owned unit Hong Kong was set up and has received licenses from the Hong Kong stock exchange for businesses including securities dealing, advisory and asset management. In September 2016, Taikang Asset founded Taikang Asset (Beijing), a new equity investment platform, and raised RMB 2bn for its Phase I Industrial Development Fund by May 2017. Apart from managing and utilizing self-owned and insurance capital, the company manages assets for clients and provides advice on asset management. It also issues public security investment funds among other asset management businesses.

The investment arm of Taikang Insurance Group, Taikang Asset Management (Taikang Asset) manages RMB 1.9tn worth of assets, including RMB 1.1tn third-party assets, RMB 420bn alternative investment and RMB 440bn pension funds as of June 2020. Investments are mainly in infrastructure sectors such as transportation, energy, utilities, environmental protection, telecoms and real estate.Taikang Asset is an important platform for Taikang Insurance Group to carry out global business. In November 2007, its wholly-owned unit Hong Kong was set up and has received licenses from the Hong Kong stock exchange for businesses including securities dealing, advisory and asset management. In September 2016, Taikang Asset founded Taikang Asset (Beijing), a new equity investment platform, and raised RMB 2bn for its Phase I Industrial Development Fund by May 2017. Apart from managing and utilizing self-owned and insurance capital, the company manages assets for clients and provides advice on asset management. It also issues public security investment funds among other asset management businesses.

CEMEX Ventures is the investment arm of global Mexican cement giant CEMEX and was established in 2017 with offices in Mexico, Spain, Colombia and China. It focuses exclusively on tech and non-tech solutions to painpoints in the construction sector. Every year, together with global management consultant Boston Consulting Group and startup monitoring platform Tracxn, it names its 50 Most Promising Startups in the Construction Ecosystem, investing in a few of the companies cited. It currently has 12 companies in its portfolio.Its most recent investments have included an undisclosed contribution to the funding round of US soil marketplace Soil Connect in 4Q 2020 and in the $1.7m July 2020 Series A round of US recycling company Arqlite.

CEMEX Ventures is the investment arm of global Mexican cement giant CEMEX and was established in 2017 with offices in Mexico, Spain, Colombia and China. It focuses exclusively on tech and non-tech solutions to painpoints in the construction sector. Every year, together with global management consultant Boston Consulting Group and startup monitoring platform Tracxn, it names its 50 Most Promising Startups in the Construction Ecosystem, investing in a few of the companies cited. It currently has 12 companies in its portfolio.Its most recent investments have included an undisclosed contribution to the funding round of US soil marketplace Soil Connect in 4Q 2020 and in the $1.7m July 2020 Series A round of US recycling company Arqlite.

US-French private equity company L Catterton is based in Greenwich, USA, with 17 offices around the world and over $28bn of equity capital. It mostly invests in the consumer industry as well as real estate and technology startups.Founded in 1989 and currently led by co-CEOs Michael Chu and Scott Dahnke, in 2016, L Catterton partnered with the LVMH Group and Groupe Arnault combining Catterton's operations with LVMH and Groupe Arnault's real estate and private equity operations across Europe Asia, and North America. The partnership formed the largest global consumer-focused private equity firm yet the 31st largest private equity firm in the world. L Catterton holds majority stakes in companies like Birkenstock, Crystal Jade, Bliss, John Hardy amongst others; it also invests in technology startups in their growth and hyper-growth phases. Most notable investments include Aleph Farms, ClassPass, and more recently the plant-based products manufacturer NotCo. Its latest growth fund, L Catterton Growth IV, targets an investment range of $10m–$75m in North America and Europe.

