Good Company

-

DATABASE (830)

-

ARTICLES (755)

Founder and CEO of Wendy's Choice

Former editor-in-chief at Trends Media Group (publisher of Harper’s Bazaar, Cosmopolitan, Trends Home in China), where she was the publisher and editor-in-chief of “Good Housekeeper” and “Good Housekeeping” for eight years. Wen Jie graduated from the Beijing Institute of Fashion Technology and Kent State University (media studies), USA.

Former editor-in-chief at Trends Media Group (publisher of Harper’s Bazaar, Cosmopolitan, Trends Home in China), where she was the publisher and editor-in-chief of “Good Housekeeper” and “Good Housekeeping” for eight years. Wen Jie graduated from the Beijing Institute of Fashion Technology and Kent State University (media studies), USA.

Co-Founder and COO of Zuoyehezi (Homework Box)

Baidu’s former manager, in strategic cooperation; following years of working in secondary education. Good friend of Liu’s for many years.

Baidu’s former manager, in strategic cooperation; following years of working in secondary education. Good friend of Liu’s for many years.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

CEO of NutraSign

The co-founder and CEO of NutraSign Abraham Gómez Toro is passionate about creating apps for good causes. His road safety app "Watch Out" won him a scholarship at an international design competition "Creative Diary 2013" run by the Institute of European Design (IED).Originally from Venezuela, he studied graphic design at IED Madrid in 2014 and completed a master’s course at the Animum Creativity Advanced School in Malaga in 2018. Based in Madrid, he also works as a creative director at nutri-holistic products company Biomol Care SL and as a visual designer for e-learning site Banana Exams.

The co-founder and CEO of NutraSign Abraham Gómez Toro is passionate about creating apps for good causes. His road safety app "Watch Out" won him a scholarship at an international design competition "Creative Diary 2013" run by the Institute of European Design (IED).Originally from Venezuela, he studied graphic design at IED Madrid in 2014 and completed a master’s course at the Animum Creativity Advanced School in Malaga in 2018. Based in Madrid, he also works as a creative director at nutri-holistic products company Biomol Care SL and as a visual designer for e-learning site Banana Exams.

Shopping concierge, Kufed, wants to be Indonesia’s coolest virtual hangout for the latest global lifestyle and fashion trends; offering exciting products without any hassle.

Shopping concierge, Kufed, wants to be Indonesia’s coolest virtual hangout for the latest global lifestyle and fashion trends; offering exciting products without any hassle.

PICC Capital Equity Investment Company

PICC Capital Equity Investment Company was founded in 2009 as a subsidiary of Chinese listed insurer PICC.In 2018, it set up a RMB 300m fund targeting health and elderly-care sectors. In 2020, the VC set up another fund to invest in cutting-edge technologies like biotech, integrated circuit, etc.

PICC Capital Equity Investment Company was founded in 2009 as a subsidiary of Chinese listed insurer PICC.In 2018, it set up a RMB 300m fund targeting health and elderly-care sectors. In 2020, the VC set up another fund to invest in cutting-edge technologies like biotech, integrated circuit, etc.

Founder and CEO of Kufed

Founder, Andrew Buntoro, was frustrated when he was unable to find good quality international products in Indonesian e-commerce websites. As a result, he decided to start Kufed, a lifestyle and community driven platform to specialize in selling high quality foreign brands to well-heeled Indonesians. In an interview with a Kufed vendor, buyMeDesign, Andrew revealed that he wanted to be like comic heroes; Batman and Iron Man who create new ways to fight the bad guys. He wants to have a management style that can be adapted to the environment and market to create unique solutions in e-commerce. Kufed is part of the e-commerce company, PT Hood Digital Asia, which was previously known as PT KlikToday, an Indonesian version of daily deals Groupon. Andrew was COO of KlikToday.

Founder, Andrew Buntoro, was frustrated when he was unable to find good quality international products in Indonesian e-commerce websites. As a result, he decided to start Kufed, a lifestyle and community driven platform to specialize in selling high quality foreign brands to well-heeled Indonesians. In an interview with a Kufed vendor, buyMeDesign, Andrew revealed that he wanted to be like comic heroes; Batman and Iron Man who create new ways to fight the bad guys. He wants to have a management style that can be adapted to the environment and market to create unique solutions in e-commerce. Kufed is part of the e-commerce company, PT Hood Digital Asia, which was previously known as PT KlikToday, an Indonesian version of daily deals Groupon. Andrew was COO of KlikToday.

Design to Improve Life Fund (The INDEX Project)

The Index Project, known by its motto “Design to Improve Life”, is a Copenhagen-based non-profit organization under the patronage of the Crown Prince and Princess of Denmark and supported by the Danish Ministry of Business and Growth.Founded in 2002, The Index Project organizes the biennial Index Award, one of the world's biggest design award. A diverse range of designs are selected through each Index Award cycle. It also backs projects with good causes through investment vehicle, Design to Improve Life Fund that has stakes in 11 solutions, ranging from seed to Series B+.