US-French private equity company L Catterton is based in Greenwich, USA, with 17 offices around the world and over $28bn of equity capital. It mostly invests in the consumer industry as well as real estate and technology startups.Founded in 1989 and currently led by co-CEOs Michael Chu and Scott Dahnke, in 2016, L Catterton partnered with the LVMH Group and Groupe Arnault combining Catterton's operations with LVMH and Groupe Arnault's real estate and private equity operations across Europe Asia, and North America. The partnership formed the largest global consumer-focused private equity firm yet the 31st largest private equity firm in the world. L Catterton holds majority stakes in companies like Birkenstock, Crystal Jade, Bliss, John Hardy amongst others; it also invests in technology startups in their growth and hyper-growth phases. Most notable investments include Aleph Farms, ClassPass, and more recently the plant-based products manufacturer NotCo. Its latest growth fund, L Catterton Growth IV, targets an investment range of $10m–$75m in North America and Europe.

Roger Federer, the Swiss 20-times Grand Slam tennis champion, has turned into an angel investor while planning his professional life beyond and after his tennis sports career.In 2019, he invested in On, the Swiss running shoe manufacturer for an undisclosed funding amount. Federer currently has no formal role in the company but he’s actively involved in its R&D and product development. “I feel like I can give input on any of the lines, the shoes, anything moving forward. I can give my opinion on anything and On can either take it or leave it. I feel like [with] a major brand like Nike, that's literally impossible. It just wouldn't work,” he has said.More recently, Federer participated in a Series D funding round backing the first Chilean unicorn NotCo, which sells plant-based food and beverage products across Latin America and the US.

Roger Federer, the Swiss 20-times Grand Slam tennis champion, has turned into an angel investor while planning his professional life beyond and after his tennis sports career.In 2019, he invested in On, the Swiss running shoe manufacturer for an undisclosed funding amount. Federer currently has no formal role in the company but he’s actively involved in its R&D and product development. “I feel like I can give input on any of the lines, the shoes, anything moving forward. I can give my opinion on anything and On can either take it or leave it. I feel like [with] a major brand like Nike, that's literally impossible. It just wouldn't work,” he has said.More recently, Federer participated in a Series D funding round backing the first Chilean unicorn NotCo, which sells plant-based food and beverage products across Latin America and the US.

Founded in Moscow in 2021 by Sergey Azatyan who has worked in investment banking since 1999, Inventure Partners currently has nine portfolio companies across diverse market segments in Europe. In March 2019, the VC took a stake in the €5m Series A round of German car-sharing platform MILES Mobility. Inventure joined Refurbed’s $17m Series A round in March 2020 and also in the Series B round in August 2021. Two investees, insurtech Lemonade and medtech Amwell, were listed via IPO in 2020 with Lemonade reported to have achieved the strongest IPO debut in 2020 for a US company. The newly-formed VC has also successfully managed five exits: Busfor, fogg, Getgoing, 2can and Netology. It also partially exited Gett.

Founded in Moscow in 2021 by Sergey Azatyan who has worked in investment banking since 1999, Inventure Partners currently has nine portfolio companies across diverse market segments in Europe. In March 2019, the VC took a stake in the €5m Series A round of German car-sharing platform MILES Mobility. Inventure joined Refurbed’s $17m Series A round in March 2020 and also in the Series B round in August 2021. Two investees, insurtech Lemonade and medtech Amwell, were listed via IPO in 2020 with Lemonade reported to have achieved the strongest IPO debut in 2020 for a US company. The newly-formed VC has also successfully managed five exits: Busfor, fogg, Getgoing, 2can and Netology. It also partially exited Gett.

Founded in London in 1998, Kreos Capital is a pioneer growth debt provider. Kreos has completed over 630 deals worth over €3bn in pan-European countries and Israel. The Kreos Capital Group of companies and various funds are regulated by the Jersey Financial Services Commission.Kreos currently has 102 companies in its portfolio and has managed over 200 exits. Investee Riskified, an Israeli e-commerce fraud protection company, was listed on the NYSE at a $3.3bn valuation in August 2021. Kreos also joined recent investments in 2021 including the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed and the €9.5m round of Berlin-based HRtech expertlead.

Founded in London in 1998, Kreos Capital is a pioneer growth debt provider. Kreos has completed over 630 deals worth over €3bn in pan-European countries and Israel. The Kreos Capital Group of companies and various funds are regulated by the Jersey Financial Services Commission.Kreos currently has 102 companies in its portfolio and has managed over 200 exits. Investee Riskified, an Israeli e-commerce fraud protection company, was listed on the NYSE at a $3.3bn valuation in August 2021. Kreos also joined recent investments in 2021 including the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed and the €9.5m round of Berlin-based HRtech expertlead.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

Co-founder of NPAW

Otto Christof Wüst Acedo is co-founder and COO at social media advertising firm Adsmurai while serving as advisor to The Real Plaza, an online platform for cross-border real estate transactions. He is also co-founder and the former CEO of NPAW, where he was responsible for new business generation developing and strategic relationships with customers and partners during the startup's growth phase. NPAW's funding round with Axon Partners Group was completed during his tenure as CEO. Wüst read Telecommunications Engineering at the Polytechnic University of Catalonia, has studied at Duke University and holds a MSc. in Computer Science from Pompeu Fabra University.

Otto Christof Wüst Acedo is co-founder and COO at social media advertising firm Adsmurai while serving as advisor to The Real Plaza, an online platform for cross-border real estate transactions. He is also co-founder and the former CEO of NPAW, where he was responsible for new business generation developing and strategic relationships with customers and partners during the startup's growth phase. NPAW's funding round with Axon Partners Group was completed during his tenure as CEO. Wüst read Telecommunications Engineering at the Polytechnic University of Catalonia, has studied at Duke University and holds a MSc. in Computer Science from Pompeu Fabra University.

Commercial Director and co-founder of Digitanimal by SensoWave

An industrial engineer by training, Rubén Blanco Carrera comes from a family of ranchers in Cabañas, 18 km from Ávila, Spain. Currently he is Commercial Director and co-founder of IoT startup SensoWave, as well as its brand Digitanimal, aimed at remote farming. The business idea of Digitanimal partly came about because of Blanco’s personal experience with his own livestock. Using IoT remote tracking, detecting heat and parturition through the use of sensors , which are analyzed to reflect the behavior of the cattle and notify alert ranchers to the anomalies detected, he was able to save a mother and calf from a difficult delivery. In another incident, the technology helped alert him to the attack of wolves. Blanco holds both a first degree and a master's degree from Madrid's Alfonso X El Sabio University, the former in Technical Engineering in Industrial and Product Design and the latter in Industrial Engineering and Industrial Electronics. He then worked as an industrial engineer at both private company Retailgas and at Alfa Imaging, the startup co-founded by Carlos Callejero, with whom Blanco later co-founded SensoWave.

An industrial engineer by training, Rubén Blanco Carrera comes from a family of ranchers in Cabañas, 18 km from Ávila, Spain. Currently he is Commercial Director and co-founder of IoT startup SensoWave, as well as its brand Digitanimal, aimed at remote farming. The business idea of Digitanimal partly came about because of Blanco’s personal experience with his own livestock. Using IoT remote tracking, detecting heat and parturition through the use of sensors , which are analyzed to reflect the behavior of the cattle and notify alert ranchers to the anomalies detected, he was able to save a mother and calf from a difficult delivery. In another incident, the technology helped alert him to the attack of wolves. Blanco holds both a first degree and a master's degree from Madrid's Alfonso X El Sabio University, the former in Technical Engineering in Industrial and Product Design and the latter in Industrial Engineering and Industrial Electronics. He then worked as an industrial engineer at both private company Retailgas and at Alfa Imaging, the startup co-founded by Carlos Callejero, with whom Blanco later co-founded SensoWave.