The Index Project, known by its motto “Design to Improve Life”, is a Copenhagen-based non-profit organization under the patronage of the Crown Prince and Princess of Denmark and supported by the Danish Ministry of Business and Growth.Founded in 2002, The Index Project organizes the biennial Index Award, one of the world's biggest design award. A diverse range of designs are selected through each Index Award cycle. It also backs projects with good causes through investment vehicle, Design to Improve Life Fund that has stakes in 11 solutions, ranging from seed to Series B+.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

With an experienced team, a hit game and fresh funding, Toge Productions is ready to take on the international indie game market.

With an experienced team, a hit game and fresh funding, Toge Productions is ready to take on the international indie game market.

Local artisans, often little known, get to reach new markets, thanks to this online marketplace that also offers them promotional events and a loan program.

Local artisans, often little known, get to reach new markets, thanks to this online marketplace that also offers them promotional events and a loan program.

Indonesia’s only computer vision startup is an Nvidia global partner solving real-world problems in security, defense and crowd management the smart city way.

Indonesia’s only computer vision startup is an Nvidia global partner solving real-world problems in security, defense and crowd management the smart city way.

CEO and co-founder of OLIO

Tessa Clarke is the British CEO and co-founder of food-sharing app OLIO that was inspired by her experience of having to throw away perfectly good unused food when she was packing up to move from Switzerland back to the UK in 2014.After graduating with a first-class degree in social and political sciences at the University of Cambridge in UK in 1997, she worked for three years at the Boston Consulting Group as a junior associate. She joined an MBA program at Stanford University Graduate School of Business in 2002 and met Saasha Celestial-One, who was also studying for an MBA at Stanford. In 2015, Clarke and Celestial-One decided to use their savings to create a food-sharing app OLIO after successfully testing the idea as a private WhatsApp group in North London.Before becoming an entrepreneur in 2015, Clarke has held various senior management roles since completing her MBA in 2004. She worked for global business publisher EMAP from 2005 until 2009, when she joined Dyson Inc as e-commerce managing director (MD). In 2013, she left Dyson to become MD of fintech PayLater based in Switzerland run by the Wonga payday loan company. Known then as Tessa Cook, she later became Wonga’s MD for eight months when she was tasked with “cleaning up” the tarnished reputation of the high interest loan company. From 2013 to 2021, she was also chair of the management board of St George’s Palace, a boutique apart-hotel and spa complex in Bansko, Bulgaria.In 2018, she became a fellow at Unreasonable, an organization that supports social and environmental entrepreneurship. For two years until 2021, Clarke was ambassador for the Meaningful Business 100 global event that advocates the achievement of the UN’s Sustainable Development Goals. She was also a board member for six years at Contentive, a global B2B media and information company. In 2021, her busy schedule now includes becoming a business mentor for not-for-profit Virgin Startup.

Tessa Clarke is the British CEO and co-founder of food-sharing app OLIO that was inspired by her experience of having to throw away perfectly good unused food when she was packing up to move from Switzerland back to the UK in 2014.After graduating with a first-class degree in social and political sciences at the University of Cambridge in UK in 1997, she worked for three years at the Boston Consulting Group as a junior associate. She joined an MBA program at Stanford University Graduate School of Business in 2002 and met Saasha Celestial-One, who was also studying for an MBA at Stanford. In 2015, Clarke and Celestial-One decided to use their savings to create a food-sharing app OLIO after successfully testing the idea as a private WhatsApp group in North London.Before becoming an entrepreneur in 2015, Clarke has held various senior management roles since completing her MBA in 2004. She worked for global business publisher EMAP from 2005 until 2009, when she joined Dyson Inc as e-commerce managing director (MD). In 2013, she left Dyson to become MD of fintech PayLater based in Switzerland run by the Wonga payday loan company. Known then as Tessa Cook, she later became Wonga’s MD for eight months when she was tasked with “cleaning up” the tarnished reputation of the high interest loan company. From 2013 to 2021, she was also chair of the management board of St George’s Palace, a boutique apart-hotel and spa complex in Bansko, Bulgaria.In 2018, she became a fellow at Unreasonable, an organization that supports social and environmental entrepreneurship. For two years until 2021, Clarke was ambassador for the Meaningful Business 100 global event that advocates the achievement of the UN’s Sustainable Development Goals. She was also a board member for six years at Contentive, a global B2B media and information company. In 2021, her busy schedule now includes becoming a business mentor for not-for-profit Virgin Startup.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Mental health services platform Ibunda wants to keep expanding its reach

Since its founding in 2015, the Indonesian startup Ibunda has provided psychological consultations to over 200,000 clients