CTO and co-founder of Aimentia

Eric Mourin is the Barcelona-based CTO and co-founder of Aimentia, which runs the first AI-powered virtual clinic for mental health patients. He met his fellow co-founder Edgar Jorba, who is now CEO of Aimentia, at the Open University of Catalonia. The company was established while both co-founders were still students.Mourin is a computer engineer by training. Prior to setting up Aimentia, he worked as a software engineer. He also spent close to two years working on a World Heath Organization (WHO) project involving the design and implementation of an IT system for the monitoring and control of neglected tropical diseases. This IT system equipped affected countries to make data-based decisions to reduce incidence of such endemic diseases, while allowing the WHO to efficiently monitor progress.Mourin holds a master’s in computer and information systems security from the Open University of Catalonia as well as a bachelor’s in computer engineering from the Polytechnic University of Catalonia.

Eric Mourin is the Barcelona-based CTO and co-founder of Aimentia, which runs the first AI-powered virtual clinic for mental health patients. He met his fellow co-founder Edgar Jorba, who is now CEO of Aimentia, at the Open University of Catalonia. The company was established while both co-founders were still students.Mourin is a computer engineer by training. Prior to setting up Aimentia, he worked as a software engineer. He also spent close to two years working on a World Heath Organization (WHO) project involving the design and implementation of an IT system for the monitoring and control of neglected tropical diseases. This IT system equipped affected countries to make data-based decisions to reduce incidence of such endemic diseases, while allowing the WHO to efficiently monitor progress.Mourin holds a master’s in computer and information systems security from the Open University of Catalonia as well as a bachelor’s in computer engineering from the Polytechnic University of Catalonia.

Fu was born in Jiangxi province in March 1978. In 2005, he led a team that created free antivirus software Qihoo 360 Security Guard. In 2008, he became vice president at Matrix Partners China. A year later, Fu became CEO and chairman of picture software firm Conew Image, which merged with Kingsoft Security in November 2010 to create Kingsoft Network. Fu has served as CEO of the merged company ever since, which, in March 2014, was renamed Cheetah Mobile. He is also founder and general partner at Purple Cow Startups.

Fu was born in Jiangxi province in March 1978. In 2005, he led a team that created free antivirus software Qihoo 360 Security Guard. In 2008, he became vice president at Matrix Partners China. A year later, Fu became CEO and chairman of picture software firm Conew Image, which merged with Kingsoft Security in November 2010 to create Kingsoft Network. Fu has served as CEO of the merged company ever since, which, in March 2014, was renamed Cheetah Mobile. He is also founder and general partner at Purple Cow Startups.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Consumers Trust: The company that gives consumers a voice

Consumers Trust has become Portugal's go-to company for customer complaint resolution; it is seeking funding to enable it to replicate its success in new markets

Payfazz aims to be Indonesia's first on-demand financial services company

Handling transactions averaging over IDR 1tn monthly, Payfazz hopes to bring the benefits of banking to all Indonesians

Alén Space: Nanosatellite company targets contracts of over €2 million by 2020

Alén Space seeks funding of €1.5 million to accelerate plans to win a share of the global market of 2,600 small satellites to be launched by 2023

“Good thing about my style. Some like it, some hate it but everybody recognizes it.” @sofíabenjumea

Outspoken with a hands-on management style, Sofía Benjumea is a force to reckon with at Google’s Campus Madrid

Fintech startup Xendit launches aid program for Indonesian businesses amid Covid-19 crisis

Xendit is helping more SMEs go online by waiving transaction fees for its digital payments solution for the first month

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

Gorry Holdings: Promoting staff wellness in Indonesia

The healthtech startup wants companies to understand how healthy employees can translate into good business

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

The charm of Jike: From search engine to popular social network

App's success shows enthusiasm for a personalized, community-based content and search platform, emulated even by Tencent