NANOxARCH: Pioneering awareness and use of sustainable materials in China

Founder Lei Yuxi reckons Covid-19 could usher China into a new era of sustainability, as her startup seeks to make sustainable materials more affordable

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Amartha CEO and founder apologizes for Covid-19 letter that mixed government work with his business

Andi Taufan retracted the letter, saying haste to support Covid-19 prevention program led to administrative errors, after public uproar and allegations of conflict of interest

VUE Vlog: Short-video editing app wants to be China’s Instagram of vlogs

From starting as a short-video editing tool to a vlogging community today, VUE is talking to potential advertisers to help its vloggers make money

In China's Covid-19-hit economy, cities dish out dining and shopping coupons to revive spending

Local governments are offering incentives to spend, but as millions have lost their jobs and income, more is needed to boost consumer confidence

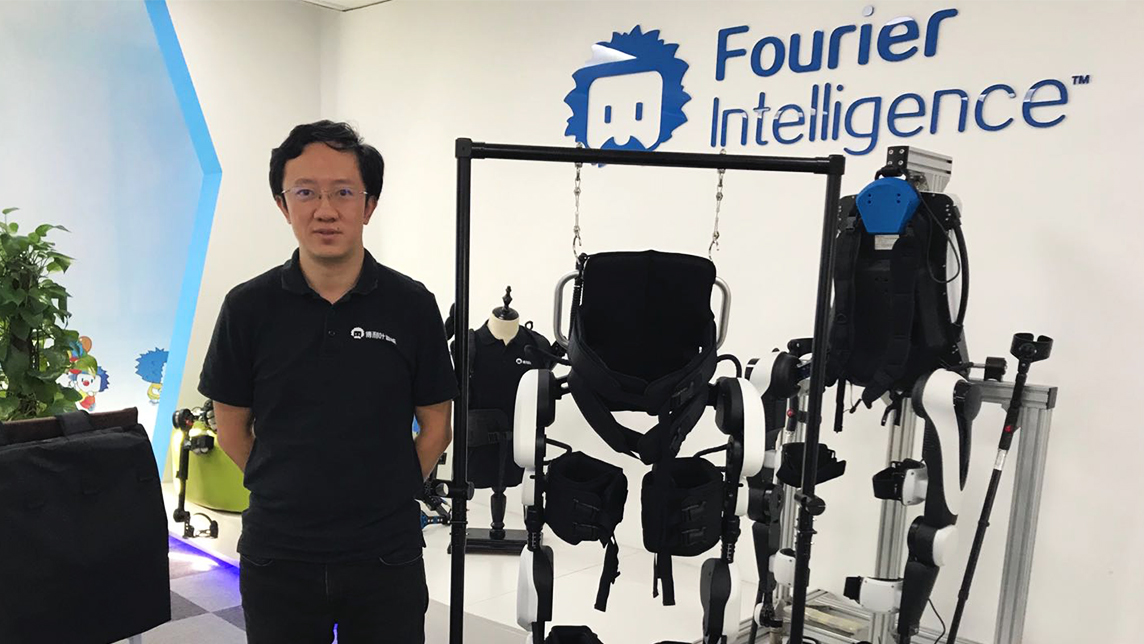

Fourier Intelligence: Quality rehabilitation robots at affordable prices

The startup has also launched an open-source platform to boost rehabilitation robotics and exoskeleton R&D and collaboration

Bound4Blue’s aeronautical tech propels first sustainable shipping vessel in the Pacific

Winning €5m fresh funding, Bound4Blue also scores with its EC-backed pilot, the first of its kind, offering new possibilities to cargo vessels seeking sustainable transportation

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

Something positive could come out of the Facebook fallout

Users and startups could learn a lot from the Facebook-Cambridge Analytica scandal. For a start, don’t succumb to apathy

Futuralga: Circular economy model to turn seaweed into biodegradable plastic alternative

A Cádiz-based young startup is winning accolades for its eco-friendly bioplastic made from seaweed washed ashore

Wahyoo wins seed funding in push to upgrade Indonesia's street food sector

It's launching a B2C app and an integrated POS system in 2019 to boost street food sales and hawkers' productivity, CEO Peter Shearer tells CompassList

Smart Agrifood Summit: Investors on key focuses and outlook in European agrifood

From boosting public-private funds to grow more European scale-ups, to improving the investment ecosystem, key investors at the Smart Agrifood Summit offer their take on how the EU agrifood sector could go a longer way

RecyGlo, Myanmar's first circular economy waste management system, targets regional growth

Turning trash into cash, Yangon-based recycling pioneer RecyGlo wants to extend its zero-waste circular economy model to the rest of Southeast Asia

Shotl: Making public transport smarter, more sustainable

The first on-demand European mass transit app, Shotl aims to revolutionize city transit

Sorry, we couldn’t find any matches for“Good Company”.