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

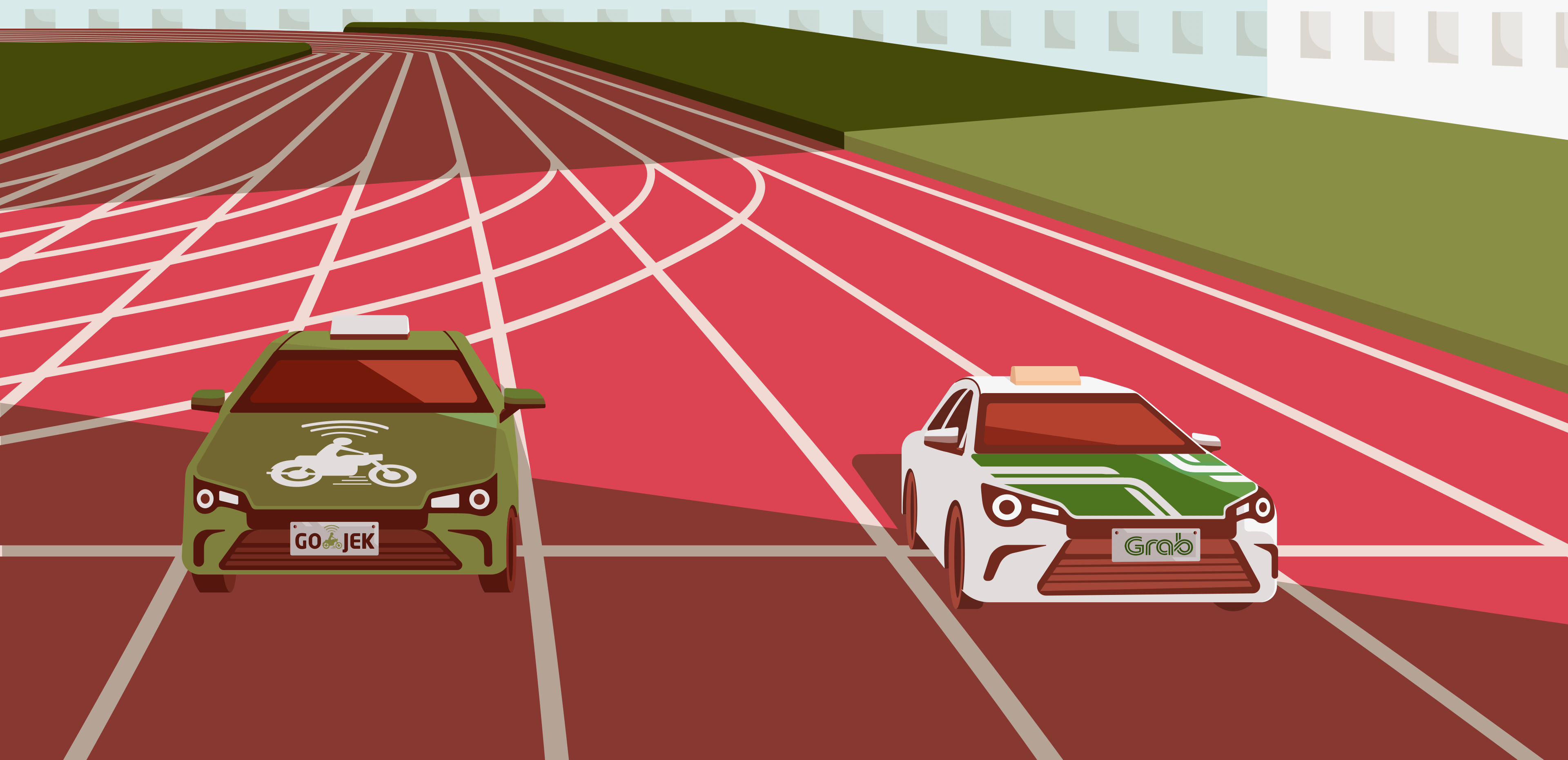

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

Venturra Capital's Raditya Pramana interview (Part II): "We need to prioritize progress"

In part two of an interview, Indonesian VC Raditya Pramana discusses foreign investment in the local ecosystem, the qualities of startups that attract him and more

Sorry, we couldn’t find any matches for“Good Company”.